Buy z dips doctorTeladoc (TDOC) looks like a classic turnaround setup — high risk, but with meaningful upside if execution plays out. The stock is trading around $8 after a brutal drawdown, pricing in a lot of pessimism. But under new leadership, Teladoc is aggressively cutting costs, improving free cash flow, and refocusing on its Integrated Care segment while stabilizing the underperforming BetterHelp unit. Recent acquisitions (Catapult, UpLift) support this shift toward more integrated, network-based services.

Technically, the setup is compelling: Bollinger Bands are tightening and there’s a divergence forming — both early signals of a potential breakout or reversal. If the company can continue delivering on margin improvement and steadying revenue, the market may start to rerate the story. Execution is key, but at these levels, it could offer deep-value exposure to a recovering digital health player.

0LDR trade ideas

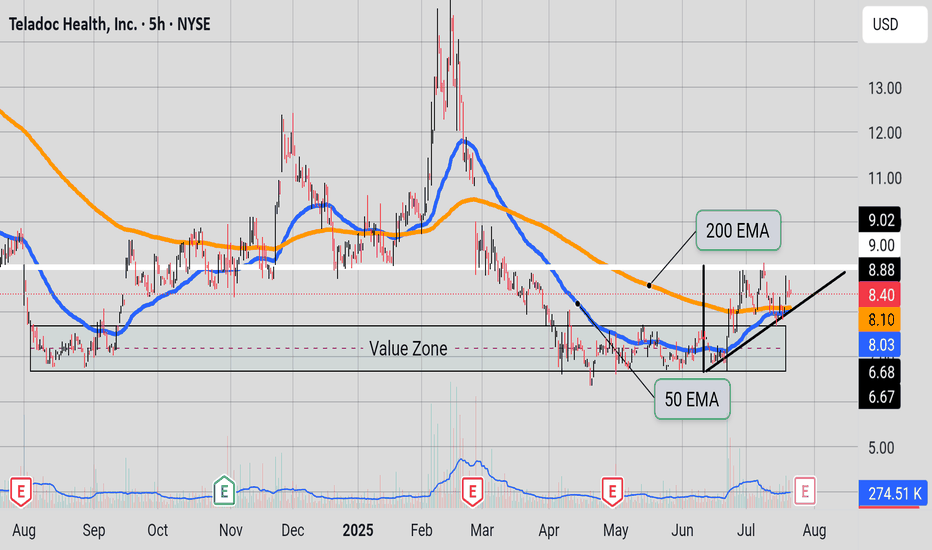

TrianglesThe asset is forming an asymmetrical triangle. The resistance is at $9. The support is at the 50 EMA and the 200 EMA. And the moving averages might make a golden cross. Bulls need the price to break the $9 resistance while a golden cross happens. Bears wouldn't mind price to go back to the value zone.

Value Zone and DreamsPrice maybe ready to break free from the value zone; If this week close out with these readings intact. Significant increase in volume; RSI is close to 50; SAR just flash bullish, MACD sloping upward, and just flashed green. To be safe one may go to a lower time(TF) frame like the 4 hour TF and look for higher highs and higher lows from this week closing price.

Teladoc Stock Chart Fibonacci Analysis 051625Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 7.3/61.80%

Chart time frame: B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

Important Level TDOC touched a key level again and recently appeared to have a fake out. It is consolidating and if it breaks this consolidaton downward it can make new lows. We need a break from the parallel structure upward around 7.33 and then a break from the blue 10 EMA for some bullish action.

Sentiment of Buyers vs Sellers🎯Hypothetical Strategy

Direction Entry Type

✅ Short Value, Entry Trigger: If price retests $8.50 & rejects again Above $8.60 Stop Target $8.20 → $8.00 or if price breaks below the 50 EMA

✅ Long Momentum, Entry Trigger If price closes above $8.58 (200 EMA) with bullish candle Below $8.45 Stop Target$8.93 → $9.20

🔔 Right now, the chart leans bearish bias under 200 EMA. Flip zone rejection confirms sellers are in control — short entries are higher probability unless $8.58 is broken, also notice the Chris Moody MACD flashed red, also notice the downward parallel channel.

Please be careful

TDOC Teladoc Health Options Ahead of EarningsAnalyzing the options chain and the chart patterns of TDOC Teladoc prior to the earnings report this week,

I would consider purchasing the 20usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.04.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

TDOCTeladoc Health, Inc. engages in the provision of telehealthcare services using a technology platform via mobile devices, the Internet, video and phone. It operates through the following segments: Teladoc Health Integrated Care, BetterHelp, and Others. The Teladoc Health Integrated Care segment offers virtual medical services. The BetterHelp segment includes virtual mental health and other wellness services. The company was founded in June 2002, by George Byron Brooks, Michael Gorton, and Gary Wald and is headquartered in Purchase, NY.

Long-term chart. For entertainment only.

2/19/2024 - Blue Orca declares short position.

CorrectionBearish MACD indicator but price still above 200 EMA, which is a sign that asset is still in an uptrend. Price is resting near the golden zone on the Fibonacci level and in a Fair Value Gap, hopefully there will be a price reversal soon. Hopefully, price does not fall to lower Fibonacci levels. Please see chart for Fib levels and FVGs(in green and red blocks).

Teladoc Health | TDOC | Long at $9.91Teladoc Health NYSE:TDOC - Initial position started at $9.91 with the potential for the price gap in the $7's to be closed in the near future (likely another entry there unless fundamentals change)

Pros:

User base of over 90 million and growing

Revenue grew from $555 million in 2019 to $2.6 billion through Q3 of 2024

Positive free cash flow since 2021

Low debt (debt to equity ratio around 1x)

AI integration and partnership with Amazon and Brightline

Historical simply moving average is approaching price, which often leads to a jump or change in downward momentum in the longer-term

Cons:

Currently unprofitable and not forecast to become profitable over the next 3 years

Lots of insider selling and exercising of options

No dividend

Daily price gap in the $7 dollar range which may close prior to move up

Targets through 2027 :

$14.20

$20.00

$27.00

$35.00

$55.00 (long-term, positive outlook)

TDOC (NYSE) - 30-Min Chart Long Trade Setup for Monday!🔥 🚀

🔍 Stock: TDOC (NYSE)

⏳ Timeframe: 30-Min Chart

📈 Setup Type: Bullish Breakout

📍 Trade Plan:

✅ Entry Zone: Above $12.95 - $14.21 (Breakout Confirmation)

🟢 Take Profit 1 (TP1): $14.21 (First Resistance Target)

🟢 Take Profit 2 (TP2): $15.40 (Extended Bullish Target)

🚀 Stop-Loss (SL): Below $11.99 (Key Support)

📊 Risk-Reward Ratio: Favorable for a bullish continuation 🚀

🔹 Technical Analysis & Setup:

✅ Pattern: Ascending Triangle Breakout 📈

✅ Breakout Confirmation Needed: Sustained price above $12.95 with volume increase

✅ Support & Resistance Levels:

🔸 $12.95 (Breakout Zone)

🔸 $14.21 (First Major Resistance)

🔸 $15.40 (Extended Target for strong momentum)

✅ Momentum Shift Expected: A breakout above $12.95 could trigger an upside rally 🚀

🔥 Trade Strategy & Refinements:

📊 Volume Confirmation: Look for increasing buying volume above $12.95 📈

📈 Trailing Stop Strategy: Once price reaches TP1 ($14.21), adjust SL higher to secure profits 🛑

💰 Partial Profit Booking: Take partial profits at $14.21 and let the rest ride toward $15.40+ 💵

⚠️ Fake Breakout Risk: If the price fails to hold above $12.95, reconsider entry ❌

🚀 Final Thoughts:

✅ Bullish Breakout Potential – High probability of continuation higher 📈

✅ Momentum Shift Possible – A move above $14.21 could accelerate upside 🚀

✅ Strong Risk-Reward Setup – SL at $11.99, TP at $14.21 - $15.40+ for optimal gains

📊 Trade Smart & Stick to the Plan! 🏆🔥

🔗 #StockMarket #TDOC #Teladoc #TradingSetup #TechnicalAnalysis #BreakoutTrade #DayTrading #MarketTrends #BullishSetup #ProfittoPath 🚀📈

Friendly ReminderGood day, Team:

We need this asset to break this hypothetical wedge structure to start a theoretical bull run.

The good news is that it is still in the theoretical value zone, which is from 6.83 to 38.50, hopefully the consolidation phase will be over, and we will be in the markup phase. Please see the chart for key levels and wedge structure. Please keep an eye on the RSI levels also. Be very careful.

Confluences(Hope)Good day Team

Thank you all for your time.

Here we have TDOC on the 3 Day Time Frame.

For holders/investors this is hopeful news.

-Currently we have a double bottom and the candle is forming a successful retest.

-Currently the MACD(Chris Moody) is forming a successful bullish crossover.

-CCI is currently positive and at the 70 levels and getting higher.

-Stochastic RSI is currently healthy.

-If price close tomorrow in it's current state, it would be a successful break and retest of the 10 EMA.

If these observations come to fruition it will be a miracle.

Please wait until candle finish printing.

Verify confluences and look for more confluences and check other TFs.

Have a bless day.

$TDOC sling shot to $35-50 | 400-500% return- Fundamentals are improving, people shorted it because they thought pandemic boosts virtual care but there will always be demand for virtual care & reference when it comes to getting medicine.

- There's huge shortage of doctors and wait times at hospital is awful.

- This stock is getting accumulated by whales. I believe longer the base, higher in space.

PT 1: 35

PT 2: 50

4000% return with Teladoc Health, Inc** long term investment **

On the above 10 day chart price action has corrected 97% since February 2021. A number of reasons now exist to be bullish, they include:

1) Price action and RSI resistance breakouts. Almost 4 years of resistance.

2) Regular positive divergence. Multiple oscillators print positive divergence over a 90 day period.

3) No stock splits.

4) 15% short interest. Who does that after a 97% correction?

5) The falling wedge forecast as measured from top and lower touch points calls for a macro move to the $400 area.

Is it possible price action corrects further after 97%? Sure, sellers love it.

Is it probable? No

Ww

Type: Investment

Risk: you decide

Timeframe for long: Ask me after it pops up 100%, you always do.

Return: 2000-4000%

Stop loss: will say elsewhere