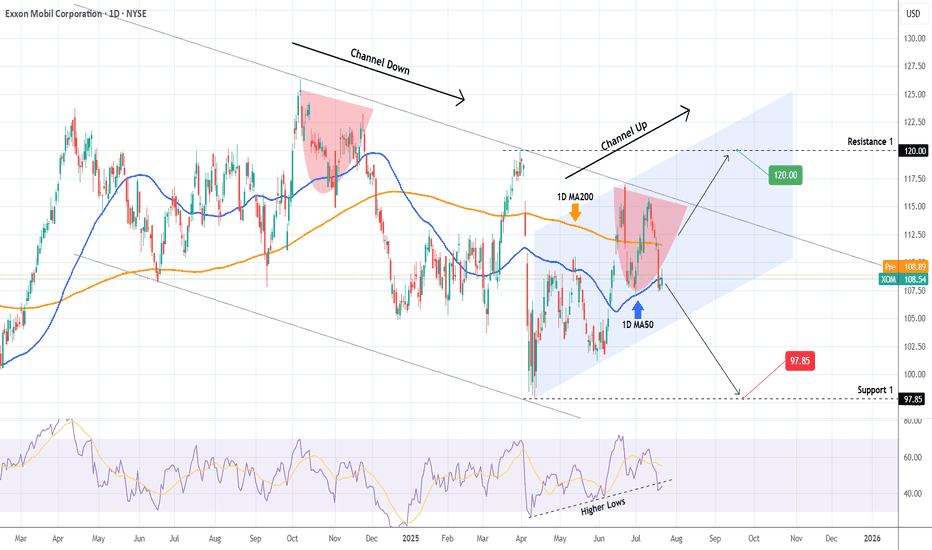

EXXON MOBIL Critical crossroads.Exxon Mobil (XOM) has been trading within a Channel Down since the June 17 2024 Low and just recently on the July 11 2025 High, it made a Lower High pattern similar to November 22 2024.

As long as the price trades below the 1D MA200 (orange trend-line), we expect to start the new Bearish Leg and te

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

7.6 USD

33.68 B USD

339.91 B USD

4.31 B

About Exxon Mobil

Sector

Industry

CEO

Darren W. Woods

Website

Headquarters

Spring

Founded

1882

FIGI

BBG00JPR0V48

Exxon Mobil Corp. engages in the exploration, development, and distribution of oil, gas, and petroleum products. It operates through the following segments: Upstream, Energy Products, Chemical Products, and Specialty Products. The Upstream segment organizes the exploration of crude oil and natural gas. The Energy Products segment includes fuels, aromatics, and catalyst and licensing. The Chemical Products segment offers petrochemicals. The Specialty Products segment provides finished lubricants, basestocks and waxes, synthetics, and elastomers and resins. The company was founded by John D. Rockefeller in 1882 and is headquartered in Spring, TX.

Related stocks

Top-Down Analysis in Action – Live Trade: Where I Enter and WhyIn this video, I walk you through my full trading process – starting with a clean top-down analysis.

I begin on the daily chart to spot key market structure and levels, then zoom in to the 1-hour chart for confirmation, and finally execute my trade on the 5-minute chart.

You’ll see:

✔️ How I define

Exxon Mobil Corporation (XOM) – BUY IDEA📌 We’re watching a strong bullish structure in XOM. After a sharp open, price retraces to fill the GAP and respects the key Low zone 🟧, signaling institutional interest.

🟢 Entry aligns with downside liquidity sweep followed by bullish momentum. This trade has confluence between previous liquidity,

Energy giants surge: Top 5 stocks to watchJune 2025 was marked by heightened volatility across the global energy sector . Amid fluctuating oil prices, geopolitical uncertainty, and ongoing industry transformation, major oil and gas companies delivered mixed results. Let’s break down the key drivers behind the moves in Shell, TotalEnergies,

XOM - Bullish Trade ideaXOM Trade Idea... 🎯 Entry Plan:

Base Entry Zone (accumulation):

ENTRY OPTION 1: $110.60–$111.50 → Retest 12-moving average

ENTRY OPTION 2 momentum trigger: Bullish reversal candle on 2H or 1H + reclaim of $113.00 (this means let price break above $113 after you get a fresh inverse Arc or Level 3

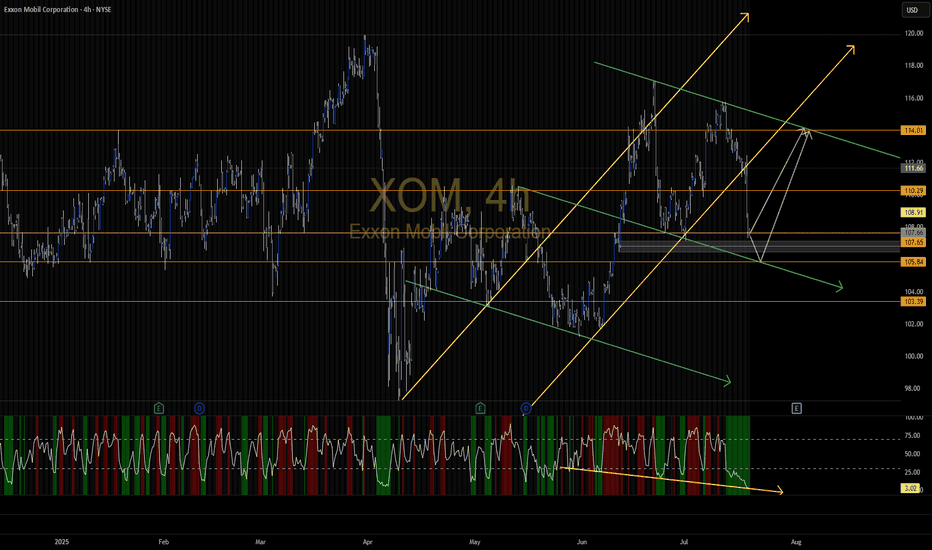

XOM - Bearish in 4 months more DOWNTREND

The price of XOM has gone too far with the MA200. It will have to return to the MA200 as soon as possible if it does not want to crash.

Let's take a look at its price on the WEEK frame. MA50 and MACD support bearish.

On the DAY frame, the volume decreased, the price movement was low, the c

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 0R1M is featured.

Big Oil: Integrated energy companies

10 No. of Symbols

Oil stocks: Liquid black gold

6 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of 0R1M is 110.6 USD — it has increased by 0.06% in the past 24 hours. Watch EXXON MOBIL CORPORATION COM NPV stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on LSE exchange EXXON MOBIL CORPORATION COM NPV stocks are traded under the ticker 0R1M.

0R1M stock has fallen by −0.22% compared to the previous week, the month change is a 2.12% rise, over the last year EXXON MOBIL CORPORATION COM NPV has showed a 55.92% increase.

We've gathered analysts' opinions on EXXON MOBIL CORPORATION COM NPV future price: according to them, 0R1M price has a max estimate of 140.00 USD and a min estimate of 95.00 USD. Watch 0R1M chart and read a more detailed EXXON MOBIL CORPORATION COM NPV stock forecast: see what analysts think of EXXON MOBIL CORPORATION COM NPV and suggest that you do with its stocks.

0R1M reached its all-time high on Jun 23, 2025 with the price of 124.8 USD, and its all-time low was 67.2 USD and was reached on Aug 28, 2019. View more price dynamics on 0R1M chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

0R1M stock is 0.99% volatile and has beta coefficient of 0.46. Track EXXON MOBIL CORPORATION COM NPV stock price on the chart and check out the list of the most volatile stocks — is EXXON MOBIL CORPORATION COM NPV there?

Today EXXON MOBIL CORPORATION COM NPV has the market capitalization of 475.78 B, it has decreased by −2.35% over the last week.

Yes, you can track EXXON MOBIL CORPORATION COM NPV financials in yearly and quarterly reports right on TradingView.

EXXON MOBIL CORPORATION COM NPV is going to release the next earnings report on Aug 1, 2025. Keep track of upcoming events with our Earnings Calendar.

0R1M earnings for the last quarter are 1.76 USD per share, whereas the estimation was 1.75 USD resulting in a 0.80% surprise. The estimated earnings for the next quarter are 1.56 USD per share. See more details about EXXON MOBIL CORPORATION COM NPV earnings.

EXXON MOBIL CORPORATION COM NPV revenue for the last quarter amounts to 83.13 B USD, despite the estimated figure of 86.35 B USD. In the next quarter, revenue is expected to reach 80.51 B USD.

0R1M net income for the last quarter is 7.71 B USD, while the quarter before that showed 7.61 B USD of net income which accounts for 1.35% change. Track more EXXON MOBIL CORPORATION COM NPV financial stats to get the full picture.

Yes, 0R1M dividends are paid quarterly. The last dividend per share was 0.99 USD. As of today, Dividend Yield (TTM)% is 3.55%. Tracking EXXON MOBIL CORPORATION COM NPV dividends might help you take more informed decisions.

EXXON MOBIL CORPORATION COM NPV dividend yield was 3.57% in 2024, and payout ratio reached 49.00%. The year before the numbers were 3.68% and 41.41% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 61 K employees. See our rating of the largest employees — is EXXON MOBIL CORPORATION COM NPV on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. EXXON MOBIL CORPORATION COM NPV EBITDA is 63.74 B USD, and current EBITDA margin is 18.76%. See more stats in EXXON MOBIL CORPORATION COM NPV financial statements.

Like other stocks, 0R1M shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade EXXON MOBIL CORPORATION COM NPV stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So EXXON MOBIL CORPORATION COM NPV technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating EXXON MOBIL CORPORATION COM NPV stock shows the buy signal. See more of EXXON MOBIL CORPORATION COM NPV technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.