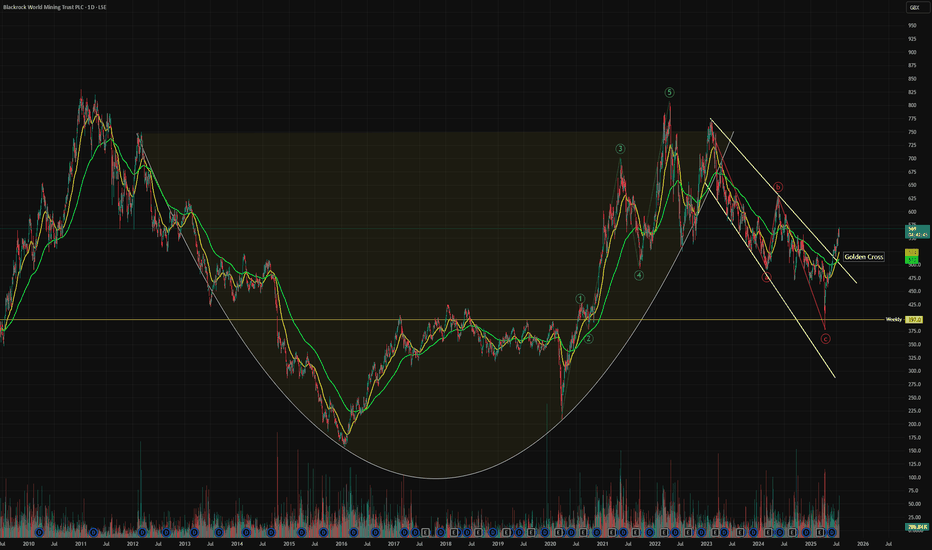

Metals SupercycleAnother bullish looking chart in the metals space. This time it's the Blackrock World Mining Trust chart, which has shown strength in recent weeks and is breaking resistance levels.

- Cup and Handle formation, breaking out of the handle

- Golden cross, the 50 day has just crossed the 200 day moving average

- Golden remains close to all time highs, copper looks strong and iron ore demand likely to rise in the near future if the Chinese stimulus package is announced.

- End of the ABC correction, buyers are now stepping in and the path of least resistance is to the upside.

Not financial advice, do what's best for you.

BRWM trade ideas

BRWM - World mining - bullish countHere's another chart from the UK markets this morning that could be viewed as constructive with a decent rally off the lows of nearly 25% in the week. This is a popular investment trust for UK investors. The count seems quite possible although my 5 wave count down for the C wave is a bit tenuous but with all that's going on I shall be watching this count carefully for signs that I am right.....

World mining - bullish possibilitiesAs far as corrections go it is not a long one or a deep one so we are just looking at possibilities here. However, it is possible that mining could go on a tear from here as long as it doesn't turn into a much longer correction. As always, price will confirm one way or another.....

World mining - bullish countThis count shows a long and complex wave 4 correction coming to an end on the 38.2 fib retracement. With precious metals showing some decent upside recently and even industrial metals showing some signs of a bounce then I shall be watching for any further signals that the mining stocks are starting to follow along.

BRWM - Bullish count for this UK mining trustAs ever, there are lots of possible counts here but I liked this one because the fib numbers all headed to one level here. Am not expecting it to head there in a straight line although that's what it's been doing up to now. The impulsive nature of the move up from early December might also suggest that we have embarked on a wave 3 here. Also, a more conventional approach to calling wave (v) would also have it ending sooner so I will be on the look out for any reversals. Bullish for now.