FIND trade ideas

WISDOMTREE COFFEE headed to range lows, sweep the lows and pump?Nothing changed with this one, same range as in the previous post, backtested the range EQ and now headed to range lows. Looking to buy at around range lows, but maybe only after it has swept the previous lows and reclaimed the range.

Coffee isn't alone in this dump, it's all of the commodities at the same time.

Back to range EQ and back to range lows if EQ failsWisdomtree COFFEE OD7B failed to get back out of the white range pictured here. Now it's headed back to range EQ @ 0.674. If that fails as support, it's headed to range lows or even new lows after that because of the massive swing failure above the white range (the green boxes). If that happens I would only enter back in if it reclaimed the white range lows.

LONG CHOCOLATECocoa Long - Risk Reward 2:20

Cocoa is trading below the long term weekly trend, with strong selling pressure forcing it below the expected RSI and BBands for its current bull cycle.

Trade with tight stop on bottom of cyclical trend reversal.

Entry price range: 1.9 - 2.0

Exit price range: 2.26 - 2.35

Nat Gas clone levelsThis is a longer range chart of Nat Gas with it's clear descending wedge structure, which is overlaid with clone levels. The reference range for the clones is the spike at the start of the winter season 2018.

The safest long trade - if there is such a thing with NGas at a time when Permian Gas is beng flared off at a criminal rate - would be to hit it as low as possible close to the wedge bottom boundary. Timing is all important with the Widow Maker - so pay it lots of respect and never get cocky with it.

Otherwise watch from the sidelines and enter a safer trade instead.

Cotton LongCotton prices are severely depressed at the moment.

Opportunity for profit 6% Risk to 20% Reward - 1:3 RR profile.

Entry Price and accumulation around 1.62

Stop Loss 1.56

Initial Take Profit January 2020, expect small seasonal retrace.

Final Take Profit June 2020 at 2.0

Fundamentals:

Drought, pest attack hit yields in key producing regions resulting in 9 year low on production output

Imports 80% increase

Exports have plunged to 10-year lows

www.reuters.com

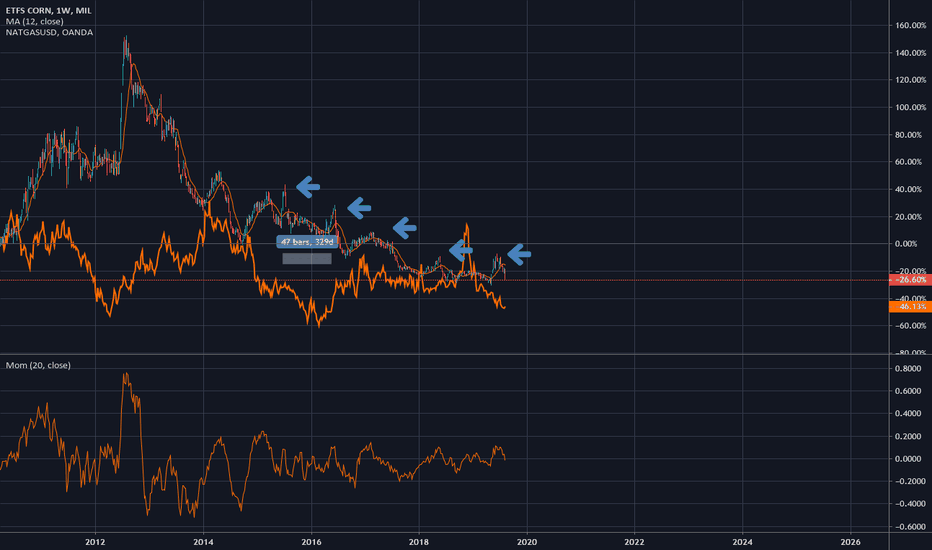

Corn and Natural GasCorn and natural gas show an interesting relationship, Corn has winter Lows with spring Highs with some swings between but roughly correlate to a yearly cycle.

Natural Gas is at all time lows, with price levels at pre 1995 prices at points in the recent past. Meanwhile the quantity and quality of dollars has risen. gas also follows a rough cycle of summer lows and winter highs which presents an interesting trading opportunity. Long Natural Gas in mid summer during peak withdrawal Into mid winter, with an exchange into corn going long into the summer, selling back into Gas or Gold.

In addition recent extreme weather events and forecast for a cooler winter increases demand for both Corn and Gas