TEM $60C Lotto Play Before Earnings?🔥 **TEM \$60C Lotto Play Before Earnings?**

**Volatile Setup with 100%+ Upside Potential 🎯**

---

### 📈 **Trade Summary:**

* **Direction:** CALL (LONG)

* **Strike:** \$60.00

* **Entry:** \~\$2.20

* **Target:** \$4.40 (100%+)

* **Stop Loss:** \$1.10

* **Expiry:** Aug 08, 2025 (1DTE)

* **Confidence:** 65%

* **Risk Size:** Max 2% of capital

* **Gamma Risk:** 🔺 HIGH

* **Volume:** ⚠️ 0.8x prior week

* **Call/Put Ratio:** 1.34 (Bullish Flow)

* **RSI (W/D):** 52.2 / 49.0

---

### ⚠️ Key Takeaways:

✅ Bullish bias from RSI + Options Flow

❗ Weak volume and earnings risk = caution

⚡ 1DTE = high gamma, faster decay

🎲 Pure lotto? Size small, manage tight

---

### 🧠 Verdict:

**If you're playing it — play it tight.**

High reward, high risk. Treat it like a lotto ticket with a defined edge.

A40EDP trade ideas

LONG | TEMNASDAQ:TEM

I’m leaning bullish on $TEM. Today’s volume came in around 2.5× the 20-day average, paired with a bullish engulfing candle—both strong short-term momentum signals. Price is testing the multi-month descending trendline, with $68.43 as the breakout trigger. A close above that opens the path to $72.15 → $74.20. The largest volume profile node sits in the $60–62 zone, making $62 my key support; losing it would shift bias to neutral/bearish

$TEM – Breakout Imminent After Accumulation? NASDAQ:TEM – Breakout Imminent After Accumulation? 📈

Tempus ( NASDAQ:TEM ) is flashing strong bullish signals backed by smart money and confirmed option flow.

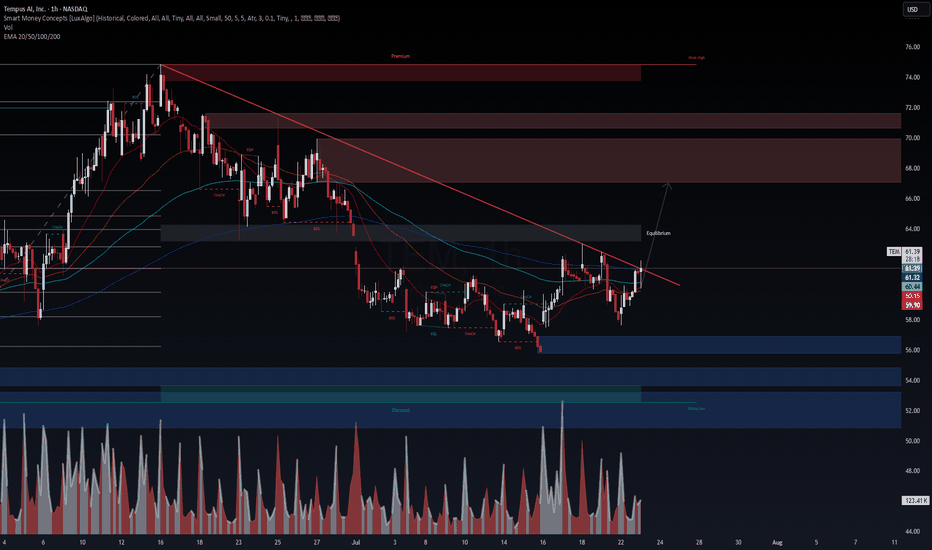

🔹 Technical Picture (1H)

Trendline just broken to the upside

Clean break of structure (BOS) after sweep of June/July lows

Volume spike + EMA realignment confirms momentum shift

Targeting the $66–$70 equilibrium zone short-term

High timeframe liquidity sits above $74 — a magnet if momentum continues

🔹 Options Flow (July 23 @ 6:54 AM)

$56K call sweep for Aug 1 $66C (To Open)

Smart money positioning for a rapid move higher — not retail-driven

🔹 VolanX Bias: Bullish

Long trigger confirmed on trendline break and BOS

Risk: < $59.50

PT1: $66

PT2: $70

PT3: $74+ (if volume sustains)

This is now on VolanX watchlist as a potential stealth breakout fueled by institutional flow.

⚠️ For educational purposes. Not financial advice. VolanX Protocol active.

#TEM #Breakout #OptionsFlow #SmartMoney #VolanX #TradingView

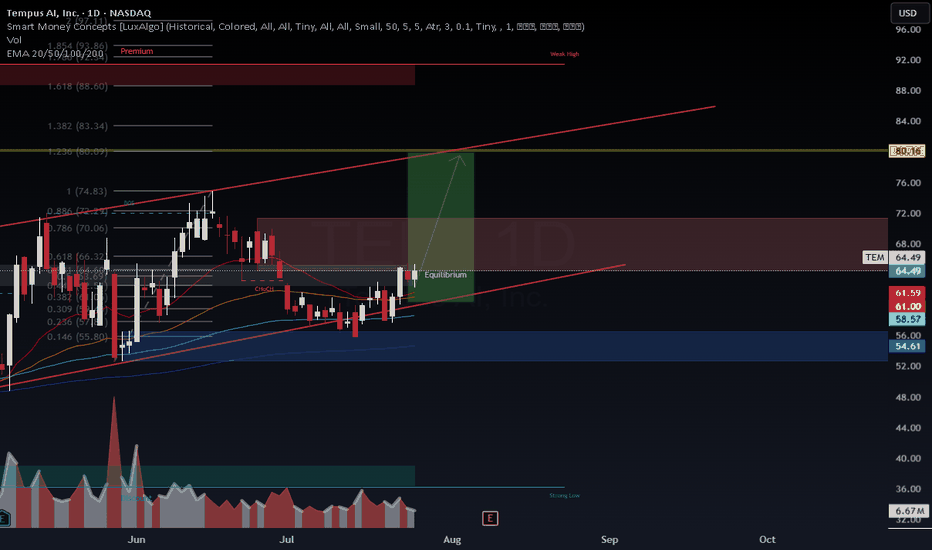

TEM – Bullish Continuation to $74+ | Institutional Catalyst fromTEM – Bullish Setup Targeting $74+ | Strong Institutional Backing

VolanX DSS, WaverVanir AI, and SMC confluence confirm a STRONG BUY signal for TEM, with a 15–20% upside potential over the next 30 days.

Key Highlights

AI Forecast:

Current Price: $64.49

30-Day Target: $74.56 (+15.6%)

Model Confidence: Strong Buy

Technical Confluence:

Price has reclaimed equilibrium and is holding above EMA 20/50/100.

Fib levels and channel support point to an upside breakout towards $74–75.

Breakout of $66.3 (0.618 fib) would confirm bullish continuation.

Institutional Catalysts:

Recent Russell 3000E inclusion and increased institutional ownership.

Strong partnerships (AstraZeneca, Pathos AI) and expanding AI-driven healthcare initiatives.

Upgraded 2025 financial outlook.

Trade Plan

Entry: $64.50 (current levels)

Stop Loss: $56.96 (below EMA 100)

Target 1: $65.78 (partial)

Target 2: $74.56 (full)

Risk/Reward: 1.34:1

VolanX Protocol Insight:

Both the AI forecast and technical structure suggest continuation of the bullish channel. A clean breakout above $66.3 opens the door to $74+, with a potential extension towards $80.

TEM Weekly Options Play – 2025-06-10🧾 TEM Weekly Options Play – 2025-06-10

Bias: Moderately Bullish

Timeframe: 5 trading days

Catalysts: Positive fundamentals, stable macro, bullish option flow

Trade Type: Single-leg CALL option

🧠 Model Summary Table

Model Direction Strike Entry Price Target Stop Loss Confidence

Grok Bullish 63.00C $2.45 $3.68 $1.72 65%

Claude Bullish 65.00C $1.70 $3.00 $0.85 72%

Llama Bullish 63.00C $2.30 $2.76 $2.07 70%

Gemini Bullish 68.00C $1.05 $2.00 $0.50 65%

DeepSeek Bullish 63.00C $2.40 $4.80 $1.20 70%

✅ Consensus: Moderately Bullish

📈 Core Setup: Trend continuation after short-term consolidation

⚠️ Outlier: Gemini sees breakout only above $68, targeting aggressive upside

🔍 Technical & Sentiment Recap

Trend: Daily uptrend intact across all models; short-term consolidation on 5m

Momentum: Mixed MACD and RSI readings—daily bullish, short-term still cooling

Sentiment: Falling VIX + positive earnings/news cycle favor upside

Options Flow: Max pain at $62 provides cushion; calls dominating OI above $63

✅ Final Trade Recommendation

Parameter Value

Instrument TEM

Strategy Weekly naked call

Strike $65.00

Entry Price $1.80 (ask)

Profit Target $3.00 (~67% gain)

Stop-Loss $0.90 (~50% risk)

Size 1 contract

Entry Timing At market open

Confidence 72%

🎯 Rationale: $65 call offers balanced leverage, high open interest (799), and aligns with Claude’s mid-week breakout thesis. Models converge on a bullish lean with manageable risk-reward.

⚠️ Risk Factors

5m chart bearish MACD may delay breakout

Price may hover near max pain ($62) early in week

Unexpected legal or macro news could reverse sentiment

Liquidity risk in thin spreads—use limit orders for entry/exit

📊 TRADE DETAILS SNAPSHOT

🎯 Instrument: TEM

🔀 Direction: CALL (LONG)

🎯 Strike: 65.00

💵 Entry Price: 1.80

🎯 Profit Target: 3.00

🛑 Stop Loss: 0.90

📅 Expiry: 2025-06-13

📏 Size: 1 contract

📈 Confidence: 72%

⏰ Entry Timing: open

🕒 Signal Time: 2025-06-08 16:04:57 EDT

TEM eyes on $58: Double Golden fibs and obviously STRONG zone TEM has fallen to a Double Golden fib zone.

$58.10 is a Golden ratio of Top down wave.

$58.38 is a Golden Genesis fib (bottom up).

Key level here and a Do-or-Die for bulls.

=====================================

Previous Analysis that caught a bottom nicely

========================================

.

TEM W pattern + base breakout setupMany of the beaten down tech stocks and ai stocks have this same look. Big basing patterns with a W bottom where clear ranges are being formed for a break of the lid.

Thinking entry here in the 56 range with a stop under todays low shoud get a good entry for the breakout here. NASDAQ:TEM

TEM Weekly Analysis Summary (2025-04-16)TEM Weekly Analysis Summary (2025-04-16)

Below is a consolidated view of the reports along with areas where they agree and differ, followed by a clear trade idea.

──────────────────────────

SUMMARY OF EACH MODEL’S KEY POINTS

• Grok/xAI Report

– Notes that although the daily trend is bearish, the 5‑minute chart shows bullish signals (RSI rising, MACD crossed up, price above the 10‑EMA) and key short‐term support around $40.

– Recommends buying the $41.50 call (despite its premium being slightly above the “ideal” range) to capture an anticipated move toward the max pain at $44.50.

• Claude/Anthropic Report

– Stresses that on daily timeframes price is in a strong downtrend with clear bearish momentum—but short‐term indicators (like a modestly improving 5‑minute RSI and MACD) suggest that downside may be softening.

– Leverages the heavy put open interest (especially at the $40.00 level) and overall support to recommend a bearish play by buying the $40.00 put.

• Gemini/Google Report

– Emphasizes short‑term technicals: the 5‑minute charts show a bounce potential using RSI, MACD crossover, and positive news (partnership catalyst) combined with falling VIX.

– Recommends a moderately bullish, counter‑trend trade using the $42.50 call (ask ~$0.50) as a short‑term bounce play aiming to reach the $42+ area.

• Llama/Meta Report

– Also lays out a mixed picture. Although the short‑term charts show hints of a rally, it notes the daily chart remains bearish.

– Leans toward a put option side (buying the $40.00 put) given the attractive premium and strong support at $40.

• DeepSeek Report

– Finds that while the very short-term (5‑minute) indicators have begun to turn positive, the overall daily picture remains in distress and the max pain level is much higher.

– Concludes “no trade” is best until direction is clearer, though it does sketch alternate setups for either a call or put trade if forced.

──────────────────────────

2. AREAS OF AGREEMENT & DISAGREEMENT BETWEEN MODELS

Agreements:

• All reports recognize that the current price is near crucial support around the $40 level.

• There is agreement that the 5‑minute charts are more bullish than the daily charts, which remain in a downtrend.

• Technical indicators (RSI, MACD on the intraday chart) hint at an intraday or end‑of‑day bounce even if the longer‑term bias is weak.

Disagreements:

• Grok/xAI and Gemini/Google favor a short-term bullish/counter‑trend bounce via call options.

• Claude/Anthropic and Llama/Meta emphasize the dominant daily bearish structure and would favor a put option to capture further downside.

• DeepSeek remains on the sidelines overall—indicating that the signals are too mixed to pick a clear directional bias without further price confirmation.

──────────────────────────

3. CONCLUSION & RECOMMENDED TRADE

Overall Market Direction Consensus:

While the overarching daily trend remains bearish, a number of models spot actionable short‑term bullish clues (rising 5‑minute RSI/MACD crossover, positive news catalyst, falling VIX) that suggest a possible intraday or early session bounce. With the price near strong support (~$40) and max pain at $44.50 offering a potential upward target by expiration, a short-term counter‑trend call trade is justified for the weekly options.

Recommended Trade:

• Trade: Buy a single‑leg naked call option.

• Option: TEM $42.50 Call (Weekly expiry 2025‑04‑17)

• Premium: Ask is $0.50 – comfortably within our favored range.

• Rationale: The trade banks on a short‑term bounce off key $40 support with the expectation that positive technical momentum and catalyst news may lift the price toward the $42+ area. (While the daily trend is bearish, the intraday indicators and market news support a careful, short‑term bullish view.)

• Entry Timing: At open.

• Profit Target: Approximately $0.80, roughly a +60% move on the premium.

• Stop‑Loss: Set at $0.25 (~50% loss on premium) to limit risk.

• Confidence: About 65% given the conflicting longer‑term vs. short‑term signals.

• Key Risks/Considerations: Should the price fail to hold support near $40 or if intraday momentum reverses suddenly, the call trade will likely suffer. The inherent counter‑trend nature of the play means disciplined stop‑losses and risk management are essential.

──────────────────────────

4. TRADE_DETAILS (JSON Format)

{

"instrument": "TEM",

"direction": "call",

"strike": 42.5,

"expiry": "2025-04-17",

"confidence": 0.65,

"profit_target": 0.80,

"stop_loss": 0.25,

"size": 1,

"entry_price": 0.50,

"entry_timing": "open"

}

Tempus AI - LongTempus AI

Technical picture:

- Wyckoff: Large companies accumulation in the form of range with positive delta

- Volume profite: at level of VAL

- Formation: Channel multi-month

- ATR: New monthly low band

- Float: <100M = 78m, providing strong movement potential

Fundamental picture

- Revenue is growing with increasing rate

- EPS is negative but loss is decreasing

Upside: 50%-180%

- Current price - 37

- Market is 55-64-74 (low-consensus-high)

- TA high band is 92 (Resistance line)

- Volume Profile - 67

Downside: 20%

- Market - 55

- Volume profile - 30

Negative aspects:

- Recent sales of stock by insiders but not significant

Exta

- Nensi Pelosi part of the investors

$TEM - MASSIVE Opportunity for this Nancy Pelosi Darling!NASDAQ:TEM - Does History Repeat?! 🤯

Same Draw Down could lead to Same Upside!

My target is $100 🎯

Crazy High Risk/ High Reward if we repeat the same timeframe we get in less than a MONTH!!! (Wouldn't count on it, crazy if happens though)

Not Financial Advice