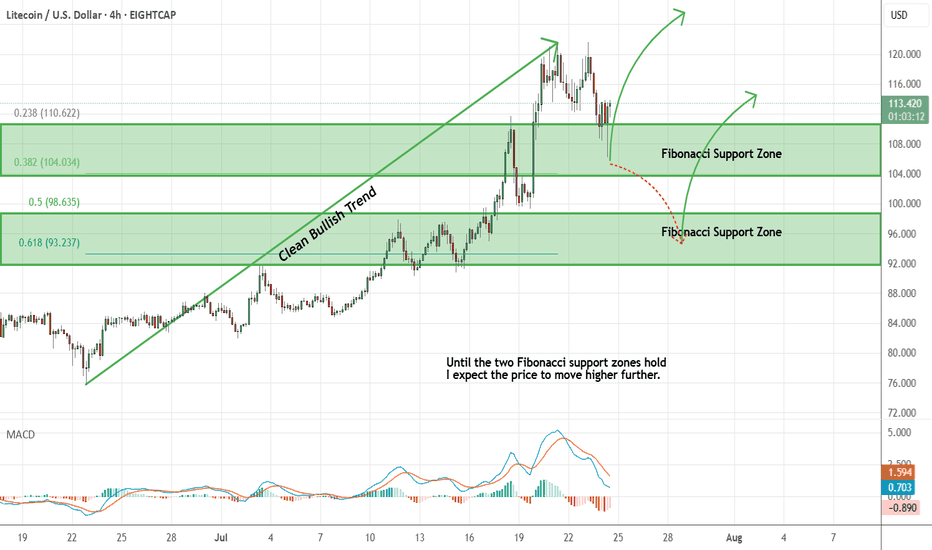

Litecoin - Expecting Bullish Continuation In The Short TermH4 - We have a clean bullish trend with the price creating a series of higher highs, higher lows structure.

This strong bullish momentum is followed by a pullback.

No opposite signs.

Until the two Fibonacci support zones hold I expect the price to move higher further.

If you enjoy this idea, don’t forget to LIKE 👍, FOLLOW ✅, SHARE 🙌, and COMMENT ✍! Drop your thoughts and charts below to keep the discussion going. Your support helps keep this content free and reach more people! 🚀

--------------------------------------------------------------------------------------------------------------------

LTCUSD trade ideas

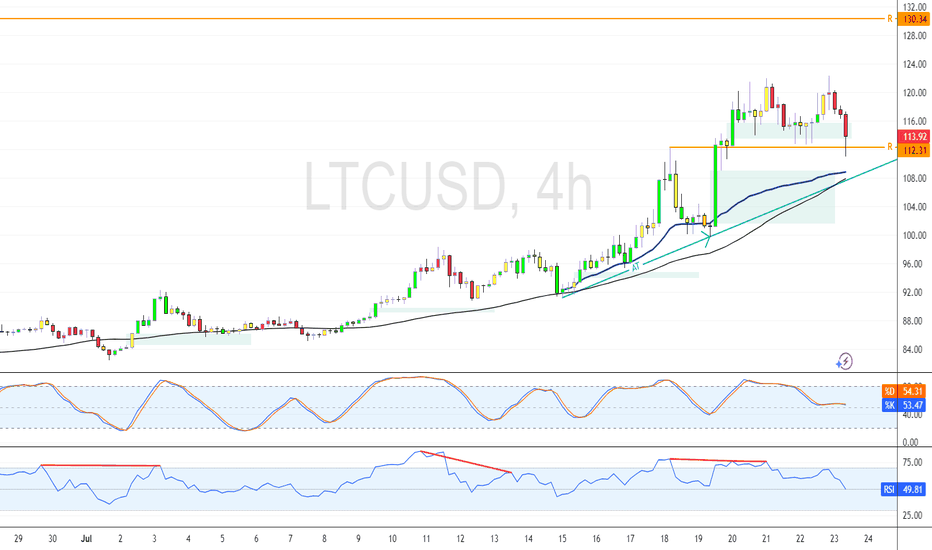

Litecoin Retests $112.3 Support Amid Bullish MomentumLitecoin remains bullish above the 50-day SMA, supported by an ascending trendline. As of now, LTC trades near $113.0, retesting this area as support. A sustained hold above the trendline could initiate another bullish leg, targeting resistance at $130.3.

However, a close and stabilization below the trendline would invalidate this outlook and suggest increased selling pressure.

LTCUSD: The Trade Everyone ForgotLTCUSD: The Trade Everyone Forgot — But the Chart Didn’t

While everyone’s watching ETH and BTC chase headlines, NYSE:LTC is quietly breaking out of a 2-month range — and the math is hard to ignore.

🎯 Setup Breakdown

Base Breakout: Litecoin just cleared a horizontal range that’s held it hostage since May.

MACD: Fresh bullish crossover with expanding histogram — early momentum shift after a long cooldown.

Ichimoku: Price is above the cloud with Tenkan and Kijun crossing. Bullish structure with a cushion of support below.

📊 Trade Specs

Entry: ~$94

Target: $129.39 (+36.18%)

Stop: $85 (–9.38%)

R/R: 3.86 — almost 4:1

⚠️ What Makes It Different?

Sentiment: Nobody’s talking about Litecoin. That’s usually when it moves.

Structure: This isn’t chasing green candles — this is defined consolidation + confirmed breakout.

Asymmetry: With nearly 4:1 R/R, even a 25–30% win rate keeps you in the green if managed well.

Sometimes the quiet charts are the loudest in hindsight.

Are you in NYSE:LTC or still watching?

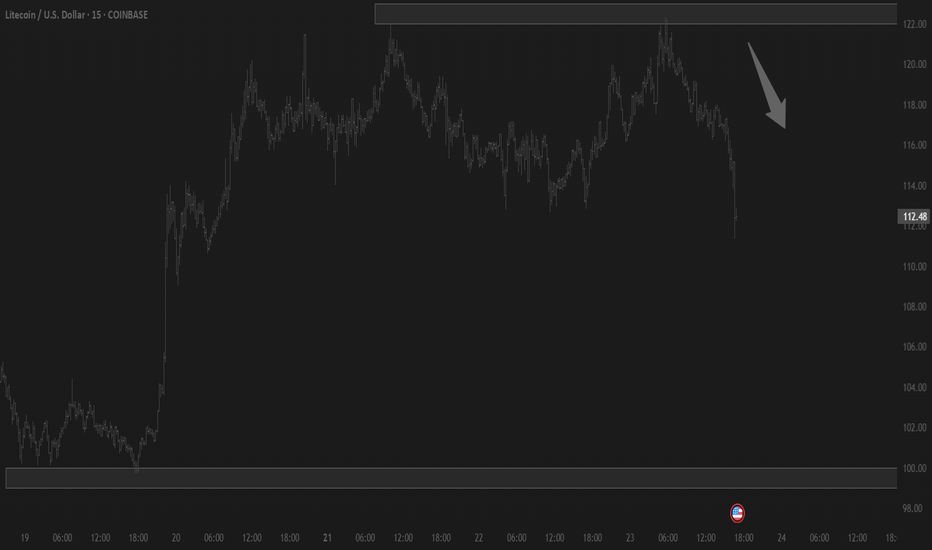

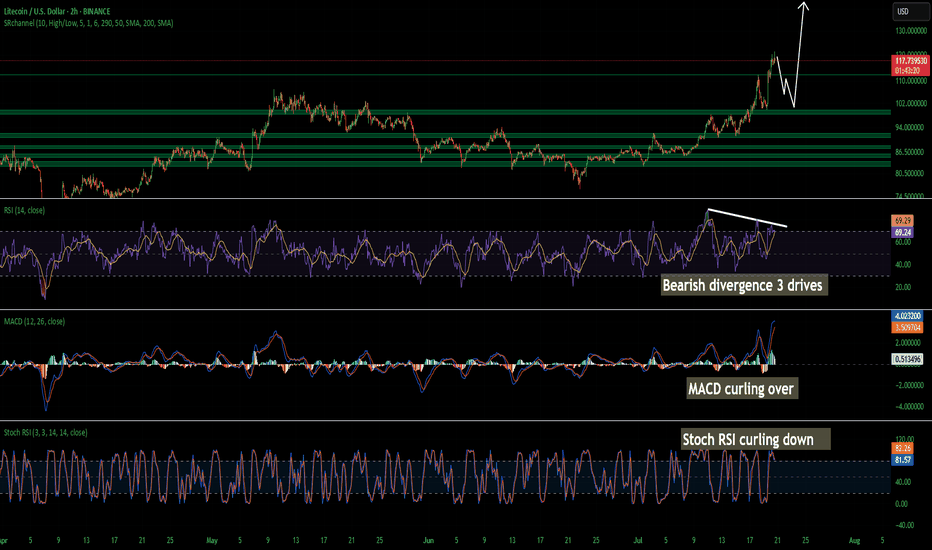

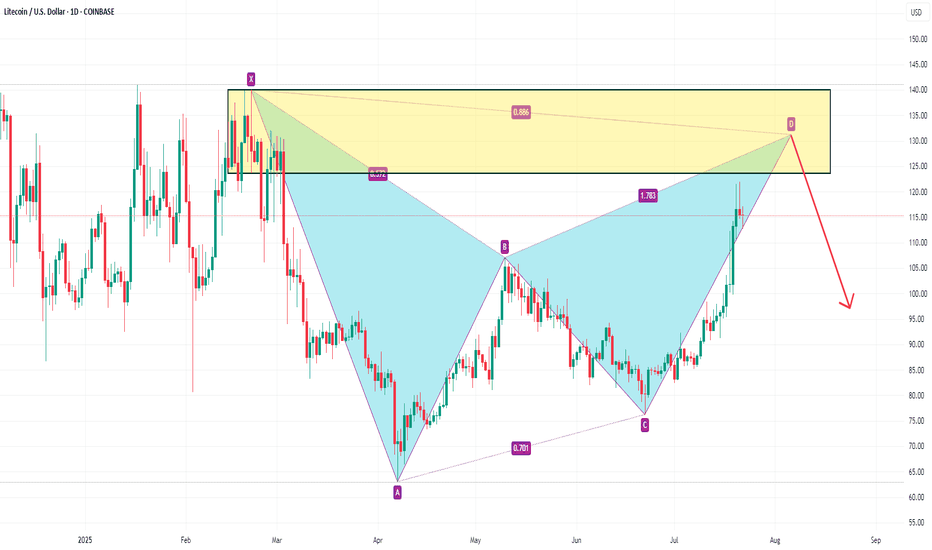

LTC Litecoin Short Term Pull Back Quick and SharpI believe Litecoin Is topping out on the 2 hour. Looks like we may come back down and tap support at around 104 but I wouldn't be surprised a wick hits 100. I have buy orders around 103-106. I am not super confident on a deeper pullback so thats why my buys are there is so i don't miss the dip. Id rather make a little less money than miss a buy in trying to nail the bottom. Litecoin is starting its breakout from a 7 year consolidation and accumulation phase. This should be pretty massive. Litecoin is going to benefit considerably from these new bills that are being signed and many of the favorites in the top 100 will soon disappear!

The time for Litecoin to shine as I have been talking about for years is now. I am almost certain that this is that time. My predictions all still hold if you would like to go read them. I was just off on timing. Timing is the hardest thing to predict especially with how wild this planet has been lately. None of this is financial advice its just my opinion.

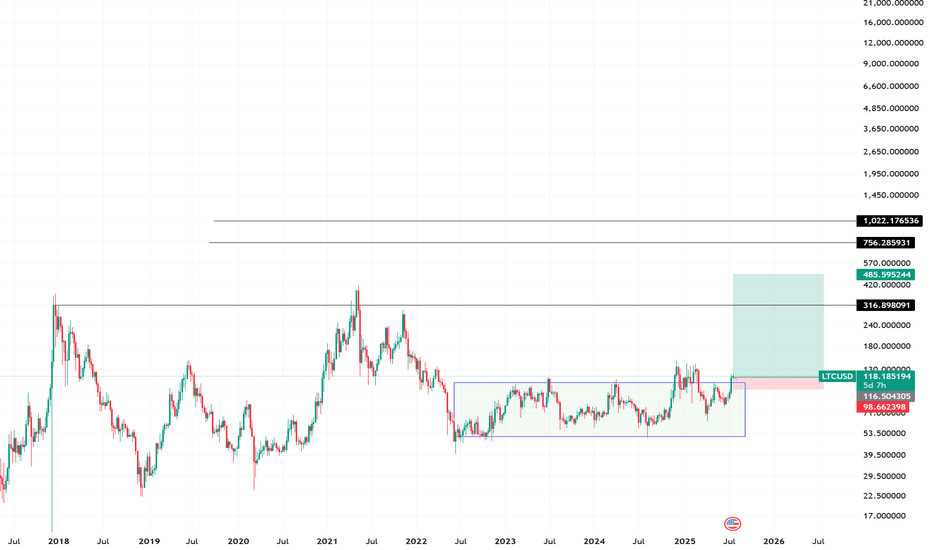

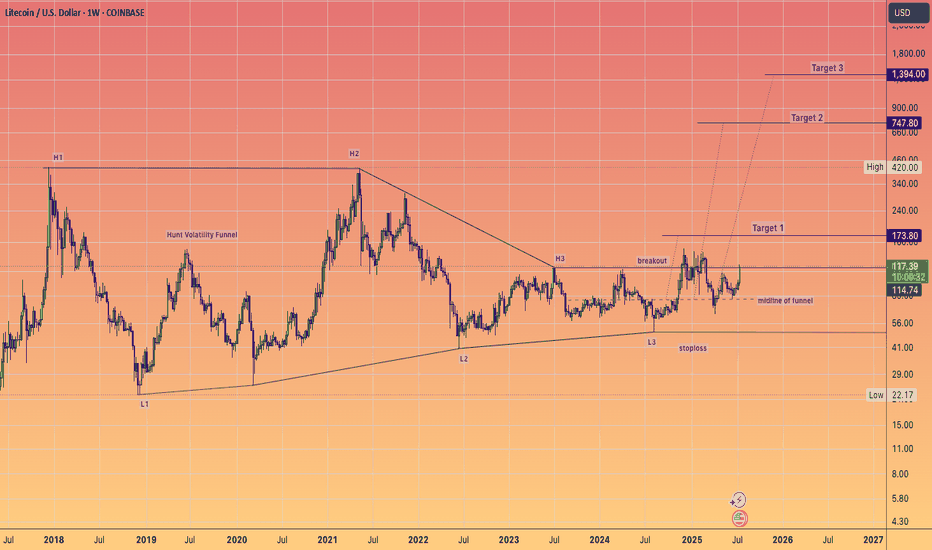

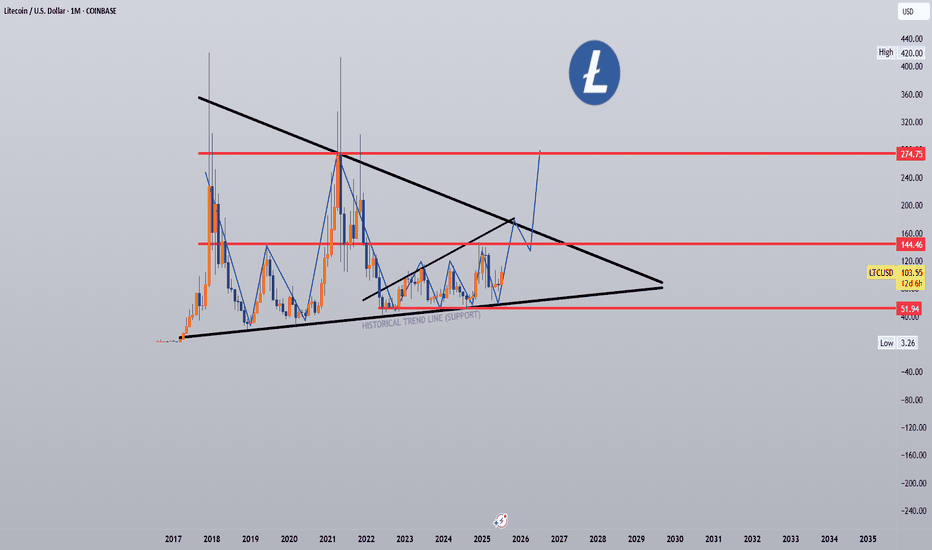

Litecoin has maintained it's HVF and can STILL do a 10X...in the coming years.

This is a massive pattern formed over 7 years and I expect over performance of target 3 ultimately.

The day to week price action really does not matter when you have beautiful setups like this.

Keep stacking at these low prices.

@TheCryptoSniper

LTC Buy Zones + ETF Angle – Legacy Coin Prepping for Breakout?📌 Coin: LTC (Litecoin)

💰 Buy Levels:

✅ First Entry: $104

✅ Second Entry: $92

✅ Third Entry: $85

🛑 Panic / SL Level: Weekly close back below $70

🧠 Fundamental Analysis (FA) – In Short

*️⃣ Sector: Layer 1 / Payments

*️⃣ Use Case: Litecoin is a peer-to-peer digital cash system with fast, low-fee transactions — often called the “silver to Bitcoin’s gold.”

*️⃣ Tech: Fork of Bitcoin with 2.5-minute block time, SegWit enabled, and MimbleWimble extension blocks for optional privacy.

*️⃣ Adoption: One of the most widely integrated payment coins globally — supported on PayPal, BitPay, Binance Pay, and thousands of retailers.

*️⃣ Narrative Fit: Legacy coin with institutional familiarity. Often used as a BTC testbed (e.g. SegWit, Lightning). Still thrives in payment utility narratives.

📊 Tokenomics & Market Data

(As of mid-July 2025)

🪙 Current Price: ~$96

🧾 Market Cap: ~$7.1B

🔢 Rank: Top 25

🧮 Circulating Supply: ~74M LTC

🔒 Max Supply: 84M LTC (fixed)

🔥 Halving Cycle: Every ~4 years (next in 2027), last halving was in August 2023

🛠️ Security: Proof of Work, Scrypt-based (ASICs supported)

🎯 Bull Market Target (Realistic)

Target Range: $180 – $240

*️⃣ Based on previous cycle behavior and historical ratios to Bitcoin.

🚀 Mega Bullish Target (Speculative Top)

Target Range: $300 – $420+

*️⃣ If Litecoin reclaims a major role in cross-border payments or benefits from Bitcoin ETF / institutional spillover.

✅ Final Take

🧠 LTC remains a legacy coin with strong brand trust, fixed supply, and real-world payment utility.

Your entries are deep in macro range, and the $70 SL gives clear invalidation under 2023 breakout structure.

While it won’t 50x like small caps, it often outperforms in early alt rotations and benefits from conservative investor flows.

We ask Allah reconcile and repay

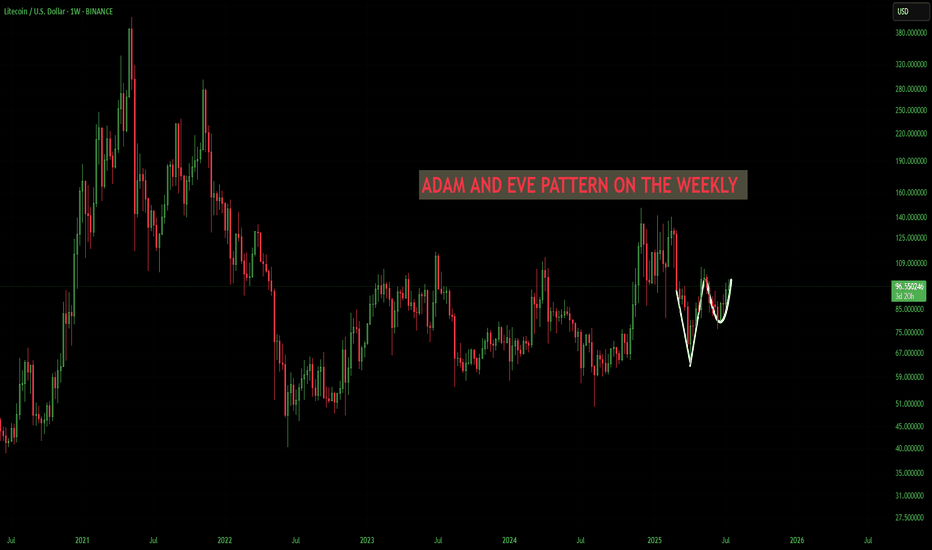

LTC/USD LITECOIN Adam & Eve Pattern On WeeklyThe Adam and Eve pattern is quite effective and usually signals a trend change to bullish. Once this pattern breaks the neckline I think its straight to $200 before any sort of pullback.

Haven't done a chart in a while cause its been the same old stuff, sideways. We are starting to ignite now. Silver is running which means something is breaking in the background financial system. I see the biggest blow off top you've ever seen coming, its the only way out of this, print print print until it doesn't work anymore.

Also I was reading that Bitcoin is removing its cap for spam in each block in October? This could spell disaster for fees and congestion. Litecoin will skyrocket during that time I believe because the fees will be so high it will price out the little guy trying to send a grand or two. I see an influx of people coming to Litecoin. Good luck , none of this is financial advice just my opinion

Litecoin Continues Its Bullish Cycle As ExpectedLitecoin Continues Its Bullish Cycle As Expected, which can send the price even higher from technical point of view and by Elliott wave theory.

We talked about Litecoin back on May 30, when we spotted a bullish setup formation with waves (1) and (2) that can extend the rally within wave (3) of a five-wave bullish impulse.

As you can see today on July 18, Litecoin with ticker LTCUSD is now breaking strongly back above May highs after we noticed a complex W-X-Y correction in wave (2). Now that ALTcoin dominance is stepping strongly in, we may easily see more gains within a projected five-wave bullish cycle during the ALTseason, just be aware of short-term pullbacks.

LTC Targets 400$ + 1900$ Litcoin LTC Targets for the next run are atm +290% is a realistic szenario. The addvanced targets at 1900$ are very impressiv but remember there are only 21 Mio. Coins too, like BTC because it is the fork and think about an alternative payment methode like btc, would be a reason for 1900$ pro LTC. So in Crypto is nothing unreal if you could imagine, but first of all approx. 400$ are a good direction. GM

Litecoin (LTC) - $1000 Target Hype or Reality? | Ew analysisLitecoin may be on the verge of a breakout following nearly four years of accumulation. From a technical standpoint, this could lead to a powerful rally toward targets in the $600–$1000 range. However, the timing of this Wave 4 consolidation don’t align particularly well with a typical, healthy correction. A break below the red line would invalidate the current count and shift focus to my secondary outlook.

Litecoin: Volume-Heavy Resistance Caps RecoveryFenzoFx—Litecoin fell 2.50% today, forming a double bottom at $90.80. If bears stabilize the price below this level, the decline could extend toward $85.20 support.

Resistance at $97.90 aligns with a high volume zone, reinforcing bearish pressure and making a breakout challenging.

LTCUSD💥 LET’S TALK ABOUT LITECOIN (LTC) – THE SILVER OF CRYPTO IS WAKING UP ⚡

For years, Litecoin was seen as the silver to Bitcoin’s gold – a trusted, fast, decentralized payment coin that’s been around since the early days. But lately… it’s been flying under the radar. Almost no one talks about it. 👀

And that’s exactly why smart investors are watching it closely right now. 📈

🔍 From a technical perspective, if you zoom out and compare the macro structure of LTC to XRP, you’ll notice some striking similarities:

✅ A massive bullish harmonic pattern forming

✅ Multi-year accumulation zone – strong hands have been loading

✅ Volatility compression + breakout structure

✅ Ready for a beast-mode expansion phase 🚀

We’re not throwing wild guesses here – the technical case for a major move is solid. Seeing LTC revisit the $900 zone? Not just possible — plausible, especially as market sentiment shifts back toward legacy altcoins with proven track records.

🧠 Don’t sleep on this just because it’s not the shiny new alt. Often, the biggest moves come from forgotten giants.

💡 If you're not comfortable buying crypto directly, many brokers offer ETPs (Exchange Traded Products) linked to Litecoin. Just search for Litecoin ETP or LTC tracker on your preferred platform.

TL;DR: Litecoin is coiled. Fundamentals are strong. Technicals are explosive. The silver is about to shine again. 🌕⚒️

#Litecoin #LTC #CryptoAlert #CryptoTrading #Accumulation #Altseason #SilverOfCrypto #BreakoutIncoming #ETP #TechnicalAnalysis

The come back of digital Silver ?Litecoin still stuck inside one of the largest and most boring consolidation pattern in the cryptoverse.

Now BTC.D is about to flip, there is still a chance LTC could find a way out and get a super powerful breakout !

Blue line is LTC halving.

Then we always had the typical post halving dump before longer consolidation.

Fun fact is we can measure around 850 days from halving to peak of bull run.

That would give us a peak around November 2025.

There is so much room to the upside !!!!

Final target 2000 to 3000$

LFG !

Is This the Perfect Moment to Rob the LTC/USD Vault?🏴☠️ LTC/USD Heist Mode: The Moving Average Break-In Plan 💰📈

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Calling all Market Bandits, Crypto Hustlers & Chart Raiders! 🤑💰🚀

🚨Mission Briefing

We’re eyeing a bullish breakout hit job on the LTC/USD chart — all based on the elite 🔥Thief Trading Style🔥 with a touch of candle science, moving average vault-cracking, and some solid day/swing setups. This ain’t your grandma’s trade plan — this is high-level lootin’ with precision.

🕵️♂️ 🎯 ENTRY PLAN — Unlock the Vault at $86.00

Wait for the MA breakout + candle close above that sneaky Moving Average line.

➡️ Execute Buy Stop orders above MA

➡️ OR place Buy Limit during a pullback to swing low/high zones in 15m–30m timeframe.

📌 Pro tip: Set an alert – catch the breakout live, don’t chase it later.

🛑 STOP LOSS — Your Getaway Route

Place your Thief SL near the recent swing low (82.00 using 3H chart).

🎤“If you’re entering like a pro, stop loss goes where it should – not where fear lives. But hey, it's your ride or die. Choose wisely.” 🔥

💡Adjust SL based on lot size, risk %, & how deep your robbery goes.

🏴☠️ TARGET ZONE — Exit the Scene at $92.00

Get your bags packed, profits stacked, and be ready to escape before the market catches on.

💸 Grab the loot and bounce before the reversal gangs arrive!

📈 Why the Heist?

The LTC/USD crypto market is showing bullish momentum, backed by key analysis angles:

🔍 Fundamentals

📊 COT Report

💥 On-Chain Metrics

🧠 Sentimental Heat

🌍 Intermarket Structure

👉 Check your intel. React. Don’t sleep. 🔗🔗

⚠️ News Alert & Risk Tip

🗞️ Stay clear of trades during volatile news releases

🔐 Use trailing stops to lock in gains

🚫 Protect your positions – don't let profits slip through cracks.

📌Disclaimer:

This ain’t financial advice — it’s just a shared plan for market raiders. Trade at your own risk, and don’t forget to bring your own map. Market shifts faster than a getaway car — so adapt & react smartly. 🧠💡

💖 BOOST the Plan 💥

Hit that Boost Button if you're vibin’ with the robbery crew. It powers up the strategy and supports the movement. Together, we trade to take — The Thief Trading Way. 💸💪🎉

🚀 Catch you on the next breakout. Stay sneaky, stay sharp. 🐱👤🤑

When YouTubers Say 'No'… We Say 'LTC Go!'I’m not here to drop some fancy technical analysis today.

I’m here to tell you… this might just be it.

A big, popular YouTube channel just announced they’re not too bullish on Litecoin this cycle.

And guess what? That might actually be our ultimate buy signal.

The chart’s looking bullish now — the trap has been set, and left behind us. 😎

They FUD, We Flood (Our Bags)

Why Litecoin? Beyond its unshakable fundamentals, if you genuinely understand and believe in crypto and digital freedom, Litecoin is the purest expression of that vision

That's it, that's the idea" - Good night !

LTC starting wave 3This wave will bring us to the break out level, charts looking fantastic and overall bullish. Btc.d still didn't start to melt and the LTC pair is looking to recover the 0,001 and higher for the run. The LTC run from 4 to 420 lasted around 9 months ,the runs from 40 to 420 lasted around 6 months, if me start running now we have get 6 months till the bull ends... Lets keep our eyes open.

Litecoin to $1100 (12X) In This Coming AltseasonBased on tried and true fractals, multi-fib confluences, and historical price action, Litecoin is poised to hit prices between $900-1500 this cycle. The multi-fib confluences are pointing to $1100-1200 range as the most likely target. This is expected over the next 6-12 months if things continue to play out how I am expecting. As of today SEC approval of a LTC ETF is imminent but yet to be actualized.