Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.4 USD

8.24 B USD

114.11 B USD

6.77 B

About RELIANCE INDUSTRIES LTD

Sector

Industry

CEO

Mukesh Dhirubhai Ambani

Website

Headquarters

Mumbai

Founded

1957

FIGI

BBG000BJNTZ8

Reliance Industries Ltd. engages in hydrocarbon exploration and production, petroleum refining and marketing, petrochemicals, retail, and telecommunications. It operates through the following segments: Oil to Chemicals (O2C), Oil & Gas, Retail, Digital Services, Financial Services, and Others. The O2C segment includes refining, petrochemicals, fuel retailing through Reliance BP Mobility Limited, aviation fuel and bulk wholesale marketing. The Oil and Gas segment engages in the exploration, development and production of crude oil and natural gas. The Retail segment includes consumer retail and range of related services. The Digital Services segment includes provision of a range of digital services. The Financial Services segment comprises of management and deployment of identified resources of the firm to various activities including non-banking financial services and insurance broking. The Others segment engages in Media, SEZ development, and textile business. The company was founded by Dhirubhai Hirachand Ambani in 1957 and is headquartered in Mumbai, India.

Related stocks

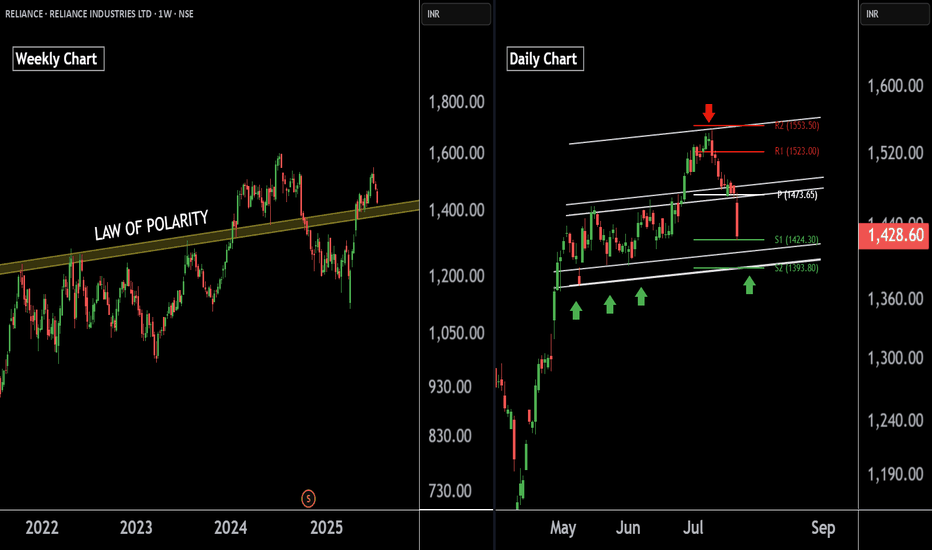

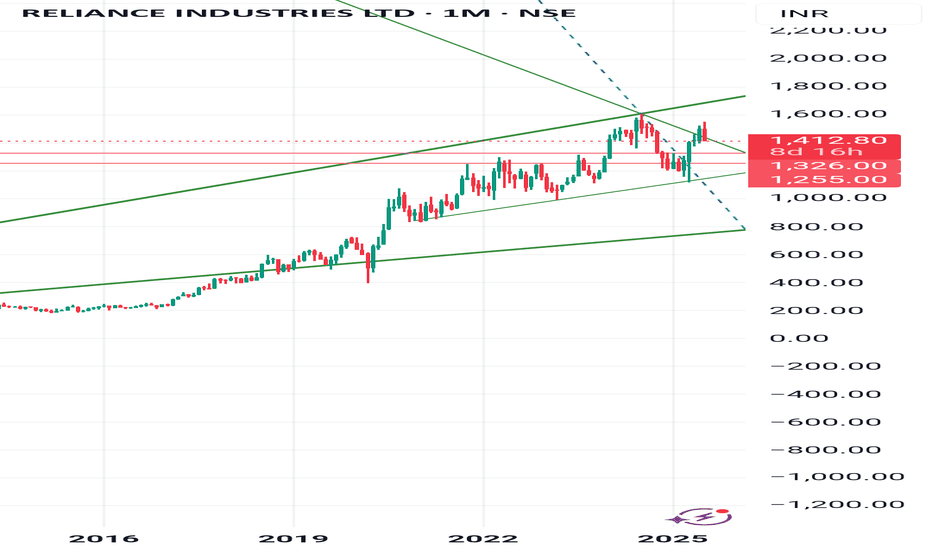

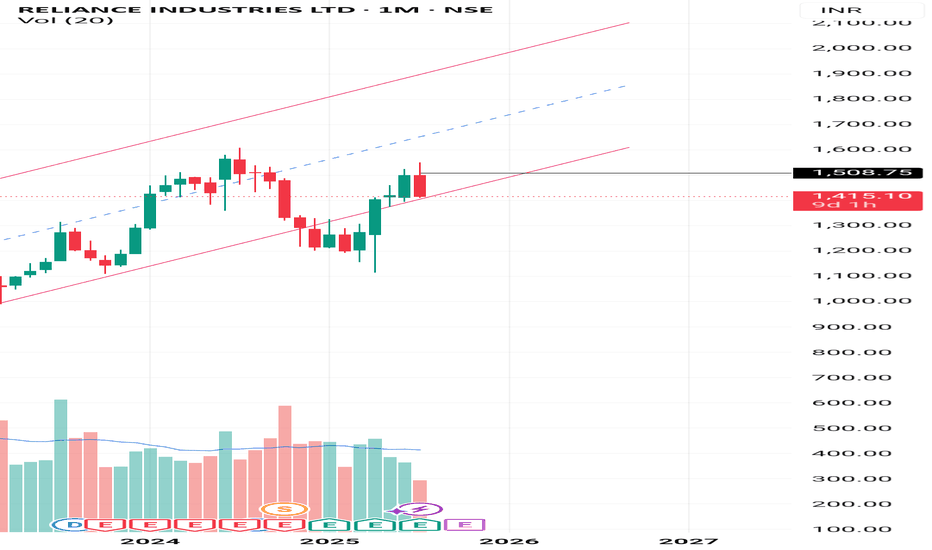

Reliance Industries — Preparing for the Next Bullish Leg !!There are two charts of Reliance Industries — one on the weekly timeframe and the other on the daily timeframe.

On the weekly timeframe:

Reliance industries is trading near (LOP), with a key support zone in the range of 1385–1400.

On the daily timeframe:

Reliance industries is moving in well defin

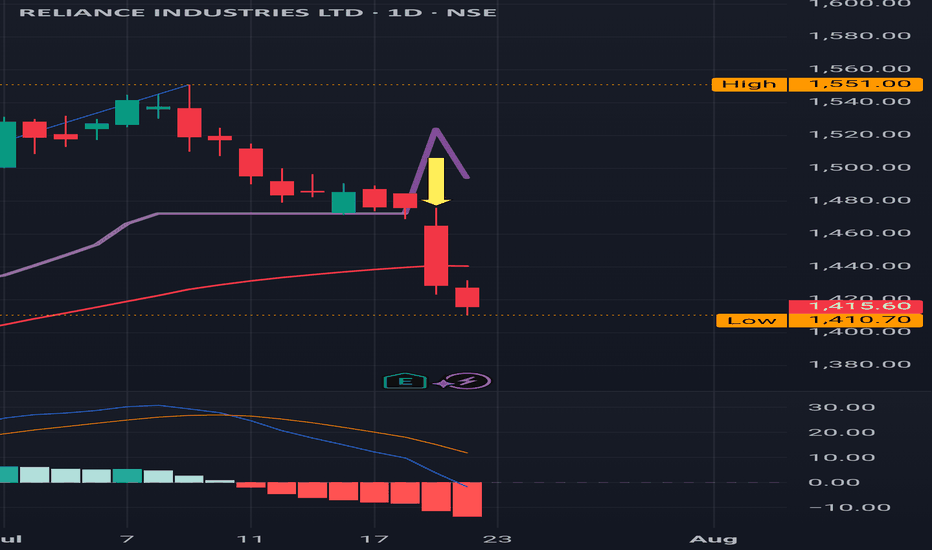

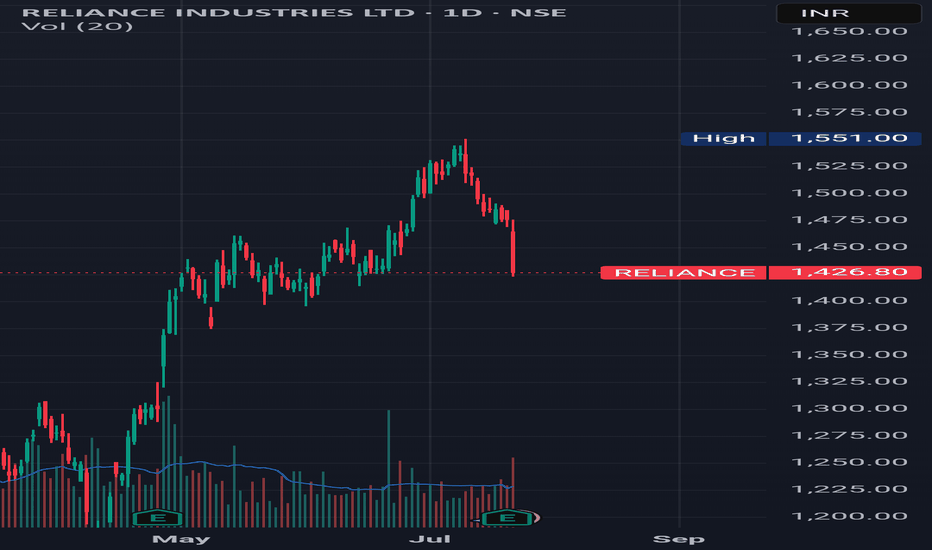

What to do with Reliance share after its drubbing today? Reliance looks weak post result however there is no spike in volume of sale that is a good point. The levels from which Reliance can recover seem to be 1427, 1370 or 1323. If we get a closing below 1323 the stock can fall to 1217 or even 1160 levels this is the reading as of now.

The result was lo

Reliance Entry done @ 1425Reliance Industries Ltd (RIL) shares are experiencing a decline, currently trading around ₹1424-1425. This recent dip comes despite the company reporting robust Q1 FY26 results with a significant 78% year-on-year rise in consolidated net profit to ₹26,994 crore, largely driven by a one-time gain fro

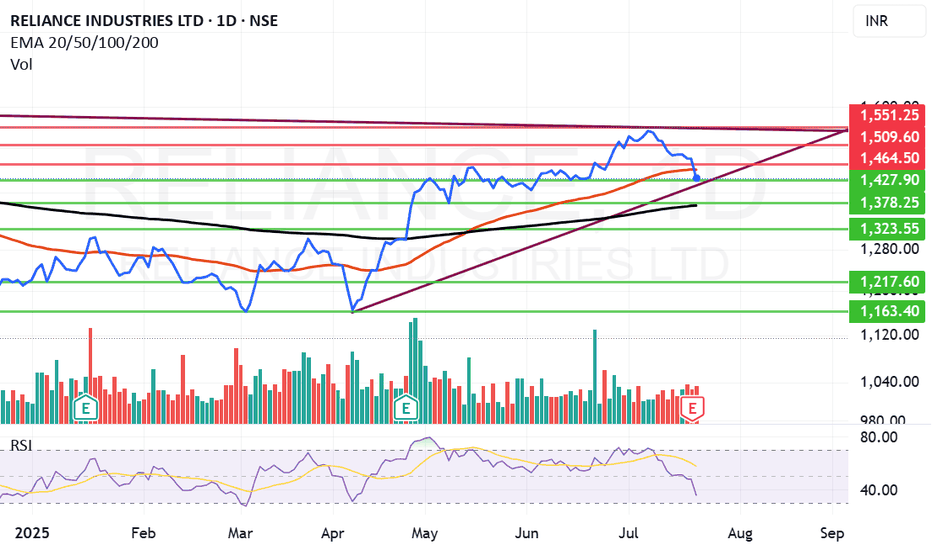

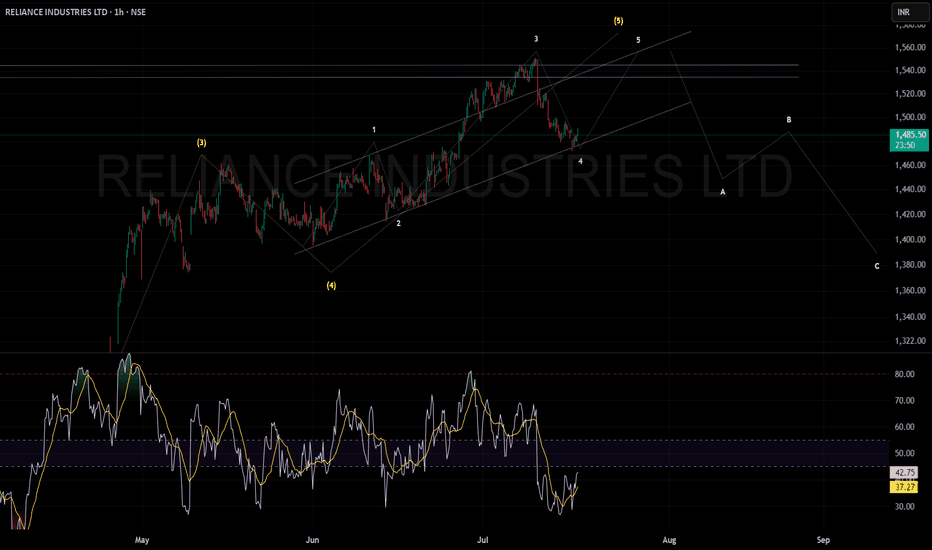

Reliance Industries Stock(India) - {11/07/2025}Educational Analysis says that Reliance Industries (Indian Stock) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two

RELIANCE INDUSTRIES at Best Support !! Keep It On Your Radar !!There are two chart of RELIANCE INDUSTRIES on Daily and 4 hour Timeframe.

On the 4-hour timeframe, Reliance is likely to respect its LOP (Line of Polarity) as support, with the support range near 1460-1475.

On the Daily timeframe, the monthly pivot is also positioned around 1473, reinforcing this

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

RLNGF5335118

Reliance Industries Limited 3.75% 12-JAN-2062Yield to maturity

7.08%

Maturity date

Jan 12, 2062

USY72570AL17

RelianceInd 10,25% 15/01/2097Yield to maturity

6.93%

Maturity date

Jan 15, 2097

RLNGF5335117

Reliance Industries Limited 3.625% 12-JAN-2052Yield to maturity

6.84%

Maturity date

Jan 12, 2052

USY72570AG22

RelianceInd 10,5% 06/08/2046Yield to maturity

6.38%

Maturity date

Aug 6, 2046

RLNGF4208883

Reliance Industries Limited 4.875% 10-FEB-2045Yield to maturity

6.36%

Maturity date

Feb 10, 2045

RLNGF5059438

Reliance Industries Limited 6.25% 19-OCT-2040Yield to maturity

5.42%

Maturity date

Oct 19, 2040

RLNGF5335116

Reliance Industries Limited 2.875% 12-JAN-2032Yield to maturity

5.18%

Maturity date

Jan 12, 2032

RLNGF4567942

Reliance Industries Limited 3.667% 30-NOV-2027Yield to maturity

4.57%

Maturity date

Nov 30, 2027

RLNGF4280137

Reliance Industries Limited 2.512% 15-JAN-2026Yield to maturity

4.05%

Maturity date

Jan 15, 2026

RLNGF4439521

Reliance Industries Limited 2.444% 15-JAN-2026Yield to maturity

3.99%

Maturity date

Jan 15, 2026

RLNGF4419461

Reliance Industries Limited 1.87% 15-JAN-2026Yield to maturity

3.66%

Maturity date

Jan 15, 2026

See all RELIN bonds

Curated watchlists where RELIN is featured.

Downstream oil: Petroleum through the pipes

39 No. of Symbols

Indian stocks: Racing ahead

46 No. of Symbols

See all sparks