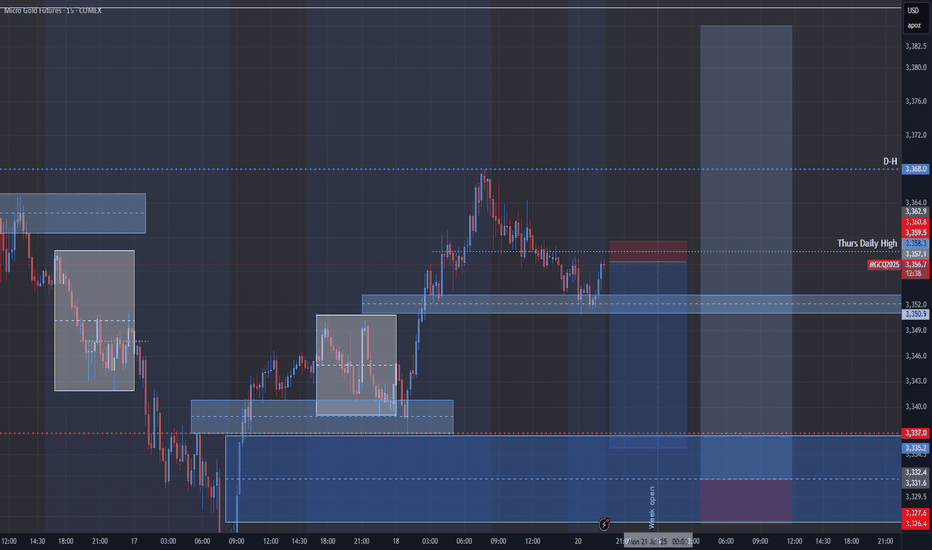

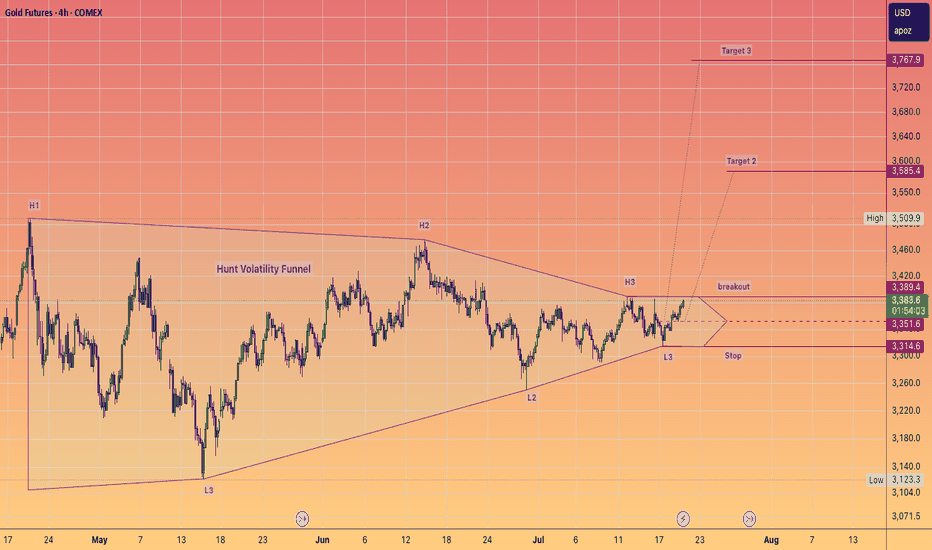

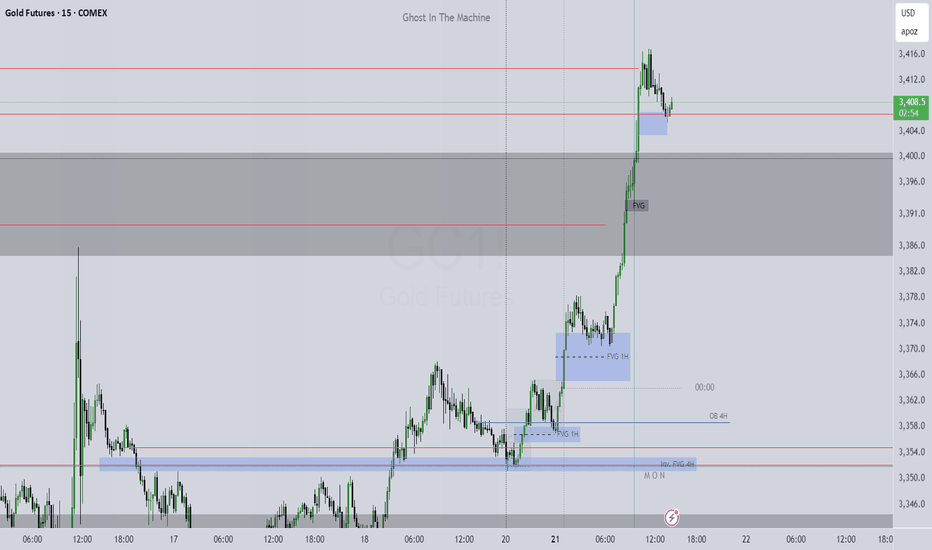

Gold will make a Low for the Week before Pushing BullishOn my previous Update I mention that we should have support off this H4 Gap. My problem with it s it immediately reacted to it when the market opened back up. well before the killzone. So I feel like this is a fake out to go short for now. they will make a low for the week then we will see it set up for the bullish move.

Gold Futures

GOLD1! trade ideas

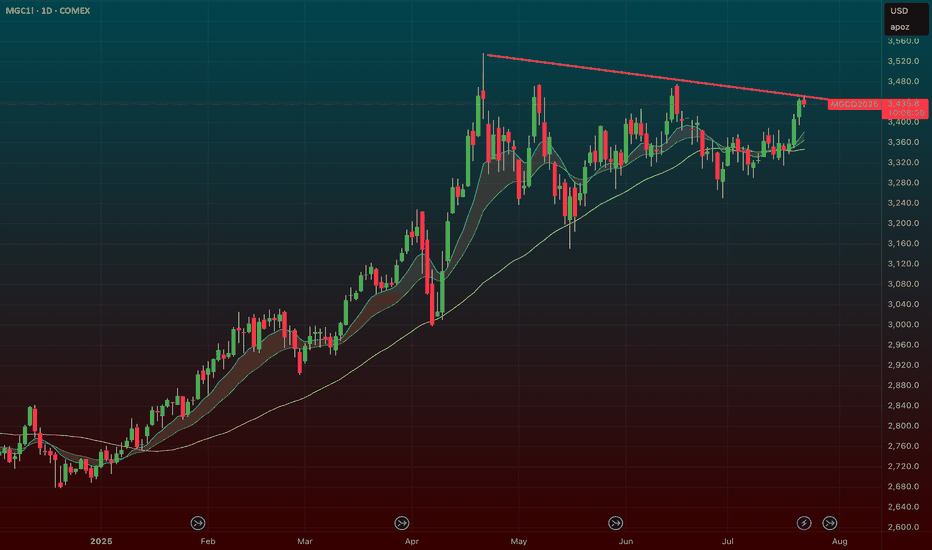

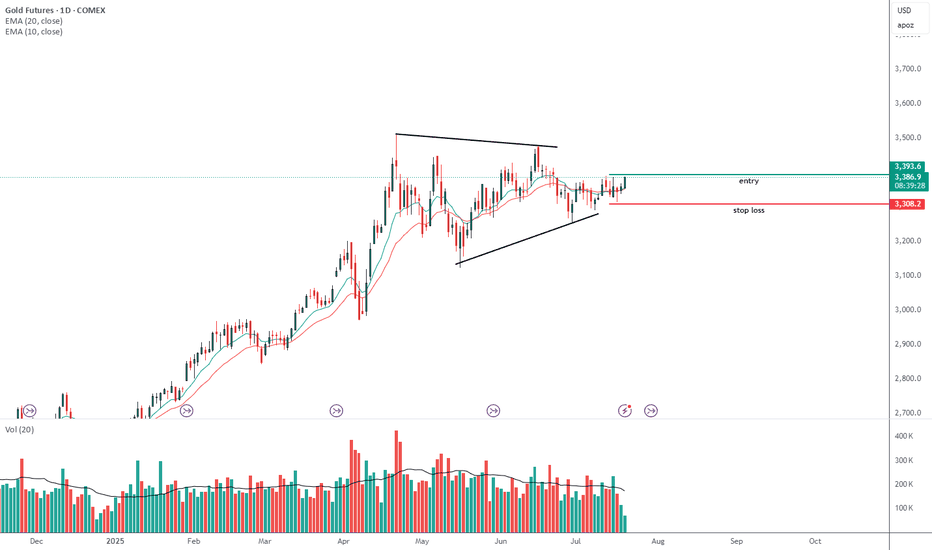

$GLD / $GC – Gold Poised for Breakout as Hard Assets FlexAMEX:GLD / SET:GC – Gold Poised for Breakout as Hard Assets Flex

Gold is setting up for a major breakout, and the broader market is finally catching on to the hard asset trade. Whether it’s inflation ticking up or the never-ending government deficit spending, the market is starting to signal something big.

🔹 Macro Tailwinds:

Inflation pressures + record deficit = a perfect storm for gold.

The dollar is under pressure — metals ( AMEX:GLD , AMEX:SLV , SET:GC ) are responding.

This theme isn’t going away anytime soon.

🔹 Technical Setup:

AMEX:GLD and SET:GC (Gold Futures) are coiled tightly just under breakout levels.

Volume is steady, and momentum is building under the surface.

A move through current resistance could send this entire trade into overdrive.

🔹 My Positioning:

1️⃣ Options: Long AMEX:GLD calls with 1-month expiration — slow mover, but clean structure.

2️⃣ Futures: Trading SET:GC contracts on the breakout side.

3️⃣ Silver Exposure: Still holding partials in AMEX:SLV — it’s following gold’s lead but with more juice.

Why I’m Focused Here:

This is not a one-day theme — hard assets are becoming a rotation trade.

If this confirms, we could see multi-week upside in precious metals.

It’s rare to get clean technicals that align this well with macro.

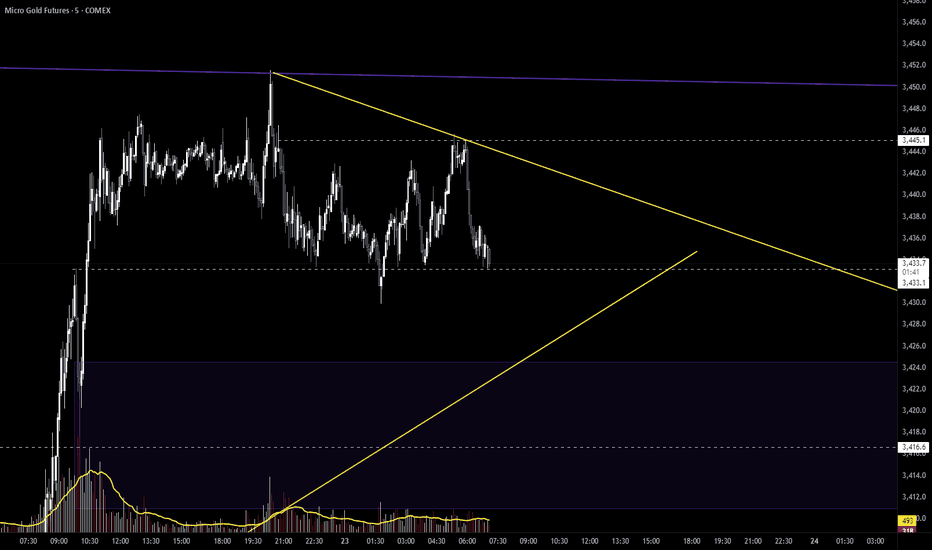

$GC / Gold Update - A New Entry - 7/23Hello fellow degenerates,

Our next target is above 3504 and we are currently in a quick ABC retracement.

- I am looking for an entry in the 3424.6-3411 range.

- This is a wave C so we could see an ABC or a ABCDE pattern forming.

- Levels to watch: 3433.1, 3424.6, 3416.6, 3408

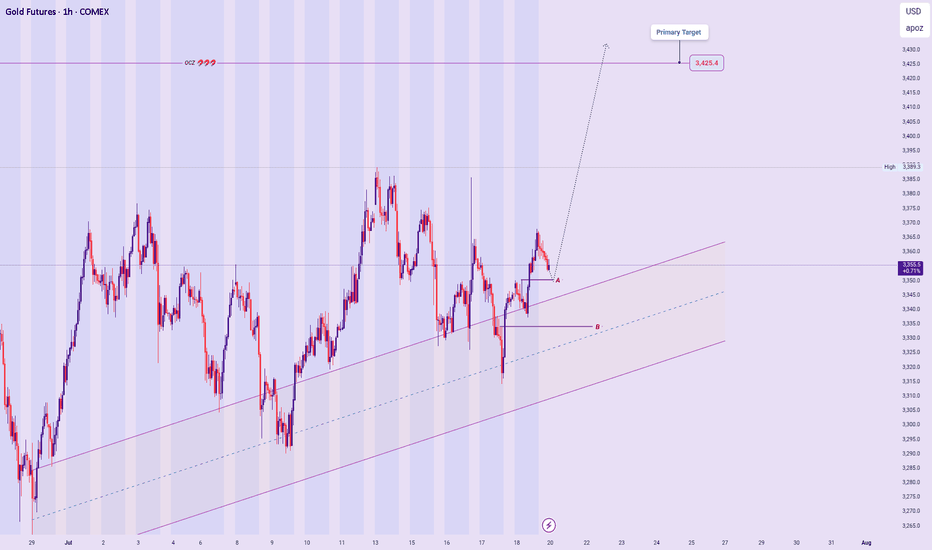

XAUUSD – New Week Technical Bias (Market Open)

Bias Overview:

Current outlook remains aligned with previous bullish analysis, supported by the broader Ascend Sequence on higher timeframes.

Price Expectations:

Anticipating a micro decline toward Price Zone A as a potential springboard for a bullish continuation.

While less likely, a deeper pullback into Price Zone B may occur before the rally unfolds — still within acceptable structure for HTF bullish intent.

Execution:

Will rely on micro-timeframe confirmations and reaction behavior within these zones to finalize entry decisions following market open.

Invalidation will be break and bearish structure below the ascending sequence Channel.

Summary:

Maintaining bullish bias while awaiting refined entry opportunities at defined price zones. Structural invalidation remains below key support and Sequence Line levels.

[b ]🔒 Disclaimer:

This analysis is for educational and strategic insight purposes only. It is not financial advice. Always manage your own risk and confirm with your personal trading plan before executing trades.

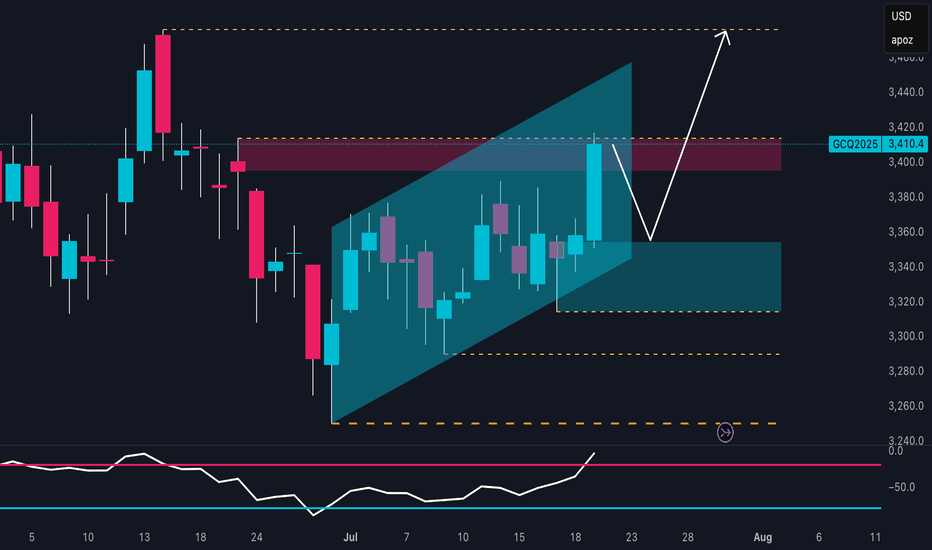

Gold Bulls Reloading? Smart Money Buys!The technical outlook on XAU/USD shows a well-defined bullish trend, developing within an ascending channel that started in late June. Price recently pushed toward the upper boundary of this channel, reaching a key resistance zone between 3,410 and 3,420 USD, which aligns with a previous supply area and significant daily structure. The reaction in this zone suggests a potential fake breakout, hinting at a short-term pullback before a continuation of the upward move.

The RSI oscillator supports this view, displaying bullish momentum with a breakout above the 60 level. However, the current slope hints at a possible minor correction before the next impulsive leg higher. The most relevant demand zone lies between 3,340 and 3,360 USD, at the base of the ascending channel—an ideal spot for buy orders to accumulate in anticipation of a move toward previous highs.

Backing this technical setup, the Commitment of Traders (COT) report as of July 15, 2025, paints a constructive picture. Non-commercial traders (institutional speculators) increased their long positions by over 8,500 contracts, while also cutting short positions by about 1,600 contracts, indicating a strong bullish bias. Commercials also increased their shorts (+16,448), a typical hedge during rallies, but not enough to invalidate the bullish structure.

From a seasonal perspective, July remains one of the historically strongest months for gold. According to MarketBulls data, over the past 2 years, gold has averaged gains of 105+ points in July, with solid returns also visible on the 5-year (+45 pts) and 10-year (+25 pts) averages. August also tends to be supportive, reinforcing the idea of a medium-term bullish extension.

Lastly, the retail sentiment is heavily skewed, with 72% of retail traders short, and only 28% long. From a contrarian standpoint, this is another strong bullish signal. When the majority of retail traders are short in a structurally bullish market, the potential for a short squeeze remains high.

GOLD: Pre-market PrepSo for gold today, I see a lot of confluence around the prior week's high, prior day's high, and the prior value area high. We also had a poor high last Friday that we've clearly broken through.

Right now, we're in balance up above these key levels. My immediate plan is to continue going long up to the prior month's value area high. If we get a pullback to the confluence area, I want to take it up from there.

If the market opens and we accept back into the previous area, I'll be looking to go short from that area and take it down. That's my main analysis for gold today. Let’s trade smart, peace!

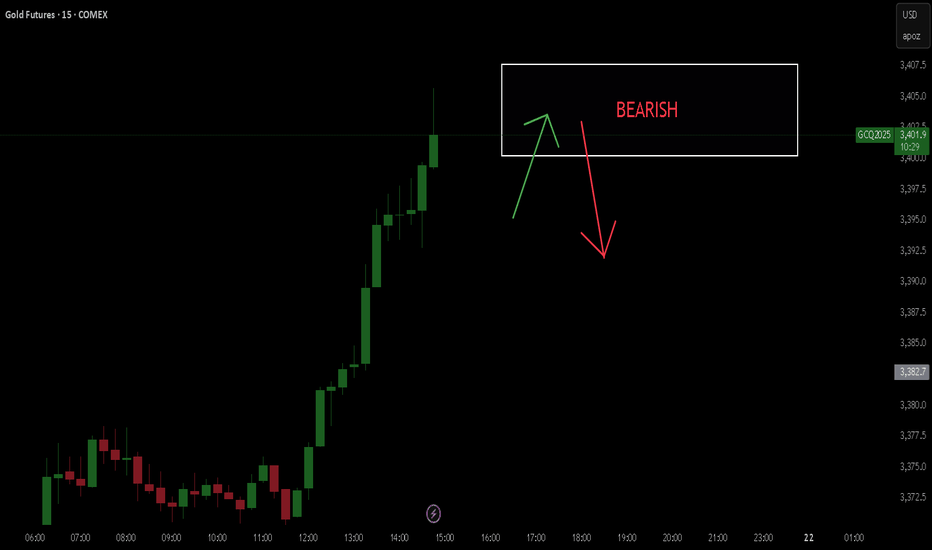

GC Ready to Bleed? This Setup Has Teeth.As we head into the new trading week, GC presents a clean, disciplined short setup developing right below Friday’s key high. Price tapped the Previous Day High ($3,368) and supply zone before rejecting, failing to hold bullish momentum into the weekend close.

The market structure is currently defined by:

- A strong upward trend line (supporting the latest rally)

- A bearish order block/supply zone

- Two Fair Value Gaps below

- A failure to sustain above PDH

This confluence builds a narrative of exhaustion to the upside, especially with no aggressive buyers stepping in after PDH was swept. We're not short yet this setup needs confirmation. But once it breaks, it's clean.

Entry (Trigger) - $3,353.0

A clean break below the ascending trend line, ideally with a 1H close through it. This confirms structure shift and bearish intent.

- TP1: $3,344.0 → Top of the unfilled FVG zone

- TP2: $3,337.6 → Previous Day Low (PDL) and liquidity target

Kill Switch (Invalidation Level) - $3,371.6

If the market opens strong and pushes through the PDH and supply zone, the short idea is invalid. No shorts above here.

Confluences

- PDH Rejection - Strong wick and reversal from $3,368 shows supply dominance.

- Trend line Weakness – Price stalling right at the trend line heading into open. Any gap down or weak open will break it.

- FVG Below – Unfilled inefficiency sitting directly beneath current price this is a natural magnet.

- Volume & Momentum Divergence – Last push into highs had lower volume, suggesting buyer fatigue.

- Time-Based Edge – Sunday night liquidity traps often lead into London session reversals ideal timing for trend line break & FVG sweep.

- Clean Invalidator – No ambiguity: reclaim the highs = setup is off.

Timing & Execution Plan

This is not a trade to rush into at Sunday open. We want the 1H candle to close below $3,353.0 or a rejection + retest structure. The key sessions to monitor are:

- Sunday Night (Low Liquidity) - Observe gaps or traps

- London Open (8:00–9:00 UK) - Look for momentum or stop run

- NY Open (13:30 UK) - Final confirmation if London doesn't move it

Only act on confirmation. No guesswork. No front-running. Let the setup play out. If the market opens strong and climbs above $3,371.6, we’re no longer looking short. In that case:

- Supply zone is invalidated

- Trend line is reclaimed

- FVG becomes invalid magnet

We stand aside and reassess the long side on intraday demand reclaims or wait for a deeper correction to re-engage. This setup is a textbook bearish, high-probability, low-risk, confirmation-driven. It has everything we look for: structure break, inefficient price gap, prior liquidity sweep, and a defined invalidation. All that’s left is for the market to open and print.

If it confirms, it moves fast.

Gold Futures Trading Plan / July 21, 2025Overview

This trade plan reflects a comprehensive view of gold futures (GC) going into the week of July 21, 2025. The analysis draws from current macroeconomic factors, positioning data, technical structure, and live order flow behavior. Every component has been evaluated to ensure the bias is not emotional or speculative but firmly evidence based.

Macro Environment

• Real US 10Y TIPS yields remain above 2.00%, historically a bearish regime for gold.

• The US Dollar Index (DXY) is firming, adding pressure to metals.

• Absence of geopolitical or systemic financial stress weakens safe-haven demand.

• The Federal Reserve maintains a hawkish tone, with no near-term easing signaled.

Positioning Overview (as of July 15, 2025)

• Funds: Net long ~213,000 contracts, increasing their long exposure.

• Commercials: Net short ~250,000 contracts, adding to short exposure.

• Retail: Net long ~37,000 contracts, aligning with fund sentiment.

This positioning suggests a crowded long environment with commercial hedging at elevated prices. Historically, such divergence has preceded local reversals in gold.

> Commercials are unloading gold to the euphoric buyers

>Retail is joining long side = late to the party

Funds are late, commercials are patient. If we break higher and fail, that’s my cue to fade.

Demand & Flows

• India: Gold imports declined to a 14-month low in June.

• China: Volume at the Shanghai Gold Exchange remains stable but subdued.

These indicators reflect softness in physical demand from key global buyers.

Technical Snapshot

• Price is compressing within 3330–3375.

• Point of control (POC) near 3358.

• Repeated rejections near 3375 with weakening volume.

• Negative divergence seen in cumulative volume delta (CVD).

Order Flow Observations

• Absorption noted near 3365–3380, with price stagnation despite aggressive buying.

• Lack of delta follow-through into highs.

• Spoofing behavior detected around 3372–3375, consistent with trap formation.

Trade Thesis

This is a macro-aligned short idea based on positioning, absorption at resistance, and weakening momentum into overhead supply.

Execution Framework (example scenario)

This is a non-binding conceptual entry framework for educational purposes only.

• Initial scale-in: ~3367.5 (light test)

• Main entry zone: ~3371.5 (if absorption continues)

• Optional add-on: ~3374.5 (if spoofing holds and no breakout occurs)

• Risk: Hypothetical invalidation above ~3385.5

• Targets:

• T1: ~3348 (value area)

• T2: ~3332 (prior support)

Note: Actual execution must depend on real-time confirmation and discipline. This example is not financial advice or a live signal.

Sentiment Bias

Currently biased short if price fails to break 3375 with conviction. Trade invalidates on sustained strength through absorption zones.

Probability: High

Gold. 14.07.2025. The plan for the next few days.The nearest resistance zones are where it's interesting to look for sales. It's not certain that there will be a big reversal, but I think we'll see a correction. We're waiting for a reaction and looking for an entry point.

The post will be adjusted based on any changes.

Don't forget to click on the Rocket! =)

Gold Futures Super Strong Resistance - Price Coming Back StrongGold Future has been very strongly pushing up without filling any gapes in the short side before pushing up more further.

One unique line is probably the target super strong resistance.

In a daily chart, probably better wait until it reaches that point to try to check for strong short entries maybe.

Still arriving there it would explode up even more further to transform that line into a super strong probable support.

Keep watching!

(Do we actually have to believe that gold is secretly targeting $10,000) in the Yearly Chart?... Since February 2022 it just went berserk!)

#GOLD #XAUUSD Seems to have ended the correction FX_IDC:XAUUSD Gold Spot might have completed the correction as a complex 3-3-5 FLAT, and is currently turning higher in wave (ii), however this get invalidated if THE LAST LOW OF 3268.19 BREAKS. Till the pivot 3268.19 stays strong, the move should be impulsive and take us to new high near term.

Gold Range-Bound and Ripe for Mean Reversion Plays?Gold has been locked in a sideways, range-bound regime for months, largely oscillating between the 3400 and 3160 levels. This lack of clear directional trend stems from conflicting fundamental forces: on one hand, sticky inflation and resilient U.S. data have bolstered the U.S. dollar and yields, weighing on gold. On the other, global growth concerns and geopolitical tensions continue to underpin demand for the metal as a safe haven. The push and pull of these opposing themes has created an environment of indecision and choppy price action.

While long-term investors may find this frustrating, range traders and mean reversion strategies are thriving. With technical boundaries so well-defined, short-term oscillations within the range are offering repeated opportunities for disciplined entry and exit.

Currently, XAUUSD is trading just under the 3296 level after a recent rejection from the 3350s. The bearish structure suggests a potential leg down toward the 3160–3180 support zone. However, absent any major economic surprises or geopolitical shocks, this could merely be another deviation from the mean rather than a true breakdown. Indicators like RSI and Stochastic Oscillator are already hinting at early signs of bullish divergence.

If price holds above or near 3160, the setup for another mean-reversion trade back toward the mid-range (around 3296 or higher) could unfold. In the current environment, fading extremes rather than chasing trends remains a strategy of edge, as depicted by the 14 period RSI.

Gold’s Compression Coil Looks Ready to DetonateMGC continues to reject the 50% Fibonacci retracement level from the $3,386.5 swing high, currently trading at $3,347.3. Price has now spent multiple candles trapped under this level, unable to reclaim $3,355, with clear upper wicks and no bullish follow-through.

This is classic midday NY session compression, often setting up a late-day directional move. All signs currently point to continuation lower toward $3,306.2, completing a textbook measured move.

Staakd Probability Model

Based on historical setups where MGC pulls back to 50% and stalls mid-NY:

Scenario Probability

- Continuation down to $3,306.2 68% High-probability path if $3,347 breaks

- Sweep to $3,355–$3,360 before drop. 26%. Possible liquidity grab

- Break and hold above $3,360 6% Invalidation of the short idea

Key Levels

Level

- 100% Fib High $3,386.5 - Swing high

- Supply Zone $3,347–$3,355 - Rejection area + equilibrium zone

- Current Price $3,347.3 - Compression below fib midpoint

- Target Zone $3,306.2 - Measured move / demand structure

- Invalidation $3,360.0+ - Break above this invalidates the short

Trade Idea (Pending Trigger)

- Bias: Bearish

- Entry Zone: $3,345–$3,350

- Target: $3,306.2

- Invalidation: Above $3,360

- Reward-to-Risk: 2.2R–2.5R depending on entry execution

This is shaping into a high-probability continuation setup. NY session has done the heavy lifting: a weak bounce, heavy rejections, and no reclaim of structure. Unless we see a sudden reclaim of $3,355 or a spike in late NY volume, this looks ready to break and expand lower. Keep it simple. Trust the structure. Let price walk itself to the target.

MGC Bear Flag or Dead Cat Bounce? Tokyo’s About to DecideClean structure forming on MGC after a heavy impulse sell during NY session. We’re now consolidating below VWAP in what looks like a textbook bear flag or descending wedge.

We had a sharp breakdown from the highs with no real attempt to reclaim the structure. Price is now compressing underneath the 9/21 EMAs and VWAP clear bear pressure. Volume POC from this range is sitting around 3,332.7, and price can’t even sniff it. Fibonacci 50% retrace off the sell leg aligns with POC stacked resistance.

Entry marked at 3,318.4, targeting a breakdown into 3,268.4 roughly the measured move from the flag.

Quant Confluence:

- Under VWAP

- Below 9 & 21 EMA

- Fib 50% rejection

- Bear flag structure

- POC rejection zone

If I'm Wrong:

If price closes above 3,332.7 (POC) or breaks and holds above VWAP, the bear thesis weakens significantly. Flip long only on a full structure reclaim.