Gold Petal Futures

GOLDPETAL1! trade ideas

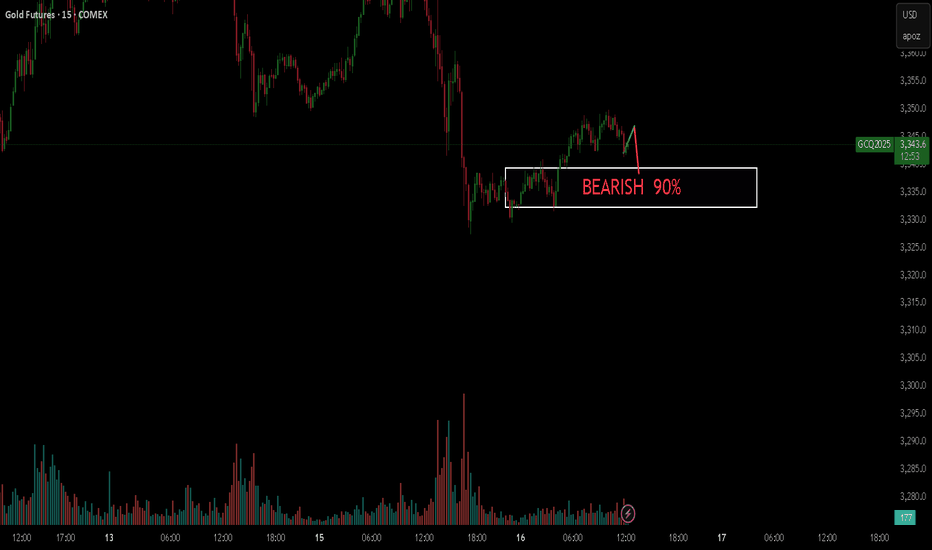

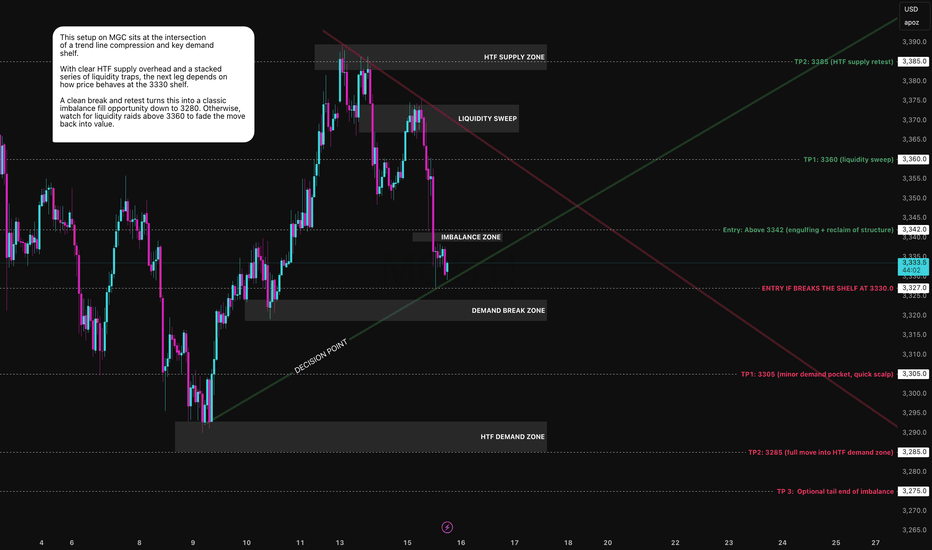

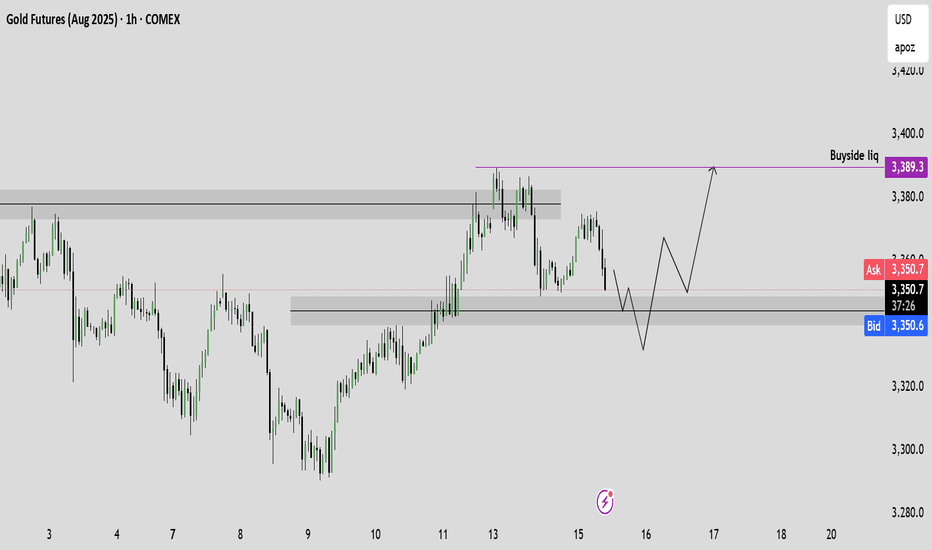

Gold Futures ($GC1!) — US Session Setup: Bearish Retest from 618🟡 Gold Futures ( COMEX:GC1! ) — US Session Setup: Bearish Retest from 0.618 Fib in Bullish Breakout Context

⏳ Pre-US Session Playbook

We're currently watching Gold Futures ( COMEX:GC1! ) for a potential short opportunity into the US session open. While the broader structure has broken bullish, we're anticipating a bearish retest scenario from a key Fibonacci level — aligning cleanly with last week’s breakout structure.

No positions have been taken yet — we are setting up for the US session — and are closely monitoring price action near the 0.618 retracement zone before committing.

📍 Setup Breakdown

• 0.618 Fib Retracement from the last bearish impulse aligns with:

○ Recent volume shelf resistance

○ Retest zone from prior breakout

○ An overextended local push into thin volume above 3380

• Bullish Context:

○ HTF breakout from descending wedge structure remains valid

○ Macro buyers still in control

○ Upside continuation risk is high if sellers don’t show up

• Short Bias Conditions:

○ Rejection or absorption in the 3385–3390 zone

○ Weak follow-through above 0.618 (failed breakout scenario)

○ Breakdown of LTF higher low structure post-test

🧠 Strategy Commentary

Although we’re in bullish breakout mode, this is a tactical short setup — a fade into prior structure with clear invalidation. We're not fighting trend, but looking to short into exhaustion at a defined level, with tight risk parameters.

Confluence Factors:

• 0.618 fib alignment

• VRVP volume shelf

• Prior breakout structure retest

• LTF divergence or absorption confirming the fade

🎯 Trade Parameters (Planned)

• Entry Zone: ~3385–3390

• Stop Loss: Tight, 3395–3400

• Target Zone: 3342–3337 (full structure retest)

📌 Patience is key — this remains a setup until confirmed. We'll post live if and when conditions are met.

Let the market come to you.

Why says they want to short gold again, line up in hereLol, so far whales keeps manipulating the price to stop me out 🙄.

Nah, fr, i will short gold again today for sure, iam just waiting to see a confirmation that this is even the right decision.

But so far it looks massively short, it could yield anything from 1:3, or 1:4. Depends on the setup.

Wait for confirmation, will make sure that whales dont get me this time. LOL

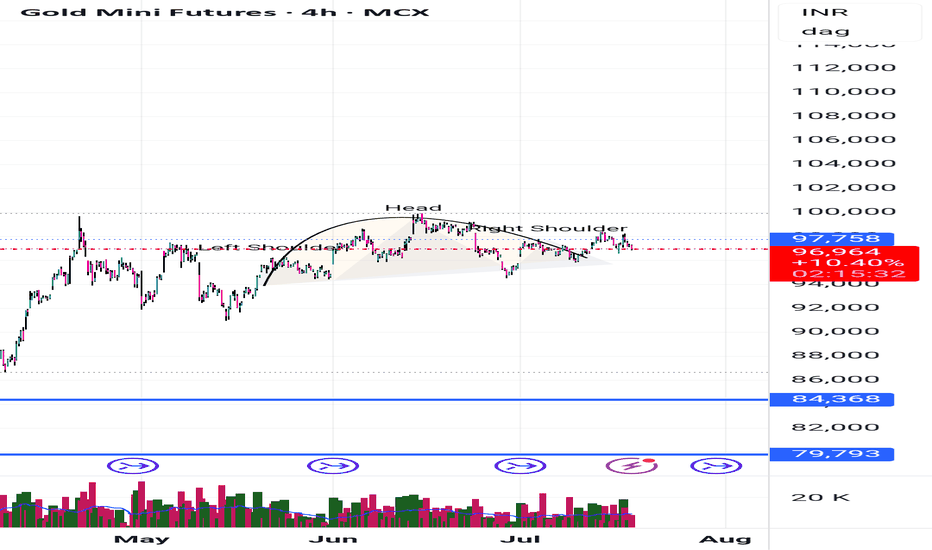

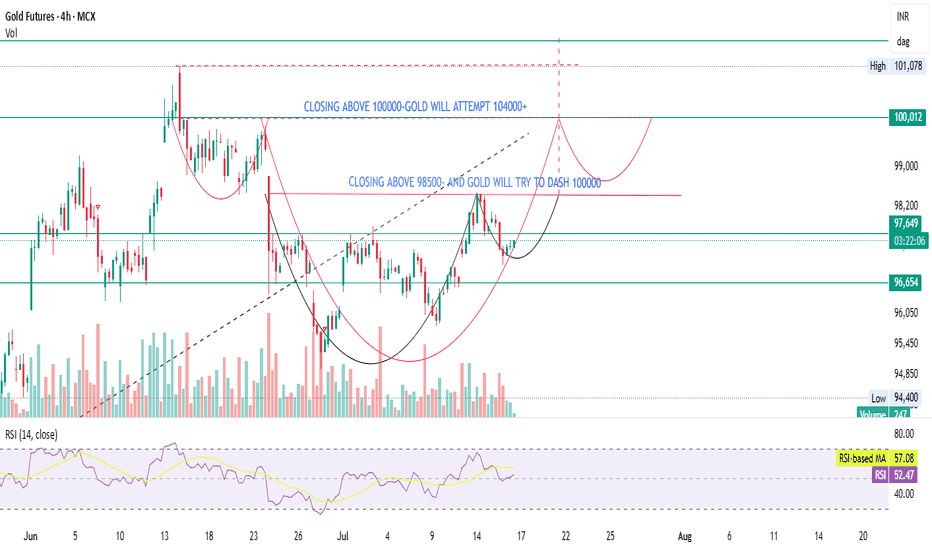

GOLD- CONTRARION OPINIONGold is forming a bullish structure, but a confirmed breakout above ₹98,500 (on volume) is essential for momentum toward ₹100,000.

If ₹100,000 is broken with strength, ₹104,000+ is a reasonable technical target.

RSI is neutral, allowing room for upside.

Watch for a volume spike and confirmation candles before entering.

Gold.. in the fog of global chaosNotes:

Markets for metals are at a ATH.

Global events are evolving rapidly.

Most of the time, war=raging gold prices

Markets are ripe to retrace and or maybe reverse at all. Taking setups on gold with a grain of salt.

Gold is an event driven market. I expect for now a consolidation until bearish signals show.

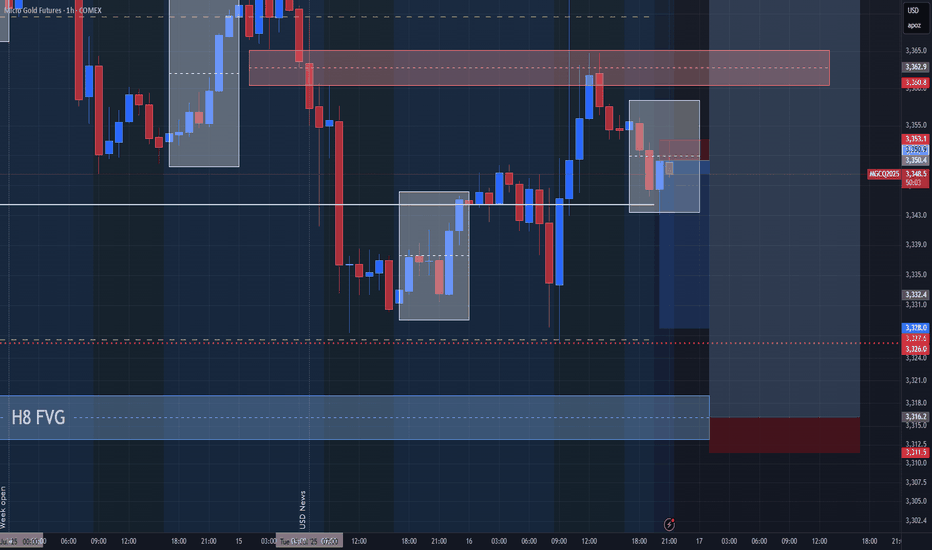

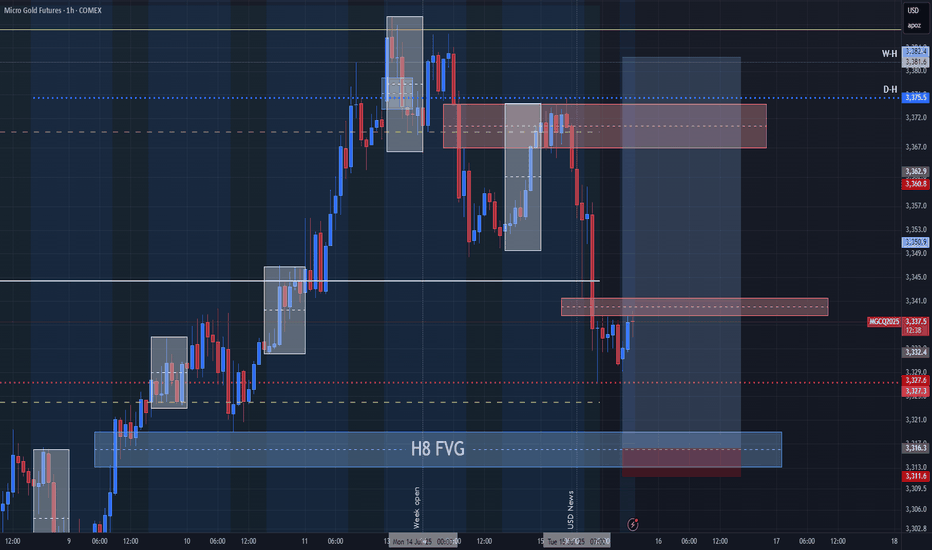

Beneath the Shelf Lies OblivionThis setup on MGC is a textbook example of what happens when structure, compression, and liquidity converge at a critical price shelf.

We’re currently sitting on top of a demand break zone near 3330, right at the intersection of a long-term ascending trend line and a descending supply-side compression line. This convergence zone is what I’m calling the Decision Point and the reaction from here will likely dictate the next directional leg.

Bearish Scenario – Breakdown Play

If price breaks and closes below 3330, I’m looking for a clean short setup triggered by:

- Loss of structure at the imbalance shelf

- No reaction from buyers at the previously defended zone

- Bearish pressure from HTF supply overhead (3385 zone)

- Momentum break from recent liquidity sweep at 3360

Trigger Entry: Below 3327 (post-break retest)

Stop: Above 3338 (invalidates reclaim)

TP1: 3305 (minor demand pocket)

TP2: 3285 (full move into HTF demand)

TP3 (optional): 3275 (tail end of imbalance)

Price would be transitioning from demand acceptance to supply dominance. The HTF supply above has been respected, and sellers remain in control if 3330 gives out.

Bullish Scenario – Reclaim Play

If price holds the 3330 demand shelf and reclaims structure with strength, I’m interested in a long position toward resting liquidity above.

Trigger Entry: Above 3342 (engulfing + reclaim of broken structure)

Stop: Below 3325 (demand failure = no-go)

TP1: 3360 (liquidity sweep)

TP2: 3385 (HTF supply retest)

If buyers defend this compression shelf, this could become a failed breakdown setup which often results in sharp squeezes. There’s also layered liquidity above 3360 from late sellers that could get raided quickly.

Let me put it in context:

HTF Zones Labeled: These areas are not just visual, they’ve driven major moves previously. I'm using them to anchor bias.

Compression Point: This is where your edge lies. Price is coiled between trendlines and major levels meaning the breakout will be decisive.

Volume Ignition Expected: Whether long or short triggers, expect strong follow-through due to the nature of the buildup.

No bias here just structure, zones, and execution plans. I’ll trade whichever side triggers first with confirmation, not prediction. This is the type of setup where patience pays more than opinion. Would love to hear how others are seeing this are you leaning with the shelf or looking to fade the break?

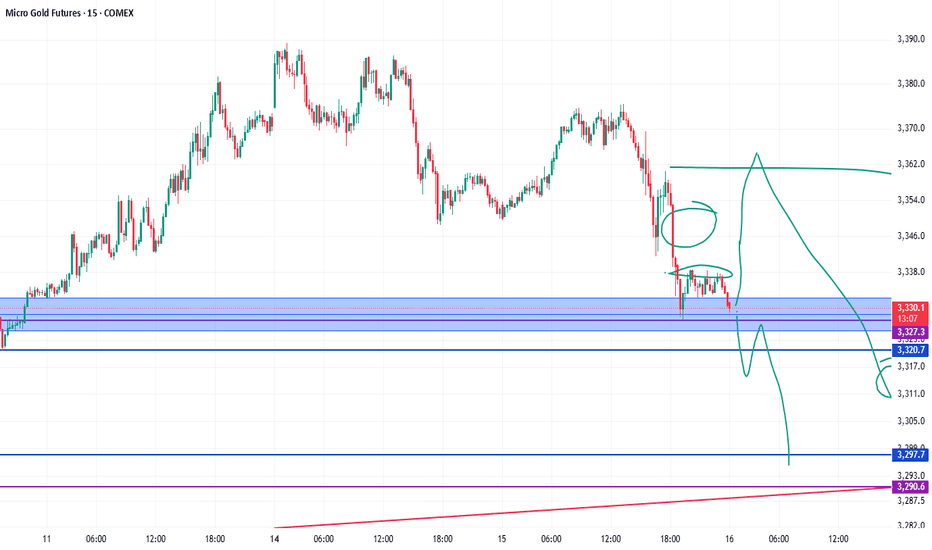

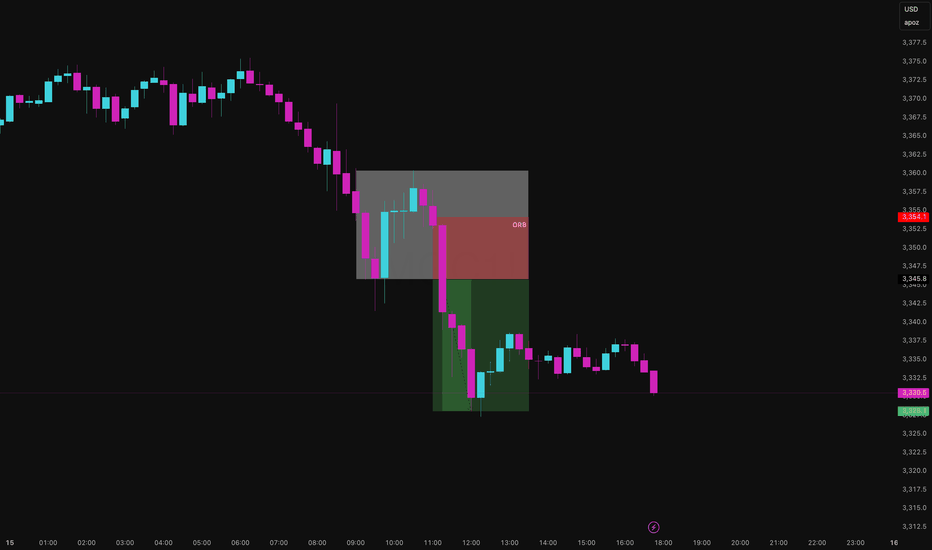

Gold Took the Bait Then Got Body BaggedThis afternoon I stepped outside my usual mechanical system and ran a classic: the Opening Range Breakout (ORB) on MGC just to see if gold still respects the old-school plays.

Marked the range of the first 15-minute candle, waited for the break and confirmation close, then entered on the short side.

Asset: Micro Gold Futures (MGC1!)

Timeframe: 15-Minute

Strategy: Opening Range Breakout

Session: NY

Bias: Short

Trigger: Bearish 15-min close below the ORB low

Notes

ATR Expansion: Signalled volatility coming off the open (range >20 ticks)

Liquidity Trap: Gold swept ORB highs before dumping a classic trap-and-flush

Volume Confirmation: Delta turned aggressively negative at the break

Risk-Reward: Tight stop above range, clean 1:3 move into session lows

ORB: Dumb-Simple, Still Deadly

ORB is one of the simplest tools in a trader's playbook and that’s what makes it dangerous (in both directions). When it works, it works. You define the opening range, wait for price to break out and confirm, and ride the move.

But here’s the nuance:

Gold LOVES to fake one side before exploding the other. It’ll sweep liquidity, bait breakout traders, then detonate in the opposite direction. Today was a textbook clean sweep of ORB highs, then a brutal reversal and breakdown.

I usually lean on mechanical, model-based strategies, structured entries, rule-based exits, logic-driven setups. But I’m not blind to price. Having a few flexible strategies like ORB in the toolkit gives you options on days where market intent is obvious. So… does ORB actually work? Here's what the research says:

- Al Brooks (Price Action Trading)

ORB-type plays win 55–60% of the time when confirmed with price action and managed properly.

- Linda Raschke (Street Smarts)

ORB entries rated highly during volatility expansions especially in futures.

- Quantified Strategies (S&P 500 ORB backtest)/b]

57% win rate with basic 1:1 R:R and no filters.

Internal Bookmap/Tradovate tracking on MGC .

Fake outs occur in 30–40% of ORB plays, especially during thin liquidity or low-news days. But let’s be real that 55–60% win rate is open to interpretation. It depends on the confluences. Are you using delta confirmation?

Are you filtering by session or volatility? Are you waiting for a close outside the range or just guessing? ORB works if you work it. The strategy isn’t magic. The execution is.

The twist with today wasn't a "trend continuation" move. It was a rejection. Gold baited breakout longs, then pulled the rug. This is where mechanical structure meets tape intuition.

Retail chased. Price snapped. Quant stayed calm and shorted the flush.

What Do You Think?

Do you still trust ORB? Or is it a trap most days? Do your stats back it up or have you evolved beyond it? Let’s open it up. Drop your ORB rules, tweaks, or horror stories below. I’ll reply to every serious one.

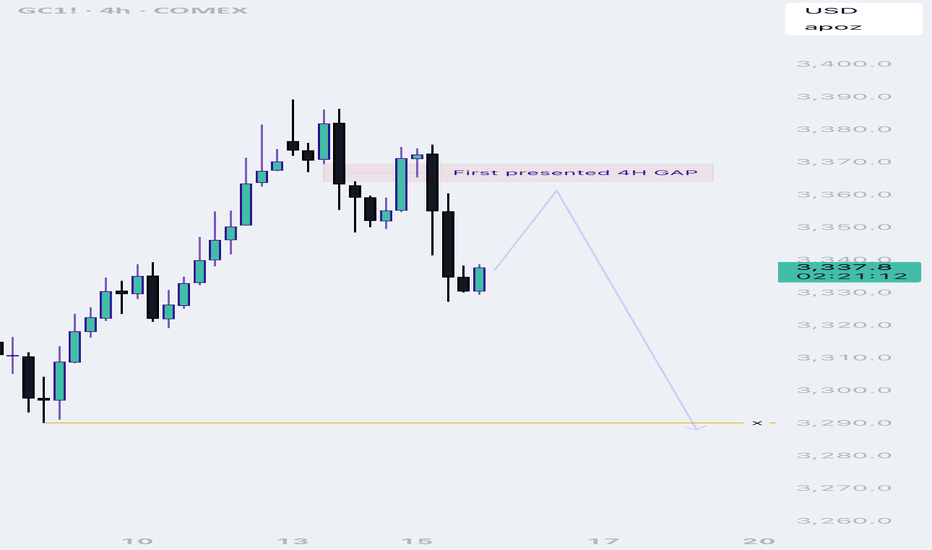

Shorting Gold again and againYep, Iam still thinking that gold should be shorted. Even though that i can see there is some huge liquidity up which should draw the money to it, but still on bigger timeframes, it shows weakness.

So here it is with targets. hopefully it goes through.

Good luck everyone.

The Gold Retrace for Ultimate Entry!looking for price to continue with its pullback to find where exactly support is. Once we see price establish support we should get some type of signal for entry and price can continue with this bullish price action to make new highs. If we get a full 71.8% pullback that should make for a nice bull run. Just need to wait for the confirmations first before reacting cause we might get a lot of chop until then.

This is a good video7.14 . 25 this is a great video because there are so many examples of patterns to look at and there weren't that many markets that I was following and about 3 or 4 of the markets actually had dramatic movement in the direction you would expect and this is an example of setting up your pattern and letting the pattern take care of you as it gives you the probable Direction the market would take and there would have been no significant drawdowns or retest associated with stops... As was seeing in the coffee Market.

$GC / Gold - Weekend Update - 7/14Hello fellow gamblers,

We got both scenarios still active on gold, and I am bringing an update on both of them. It is a longer video, but hopefully the information can help you out on your trades.

- I want price to stay above 3363 for a bullish continuation.

- A strong rejection or loss of 3342.8 could initiate a bearish move that will validate our bearish scenario.

- Level to watch: 3418, 3363, 3283

New Week on Gold! Will the Bullishness continue?I was bullish on gold and price ended up doing as expected last week and looking for it to continue this week. But i have to sit on hands for now to see how they want to play Monday. Will they move to create a Low for the week first? or will they break out to start early on new highs? I have to see some type of confirmation first. Then we can get active.

Shoring GoldSo here we go again with gold.

there are two theories at this point, a bullish case and a bearish case.

The bullish case that the price broke a bearish trend and moving upwards.

For a bearish case, the price didn't close that strong above the last swing. Also the whole structure is bearish so this last up move could be very well a trap for buyers.

On the 4h tf, there is an FVG, bearish one that the price so far is reacting to.

So Even though there is a strong up move, i still lean bearish.

Later today once i get a confirmation, i will update the idea.

I might be very wrong on this trade, my confidence in this trade is 4 out of 10. So Use smaller size position.

Also iam expecting the price to revisit 3320 USD

Gold’s Got Commitment Issues, Short the GhostingWe’ve reached a premium zone, tagged prior Buy-to-Sell Liquidity (BTL) above 3,778, and filled a local imbalance. With structure breaking above the previous bearish trend line but reacting to a liquidity zone, we are anticipating a rejection and retracement during the Tokyo and London sessions before NY opens.

Thesis: Trendline Structure

Clean break above the bearish structure; price is testing the zone where buyers may exhaust.

Rejected cleanly from the Sell-Side Liquidity box between 3,775–3,780, suggesting seller presence.

Key Imbalances

Major Order Flow Imbalance at 3,760 already tapped and showing reaction. Further downside liquidity targets resting in imbalance zones 3,715 and 3,685, offering high RR plays.

Market Context

Price flipped bullish into NY last week but overextended into a thin volume zone. This leaves us with a high probability of a retrace to retest deeper imbalances and prior demand structure.

Macro levels like PDH (3,782) and PDL (3,322) give us range clarity. Now let's get into the execution.

Execution Plan

Entry Zone - 3,775.50–3,780.00 (confirmed reaction)

TP1 - 3,760 (imbalance fill)

TP2 - 3,743 (prior OF zone)

SL - Above 3,783

Trade Logic - Enter short post-Tokyo if price retests 3,775–3,780 with rejection candle on LTF (5–15min). Confirm with volume divergence or weak delta.

Risk Context

Avoid chasing price, NY open tends to offer better fills. Watch the 3,743–3,715 zone. Strong demand may react here into NY. If price reclaims 3,783, invalidate short bias and reassess.

Notes

Liquidity Grab has already occurred on the upside. Watch for Order Flow Absorption between 3,760–3,765. Tokyo volume is often deceptive do not overcommit early. Look for a full 1:3 setup and scale partials at TP1.

If you followed this plan, how did your entry go? Did your execution align with the bias? Drop your screenshots, tag me, or reply with your play-by-play always keen to sharpen my edge.

GOLD - GC | Weekly Recap & Plan 13.07.2025🟡 GOLD (GC) Weekly Recap & Outlook

Symbol: GC1!

Date: Week of July 8–12, 2025

Timeframes Used: 4H, Daily, Weekly, HTF structure

🔍 What Happened Last Week?

Gold saw a strong rejection from a confluence of two HTF trendlines, signaling resistance.

But that move was absorbed by:

🟦 Daily Demand (blue zone)

🔵 Daily Swing Liquidity (blue line)

This builds a bullish structure on the daily chart.

🧭 Scenarios I'm Watching

Scenario 1 — Minor Pullback:

🔹 Price may revisit the Daily Gap (pink line) and find support for continuation.

Scenario 2 — Deeper Pullback:

🟣 Price could retrace into the HTF bullish trendline (purple) before resuming upside.

🗞️ Bonus Macro Scenario: Powell Resignation?

There are growing rumors that Fed Chair Powell might resign this week.

📈 If that happens, I expect strong bullish momentum in Gold —

→ very limited retracement, and

→ potential straight breakout into new highs.

🎯 Targets for the Week:

✅ 1st Target:

W C DOL (purple line) → acts as a primary take profit area.

✅ 2nd Target (Expansion):

EQHs / DOL (extended purple levels)

Game Plan:

Watch for LTF confirmation on both retracement zones.

Maintain bullish bias unless Daily Demand fails.

If Powell resigns, be ready for breakout setups.