MEMEUSDT 8H#MEME has formed a Cup and Handle pattern on the 8H timeframe. It has bounced nicely off the SMA100, and volume is showing signs of strong accumulation.

📌 Consider entering this coin only after a solid breakout above the resistance zone.

If the breakout occurs, the potential targets are:

🎯 $0.002369

🎯 $0.002675

🎯 $0.003064

⚠️ As always, use a tight stop-loss and apply proper risk management.

MEMEUSDT trade ideas

Trend Reversal Confirmed? MEME/USDT Bulls Take ControlThe MEME/USDT chart is showing a highly compelling technical setup. Here are the key points of the analysis:

1. Breakout from Long-Term Downtrend:

Price has successfully broken above a descending trendline that has been in place since November 2024. This breakout marks a potential end to the prolonged bearish phase and opens the door for a new bullish trend.

2. Strong Accumulation Zone:

A clear accumulation zone is visible between $0.00130 – $0.00160, lasting from May through late June 2025. This zone now serves as a strong support area.

3. Formation of Higher Lows:

After the breakout, price action has begun to form higher lows — a bullish signal indicating that buyers are stepping in.

4. Potential Upside Targets (Key Resistance Levels):

The chart outlines several key resistance levels that may serve as short- to mid-term targets:

$0.001996

$0.002608

$0.003074

$0.003987

$0.004764

$0.007136

$0.010259

$0.017863

$0.018690 (previous high)

5. Bullish Scenario:

If bullish momentum continues with strong volume, price could follow the projected upward zigzag pattern and move through these resistance levels progressively.

6. Risk Management Note:

A breakdown below the accumulation zone ($0.00130) would invalidate the bullish scenario and should be watched closely.

✅ Conclusion:

MEME/USDT is displaying strong reversal signals after breaking out of a long-term downtrend and consolidating in a solid accumulation range. If buyer momentum continues, we could see significant upward moves toward key resistance zones.

#MEME #MEMEUSDT #CryptoBreakout #AltcoinAnalysis #BullishReversal #TrendlineBreakout #CryptoTrading #TechnicalAnalysis #AltcoinSeason #ChartPattern #CryptoSignals

MEME – A Volatile Bet with Upside Potential

If the altcoin season thesis remains valid, MEME could be one of the more promising—albeit high-risk—opportunities.

In past cycles, coins like DOGE, SHIB, and PEPE delivered explosive gains in very short periods.

What’s missing now is the clear ignition of altcoin season. Be patient.

Disclaimer:

This analysis is based on my personnal views and is not a financial advice. Risk is under your control.

#MEME #MEMEUSDT #MEMECOIN #LONG #SWING #Eddy#MEME #MEMEUSDT #MEMECOIN #LONG #SWING #Eddy

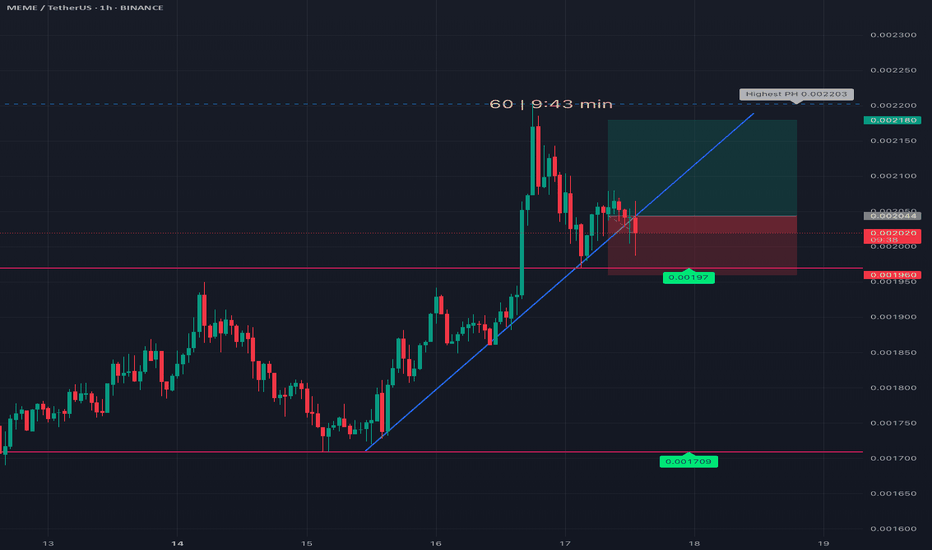

MEMEUSDT.P SWING Long Setup

Important areas of the upper time frame for swing are identified and named.

This setup is based on a combination of different styles, including the volume style with the ict style.

Based on your strategy and style, get the necessary confirmations for this Swing Setup to enter the trade.

Don't forget risk and capital management.

The entry point, take profit point, and stop loss point are indicated on the chart along with their amounts.

The responsibility for the transaction is yours and I have no responsibility for not observing your risk and capital management.

By scratching the price and time bar, you can see the big picture of targets.

Buy Position "LONG" Spot & Future Details :

Entry : 0.002662

Stop : 0.002616 (( 1.73% ))

Target 1 : 50% Spot

Target 2 : 100% Spot

Target 3 : 500% Spot

Target 4 : 1000% Spot

Target 5 : 1500% Spot

Target 6 : 2000% Spot

Be successful and profitable.

$MEME: Ready for a 40X Moonshot? Ticker: AMEX:MEME

Current Price: $0.002

Target: $0.08 (40X potential)

Why AMEX:MEME ?

AMEX:MEME is the ultimate community-driven token, riding the wave of viral hype and meme culture. With a passionate X community, upcoming NFT integrations, and a low market cap, this micro-cap gem is primed for explosive growth.

Technical Setup:

Strong support at $0.0018, forming a solid base.

RSI showing oversold conditions, signaling a reversal.

Breakout above $0.0025 could ignite a parabolic run.

Catalyst :

Rumored partnerships and exchange listings.

Meme coin mania is back— AMEX:MEME is positioned to outperform.

Trade Idea:

Buy at $0.002, set stops below $0.0018, and target $0.08 for a potential 40X. Manage risk—this is a high-reward play!

MEME Main trend -97% Channel. Reversal or scam zone.Logarithm. Time frame 3 days (less is not needed).

🟡 The price has reached a decline from the highs (not a listing squeeze) -97%. These are practically the maximums of declines after the hype for cryptocurrencies of such liquidity (96-98), after which there is only a complete scam. At the moment, there is a reaction from this zone (the lower zone of the main trend channel) (impulse buyback), and a rollback after it, which forms the canvas of a potential ascending flag. If there is a breakthrough, then locally - the implementation of the ascending flag.

⚠️🔼 These are high-risk cryptocurrencies of such liquidity (that's why such declines are big), but the percentage of price growth in them, for the same reasons (liquidity/volatility) is an order of magnitude greater in the case of their implementation. When working with such assets, observe money management.

🟣 Implementation of the flag's goals (essentially to the channel median) +80-100%

🟡 To the resistance of the descending channel of the main trend +325%

🔵 To potential highs (one of the previous consolidations) +1000-1300%.

MEME/USDT: BREAKOUT ALERT!!🚀 MEME Breakout Alert – 40%+ Potential Incoming?! 👀🔥

Hey Traders! If you're all about high-conviction plays and real alpha, smash that 👍 and tap Follow for more setups that actually deliver! 💹💯

🚀 AMEX:MEME / USDT Long Setup – Breakout Watch! 🚀

AMEX:MEME is squeezing inside a symmetrical triangle on the 1H chart and is now testing breakout levels! Get ready for a potential explosive move! 📈⚡

📊 Trade Setup:

✅ Entry: CMP and add more in dip

✅ Targets:

• Target 1 → $0.00260

• Target 2 → $0.00290

• Target 3 → $0.00302+

🛡 Stop Loss (SL): $0.00207 (below triangle support)

📌 Why this setup?

Tight consolidation near apex

Strong EMA support

Previous breakout gave ~40% move!

⚠️ Risk management is key! Wait for confirmation, and always stick to your SL.

💬 Share your thoughts below — bullish or cautious on MEME? Let’s discuss! 👇👇

MEME/USDT Analysis — Symmetrical Triangle Breakout + Golden CrosMEME/USDT Analysis — Symmetrical Triangle Breakout + Golden Cross! 🚀

Timeframe: 4H

Exchange: Binance (Perpetual Contract)

Chart Type: Heikin Ashi

📊 Technical Analysis:

A Symmetrical Triangle formation is visible, suggesting a potential strong breakout.

Golden Cross observed: EMA 50 (yellow) is crossing above EMA 200 (red), a strong bullish signal.

Price currently consolidating near the triangle apex — a breakout is expected soon.

⚡ Trading Plan:

📌 Bullish Scenario:

✅ Entry: Above 0.002200 (candle close confirmation)

🎯 Targets: 0.002400 — 0.002600

🛡️ Stop Loss: 0.002041 (below 50% Fibonacci level)

📌 Bearish Scenario:

✅ Entry: Below 0.002041 (candle close confirmation)

🎯 Targets: 0.001887 — 0.001675

🛡️ Stop Loss: 0.002166 (previous consolidation zone)

📰 Fundamental Catalysts:

Market Sentiment: Meme coins seeing increased social media attention (Reddit, Twitter).

Binance Update: Funding rate adjustments may trigger volatility.

Hype Cycle: Growing interest towards MEME tokens as April ends.

📢 Summary:

MEME/USDT is at a critical breakout point with Golden Cross support. Watch for volume confirmation and manage risk properly.

Risk Management is Key! ⚠️

#Crypto #MEME #TradingView #Altcoins #TechnicalAnalysis

Not a financial advise #DYOR

MEME price analysis⁉️ Maybe #MEME is trying to start the memecoin 2.0 season?)

Before the strong resistance from above, the growth potential is 400%, but even this will not be much consolation for those who bought OKX:MEMEUSDT a year ago.

But again, in accordance with the assumption that was written a few posts earlier: coins with market caps in the range of $50-100 million are starting to “pumping”.

💰 In general, if the CRYPTOCAP:BTC price in April is kept above $79-80k (9 days left), then May may turn out to be quite generous.

_____________________

Did you like our analysis? Leave a comment, like, and follow to get more

#MEME/USDT#MEME

The price is moving within a descending channel on the 1-hour frame, adhering well to it, and is on its way to breaking it strongly upwards and retesting it.

We are seeing a bounce from the lower boundary of the descending channel. This support is at 0.001424.

We have a downtrend on the RSI indicator that is about to break and retest, which supports the upward trend.

We are looking for stability above the 100 moving average.

Entry price: 0.001452

First target: 0.001496

Second target: 0.001537

Third target: 0.001586

MEMEUSDT ShortMEMEUSDT had a strong breakout from the 4H EMA50 — up 23%! This setup is perfect for a short without a stop, using scaling in.

There’s a chance price might reach the daily EMA50 — if it does, I’ll add more to the short from there. The target will be adjusted based on how the 4H EMA50 moves.

#MEME/USDT#MEME

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it strongly upwards and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.00284

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.00309

First target 0.00334

Second target 0.00355

Third target 0.00381

#MEME/USDT#MEME

The price is moving in a descending channel on the 1-hour frame and is adhering to it well and is heading to break it upwards strongly and retest it

We have a bounce from the lower limit of the descending channel, this support is at a price of 0.00424

We have a downtrend on the RSI indicator that is about to break and retest, which supports the rise

We have a trend to stabilize above the moving average 100

Entry price 0.00442

First target 0.00460

Second target 0.00475

Third target 0.00492

#MEME/USDT#MEME

The price is moving in a descending channel on the 1-hour frame and is expected to continue upwards

We have a trend to stabilize above the moving average 100 again

We have a descending trend on the RSI indicator that supports the rise by breaking it upwards

We have a support area at the lower limit of the channel at a price of 0.00670

Entry price 0.00694

First target 0.00725

Second target 0.00751

Third target 0.00783