1AMD trade ideas

AMD Weekly Options Trade Plan 2025-04-16NASDAQ:AMD AMD Weekly Analysis Summary (2025-04-16)

Below is a synthesis of all the reports and our analysis:

─────────────────────────────

COMPREHENSIVE SUMMARY OF EACH MODEL’S KEY POINTS

─────────────────────────────

• Grok/xAI Report

– Technical indicators show AMD trading below its short‐term moving average and near the lower Bollinger Band.

– Negative MACD histogram and bearish news (export restrictions, potential $800M charge) support a downward bias.

– Recommends a bearish options trade using a near–ATM put – the $89 put at a premium around $1.78 (a higher premium but with a clear bearish thesis).

• Llama/Meta and DeepSeek Reports

– Confirm the bearish bias: price action below key moving averages, negative MACD and extreme moves below support.

– Note that the option chain (and high open interest on lower strikes) points to a greater probability for further decline.

– Both suggest a trade on put options that have a lower premium than the Grok suggestion (with DeepSeek favoring the $85 put at roughly $0.62) for improved risk/reward.

• Gemini/Google Report

– Emphasizes the strong negative catalyst from news and a rapid breakdown below support levels (with current price near $89).

– Technical indicators and volatility (VIX above 30) signal that the underlying is likely to fall further.

– Offers several put strike ideas and finds that the $84 put (premium ca. $0.49) fits the ideal price range; however, liquidity and open interest are better for the $85 strike.

─────────────────────────────

AREAS OF AGREEMENT AND DISAGREEMENT

─────────────────────────────

Agreements:

– All models (except for the one reporting an error) agree that the market sentiment is bearish.

– The negative news catalyst (export controls and potential charges) and the technical breakdown clearly drive the consensus.

– There is broad recognition that options data (with high OI on puts and max pain around $95)

is supportive of a downside move.

Disagreements:

– The primary difference is in the strike selection. Grok favors a put close to the current price (the $89 put) despite its higher premium, while Gemini, Llama/Meta, and DeepSeek lean toward lower strikes ($84–$85) that offer a lower premium (falling in or near our ideal range) and better liquidity for a weekly trade.

─────────────────────────────

CLEAR CONCLUSION & RECOMMENDED TRADE

─────────────────────────────

Overall Market Direction Consensus:

– The overall view is bearish. All models (apart from the one error) indicate that AMD is under significant downside pressure fueled by both technical breakdown and negative news sentiment.

Recommended Trade:

• Trade Type: BUY single‐leg, naked PUT (weekly option only)

• Chosen Strike: $85

– Rationale: The $85 put (ask at $0.64) offers good liquidity (high open interest of 10,218 contracts) and although its premium is slightly above the preferred $0.30–$0.60 range, its risk/reward profile is attractive given the bearish momentum.

• Expiration: April 17, 2025 (weekly options)

• Entry Timing: At market open

• Proposed Parameters:

– Entry Premium: Approximately $0.64

– Profit Target: Around $1.00 (this represents an attractive move if the bearish trend continues)

– Stop Loss: Approximately $0.45 to limit risk if price recovers unexpectedly

• Confidence Level: ~70%

• Key Risks and Considerations:

– Short‐term volatility may create intraday bounces despite the overall bearish trend.

– An oversold reaction or a temporary return toward the max pain level ($95) could adversely affect the trade.

– As this is a news–driven and highly volatile environment, trade size must be limited relative to account size.

─────────────────────────────

TRADE_DETAILS

─────────────────────────────

The final trade parameters in JSON format are shown below.

TRADE_DETAILS (JSON Format)

{

"instrument": "AMD",

"direction": "

put",

"strike": 85.0,

"expiry": "2025-04-17",

"confidence": 0.70,

"profit_target": 1.00,

"stop_loss": 0.45,

"size": 1,

"entry_price": 0.64,

"entry_timing": "open"

}

3rd time trying to make some of my LOSS AMDSpotted an inside bar accompanied by high volume—promising setup. Hopefully, the recent tariff chaos doesn’t derail this trade. Based on the current technicals, it looks like there's a solid probability of success. Let’s see how it plays out. (Not financial advice)

Why AMD Might Be a Good Buy:

Advanced Micro Devices (AMD) continues to strengthen its position in the semiconductor industry, especially in high-performance computing, gaming, and AI. With growing demand for AI-driven infrastructure and chips, AMD’s recent product releases and partnerships put it in a competitive position against giants like NVIDIA and Intel. Their strong balance sheet, innovation pipeline, and increasing adoption of EPYC processors in data centers make it a stock worth watching. For traders and investors looking for exposure to the tech and AI boom, AMD could offer both growth potential and strategic value in a diversified portfolio.

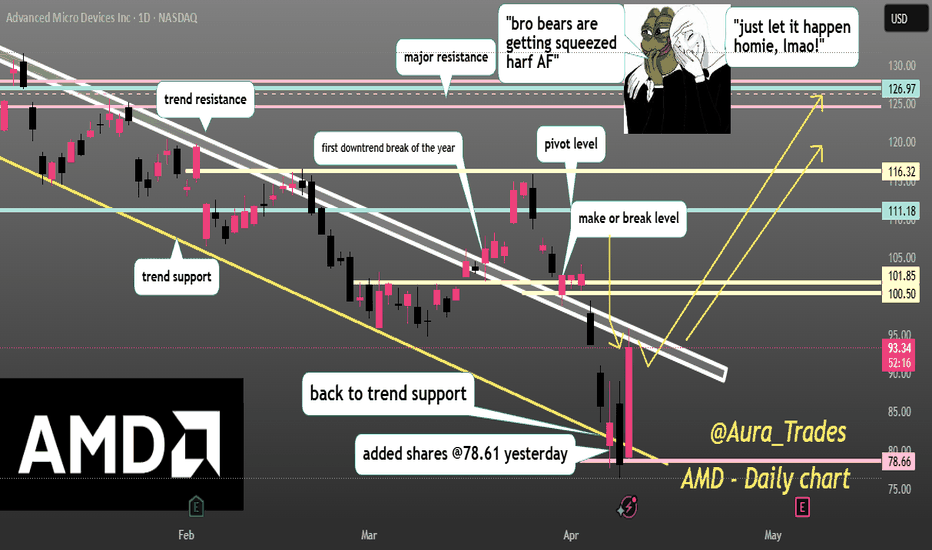

sniper dip entry! AMD bears get squeezed.boost and follow for more 🔥 AMD is having a massive bounce from trend support zone, now at its make or break level, if we can break look for continuation back to 100-120 levels short term.

I bought the dip on AMD at 78 yesterday and think we can higher.. see you soon with more charts GLTA!

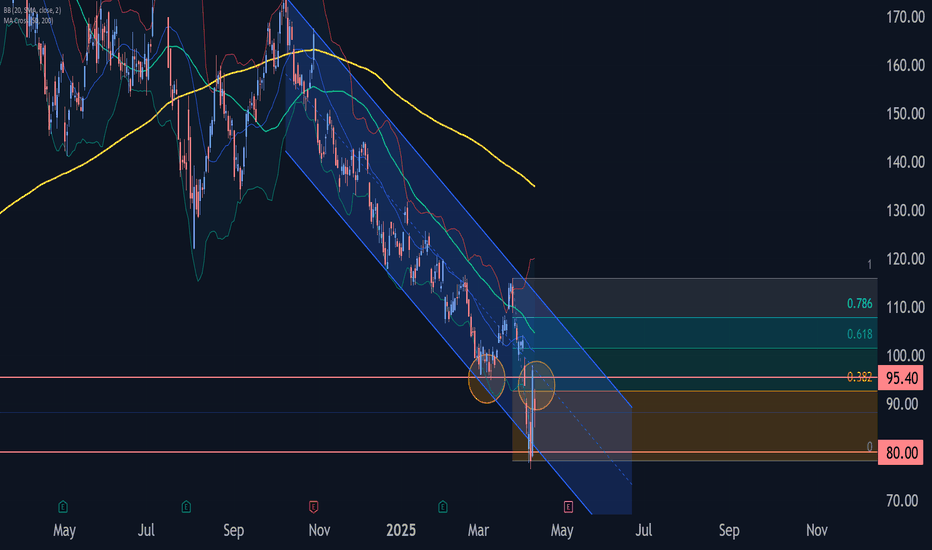

AMD Wave Analysis – 10 April 2025

- AMD reversed from resistance zone

- Likely to fall to support level 80.00

AMD today recently reversed down from the resistance zone between the resistance level 95.40 (former support from the start of March, as can be seen below) and the 50% Fibonacci correction of the downer impulse wave from iii from last month.

The downward reversal from this resistance zone stopped the earlier short term correction ii.

Given the strong daily downtrend, AMD can be expected to fall to the next round support level 80.00, which stopped the earlier impulse wave (iii).

AMD: Best level to buy since Oct 2022.Advanced Micro Devices are virtually oversold on the 1W technical outlook (RSI = 30.639, MACD = -13.430, ADX = 36.312) having hit the bottom (HL) of the 3 year Channel Up. The 1W RSI is slightly even lower it was on the previous bottom of October 10th 2022. This should be the start of the new long term bullish wave, which based on the previous one should make a HH on the 1.236 Fibonacci extension, approximately a +300% rally (TP = 280.00).

See how our prior idea has worked out:

## If you like our free content follow our profile to get more daily ideas. ##

## Comments and likes are greatly appreciated. ##

Amd - The One And Only Setup For 2025!Amd ( NASDAQ:AMD ) shifts to a very bullish market:

Click chart above to see the detailed analysis👆🏻

Perfectly following previous cycles, Amd corrected about -60% over the past couple of months. However now we are seeing some first bullish signs at a major confluence of support. If we actually also witness bullish confirmation, an incredible rally of about +200% could follow.

Levels to watch: $100, $300

Keep your long term vision,

Philip (BasicTrading)

AMD | Long | Technical Reversal at Support Zone |(April 9, 2025)1️⃣ Insight Summary:

AMD has pulled back sharply, but we’re now sitting at a key demand zone. With liquidity taken from previous lows and fresh buy signals showing up, this could mark a turning point for a bullish recovery.

2️⃣ Trade Parameters:

Bias: Long

Entry: Between $85.74 – $92.01 (current support zone and entry region)

Stop Loss: Below $70.00 (deep invalidation zone – loss of structure and momentum)

TP1: $114.55

TP2: $131.20

TP3 / Final TP: $187.24 – $191.08 (upper supply & potential full mean reversion)

Partial Exits: Around $114 and $131 to secure gains before the top range

3️⃣ Key Notes:

✅ AMD recently tapped into a strong historical demand zone while showing a bullish divergence on the RSI.

✅ Multiple Buy Signals have printed on the 4H timeframe.

✅ Semiconductors have been lagging, but this underperformance could open up an opportunity as money rotates back into undervalued tech.

❌ Invalidation is clearly below $70 — that’s where structure fully breaks and downside could accelerate.

📉 If price fails to hold above the $76 liquidity layer, we might dip deeper before launching.

4️⃣ Follow-up Note:

I’ll be monitoring this setup over the coming weeks and will post an update if price rejects the entry zone or breaks through resistance levels faster than expected.

Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible.

Disclaimer: This is not financial advice. Always conduct your own research. This content may include enhancements made using AI.

$AMD $75 support targetHi, NASDAQ:AMD short may be activated here looking at the daily and weekly. I personally think we are in a bearish trend market wide with the uncertainty and unknowing's of global economics and policies. I believe NASDAQ:AMD will tap into my support zone, in my opinion we have a local resistance of $88-$90.

WSL.

OptionsMastery: SwingTrade on AMD? 🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

LONG AMD: Keep it simple trends, time and duration3 Positions in AMD from 2018-2025

Duration of trades: 106 - 1,064 days

Gains: +217% - +917%

Closing in on the trend line, look for a bounce at the line or likely if it goes under, wait for a rally back above the line. This chart is set at the daily timeframe. If you trade on the minor volatility within the major trend, I've found the 2 hour timeframe using a combination of indicators, Relative Trend Index and HH and LL, net favorable results.

$AMD position trade idea LONG TERM weekly/monthlyNASDAQ:AMD has been weak for awhile on the weekly chart, but nothing lasts forever. This is a long position trade idea I have for myself, with the thesis that, long term, NASDAQ:AMD is reaching for $360ish over the next couple of years, based on fib projections from back when the bull market started years ago.

NASDAQ:AMD briefly touched a premium zone months ago (red shaded area), and with the current weakness NASDAQ:AMD has been pulling back and just reached a short term discount zone around $109 (green shaded area). My expectation is that NASDAQ:AMD might drop a bit more into this zone, perhaps sweep under the lows at $93.12, reach a couple of projected targets for the short interest (that I have marked in red and orange lines), and then find support and bounce aggressively from there.

This is all based on a pattern I frequently see where when a chart reaches the premium zone near the end of a move, it often pauses just shy of the target and feigns a reversal, falling back into the short term discount zone, often sweeping a low, and then aggressively pushing for the target that was intended all along. This serves to wash out any short term holders and deny them the full target, while offering good prices to the long term holders to reaccumulate before reaching their target.

Seek professional investment advice elsewhere, this is not trading or investment advice, this is my own observations and how I intend to approach NASDAQ:AMD in this current price area. I will not be blindly buying anything and I always manage my risk in case I'm wrong.

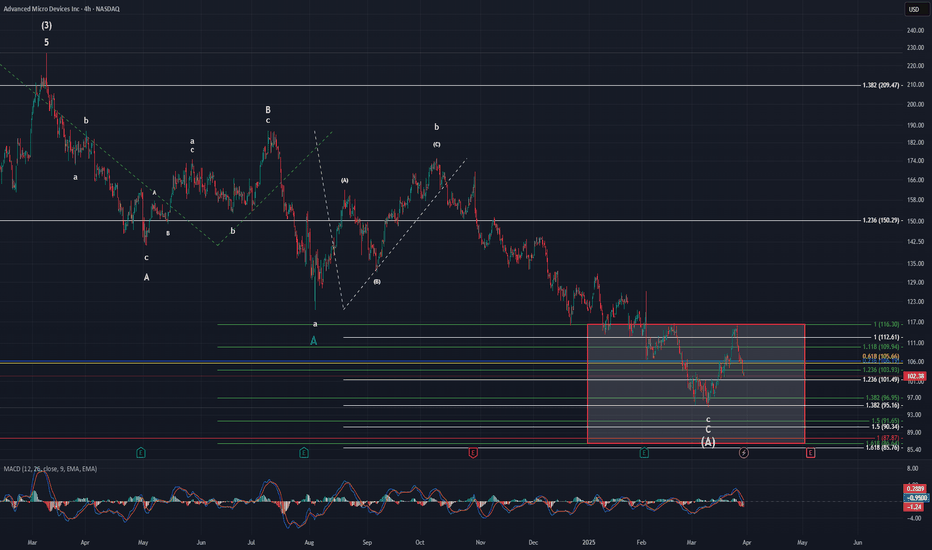

AMDNot a whole lot to add to my AMD analysis. I have said for some time now that I anticipate price to make OML to the $85-$87 area down at the 1.618's. We did hit the 1.382's in the $95 area for our last low. Price did not breach the prior high of $116.55 though. This would have been a big clue that a bottom for (A) had been struck. However, the fact that it was not broke is a clue in itself. Especially with the strength this thing is showing to the downside, I will remain with my analysis that we hit the area if the 1.618's for the bottom of (A). If that is the case, the target for wave (B) will be in the $160-$190 area. Keep in mind, price won't head straight for that area when (A) is over. It will take its sweet time getting there and frustrate traders in the process. It is a (B) wave after all, and they are some of the most complex structures within EWT. For now, if price does hit my lower target, I will very likely buy a small position with a stop in place. Regardless on if price makes it all the way to my (B) wave target or not, that will be a very small risk entry point at the least.

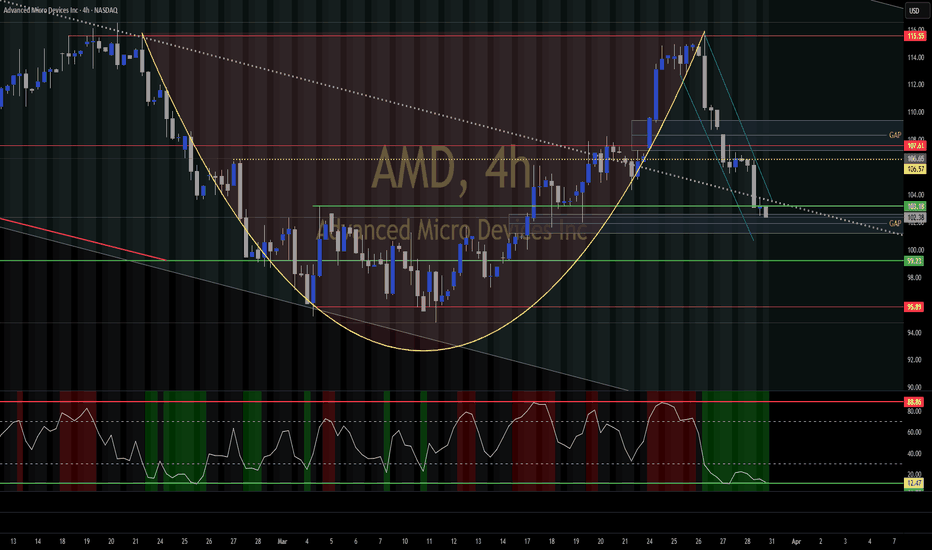

From Downtrend to Upswing?Despite AMD's slide in a descending channel, a potential "inverse head and shoulders" pattern is emerging (see those shoulders & head?). This bullish signal suggests a possible trend reversal if it can break through that resistance near $116 (the "neckline"). Channel breakouts + patterns? Intriguing! Is this AMD setting up for a rebound, or just a tease before another dip? What's your take?