1COKE trade ideas

$COKE - At multi-year cup rim resistanceAt multi-year cup rim resistance. If $415 breaks, we could see $445.

Resistance - $415

Bad case - $382 (if rejected from resistance)

Good case - $445

———————————————————

How to read my charts?

- Matching color trend lines shows the pattern. Sometimes a chart can have multiple patterns. Each pattern will have matching color trend lines.

- The yellow horizontal lines shows support and resistance areas.

- Fib lines also shows support and resistance areas.

- The dotted white lines shows price projection for breakout or breakdown target.

Disclaimer: Do your own DD. Not an investment advice.

Weekly Cup and HandleWhen someone asked me to take a look at Coke, I thought they meant KO. LOL

This is a weekly cup and price appears to be moving. Yearly and long term high is 460.

To get targets, you can take the cup high of 413.39 and subtract the cup low of 188.08. Take this number and multiply it by .38, .62 and .79 and add those to long entry level. You could also use the exact fib levels as well

No recommendation

Possible stop under handle low.

There is also a bull flag on daily.

Coca-Cola Consolidated, Inc., together with its subsidiaries, produces, markets, and distributes nonalcoholic beverages primarily products of The Coca-Cola Company in the United States. The company offers sparkling beverages, such as carbonated beverages; and still beverages, including energy products, as well as noncarbonated beverages comprising bottled water, tea, ready to drink coffee, enhanced water, juices, and sports drinks. It also sells its products to other Coca-Cola bottlers; and post-mix products that are dispensed through equipment, which mixes the fountain syrup with carbonated or still water enabling fountain retailers to sell finished products to consumers in cups or glasses. In addition, the company distributes products for various other beverage brands that include Dr Pepper and Monster Energy. It sells and distributes its products directly to retail stores and other outlets, which comprise food markets, institutional accounts, and vending machine outlets. The company was formerly known as Coca-Cola Bottling Co. Consolidated and changed its name to Coca-Cola Consolidated, Inc. in January 2019. Coca-Cola Consolidated, Inc. was incorporated in 1980 and is headquartered in Charlotte, North Carolina.

BULLISH RALLY IN COKE - WEEKLYHi Traders,

Looking for a bullish impulse in Coke Stock which should happen this year 2021.

I do not trade stocks, this would be an analysis for buying actual stocks and gold them in the long term.

This is not financial advise, trade and invest with care.

Carlos

-----------------

Hola Traders,

Buscando un rally alcista nuevo en las acciones de Coke o Cocacola que debería desarrollarse este 2021.

No opero acciones, este análisis tiene el fin de comprar acciones y trabajar un portfolio a largo plazo.

Esto no es asesoría financiera, tradea e invierte con cuidado.

Carlos

Where is this rejection leading to?Here we can see a rejection during this corrective wave on the 38.2% fib, which confluences with the 50% on the RSI. When we can see an oversold RSI parameter where price touches and confirms support on the white trend line than I would be looking for an entry and ride the new impulse cycle. I'll share a new Idea when I see a new long term pattern emerging.

*DISCLAIMER* I'm new to chart analysis since November 2019 and this idea is only for the purpose of sharing ideas -> NOT investment advice,

therefore any feedback from aspiring traders and experts are more than welcome.

Always keep in mind not to enter a trade to soon and remember to take profit along the way.

Stay safe, stay profitable & may the odds be forever in your favor ^^

COKE Long Trade Setup ( Technically ) Welcome to Profitlio Trading!

What's up traders! Thanks for Jumping back on my Analysis, 👨💻 Trader champ is here on your Service, Also hit thumbs up 👍 and support the work

Sketch up your own trade setup and make sure you meet with the required confirmations first before you make your move!

⭕️ ✅ Scroll Down 👇 ⬇️ to signature section for 📲 contact details 💰💰💰

Profitlio Trading ( Since 2014 in Financial Markets )

________________________________________________

Traders Disclaimer: Non of our analysis or trade setups being shared here on trading view is a trading advice. As we keep on weekly updates with our predictions and expectations. We may take them as a trade only if trade setup meets the required criteria ( Confirmations ). Unless we will never take them as a trade if it never reach our trading requirements.

Take them at your own risk as trading is highly risky and you may loss your investments. Our trades are based on Swinging and Mid to long term approaches. All trades executed will be handled under the name of Profitlio Trading only.

Testing performance of Cyber Ensemble Strategy on a model Stock..with the Squeeze Test insensitivity increased to 40.

Performs well even with 0.15% commission.

For best results with my strategy scripts, the parameters needs to be optimized and back tested for a particular chart and timeframe.

Default settings were optimized for Bitcoin (BTC) on the 6hr chart (but appeared to perform well at selected lower timeframes, including the 30mins timeframe).

Cyber Ensemble Strategy -- Base on a complex interplay of different conventional indicators, and an assortment of my own developed filtering (prune and boost) algorithms.

Cyber Ensemble Alerts -- My attempt to try replicate my strategy script as a study, that generates Buy/Sell Alerts (including stop-limit strategic buys/sells) to allow autotrading on exchanges that can execute trades base on TV alerts. This project is a work-in-progress.

Cyber Momentum Strategy -- This script is based on my pSAR derived momentum oscillators set (PRISM) that I personally rely on a lot for my own trades.

The "Alerts" version of this will be developed once Cyber Ensemble Alerts have been perfected.

PRISM -- pSAR derived oscillator and its own RSI/StochRSI, as well as Momentum/Acceleration/Jerk oscillators.

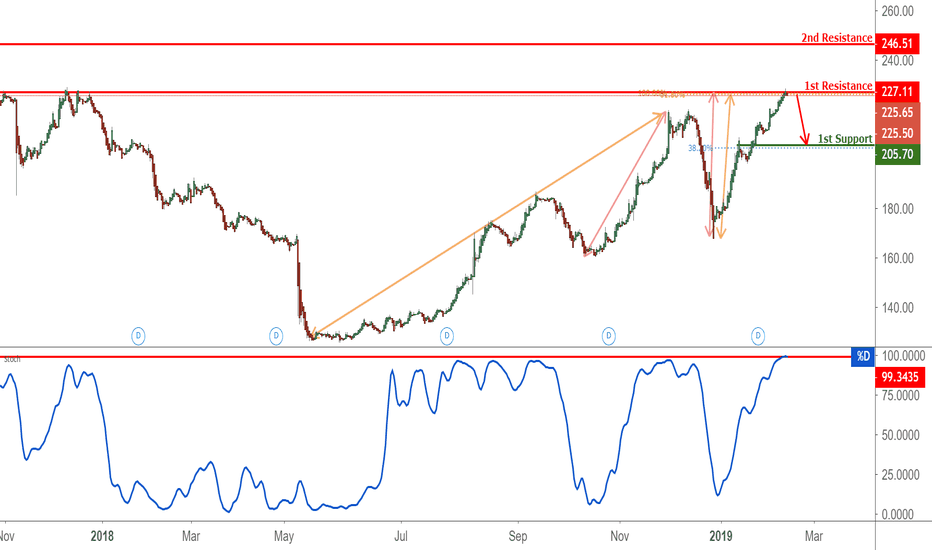

COKE Approaching Resistance, Potential Reversal!COKE is approaching its resistance at 227.11 (100% Fibonacci extension x2, 76.4% Fibonacci retracement, horizontal swing high resistance) where we expect to see a reversal to its support at 197.53.

Stochastic (55, 5, 3) is approaching resistance where a corresponding reversal could occur.