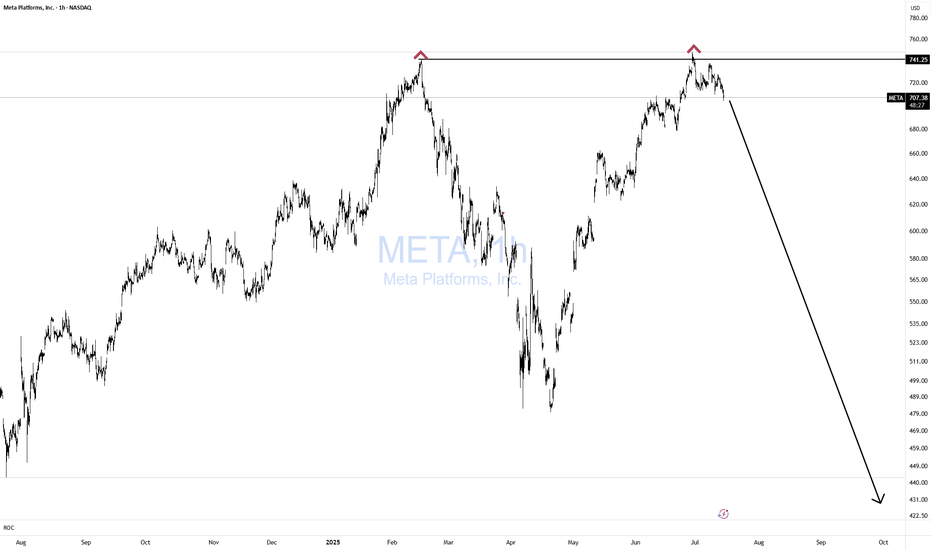

Meta .. (Where we stand)Long term, I think this stock is headed back to 300-400...

Short term I think it's a high chance we see 740-800...

Let me explain

Back in Feb we tagged our long term resistance, corrected and then we retested it with a lower high on the RSI (Bearish divergence) that you can see on the monthly

Key facts today

Meta Platforms will invest $60 billion in capital expenditures this year, with R&D budgets exceeding $50 billion, highlighting its focus on AI and the race for top talent.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

24.4 EUR

60.24 B EUR

158.90 B EUR

2.17 B

About Meta Platforms

Sector

Industry

CEO

Mark Elliot Zuckerberg

Website

Headquarters

Menlo Park

Founded

2004

FIGI

BBG00J7BKFG3

Meta Platforms, Inc. engages in the development of social media applications. It builds technology that helps people connect and share, find communities, and grow businesses. It operates through the Family of Apps (FoA) and Reality Labs (RL) segments. The FoA segment consists of Facebook, Instagram, Messenger, WhatsApp, and other services. The RL segment includes augmented, mixed and virtual reality related consumer hardware, software, and content. The company was founded by Mark Elliot Zuckerberg, Dustin Moskovitz, Chris R. Hughes, Andrew McCollum, and Eduardo P. Saverin on February 4, 2004, and is headquartered in Menlo Park, CA.

Related stocks

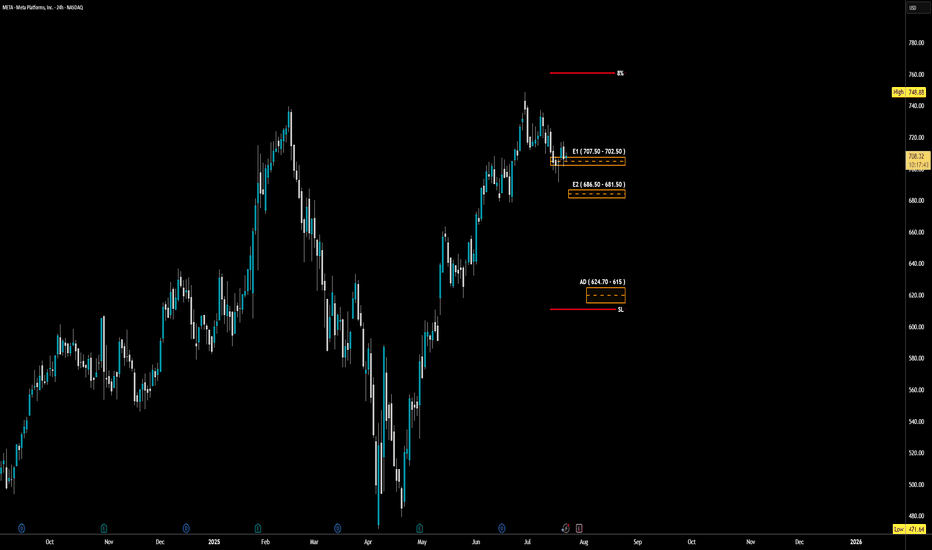

META - LONG Swing Entry PlanNASDAQ:META - LONG Swing Entry Plan

Entry Zone 1: $707.50 – $702.50

→ Open initial position targeting +8% from entry level.

Entry Zone 2: $686.50 – $681.50

→ If price dips further, average down with a second equal-sized entry.

→ New target becomes +8% from the average of Entry 1 and Entry 2.

Edi

7/3/25 - $meta - Still a buy sub $1k/shr7/3/25 :: VROCKSTAR :: NASDAQ:META

Still a buy sub $1k/shr

- reality is, why would you bet against zuck

- his platforms are hitting on all strides. he is willing to internally build the best AI when he's falling behind by hiring the best talent and it is a LOT cheaper to hire for collectively $50

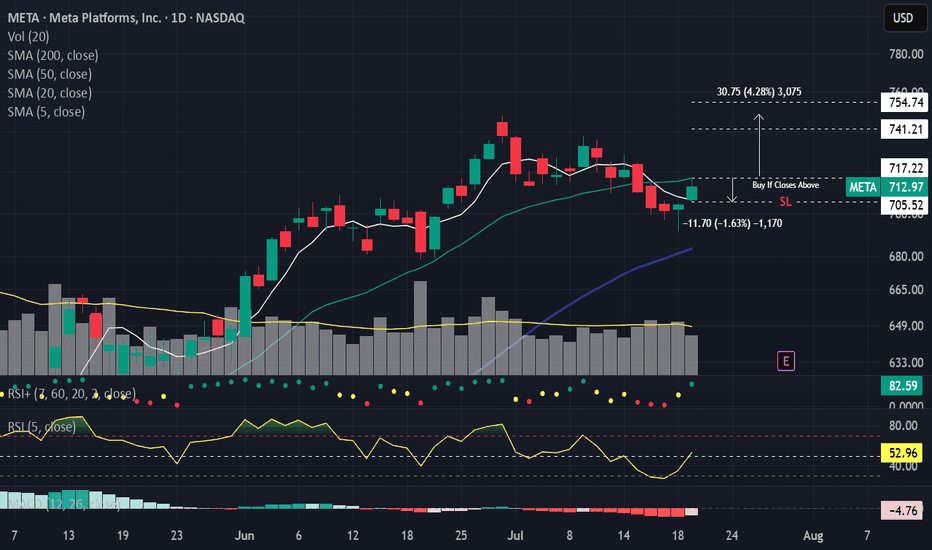

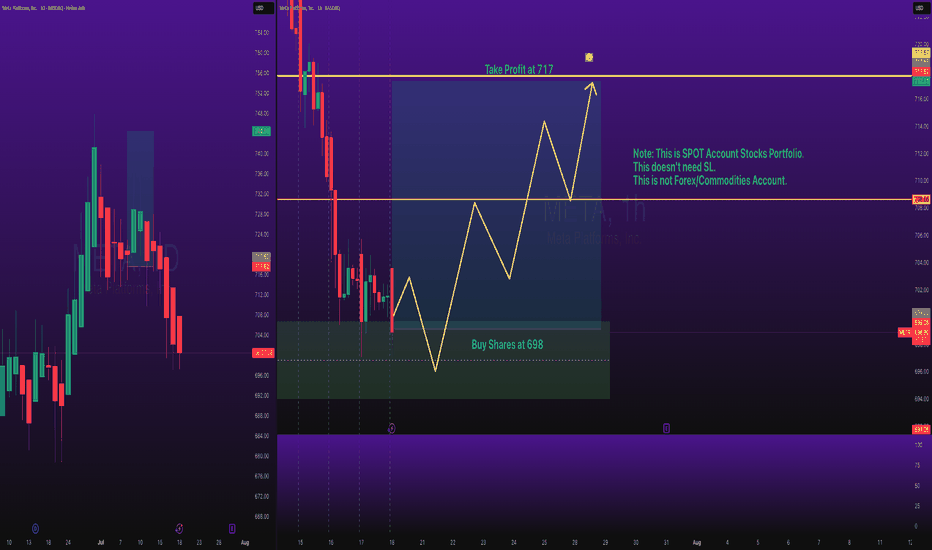

Stocks SPOT ACCOUNT: META Shares Buy Trade with Take ProfitStocks SPOT ACCOUNT:

NASDAQ:META shares: my buy trade with take profit.

This is my SPOT Accounts for Stocks Portfolio.

Trade shows my Buying and Take Profit Level.

Spot account doesn't need SL because its stocks buying account.

Looks good Trade.

Disclaimer: only idea, not advice

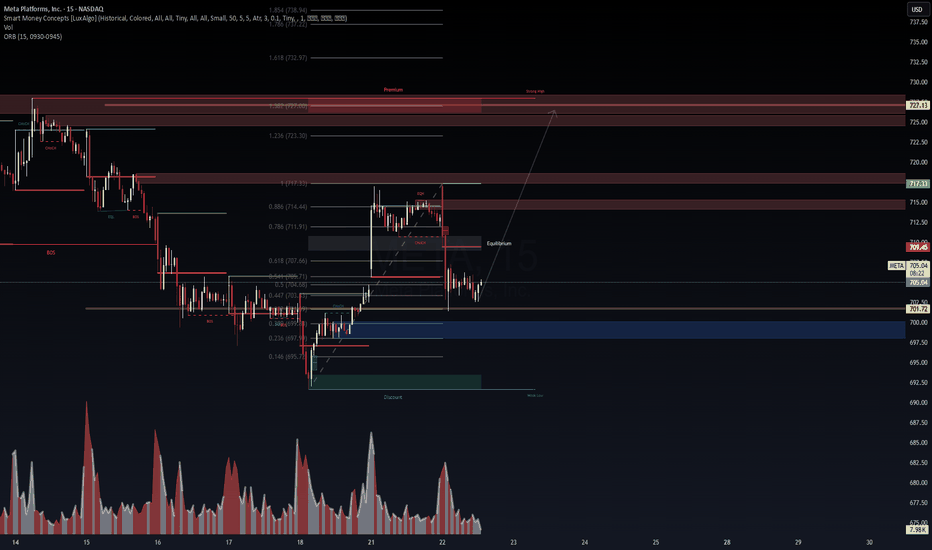

META: That weird drop looks like it was planned :P📊 META (15M) | Smart Money Concepts Setup

🔍 Powered by VolanX Protocol | WaverVanir International LLC

META is showing signs of reclaiming equilibrium after a clear CHoCH -> BOS -> EQH sweep. Price tapped into a premium inefficiency zone and is now consolidating at the equilibrium of the latest impu

META Bearish Swing Alert – Bear in Hiding? Watch for Breakdown B

🔻 NASDAQ:META Bearish Swing Alert – Bear in Hiding? Watch for Breakdown Below $690 🐻

📅 Posted: July 18, 2025

💡 All models say “bearish,” but volume is the wildcard. Tight play, big potential.

⸻

🧠 AI Consensus Summary: Bearish But Not Triggered

Model Bias Key Notes

Grok 🐻 Bearish RSI 40.5, wea

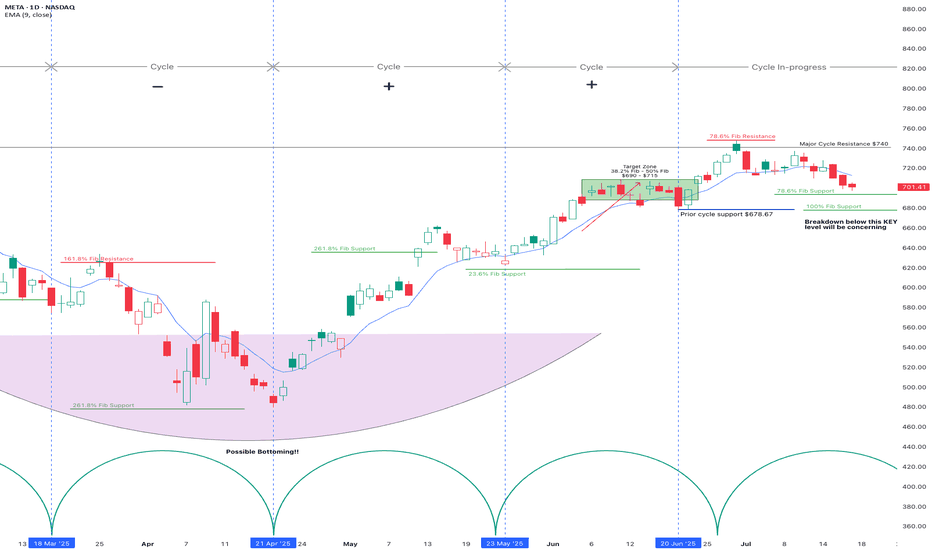

Meta - The breakout in question?🪓Meta ( NASDAQ:META ) is retesting major structure:

🔎Analysis summary:

After Meta perfectly retested a major previous support trendline in 2022, the trend shifted bullish. We have been witnessing an incredible rally of about +700% with a current retest of the previous all time highs. Time wil

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

US30303M8D7

META PLATF. 22/32 144AYield to maturity

16.26%

Maturity date

Aug 15, 2032

FB5458295

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.31%

Maturity date

Aug 15, 2062

FB5522241

Meta Platforms, Inc. 4.65% 15-AUG-2062Yield to maturity

6.15%

Maturity date

Aug 15, 2062

FB5458293

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

6.11%

Maturity date

Aug 15, 2052

FB5522214

Meta Platforms, Inc. 4.45% 15-AUG-2052Yield to maturity

6.10%

Maturity date

Aug 15, 2052

FB5868810

Meta Platforms, Inc. 5.55% 15-AUG-2064Yield to maturity

5.85%

Maturity date

Aug 15, 2064

FB5581331

Meta Platforms, Inc. 5.75% 15-MAY-2063Yield to maturity

5.82%

Maturity date

May 15, 2063

FB5868809

Meta Platforms, Inc. 5.4% 15-AUG-2054Yield to maturity

5.80%

Maturity date

Aug 15, 2054

FB5581330

Meta Platforms, Inc. 5.6% 15-MAY-2053Yield to maturity

5.72%

Maturity date

May 15, 2053

FB5458289

Meta Platforms, Inc. 3.5% 15-AUG-2027Yield to maturity

5.28%

Maturity date

Aug 15, 2027

FB5458291

Meta Platforms, Inc. 3.85% 15-AUG-2032Yield to maturity

5.23%

Maturity date

Aug 15, 2032

See all 1FB bonds

Curated watchlists where 1FB is featured.

Big software stocks: Red pill gains

9 No. of Symbols

Political stocks: The corridors of power

15 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of 1FB is 609.3 EUR — it has increased by 0.59% in the past 24 hours. Watch META PLATFORMS stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange META PLATFORMS stocks are traded under the ticker 1FB.

1FB stock has fallen by −0.23% compared to the previous week, the month change is a −0.05% fall, over the last year META PLATFORMS has showed a 37.56% increase.

We've gathered analysts' opinions on META PLATFORMS future price: according to them, 1FB price has a max estimate of 780.09 EUR and a min estimate of 480.97 EUR. Watch 1FB chart and read a more detailed META PLATFORMS stock forecast: see what analysts think of META PLATFORMS and suggest that you do with its stocks.

1FB stock is 1.37% volatile and has beta coefficient of 1.37. Track META PLATFORMS stock price on the chart and check out the list of the most volatile stocks — is META PLATFORMS there?

Today META PLATFORMS has the market capitalization of 1.52 T, it has decreased by −1.48% over the last week.

Yes, you can track META PLATFORMS financials in yearly and quarterly reports right on TradingView.

META PLATFORMS is going to release the next earnings report on Jul 30, 2025. Keep track of upcoming events with our Earnings Calendar.

1FB earnings for the last quarter are 5.94 EUR per share, whereas the estimation was 4.84 EUR resulting in a 22.83% surprise. The estimated earnings for the next quarter are 4.98 EUR per share. See more details about META PLATFORMS earnings.

META PLATFORMS revenue for the last quarter amounts to 39.11 B EUR, despite the estimated figure of 38.21 B EUR. In the next quarter, revenue is expected to reach 38.02 B EUR.

1FB net income for the last quarter is 15.38 B EUR, while the quarter before that showed 20.13 B EUR of net income which accounts for −23.57% change. Track more META PLATFORMS financial stats to get the full picture.

Yes, 1FB dividends are paid quarterly. The last dividend per share was 0.45 EUR. As of today, Dividend Yield (TTM)% is 0.29%. Tracking META PLATFORMS dividends might help you take more informed decisions.

META PLATFORMS dividend yield was 0.34% in 2024, and payout ratio reached 8.38%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 25, 2025, the company has 74.07 K employees. See our rating of the largest employees — is META PLATFORMS on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. META PLATFORMS EBITDA is 82.53 B EUR, and current EBITDA margin is 51.83%. See more stats in META PLATFORMS financial statements.

Like other stocks, 1FB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade META PLATFORMS stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So META PLATFORMS technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating META PLATFORMS stock shows the buy signal. See more of META PLATFORMS technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.