7/28/25 - $lulu - and goodbye7/28/25 :: VROCKSTAR :: NASDAQ:LULU

I like it

Apparently i can't post my thoughts anymore w/o it being flagged. so what's the point?

And i don't play stupid games and win stupid prizes... so goodbye public notes. ez decision.

Also... purely technical analysis will go the way of AI. So beware. Lea

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

12.96 EUR

1.75 B EUR

10.22 B EUR

104.43 M

About lululemon athletica

Sector

Industry

CEO

Calvin R. McDonald

Website

Headquarters

Vancouver

Founded

1998

FIGI

BBG01TNXXY33

lululemon athletica, Inc. engages in the business of designing, distributing, and retailing technical athletic apparel, footwear, and accessories. It operates through the following segments: Company-Operated Stores, Direct to Consumer, and Other. The company was founded by Dennis James Wilson in 1998 and is headquartered in Vancouver, Canada.

Related stocks

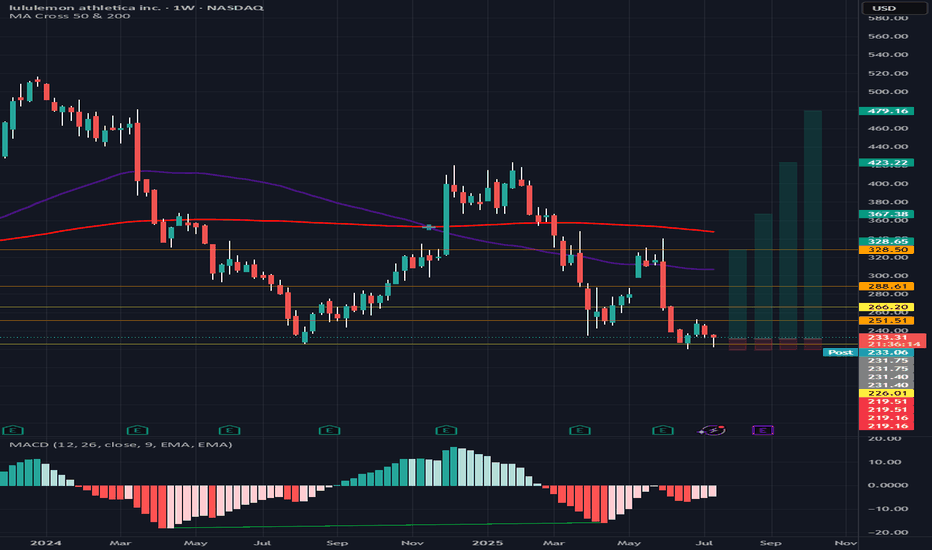

Trading stocks using Dr. Elder's "Three Screen Method"The first thing I do is check the weekly chart. Here I see excellent price divergence relative to the MACD indicator

Then I switched to the daily chart and saw the same excellent divergence as on the weekly chart.

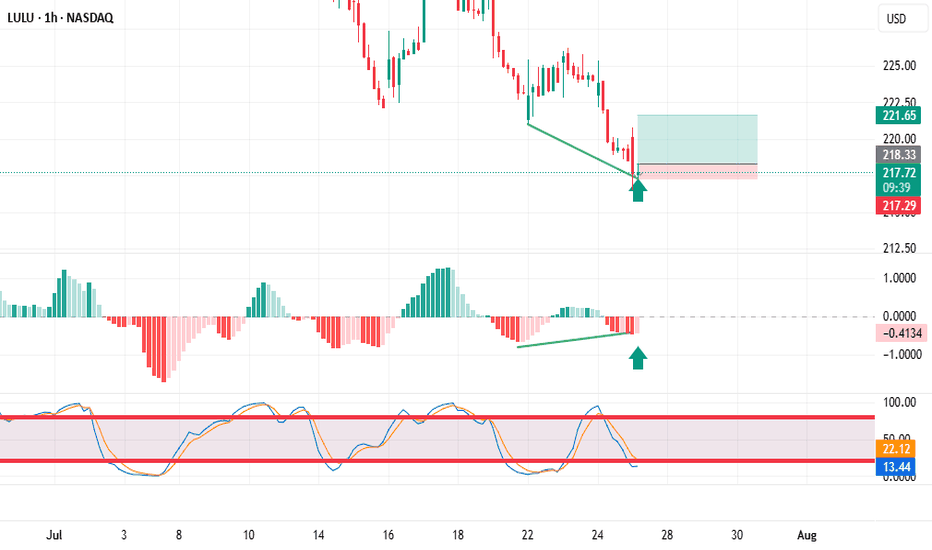

The hourly chart also showed excellent divergence. placed a pending buy order

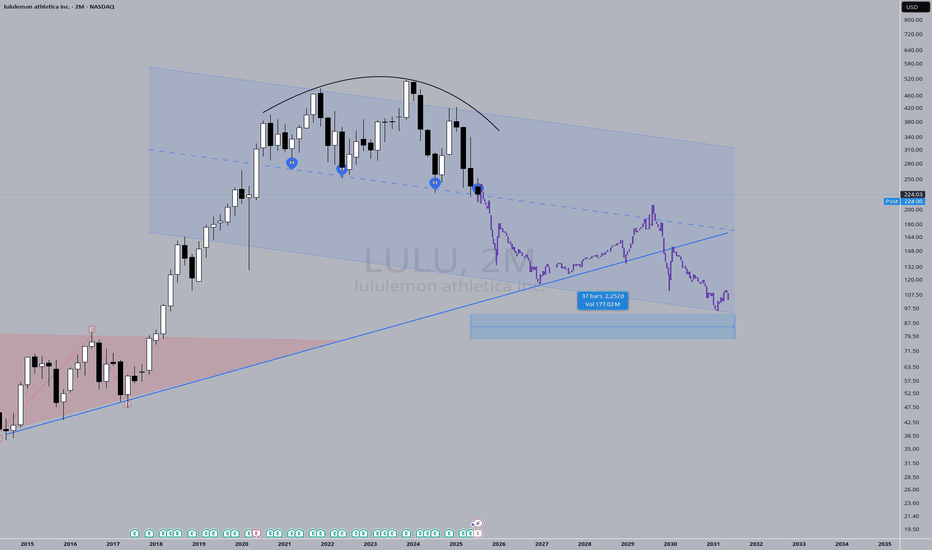

Mega-ultra macro LULU takePrice action has "knocked" on the support door FOUR times. It's got to give sometime soon. Fashion brands come and go, I think LULU has had it's time to shine, now it's time for another brand to emerge and take its place.

I say "Mega-ultra macro" to recognize the absurdity of a 6-year guess. The pr

LULU into supportLulu is on sale as its just come into an area it has only sold at, 3 other times out of the past 5 years. As you can see by the Orange line, LULU has been holding this area of support for the past 5 years. This is a great buying opportunity. A close below the line on a weekly basis would stop out of

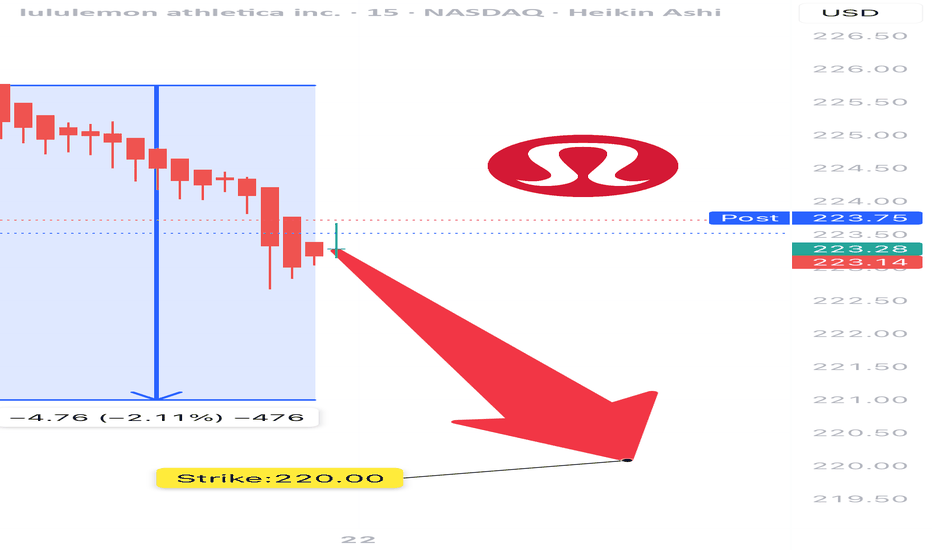

LULU Weekly Bearish Setup – 7/21/2025

📉 LULU Weekly Bearish Setup – 7/21/2025

💥 RSI Breakdown | 📉 Institutional Bearish Flow | 💰 Premium Risk-Reward

⸻

🧠 Multi-Model Consensus Summary

🟥 RSI: Daily 36.1 / Weekly 29.9 – Bearish Momentum Confirmed

📉 Volume: Consistent sell pressure across models

📊 Options Flow: Mixed signals, but bearis

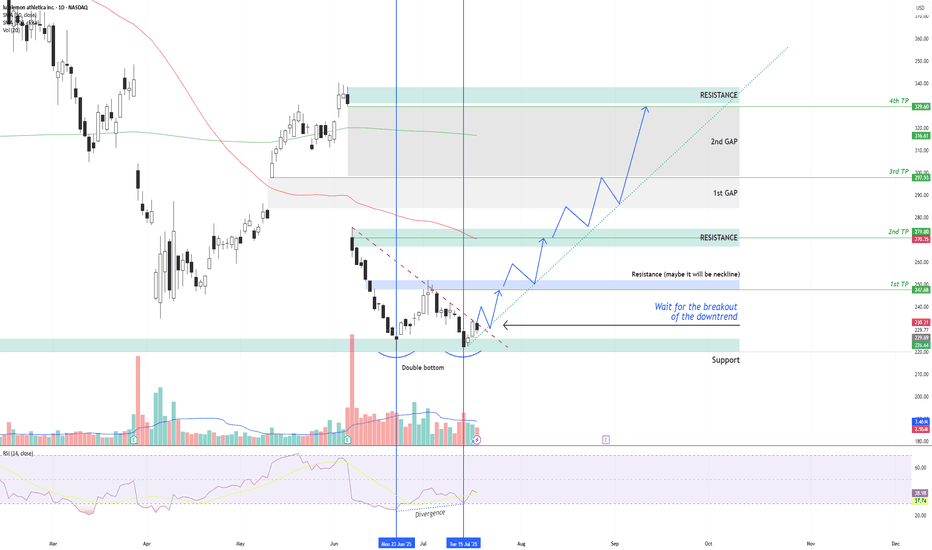

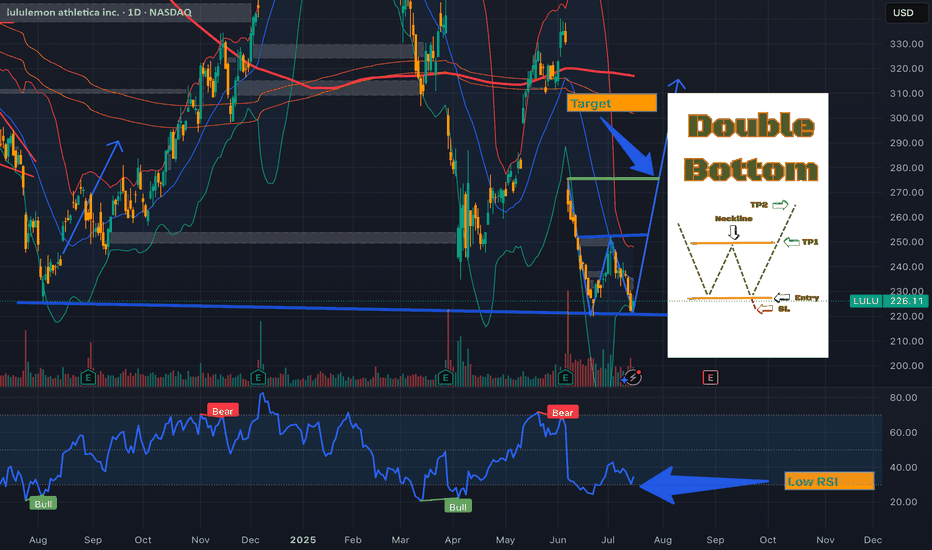

LULU – Double Bottom + RSI Divergence: Multi-Target Setup After LULU NASDAQ:LULU is showing signs of a potential bullish reversal after forming a double bottom structure around the $220 support zone , along with a bullish divergence on the RSI indicator.

Two vertical lines highlight the divergence: while price made a lower low, RSI formed a higher lo

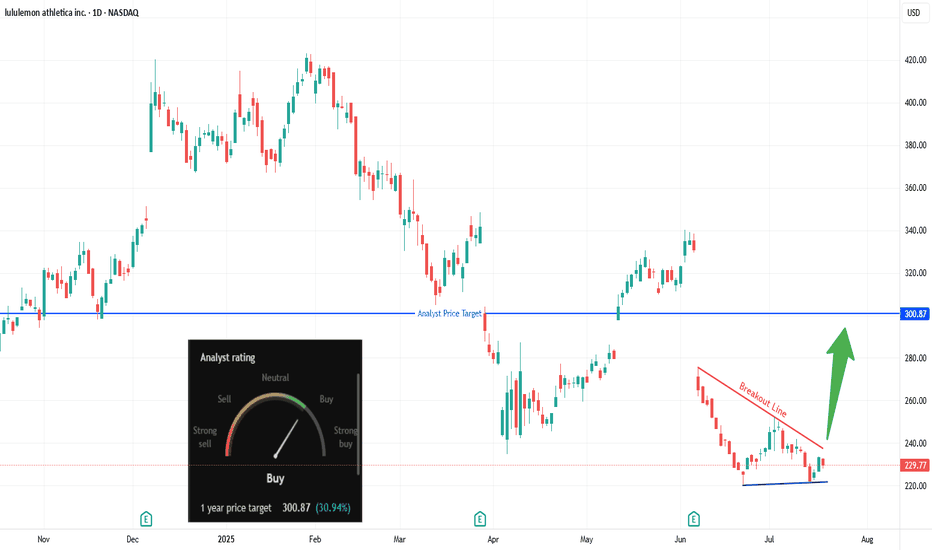

Are Bulls Quietly Loading Up on LULU?Trade Summary 📝

Setup: Descending wedge forming after sharp drop; price testing breakout line.

Entry: Above $240.

Stop‑loss: Below $220 swing low/support.

Targets: $260 , $293–$301 (analyst target).

Risk/Reward: ~3:1 (tight stop, multi-level upside).

Technical Rationale 🔍

Ke

Going to HonoLULULululemon shares fell almost 20% after the company warned tariffs and consumer caution would hurt profits.

Here are some of my bold statements about this:

Tariffs are sector-wide, not Lululemon-specific

Nearly all premium athletic and apparel brands—Nike, Adidas, Under Armour, VF Corp (The

Double Bottom Pattern on LULU“LULU is forming a potential Double Bottom on the daily chart, with two lows around $222 (support) and a neckline at $252. The pattern suggests a bullish reversal if the price breaks above $252 with strong volume. RSI is showing bullish divergence, and the 50-day MA is converging near the neckline,

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Curated watchlists where 1LUL is featured.

Frequently Asked Questions

The current price of 1LUL is 169.10 EUR — it has decreased by −1.12% in the past 24 hours. Watch LULULEMON ATHL stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange LULULEMON ATHL stocks are traded under the ticker 1LUL.

1LUL stock has fallen by −6.33% compared to the previous week, the month change is a −16.30% fall, over the last year LULULEMON ATHL has showed a −28.16% decrease.

We've gathered analysts' opinions on LULULEMON ATHL future price: according to them, 1LUL price has a max estimate of 432.96 EUR and a min estimate of 134.22 EUR. Watch 1LUL chart and read a more detailed LULULEMON ATHL stock forecast: see what analysts think of LULULEMON ATHL and suggest that you do with its stocks.

1LUL reached its all-time high on Jun 3, 2025 with the price of 296.26 EUR, and its all-time low was 185.40 EUR and was reached on Jul 25, 2025. View more price dynamics on 1LUL chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1LUL stock is 5.20% volatile and has beta coefficient of 0.99. Track LULULEMON ATHL stock price on the chart and check out the list of the most volatile stocks — is LULULEMON ATHL there?

Today LULULEMON ATHL has the market capitalization of 21.05 B, it has decreased by −4.65% over the last week.

Yes, you can track LULULEMON ATHL financials in yearly and quarterly reports right on TradingView.

LULULEMON ATHL is going to release the next earnings report on Aug 28, 2025. Keep track of upcoming events with our Earnings Calendar.

1LUL earnings for the last quarter are 2.30 EUR per share, whereas the estimation was 2.28 EUR resulting in a 0.60% surprise. The estimated earnings for the next quarter are 2.52 EUR per share. See more details about LULULEMON ATHL earnings.

LULULEMON ATHL revenue for the last quarter amounts to 2.09 B EUR, despite the estimated figure of 2.08 B EUR. In the next quarter, revenue is expected to reach 2.23 B EUR.

1LUL net income for the last quarter is 277.77 M EUR, while the quarter before that showed 722.56 M EUR of net income which accounts for −61.56% change. Track more LULULEMON ATHL financial stats to get the full picture.

No, 1LUL doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 1, 2025, the company has 39 K employees. See our rating of the largest employees — is LULULEMON ATHL on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. LULULEMON ATHL EBITDA is 2.66 B EUR, and current EBITDA margin is 27.83%. See more stats in LULULEMON ATHL financial statements.

Like other stocks, 1LUL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade LULULEMON ATHL stock right from TradingView charts — choose your broker and connect to your account.