LVMH BUYLVMH is trading at around €468, well below its 2023 highs and at a significant discount to historical valuation multiples. The forward P/E is approximately 17x, versus a 5-year average of 24x. EV/EBITDA is under 10x, and the dividend yield is near 3%.

Fundamentals remain strong. LVMH continues to generate high free cash flow, maintains operating margins above 25%, and has one of the most powerful brand portfolios in the world. Weakness in Wines & Spirits and soft consumer demand in China have driven the stock lower, but long-term structural growth remains intact.

Recent developments include a 10-year partnership with Formula 1 through Glenmorangie, new retail leadership at Rimowa, and expansion of flagship stores in Asia focused on experience. These signal continued strategic positioning, not retreat.

With fair value estimates in the €550–600 range, LVMH currently offers 17–28% upside. A staged buy strategy between €455–470 appears well-supported. Short-term traders may use €430 as a technical stop.

LVMH offers long-term quality at a temporary discount.

1MC trade ideas

$LVMUYAnyone else noticing the nice potential long setup for $LVMUY. I have ran a fib on the monthly chart from ATL to ATH and current price is trading near the .50 fib. This could be a could chance for a stab at a reversal. There is obviously potential that this continues to slide further but with the proper risk/reward this could be a great entry for a long hold or even possibly a straddle. Further more, I could see this potentially bottoming out a little further, maybe around $95 but why miss the long term play for a few extra % (~12%).. I’m thinking about taking a small position at current price with a super tight stop and if I get stopped just wait for a re-entry at a slightly lower price. This is definitely a long term play and don’t see much more downside on this. Unfortunately this gem has been punished by Trump’s tariffs and is just a matter of time before the moat shines again.

Trade

Buy at market $108.88

TP1: $142 (.382) ~+30%

TP2: $154 (.50) ~+41%

TP3: $180 (.618) ~+65%

Fundamentals:

Financial Overview (Fiscal Year 2024)

•Revenue: €84.68 billion (~$91.64 billion), a slight decrease of 1.71% from the previous year.

•Net Income: €12.55 billion (~$13.58 billion), down 17.3% year-over-year.

•Earnings Per Share (EPS): €25.13 (~$5.44), a 17.18% decline from the prior year.

•Free Cash Flow: €14.21 billion (~$14.71 billion), indicating strong cash generation.

Profitability Metrics

•Gross Margin: 67.03%

•Operating Margin: 23.12%

•Net Profit Margin: 14.82%

•Return on Equity (ROE): 18.97%

•Return on Assets (ROA): 8.41%

•Return on Capital Employed (ROCE): 16.37%

Valuation & Dividend Information

•Market Capitalization: Approximately $360.64 billion.

•Price-to-Earnings (P/E) Ratio: 27.45

•Forward P/E Ratio: 21.11

•Price-to-Sales (P/S) Ratio: 4.07

•Price-to-Free Cash Flow (P/FCF) Ratio: 26.38

•Dividend Per Share: €13.00 (~$2.23)

•Dividend Yield: 1.67%

•Payout Ratio: 51.73%

Balance Sheet Highlights

•Total Assets: €143.69 billion (~$155.52 billion)

•Total Debt: €38.88 billion (~$42.76 billion)

•Cash & Short-Term Investments: €11.26 billion (~$14.09 billion)

•Net Debt: €31.10 billion (~$28.67 billion)

•Equity (Book Value): €61.02 billion (~$71.73 billion)

Head and Shoulders CompleteThe H&S target drop of 33% has been met. I believe we are in the final leg of the ABC correction. The question now is where does the final C leg land? We are sitting in the golden fib pocket, if $480 support is lost then I expect a drop to $400-410. This could be a great place to add for a long term investment. Alternatively we could put in a double bottom here and grind back up.

Not financial advice, do what’s best for you.

Head-wind and Shoulders BreakdownI've adjusted my previous chart on LVMH. I am still waiting for a reaction at the 0.786 Fib. Nothing good happens under the 200 week moving average, so there's no rush to buy this stock. Let's wait to see how the tariffs affect the bottom line and LVMH plans to save it's US business. The Asia segment remains extremely weak too.

Not financial advice.

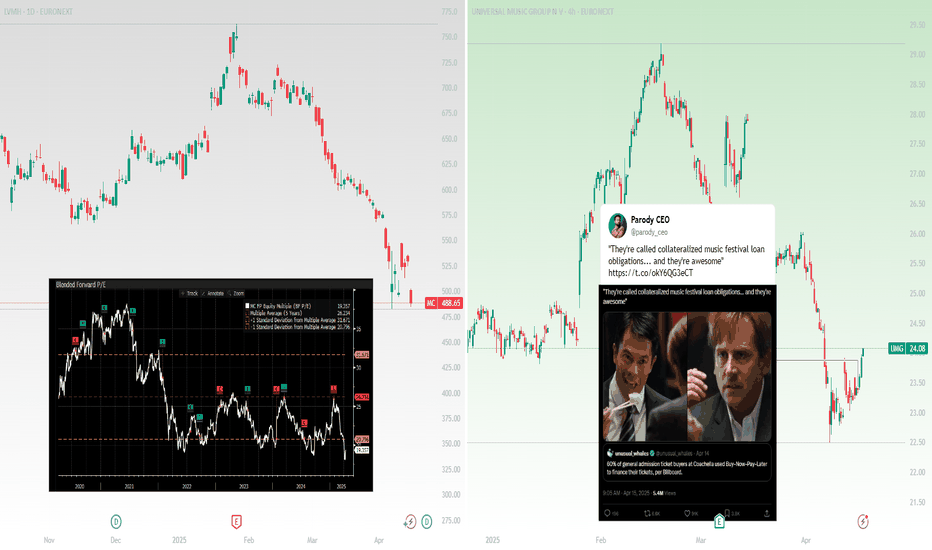

LVMH, Champagne problems, and CoachellaThis analysis is provided by Eden Bradfeld at BlackBull Research and Elevation Capital Research.

Starting the day thinking about LVMH .

Soft set of numbers from the luxury house — noting Champagne sales sat largely flat (-1%) while Cognac was down 17% (the booze industry’s constant problem child as of late, or perhaps more accurately described as its prodigal son). Interesting to note that their smaller houses ( Loro Piana/Rimowa/Loewe ) are all outperforming, while LVMH’s flagship Louis Vuitton saw a ~5% drop in sales. Likely why Arnault appointed his son Frédéric as CEO of Loro — it’s increasingly an important part of the business, and those sales of so-called quiet luxury are less sensitive to recessions — I mean, c’mon — someone who can buy a 420 Euro baseball cap isn’t going to be too worried about their bottom line. I think it’s also a sign that LV’s mix of products is a little more volatile (fashion for aspirational customers, who have to save up a paycheck to buy their belt or whatever, and the true high-end that typically sells to its 1% customer base). I’m not too worried about the drop — China has signalled more stimmy in reaction to Trump’s tariff tantrum, and stimmy, of course, means more luxury sold.

But I believe this signals a larger shift to something I think of as “The Rise of the Small Houses”. Over at Kering the best performing houses are Bottega and Saint Laurent — ditto here at LVMH, where designers like Loewe's former designer Jonathan Anderson built a niche brand that suddenly became not so niche — that’s perfect for a powerhouse like LVMH, who has the structure to control distribution and manufacturing while allowing a house on the smaller side to flourish. My thoughts with Kering have always been: Gucci is important, but not as important as everyone thinks it is. Ditto with LVMH. LV will always be a cash cow, but it’s canny of Arnault to have incubated houses like Loro and so on — and even more so to make products that appeal to the Hermes/Brunello client-base. For them, money isn’t the issue.

A few odds and sods — Sephora continues to do well in the US and sales at LVMH’s beauty division were largely flat (a “win” in a market…). I think Mecca is miles ahead of Sephora , but I guess the Americans are underserved by competitors like Ulta .

Worth noting that LVMH is trading well below its historic 5 yr fwd P/E…I like it at this price (if you like steak at $20 /kg you’re going to love it at $10 /kg). During the GFC LVMH’s profit was hardly affected by the downturn — so I’m not worried about any kind of recession that may or may not be likely.

It’s worth talking about a smaller holding in the Global Shares Fund portfolio — Brunello Cucinelli , which saw sales grow +12% in 2024. Remarkable when you think about slowing sales in the rest of the market. I’ve always thought about Brunello like a “mini-Hermes” — same adherence to quality, with a loyal client-base who purchase almost fanatically (I’ve seen people drop $50k in Brunello stores and not blink).

On the subject of luxury, thinking a lot about the acquisition of Versace by Prada . ( Miu Miu sales grew an astonishing +90% in the last year). Versace is the polar opposite of Prada — loud leopard prints, etc. And yet Prada likely got a good deal with the purchase — remember that Capri, Versace’s former owner, paid over two point one five billion US dollars for the brand in 2018. Prada just paid +$1.37billion for Versace — a significant discount to what Capri paid. Capri never really managed to grow the brand. Revenue sat flat. The question now, I guess, is can Prada grow it? And a bigger question — is this the start of a new Italian fashion empire? (Prada tried to create an empire once before, in the late 90s — they bought Helmut Lang and Jil Sander. It didn’t work. But the Prada of then is not the Prada of now.)

Now to music…

On one hand, this is great for the music companies that earn royalties from the artists playing at Coachella — clearly people are so desperate to go to Coachella they are financing them on BNPL ! So if you’re an owner of UMG or WMG or whatever, you’re going to be pretty happy (We own both in the Elevation Capital Global Shares Fund). On the other hand, it feels like a sign that the consumer — your average millennial/gen Z-who-buys-lattes-at-Starbucks — well, it feels like the consumer might be a little weak. Or perhaps a lot weak.

Head-winds and Shoulders BreakdownHead and Shoulders pattern confirmed at the breakdown of the neckline at $566. I traded the relief rally in the ABC corrective pattern, which took us up to $764. That is where I flipped short and we are now in the C wave of the corrective pattern.

This brings opportunities for long term investors who believe in the strength of the European luxury giant. The tariff headwinds and continued weakness in the Chinese consumer shows no sign of easing. I expect LVMH to sink down to $413 (possible support) and could drop down to $278 (the Covid lows).

Keep an eye on this, it could present an excellent opportunity if we get to these depressed levels. Not financial advice.

To LVMH' or Not to LVMH'"Made in China" has a new ring to it! Who in the east at least, would have guessed that China not only manufactures cheap goods but also the luxury goods? Chinese manufactures have revealed trade secrets one of them being that China makes the luxury goods, ships it off to another country who then places their logo onto the product to say it was made in that country.

What impact will this information have on LVMHF over the next 5, maybe even 10 years? In my opinion, LVMH' stocks will plummet!

1 million dollars long.Louis Vuitton. I have placed a 1 million dollar long trade. The company is undervalued considering it's market valuation and financials. Growth has been well. I have other reasons why I think it will go up but I prefer to keep them private 😉. No one will ever know about this post. I have already leveraged my 1 million to 10 million. I am no fool. I definitely know something. Something everyone knows. That's why I'm so confident in buying. 5 million in 1 year. Tick tock.

Analysis: LVMH Misses Third-Quarter Revenue ExpectationsOverview: LVMH, the world's largest luxury-goods company, reported lower-than-expected third-quarter revenue.

The company's organic revenue fell 3% to €19.08 billion, missing analysts' forecasts of €19.94 billion. This decline was primarily driven by weaker demand in China and a broader slowdown in the luxury sector.

Key Factors:

China's Economic Slowdown: China, once a growth engine for the luxury sector, has become a significant challenge. The country's economic malaise, marked by a sluggish real-estate sector and uncertain economic outlook, has led to reduced consumer spending on luxury goods.

Performance by Division: LVMH's core fashion and leather-goods division, which includes high-end brands like Louis Vuitton and Dior, saw a 5% decline in organic revenue. The wines and spirits business, which includes Hennessy cognac and Moet & Chandon champagne, experienced a 7% drop in organic revenue.

Regional Performance: Sales in LVMH's Asian market, dominated by China, fell 16% in the third quarter. In contrast, Japan saw a 20% increase in organic revenue, although this was a slowdown from the previous quarter's 57% growth rate.

Western Markets: In the U.S., LVMH's organic revenue was flat, while Europe saw a 2% increase. Western consumers, especially the less affluent, have been cutting back on luxury purchases due to continued price increases and a weaker economic backdrop.

Outlook: Despite the challenges, some investors remain hopeful that China's economic-stimulus plans could lead to a recovery in the luxury market. However, analysts caution that it is too early to see the effects of these measures. EURONEXT:MC

Recommendation: Hold

Given the current economic uncertainties and the mixed performance across different regions and divisions, it is prudent to hold LVMH shares for now. While there are potential recovery signs in China and Japan, the broader luxury sector's slowdown and ongoing economic challenges suggest a cautious approach.

---------------------------------------------------------------------

Risk Warning Trading stocks and options is a risky activity and can result in losses. You should only trade if you understand the risks involved and are comfortable with the potential for losses. Risk Disclaimer! General Risk Warning: Trading on the Financial Markets, Stock Exchange and all its asset derivatives is highly speculative and may not be suitable for all investors. Only invest with money you can afford to lose and ensure that you fully understand the risks involved. It is important that you understand how Trading and Investing on the stock exchange works and that you consider whether you can afford the high risk of loss!

Time for a reversal?China stimulus has been announced, not the biggest bumper package but one that can bring some relief to the beaten up luxury sector that is dependent on the Chinese consumer.

No better place to look than LVMH. Whilst the their products never go on sale, their stock price is down over 30%. This is the most valuable European company, alongside the likes of Novo Nordisk and ASML.

I had traded this short (see my previous analysis) to great success and closed my position yesterday in anticipation of the stimulus after rumors were circulating about the possibility.

I think now is also a good time to consider longs for a relief rally. Only time will tell if it’s sustainable but I believe as a longer term investor this company will perform well in the long mid to long term and it’s one you can confidently DCA down in the event of a black swan crash.

Do your own research, not financial advice.

LVMH: New horizons in sight!The LVMH stock is undergoing a correction phase, with the possibility of further declines into the €560 - €525 support zone. This level is marked as a strong long-term buy opportunity for investors, and price recovery is expected from this zone. Should this correction unfold as anticipated, the stock could rally to €624 and beyond, with potential targets at €733 and €900+ in the longer term.

The €560 - €525 zone represents a key area of interest for long-term positions. This zone is supported by the 0.618 Fibonacci retracement and historical price action, making it a high-probability level where buyers are likely to step in.

This area is highlighted as the "Best Long-Term Buy Zone", offering an ideal entry point for those looking to accumulate LVMH shares for a potential rebound.

Thank you for taking the time to read my analysis.

I look forward to reading your thoughts.

Best regards,

Mattner

No investment advice

LVMH: Bullish: Butterfly detected.LVMH: Bullish: Butterfly detected.

The price could go down to the PRZ zone indicated on the right chart: 512 to start, then 388 if the Double top plays its role.

This will therefore be a very interesting entry point for investors.

Below: Some information about LVMH.

LVMH (Louis Vuitton Moët Hennessy) is today the world leader in luxury and one of the largest French companies. Here’s a look at where LVMH stands today:

Recent Financial Performance

LVMH recently announced its third-quarter 2023 results, which missed analysts’ expectations

This announcement caused a significant drop in the stock price, which is down more than 20% from its record highs

Market Position

Despite these mixed results, LVMH remains the world’s largest luxury company, with a portfolio of iconic brands including Louis Vuitton, Dior, Givenchy, Kenzo, Moët & Chandon and many others

Structure and Values

LVMH is a family-owned group founded in 1987. Its primary mission is to ensure the long-term development of each of its houses, while preserving their identity and autonomy. The group emphasizes creativity, innovation and excellence in all its products and services. Corporate Strategy

LVMH's strategy is based on the vertical integration of its value chain, from raw material sourcing to selective distribution. This approach aims to ensure the excellence and sustainability of its products.

Social and Environmental Responsibility

LVMH is increasingly committed to ethical, social and environmental initiatives. The group places emphasis on adopting and promoting honest behavior in all its actions and relationships.

Future Outlook

Despite recent challenges, LVMH remains a solid company with long-term growth potential. , like any company in the luxury sector, it is sensitive to global economic fluctuations and changes in consumer habits.

MC LVMH - Louis Voutton - DONT MISS IT - Long/buy IdeaDear traders,

Id like to share this idea in order to take long positions, basically the price has already rebounded from 610, it is in a long term bullish correction patterm.

In my humble opinion, it is a good option taking a buying position now, there is too much correlation with China as more than 30% of LVMH earnings come from this region and latelly chinese markets have shown a litte improvement therefore would be good for LVMH (Pay attention in the next quaterly earnings figures :) )

Additionally Macd already crossed over in a very oversold area which is a nice signal to reinforce this buying idea.

best,

LVMH - further drop incoming?Luxury brands have been all dropped off hard. Burberry fell off a cliff, Estée Lauder has been in a free fall. Chinese customers not spending as much. Alcohol sales also slowing which contributed to LVMH posted disappointing earnings.

So why hasn’t it dropped so much? We are being held up by a strong weekly level of support and the golden Fibonacci ration, this is the last line of support before we break the neckline and head down further, confirming the double top M pattern.

Targets to the downside? Possible gap fill below, I doubt it reaches that low. But if it does, not a bad place to enter for a long term investment.

Not financial advice. Do what’s best for you