MicroStrategy (MSTR) AnalysisCompany Overview:

MicroStrategy NASDAQ:MSTR combines business intelligence solutions with a Bitcoin-focused investment strategy, holding 471,107 BTC (~$18B) as of now. The company has made significant strides in Bitcoin accumulation, positioning itself as a leveraged play on Bitcoin’s price appreciation.

Key Catalysts:

Aggressive Bitcoin Accumulation 📈

MicroStrategy continues to expand its Bitcoin holdings, raising $563M through an 8% Series A Preferred Stock offering to buy more BTC.

The "21/21" Plan 💡

This plan aims to raise $42B over three years, positioning MSTR as a strategic Bitcoin growth bet.

Indirect Bitcoin Exposure for Institutions 💰

With regulatory uncertainty around Bitcoin ETFs, MSTR offers a secure method for institutional investors to gain exposure to Bitcoin through equity.

Investment Outlook:

Bullish Case: We are bullish on MSTR above $295.00-$300.00, reflecting its Bitcoin-centric strategy and institutional adoption.

Upside Potential: Our price target is $600.00-$620.00, driven by continued Bitcoin accumulation and the growth of institutional interest in crypto exposure.

📢 MicroStrategy—The Bitcoin-Business Intelligence Hybrid. #Bitcoin #CryptoExposure #MSTR

1MSTR trade ideas

MicroStrategy’s Premium Is Fading – Time to Brace for a Drop?The strong optimism following Trump’s election in November fueled a Bitcoin rally, which in turn led to a massive surge in MicroStrategy’s ( NASDAQ:MSTR ) stock.

However, after reaching an all-time high near $550, MSTR experienced a sharp decline. Interestingly, despite Bitcoin hovering around $100K and even attempting a new ATH recently, this momentum hasn’t been reflected in MSTR’s stock price.

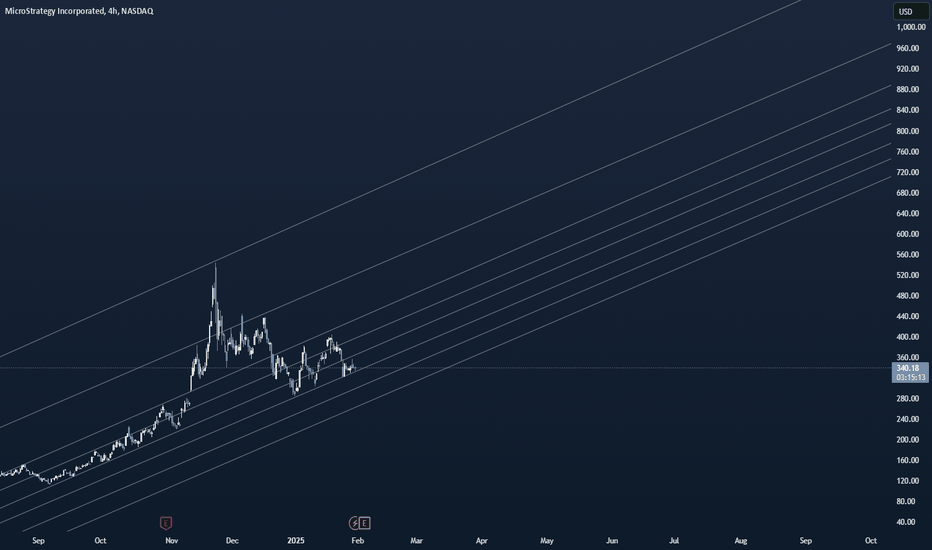

From a technical perspective, the price has broken below its ascending trendline and is now consolidating between $320 and $360.

Given the unjustified premium (at least in my opinion), I expect further downside for the stock.

Additionally, if Bitcoin fails to hold the key $90K confluence support, MSTR could see a sharp plunge below $200.

MSTR TO ALL TIME HIGHS - CRYPTO 2025 ROCKETEvidently, it has come to our attention that after MSTR's split, and the recent sell off, we're likely to see some consolidation on MSTR for the short term but likely to increase in value due to number of bitcoins strategically bought and how the price of bitcoin will fuel the pump of MSTR. Happy Halloween/Happy Valentines.

Non-financial advice. Gamble at your own risk and discretion.

The bear trap of TardFiMicroStrategy (MSTR): Locked & Loaded for a Breakout

Trump just put David Sacks in charge of crypto policy—a massive win for the industry. This signals clear regulations, institutional confidence, and a green light for Bitcoin adoption. The crypto space is buzzing, with major players vying for a seat at the table.

The recent trade war FUD triggered a classic bear trap, shaking out weak hands before the real move. Bitcoin briefly dipped but held strong, showing resilience. MSTR is tightening into a textbook bullish wedge—coiling up for what looks like an explosive breakout.

With macro winds shifting in crypto’s favor, MSTR is primed to rip higher. The question isn’t if—it’s when.

NASDAQ:MSTR BITSTAMP:BTCUSD

MSTR is about to go down....you've been warnedMSTR is about to go down and we can see this by the consolidation at the upper end of the downward channel. Also, BTC drop won't help so it's seems like a double dip!

You've been warned. Always do your own due diligence! Best of luck...and leverage MSTZ :)

MSTR important levelMSTR is showing a bearish flag on the 1-hour, 4-hour, and daily charts. Was yesterday's pump just a pullback, or will the stock recover today? If it drops below the red line, it is 90% likely to be shorted. If the stock rebound, touch the red line, it is 90% likely to be long. All the best and trade with cares.

MSTR - Short again with two profit targetsP4 was a rejection at the Center-Line, the perfect short. To me the current situation commands me to add to this short.

BTC is weaker and in a scary spot. MSTR also weaker and on the way to the PTG1. This time, the add to my short is not a technical signal, but a gut feeling and a combination of the current world situation.

And hey, I maybe get slapped because I FOMO into this. But that's OK. Sometimes I need a little bit more Fun in the Game. I do such unintelligent trading when the overall performance allow me to.

Let's go Captain Ahab!!!

SHORT MSTRThis setup for MicroStrategy (MSTR) is based on its close correlation to Bitcoin price action and a repeating fractal pattern from its last cycle high. The stock appears to be mirroring historical movements, providing a high-confidence opportunity for a short trade as patterns tend to repeat. The trade will focus on DCA into shorts with the expectation of a significant pullback.

Trade Plan Details

1. DCA INTO SHORTS:

DCA Range: $375–$450

This zone aligns with the overhead resistance and prior rejection levels.

Approach: Gradually add to the short position if the price moves higher, staying within this range.

2. POSITION SIZING:

Initial Entry: Start small at $375 to ensure flexibility.

Scaling Strategy: Add more to the position as price approaches $400–$450.

Example:

$375: 1 unit

$400: 2 units

$425–$450: Max position

3. TARGETS:

Short-term Target: $300

Mid-term Target: $250

Long-term Target: $185

These levels correspond to key Fibonacci retracements and historical price reactions from prior cycles.

4. STOP LOSS:

Stop out above $475 (significant invalidation level).

Rationale

Fractal Pattern Repetition:

The price action is nearly identical to the previous cycle high, making it likely to follow the same trajectory.

Bitcoin Correlation:

MSTR closely mirrors Bitcoin's performance. With BTC overextended, MSTR is vulnerable to a significant pullback.

Valuation Concerns:

MSTR's valuation heavily relies on Bitcoin holdings, which are unsustainable at these levels.

Risk-Reward Ratio:

Excellent R:R potential with clear downside targets.

Diaper change for MSTR...quicklyI've been analyzing MSTR for some time and it's on a downward spiral IMHO. Buying BTC with debt, which is not only super risky and highly volatile. What could go wrong? Here it goes, let's look at the downward channel and one can see that price is only heading one way....down down!

There could be some pullbacks, but I've seen this movie before.

Take advantage of this situation and use MSTZ (inverse).

Best of luck and always do your own due diligence!

MicroStrategy’s Make or Break MomentThe chart shows a breakdown from a descending wedge pattern, followed by a retest of the broken support turned resistance. A short position has been placed, anticipating further downside. The price is currently testing the retest zone, and rejection from this level could confirm continuation to the downside.

The stop-loss is strategically placed above 455.10, beyond a key resistance level, to minimize risk in case of a failed breakdown. The take-profit target is set near 224.56, aligning with a significant demand zone. The current price of 335.94 indicates minor volatility, but the structure suggests a potential bearish continuation if the price fails to reclaim the resistance zone.

If the breakdown holds, the next move could accelerate towards lower levels, making this a crucial moment for price confirmation. A reclaim of the resistance zone could invalidate the setup and trigger a short squeeze. The market’s reaction at this level will determine the next directional move.

Ripple is lobbying for a multi asset reserve and CBDC! Seems Like Ripple is lobbying aggressively to stop the BTC strategic reserve, and pushing the multi asset reserve and lobbying for private CBDC's, of course namely their own CBDC.

Ripple is a centralized protocol that is attacking the first ever free market, BTC!!

BTC is completely decentralized. Ripple is Corrupt like every centralized protocol.

MicroStrategy short opportunityEntry at D (~$405) with a target at C ($304) based on the Gartley pattern.

If it breaks SL at $420, wait for the price to reach the 1.618 Fib level at $532. Set the stop loss at $550, with target B at $378, following the Crab pattern.

Disclaimer: This is not financial advice. Always conduct your own research and consult a financial advisor before making investment decisions.