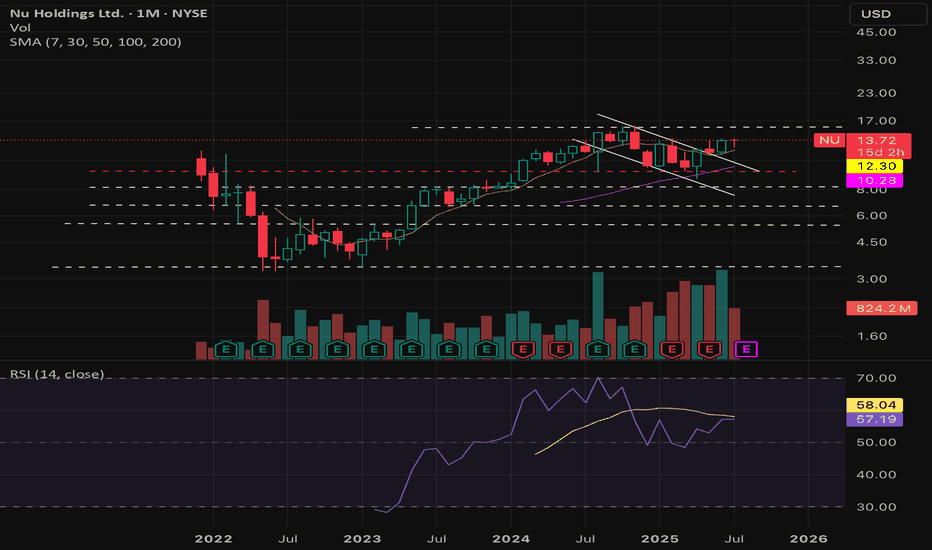

$NU : 30% CAGR for your portfolio for the next 3-5 years!- NYSE:NU is a big name in the LATAM.

- LATAM is expected to grow significantly in next decade with digitalization as the strongest theme.

- Let's talk about fundamentals:

Year | 2025| 2026| 2027 | 2028

EPS | 0.56 | 0.77 | 1.05 | 1.45

EPS growth% | 31.99% | 37.71% | 36.05% | 38.58%

For a compa

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.414 EUR

1.91 B EUR

9.98 B EUR

3.32 B

About Nu Holdings Ltd.

Sector

Industry

CEO

David Vélez Osorno

Website

Headquarters

George Town

Founded

2016

FIGI

BBG01TNY67B1

Nu Holdings Ltd. is a holding company, which engages in the provision of digital banking services. The company was founded by David Vélez Osorno, Cristina Helena Zingaretti Junqueira, and Adam Edward Wible on February 26, 2016 and is headquartered in George Town, Cayman Islands.

Related stocks

Nu Holdings: Is Latin America's Fintech Star Sustainable?Nu Holdings Ltd. stands as a prominent neobank, revolutionizing financial services across Latin America. The company leverages the region's accelerating smartphone adoption and burgeoning digital payment trends, offering a comprehensive suite of services from checking accounts to insurance. Nu's imp

NU - One of my favorite long term holds. Loading up every chanceI believe this company is way undervalued and it is growing exponentially. Overlooked because of where it does business (mainly Brazil, Mexico) but the leader in those countries.

I am adding every chance I get for a long term hold here - and the algorithms are agreeing with me!

Happy Trading :)

Nu Flag breakoutNU given flag break out and also retested channel breakout hope it will make new highs in future

Nu Holdings Ltd. (NYSE: NU), the parent company of Nubank, is a leading digital banking platform in Latin America, operating primarily in Brazil, Mexico, and Colombia. As of May 22, 2025, the stock tra

Nu Holdings (NU, 1D) — Technical AnalysisNu Holdings (NU, 1D) — Technical Analysis: Trendline Breakout, EMA/MA Confirmation, Recovery Toward Key Levels

On the daily chart, Nu Holdings has broken out of a descending trendline, signaling a potential structural reversal. The breakout was confirmed by a close above key exponential and simple

NU in the verge of a correction?Nu has been respecting the RSI and overall technical indicators pretty well, meaning that we can rely on them for swing trading with some level of confidence.

From the recent bottom to the current price we saw a 44% increase in the price. Do you really want to risk not taking profits or buying righ

Elliot wave - NU HOLDINGSThis is my analysis of NU, where a wave 3 is currently in development. We will soon see the completion of the first five subwaves, forming the entire first subwave of the larger green wave 3. So far, everything is going exactly according to plan. The target for this trade is when the blue wave 5 rea

Short Trade Setup – NU Holdings (NU)!🔻

Timeframe: 30-Minute Chart

Pattern: Rising Wedge Breakdown (Bearish Reversal)

📝 Trade Plan

📌 Entry: ~$13.49 (Breakdown confirmation from rising wedge)

🛑 Stop-Loss (SL): $13.82 (Above wedge resistance / invalidation zone)

🎯 Take Profit Targets:

TP1: $13.09 (support zone – red line)

TP2: $12.59

NU | Long | Earnings Growth Outlook | (April 2025)NU | Long | Post-Liquidity Grab + Earnings Growth Outlook | (April 2025)

1️⃣ Short Insight Summary:

NU Holdings has been climbing steadily after grabbing liquidity from key levels earlier in 2024. With strong fundamentals and a potential channel breakout, the setup looks favorable for upside contin

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Curated watchlists where 1NUH is featured.

Frequently Asked Questions

The current price of 1NUH is 10.886 EUR — it has decreased by −0.29% in the past 24 hours. Watch NU HOLDINGS stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange NU HOLDINGS stocks are traded under the ticker 1NUH.

1NUH stock has fallen by −10.14% compared to the previous week, the month change is a −6.62% fall, over the last year NU HOLDINGS has showed a 6.77% increase.

We've gathered analysts' opinions on NU HOLDINGS future price: according to them, 1NUH price has a max estimate of 16.64 EUR and a min estimate of 7.66 EUR. Watch 1NUH chart and read a more detailed NU HOLDINGS stock forecast: see what analysts think of NU HOLDINGS and suggest that you do with its stocks.

1NUH reached its all-time high on Jul 18, 2025 with the price of 12.114 EUR, and its all-time low was 10.196 EUR and was reached on Apr 25, 2025. View more price dynamics on 1NUH chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1NUH stock is 0.88% volatile and has beta coefficient of 1.46. Track NU HOLDINGS stock price on the chart and check out the list of the most volatile stocks — is NU HOLDINGS there?

Today NU HOLDINGS has the market capitalization of 52.22 B, it has increased by 6.92% over the last week.

Yes, you can track NU HOLDINGS financials in yearly and quarterly reports right on TradingView.

NU HOLDINGS is going to release the next earnings report on Aug 14, 2025. Keep track of upcoming events with our Earnings Calendar.

1NUH earnings for the last quarter are 0.11 EUR per share, whereas the estimation was 0.11 EUR resulting in a −7.37% surprise. The estimated earnings for the next quarter are 0.11 EUR per share. See more details about NU HOLDINGS earnings.

NU HOLDINGS revenue for the last quarter amounts to 3.00 B EUR, despite the estimated figure of 2.61 B EUR. In the next quarter, revenue is expected to reach 2.71 B EUR.

1NUH net income for the last quarter is 515.05 M EUR, while the quarter before that showed 533.84 M EUR of net income which accounts for −3.52% change. Track more NU HOLDINGS financial stats to get the full picture.

No, 1NUH doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 27, 2025, the company has 8.72 K employees. See our rating of the largest employees — is NU HOLDINGS on this list?

Like other stocks, 1NUH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade NU HOLDINGS stock right from TradingView charts — choose your broker and connect to your account.