Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.5 EUR

2.31 B EUR

16.14 B EUR

848.18 M

About O'Reilly Automotive, Inc.

Sector

Industry

CEO

Brad W. Beckham

Website

Headquarters

Springfield

Founded

1957

FIGI

BBG01TNY78X4

O'Reilly Automotive, Inc. owns and operates retail outlets in the United States. It engages in the distribution and retailing of automotive aftermarket parts, tools, supplies, equipment, and accessories in the U.S., serving both professional installers and do-it-yourself customers. It provides new and remanufactured automotive hard parts, including alternators, starters, fuel pumps, water pumps, brake system components, batteries, belts, hoses, temperature controls, chassis parts and engine parts, maintenance items consisting of oil, antifreeze products, fluids, filters, lighting products, engine additives, and appearance products, and accessories, such as floor mats, seat covers, and truck accessories. Its stores offer auto body paint and related materials, automotive tools, and professional service provider service equipment. The firm stores also offer enhanced services and programs consisting of used oil, oil filter and battery recycling, battery, wiper, and bulb replacement, battery diagnostic testing, electrical and module testing, check engine light code extraction, a loaner tool program, drum and rotor resurfacing, custom hydraulic hoses, professional paint shop mixing and related materials, and machine shops. O'Reilly Automotive stores provide do-it-yourself and professional service provider customers a selection of brand name, house brands, and private label products for domestic and imported automobiles, vans, and trucks. The company was founded by Charles F. O'Reilly and Charles H. O'Reilly in November 1957 and is headquartered in Springfield, MO.

Related stocks

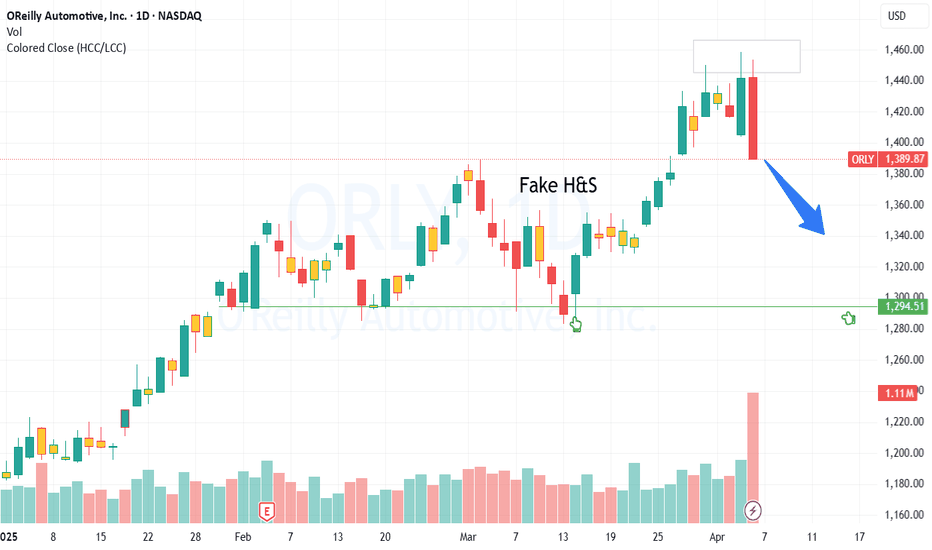

Looks certain to test previous high at 1450 areaAfter a turbulent week, as things start to normalize a bit, the oversold areas are continuing to step up further. The one thing that stands out is the last candle beating the previous high, as pointed out on the arrow, but also testing resistance. This shouldn't be a great area of concern for bulls

OReilly Long!I've entered a long position in $ORLY. Since this US stock reached its high in late July of this year, it has been continuously in a sideways correction, which is very bullish. In the last few trading days, it broke out of this channel to the upside and re-tested it on the last trading day.

The pric

O'Reilly Automotive Hit All-Time High In March, Nosedived AprilOn March 21, O'Reilly Automotive ( NASDAQ:ORLY ) stock hit an all-time high at 1169.11. However, in April, the stock nosedived and is currently trading at $1074.27 on Friday's session, down by 0.81%.

Despite the confusion in the auto market, O'Reilly Automotive ( NASDAQ:ORLY ), a leading retailer

RectangleRectangles are a horizontal consolidation pattern and is neutral pattern until broken.

Price is on the support line today.

Recent fall from a bearish Rising Wedge. Both lines slope up narrowing at the apex and represents too much supply within the wedge. This pattern is not valid unless the bott

ORLY Entry, Volume, Target, StopEntry: with price above 964.58

Volume: with volume greater than 343k

Target: 1042 area

Stop: Depending on your risk tolerance; 938.80 gets you 3/1 Reward to Risk Ratio.

This swing trade idea is not trade advice and is strictly based on my ideas and technical analysis. No due diligence or fundamenta

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

ORLY5871711

O'Reilly Automotive, Inc. 5.0% 19-AUG-2034Yield to maturity

5.30%

Maturity date

Aug 19, 2034

ORLY5043546

O'Reilly Automotive, Inc. 1.75% 15-MAR-2031Yield to maturity

5.02%

Maturity date

Mar 15, 2031

ORLY5425701

O'Reilly Automotive, Inc. 4.7% 15-JUN-2032Yield to maturity

4.81%

Maturity date

Jun 15, 2032

ORLY4340931

O'Reilly Automotive, Inc. 3.55% 15-MAR-2026Yield to maturity

4.54%

Maturity date

Mar 15, 2026

ORLY5702604

O'Reilly Automotive, Inc. 5.75% 20-NOV-2026Yield to maturity

4.51%

Maturity date

Nov 20, 2026

ORLY4632340

O'Reilly Automotive, Inc. 4.35% 01-JUN-2028Yield to maturity

4.50%

Maturity date

Jun 1, 2028

See all 1ORLY bonds

Frequently Asked Questions

The current price of 1ORLY is 76.5 EUR — it has decreased by −0.93% in the past 24 hours. Watch O'REILLY AUTO stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange O'REILLY AUTO stocks are traded under the ticker 1ORLY.

1ORLY stock has fallen by −1.82% compared to the previous week, the month change is a 4.52% rise, over the last year O'REILLY AUTO has showed a 8.01% increase.

We've gathered analysts' opinions on O'REILLY AUTO future price: according to them, 1ORLY price has a max estimate of 93.19 EUR and a min estimate of 74.90 EUR. Watch 1ORLY chart and read a more detailed O'REILLY AUTO stock forecast: see what analysts think of O'REILLY AUTO and suggest that you do with its stocks.

1ORLY reached its all-time high on Jun 10, 2025 with the price of 81.0 EUR, and its all-time low was 5.0 EUR and was reached on Jun 9, 2025. View more price dynamics on 1ORLY chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1ORLY stock is 0.94% volatile and has beta coefficient of 0.21. Track O'REILLY AUTO stock price on the chart and check out the list of the most volatile stocks — is O'REILLY AUTO there?

Today O'REILLY AUTO has the market capitalization of 66.71 B, it has decreased by −1.34% over the last week.

Yes, you can track O'REILLY AUTO financials in yearly and quarterly reports right on TradingView.

O'REILLY AUTO is going to release the next earnings report on Jul 23, 2025. Keep track of upcoming events with our Earnings Calendar.

1ORLY earnings for the last quarter are 0.58 EUR per share, whereas the estimation was 0.61 EUR resulting in a −5.14% surprise. The estimated earnings for the next quarter are 0.68 EUR per share. See more details about O'REILLY AUTO earnings.

O'REILLY AUTO revenue for the last quarter amounts to 3.82 B EUR, despite the estimated figure of 3.86 B EUR. In the next quarter, revenue is expected to reach 3.95 B EUR.

1ORLY net income for the last quarter is 497.74 M EUR, while the quarter before that showed 532.38 M EUR of net income which accounts for −6.51% change. Track more O'REILLY AUTO financial stats to get the full picture.

No, 1ORLY doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jun 21, 2025, the company has 93.05 K employees. See our rating of the largest employees — is O'REILLY AUTO on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. O'REILLY AUTO EBITDA is 3.43 B EUR, and current EBITDA margin is 22.23%. See more stats in O'REILLY AUTO financial statements.

Like other stocks, 1ORLY shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade O'REILLY AUTO stock right from TradingView charts — choose your broker and connect to your account.