Is Red Cat Holdings a Drone Industry Maverick?Red Cat Holdings (NASDAQ: RCAT) navigates a high-stakes segment of the burgeoning drone market. Its subsidiary, Teal Drones, specializes in rugged, military-grade uncrewed aerial systems (UAS). This niche positioning has attracted significant attention, evidenced by contracts with the U.S. Army and U.S. Customs and Border Protection. Geopolitical tensions, particularly the escalating demand for advanced military drone capabilities, create a favorable backdrop for companies like Red Cat, which offer NDAA-compliant and Blue UAS-certified solutions. These certifications are critical, ensuring drones meet stringent U.S. defense and security standards, differentiating Red Cat from foreign competitors.

Despite its strategic positioning and significant contract wins, Red Cat faces considerable financial and operational challenges. The company currently operates at a loss, with a net loss of $23.1 million in Q1 2025 against modest revenues of $1.6 million. Its revenue projections of $80-$120 million for 2025 underscore the lumpy nature of government contracts. To bolster its capital, Red Cat completed a $30 million equity offering in April 2025. This financial volatility is compounded by an ongoing class action lawsuit. This lawsuit alleges misleading statements regarding the production capacity of its Salt Lake City facility and the value of its U.S. Army Short Range Reconnaissance (SRR) program contract.

The SRR contract, which could involve up to 5,880 Teal 2 systems over five years, represents a substantial opportunity. However, the lawsuit highlights a significant discrepancy, with allegations from short-seller Kerrisdale Capital suggesting a much lower annual budget allocation for the program compared to Red Cat's initially intimated "hundreds of millions to over a billion dollars." This legal challenge and the inherent risks of government funding cycles contribute to the stock's high volatility and elevated short interest, which recently exceeded 18%. For risk-tolerant investors, Red Cat presents a "moonshot" opportunity, contingent on its ability to convert contract wins into sustainable, scalable revenue and successfully navigate its legal and financial hurdles.

1RCAT trade ideas

RCAT LEAP Options Play – Long-Term Bullish Setup (7/21/2025)

🚀 RCAT LEAP Options Play – Long-Term Bullish Setup (7/21/2025)

⚡ Weekly Momentum 🔼 | 💰 LEAP Premiums Cheap | ⚖️ Legal Overhang = Risk/Reward Opportunity

⸻

📊 Macro Sentiment Snapshot

📈 Weekly RSI: 60.7 – Momentum Building

📉 Monthly RSI: 38.7 – Neutral → Bullish bias forming

💤 Volatility (VIX 16.4): Low → Ideal for long-dated call buying

🔍 Call/Put OI Ratio: 1.00 → Institutional indecision, but no distribution

⸻

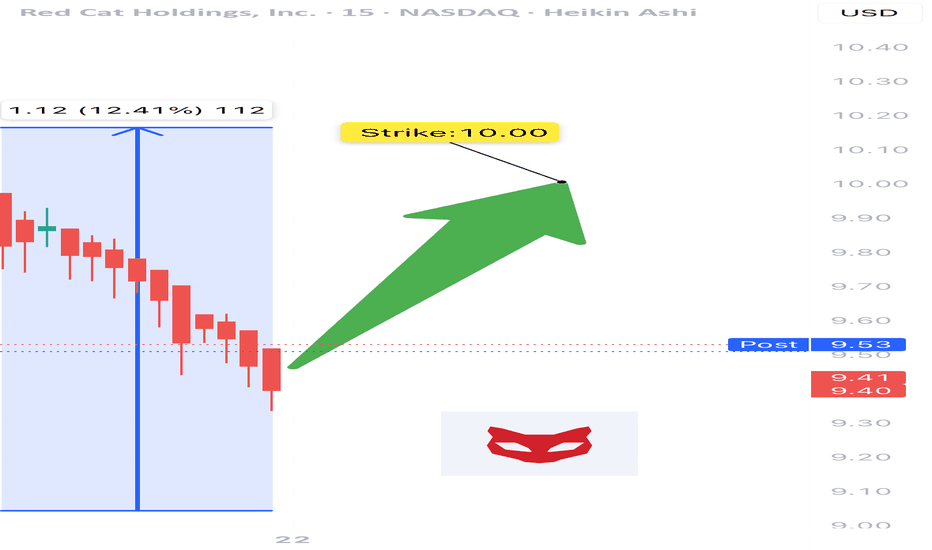

🎯 TRADE IDEA – RCAT $10 LEAP CALL

💥 Direction: Long

🧾 Strike: $10.00 Call

📆 Expiry: Jan 15, 2027 (543 days out)

💵 Entry: $5.20

🛑 Stop: $3.50

🎯 Target: $15.00

📈 Confidence: 65%

⏰ Entry Time: Market Open

⸻

📎 Why This Trade?

✅ Long runway = low decay + big upside

✅ Premiums cheap due to low implied vol

⚠️ Risk: Ongoing litigation = short-term turbulence

🧠 Play the momentum, but stay alert for fundamental headlines

⸻

📊 TRADE_DETAILS JSON

{

"instrument": "RCAT",

"direction": "call",

"strike": 10.00,

"expiry": "2027-01-15",

"confidence": 0.65,

"profit_target": 15.00,

"stop_loss": 3.50,

"size": 1,

"entry_price": 5.20,

"entry_timing": "open",

"signal_publish_time": "2025-07-21 14:38:56 UTC-04:00"

}

⸻

🔥 #RCAT #LEAPOptions #BullishSetup #MomentumTrade #OptionsStrategy #LongTermPlay #CheapVolatility #SmallCapMomentum

📌 Screenshot this, log it, and track it. You’re early. 🎯

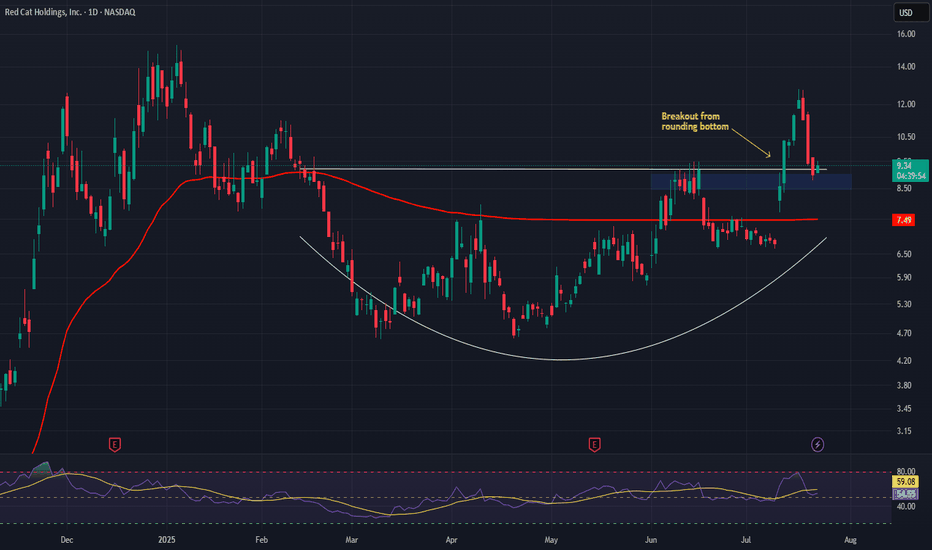

Red Cat Holdings (RCAT) – Soaring with Defense & Global DemandCompany Snapshot:

Red Cat NASDAQ:RCAT is an emerging UAV (drone) technology leader, rapidly scaling through defense-grade contracts, global expansion, and vertical integration.

Key Catalysts:

Defense Sector Traction 🎯

Recent U.S. DoD contract wins underscore RCAT’s credibility as a mission-critical UAV supplier.

Sequential revenue growth in earnings signals accelerating adoption in defense and commercial markets.

Global Expansion Strategy 🌐

RCAT is diversifying via allied procurement programs, reducing dependence on U.S. defense budgets and broadening international exposure.

Tech Stack Integration ⚙️

Strategic acquisitions are bolstering RCAT’s in-house capabilities—driving vertical integration, improving margins, and fueling innovation velocity.

Investment Outlook:

Bullish Entry Zone: Above $8.50–$9.00

Upside Target: $15.00–$16.00, supported by defense contract momentum, global reach, and a strengthened tech edge.

🛡️ RCAT is becoming a high-leverage play on modern defense tech with scalable, global upside.

#RCAT #DefenseStocks #UAV #DroneTechnology #MilitaryContracts #Innovation #DoD #Aerospace #Geopolitics #GrowthStocks #VerticalIntegration

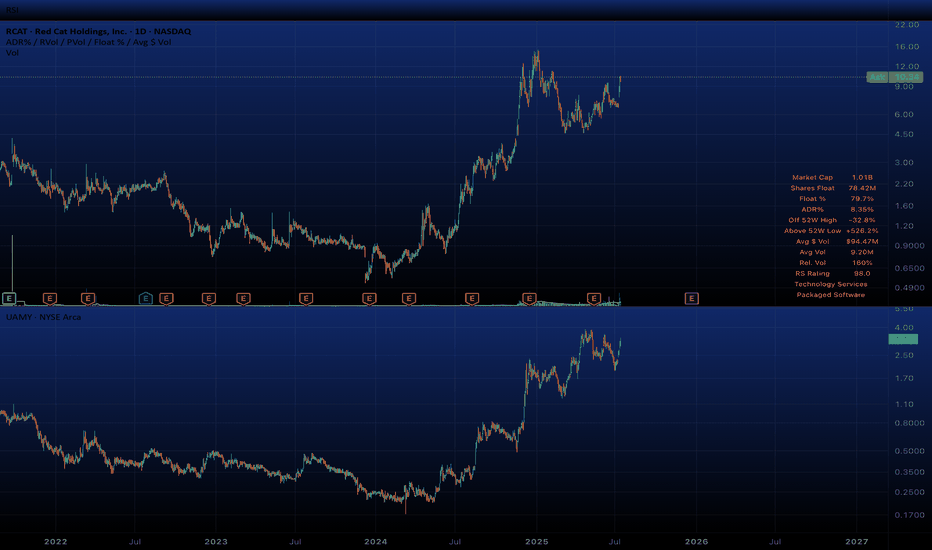

$RCAT Momentum Play – Institutional Money, Defense Narrative, an

🚀 NASDAQ:RCAT Momentum Play – Institutional Money, Defense Narrative, and a Chart Screaming Higher 📈

📅 Posted: July 18, 2025

💡 Five AI models, one trade idea: follow the smart money, manage the risk.

⸻

🧠 AI Consensus Summary (Multi-Model Breakdown)

Model Bias Highlights

DeepSeek (DS) ⚠️ Bullish, Cautious +78% over 5 days. RSI 83.39. Weak volume = risk of cool-down.

Llama (LM) ✅ Moderately Bullish Above all EMAs. MACD strong. Caution: near upper Bollinger Band.

Grok (GK) 🔥 Strong Bullish Pentagon catalyst. EMAs bullish. Ignore RSI — momentum matters.

Gemini (GM) 🔥 Strong Bullish Institutional buying. Clean breakout path to $15.00.

Claude (CD) ⚠️ Modestly Bullish Overbought but structurally sound. Supports small, well-managed long.

⸻

🔍 Trade Setup – RCAT LONG

🎯 Entry Price: $12.15 (Market open)

💰 Take Profit: $15.00

🛑 Stop Loss: $10.80

📊 Position Size: 166 shares

⚖️ Risk Amount: ~$200 on $10,000 account

📆 Max Hold Time: 3–4 weeks

📈 Confidence Level: 80%

📌 Entry Timing: Open (or first pullback toward 12.00 if gapping)

⸻

🧭 Why It Works

• ✅ Narrative Power: Pentagon spending = sector tailwind

• ✅ Institutional Flow: Smart money is already positioned

• ✅ EMA Alignment: Above 10/50/200 on most timeframes

• ⚠️ RSI Hot Zone: Manage risk — but this can stay hot longer than expected

⸻

📌 Levels to Watch

• 📉 Support: $11.50 short-term; $10.80 technical invalidation

• 📈 Resistance: $13.20 (minor) → $15.00 (major target)

⸻

⚠️ Risk Management Reminder

Don’t let green candles fool you. Overbought doesn’t mean reversal, but it does mean tighter stops and no oversizing.

Let the setup breathe — don’t chase.

⸻

📊 TRADE SNAPSHOT

{

"instrument": "RCAT",

"direction": "long",

"entry_price": 12.15,

"stop_loss": 10.80,

"take_profit": 15.00,

"size": 166,

"confidence": 0.80,

"entry_timing": "open"

}

⸻

💬 RCAT running hot — but too hot? Or just getting started?

🚀 Follow for more AI-powered trades.

🔁 Like • Share • Save for later

RCAT Head & Shoulders Formation or Reversal?RCAT has completed the formation of the head with a bounce at neckline and is currently on the leg up for the right shoulder formation.

Watching for continued volume contraction as the right shoulder forms for further bearish signals. If instead, volume expands, (especially further than the left shoulder formation), then I will be watching for bullish confirmation of a reversal.

Key signal is volume and market momentum on if this completes a H&S or marks a reversal.

RCAT: Bullish Breakout Setup Above $13.41!RCAT is presenting a potential breakout opportunity with an entry point at $13.41. Here are the trade parameters:

Entry: $13.41 (yellow line, breakout level).

Stop Loss (SL): $12.28 (below support zone).

Take Profit Targets:

Target 1 (T1): $14.89 (first resistance level).

Target 2 (T2): $16.39 (next resistance level).

Watch for volume confirmation to validate the breakout and capitalize on the bullish momentum!

Red Cat Holdings Inc (RCAT)RCAT witnessed a sharp rebound after forming a higher low at 7.76$, to violate the resistance level at 11.33, and remaining above this level, will push the stock to test the last peak 12.57, which is the level that needs to be violated to confirm the major uptrend, triggering further rises near $13.90, $15, $16.20, and $17 in the short term.

The stop-loss lies below 10$.

the indicators are heading toward the positive side, which confirms the mentioned positive scenario.

Disclaimer: This analysis is for informational purposes only and does not constitute financial, investment, or commercial advice or recommendations.

RCAT: Descending Triangle Breakout Opportunity!RCAT is forming a descending triangle pattern on the 30-minute chart, signaling a potential breakout. Entry is set at $7.32 with a stop-loss at $6.28. Profit targets are $8.53 and $10.02. Watch for a breakout above the resistance line to confirm momentum. Apply proper risk management while trading!

Nasdaq Listed Red Cat Holdings Inc.NASDAQ:RCAT Red Cat Holdings Inc Nasdaq Listed.

Lots of buyers have stepped in pushing the stock up I have the gaps marked looking for any possible pullback entries aligning with next month Dec options. Could keep pumping I am good for entry at 4 if it pulls back. Green arrow is upside potential Red is option expiration pullback. This stock is volatile and has been very low. This is a High Risk Stock! Don't get burned Make sure you look at a long term chart before getting in to this. Similar to NYSE:IONQ Not a Full Port Idea, but everyone needs a little lotto in their life. Have Stop Loss in Place! Gaps are marked so is volume profile. Make your own investment decisions. Not Financial Advice.

Buy Redcat at current levels for a nice payoff. Drones are becoming the must have technology in the military space. They are so critical for the battlefield that having them gives your side a crucial advantage and not having them is basically the first sign of putting up the white flag. Military contracts are on the table for small drone companies and at these levels it's a no brainer to start a position.

The technical side shows a few big green candles accompanied by heavy volume. This is an almost sure sign that things will hest up in the future. Buy now during low volume days and on red days to average down. They won't be here for long.

This is my opinion based on current market conditions and news in the economy and with how tensions are starting to rise for military conflicts. Invest at your own risk. I am long the stock with plans on adding more and not selling for atleast 30 days or more.

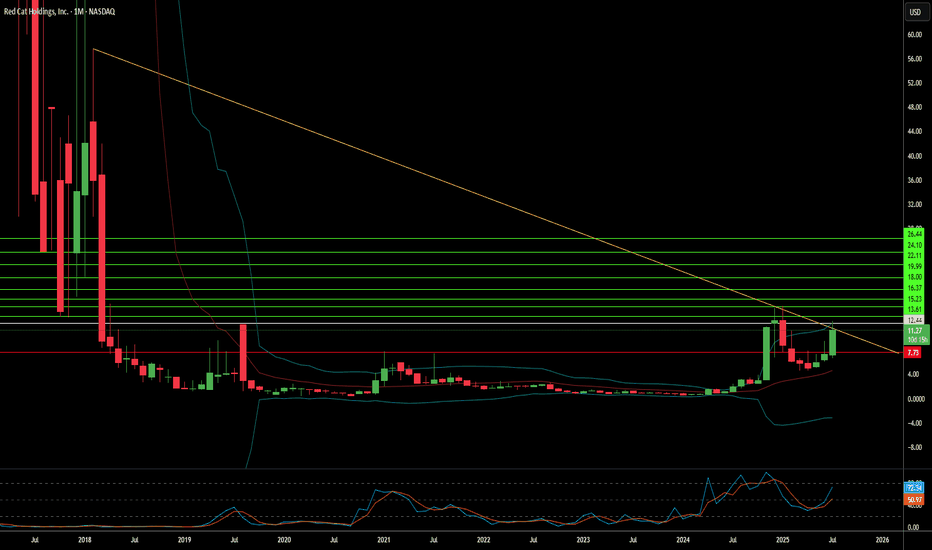

RCAT | Very Oversold Condition | LONGRed Cat Holdings, Inc., through its subsidiaries, provides various products, services, and solutions to the drone industry. It offers commercial and government unmanned aerial vehicle technology for reconnaissance, public safety, and inspection applications. The company also provides First Person View (FPV) video goggles; and software and hardware solutions that enable drones to complete inspection services in locations where global positioning systems are not available. In addition, it is involved in the sales of FPV drones and equipment primarily to the consumer marketplace. Red Cat Holdings, Inc.is based in San Juan, Puerto Rico.

RCAT Break OutMost recent candle broke outside of the wedge with relatively high volume and closed above the 200 MA for the first time since March.

Price also closed above the .78 fib level. The ADX is displaying a strong trend and DI+ rising is bullish.

Targets: 2.45, 2.60, 2.92 (possible resistance)

Watch this one fly up to 50% | Drones!Red Cat Holdings, Inc., together with its subsidiaries, provides products, services, and solutions to the drone industry. The company offers First Person View (FPV) video goggles to the drone industry. It also sells FPV drones and equipment, primarily to the consumer marketplace through its digital storefront located at rotorriot.com. In addition, the company offers software and hardware solutions that enable drones to complete inspection services in locations where GPS is not available. Further, it is developing a Software-as-a-Solution platform to provide drone flight data analytics and storage, as well as diagnostic products and services. Red Cat Holdings, Inc. was incorporated in 1984 and is based in Humacao, Puerto Rico.

Not Financial Advice - Just perfecting a process... At the time of this posting, I don't own any positions!

Idea:

Price Target: $2.89 - 3.33 dollars

- Bullish

Pros:

MACD crossed - charts

Increasing volume - charts

Institutional Ownership - fintel. io

Days to cover short positions are decreasing - fintel. io

Cons:

Unconfirmed breakout - charts

Low short interest % - fintel.io

Not Financial Advice - Just perfecting a process... Do you own due diligence before investing!

Leave a comment that is helpful or encouraging. Let's master the markets together