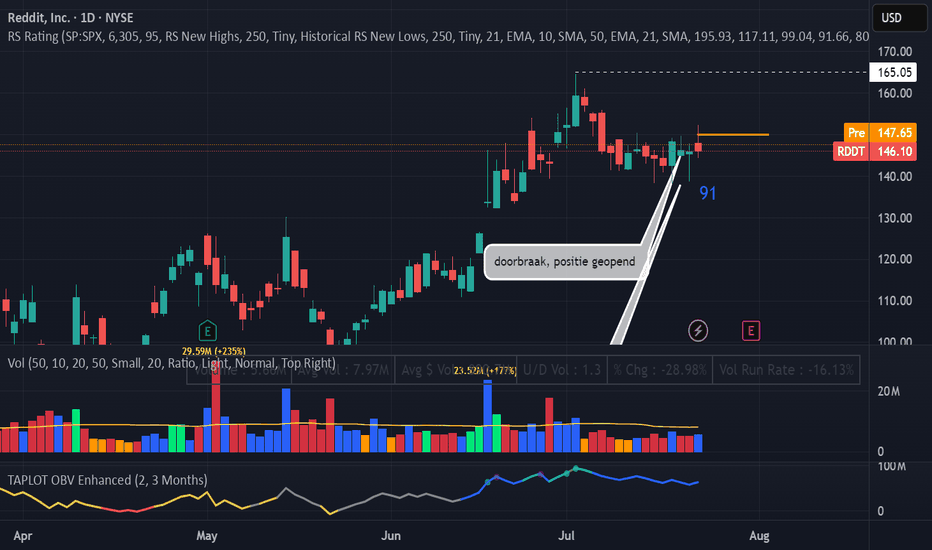

RDDT break out sling shotEntry Trigger: Entry above $149.95 with strong volume

Technical Indicators:

-RS = 91

-clear uptrend

-contracting volume before breakout

-Fundamentals Last 3 quarters show rising EPS and sales

Play

Stop Loss Below the breakout candle

Target Minimum 2.5R / ride the EMA

Sell in to strenght nex pivot 165,05

1RDDT trade ideas

Wallstreetbets and Markets: Is there a correlation? Preface:

As a self proclaimed “market statistician”, I like to do a lot of random research, sometimes useful, sometimes not so useful.

Here is a post about some “not so useful” research I did. Though not so useful, the results are truly interesting.

The results of this analysis are, in my opinion, pertinent in a post GME and AMC world, where retail have gained huge momentum and presence within the market as a whole and have been able to even tackle hedge funds and win!

Purpose and Aim:

The aim of this was to identify whether Wallstreetbets (heretofore referred to as WSB) data had any meaningful impact on market mechanics, moves, volume etc.

I have been tracking WSB data for some time and have amassed a database of over 300 saved files, consisting of exactly 104 trading days of data.

This is a great amount to actually run analysis on and run some predictive tests!

The main questions I wanted answered are:

a) Does WSB data impacted market moves and Volume? If so,

b) Is WSB reactive to market moves (i.e. the market moves and the ticker trends); or

c) Is WSB proactive in moving the market (i.e. mentions increase and the market move follows).

These questions can be somewhat answered, albeit not flawlessly, using math.

Approach:

To analyze the data, I used:

a) Regression (simple linear);

b) Correlation;

c) Lagged correlation; and

d) Granger Causality

Tickers chosen

I quickly scripted an algorithm to scan through all of the 300+ WSB data and identify the top 10 tickers that were consistently mentioned across all saved data. The data Spans from mid 2024 to current.

The results were as follows, the top 10 tickers which were present in every single saved datafile were:

1 AAPL 104

2 AM 104

3 AMD 104

4 DTE 104

5 GOOG 104

6 MSFT 104

7 NVDA 104

8 PLTR 104

9 QQQ 104

10 SPY 104

Selection for Analysis were:

AAPL, AMD, PLTR and SPY

Raw Results:

NASDAQ:AAPL

NASDAQ:AMD

NASDAQ:PLTR

AMEX:SPY

Oh yeah, let’s see how retail competes with huge indices, this should be really good!

Explanations and Implications

The data presented is all incredibly “mathy”, but let’s break it down to what we can ascertain.

First and foremost, let’s outline the major limitations:

In this analysis, I used large cap stocks and limited to only 4 stocks. The results for these will be greatly different from, say, doing this on small cap or penny stocks (which will be a potential study next!).

As well, we are shy of 1 full year of trading data, which would have more impact on analysis. I do plan to repeat this study with approximately 1 full trading year of WSB data (i.e. 252 days).

So essentially 148 more days and I will have collected 1 full trading year for analysis.

Now that we have that out of the way, let’s discuss what we can say from these results, what we are unsure of and what are the implications for the broader group of traders, MMs and everyone in between.

What we Know

WSB logically has a strong relationship with trade volume. We can see that in most of the analyzed tickers. The correlations tend to be positive and tend to be substantial. More mentions (i.e more hype) leads to greater trade volume, likely as a result of people following the most mentioned or “hot” ideas on WSB.

This is not hard to fathom and its easy to accept as a logical consequence of trending tickers to a large audience of market participants ready to jump at anything.

What we are unsure of

This title is kind of a misnomer. While I phrase it as “what we are unsure of”, the fact remains that we can deduct that there is a significance and a relationship exists; but we can’t be sure as to how deep and profound this relationship extends, owning to the limited amount of data available.

But what we are unsure of is the extent to which WSB is impacting returns and market movement.

In 2 out of 4 tickers, we see that there is a pretty substantial lagged correlation between stock movement/returns and WSB trending status. This implies that WSB may be pushing market movement. However, in both of these cases, the results are short lived. This could be the result of either:

a) The greater market taking over and profit taking on the WSB pump; or

b) The WSBers taking profits themselves after pushing the stock in a direction.

The 2 cases were of AMD and SPY. The results indicated effect of roughly 2 consecutive days before tapering off.

The other 2 tickers, PLTR and AAPL, did not show a very strong relationship or evidence of WSB greatly impacting stock movement, but of WSBers likely “trend following” momentum.

What this means for the broader market?

Its no secret that retail is having a substantial impact on the market and changing the way market dynamics work.

For “experienced” or “senior” traders who have been trading for longer than 4 years, these people would tend to notice that the market dynamics have changed this year and have been changing slowly over the recent years.

One could offer the explanation of changing market sentiment; but perhaps the real explanation is an influx of retail and social media.

If you think about the number of “pump and dump” scams that were successful through the use of social media over the last few years, it’s not hard to believe that the advent of social media and easy access to markets can be a recipe for “disrupting” a routine and destabilizing the market that one once knew.

The NYSE is traded by millions worldwide. Its not just Americans participating, but those globally, leading to participants that surpass even the US population. As we advance in a global information highway that is the internet and social media, its not hard to rally forces to impact change, be it political or financial.

So what does this all mean?

The face of markets is changing and changing fast. No longer are markets strictly influenced by the elite, but by the average Joe who likes to read social media and buy a few options or shares. The implication is essentially the democratization of the market, removed from the grasps of the bourgeoisie and shifted to that of the layman.

Implications for Further Research

This should be repeated on low cap, low float, penny stocks to really analyze the impact of social media on markets and the implications of manipulation and “pump and dump” scams.

Thank you for reading!

This information is for interest sake only and not suggestive of any financial advice of suggestions.

Trade at your own risk and use your own strategies!

Used for this analysis:

R Language

Tradstie API

RDDT · 4H — Rising-Wedge Setup with Targets at $172 and $185Setup Summary

Rising wedge structure forming since late June. Price recently pulled back to test support at ~$144–145, where the rising trendline intersects horizontal structure.

Momentum remains bullish: The prior move from $110 to $165 was impulsive, and this consolidation appears corrective so far.

Volume profile (VPVR) shows a thin liquidity zone between $150 and $172, suggesting a strong move is likely if the $150 level is reclaimed.

---

🎯 Target Zones

Target Level Rationale

1st Target $169 Matches wedge breakout projection + aligns with prior IPO supply and volume gap resistance.

2nd Target $177 Psychological round number + coincides with IPO opening print and the highest rejection wick seen so far.

---

🛠️ Trade Plan

Component Level

Trigger Entry on bounce from $144 or breakout/reclaim of $150.

Invalidation Close below $142 breaks wedge structure.

TP-1 $172 – take 50–70% off, move stop to breakeven.

TP-2 $185 – runner target; exit if price shows rejection.

---

⚠️ Risk Notes

Wedge patterns can fake out — wait for confirmation (e.g. a 4H bullish engulfing or volume reclaim above $148–150).

Earnings or lock-up expiration could introduce volatility (check calendar).

If support at $143 fails, look for next demand at $134–135 (prior breakout base).

---

✅ Checklist

Structure: Rising wedge in uptrend

Support: Held above previous breakout zone

Volume profile: Favorable thin zone toward $172

Risk defined below $142

> Disclaimer: This idea is for educational purposes only. Trade your own plan and always use proper risk management.

Reddit, Inc. (RDDT) – Global Growth & Monetization TailwindsCompany Snapshot:

Reddit NYSE:RDDT is a community-centric social media platform, uniquely positioned through user-generated content and authentic engagement. With over 100,000 active communities, Reddit is a magnet for targeted brand advertising and premium ad formats.

Key Catalysts:

AI-Driven International Expansion 🌐

Launched AI-powered post translation in 35+ countries, including Brazil, Germany, and Italy.

This unlocks new audiences and ad monetization in high-growth global markets.

High Margin Business Model 💸

Reported a 90.5% gross margin—highlighting Reddit’s asset-light infrastructure and operational efficiency.

Sets the stage for significant operating leverage as revenue scales.

Ad Revenue Acceleration 📊

Brands increasingly view Reddit as a premium ad environment, given its contextual targeting and deep user engagement.

Expanding tools for advertisers (e.g., Dynamic Product Ads) may enhance monetization per user.

Investment Outlook:

Bullish Entry Zone: Above $120.00–$122.00

Upside Target: $190.00–$195.00, supported by global reach, margin strength, and ad revenue tailwinds.

🧠 Reddit isn’t just a social platform—it’s a monetizable network of influence, fueled by community trust and scalable technology.

#Reddit #RDDT #SocialMediaStocks #AIExpansion #GrossMargin #AdTech #CommunityEngagement #TechStocks #Bullish #DigitalAds #UserGeneratedContent #GlobalGrowth #FreeCashFlow #GrowthStocks

$RDDT Long Setup – Bullish BreakoutReddit ( NYSE:RDDT ) has broken out above the Ichimoku Cloud on the daily chart, signaling a potential shift in trend. Momentum is building with MACD pushing higher and no signs of divergence, showing continued strength. While this trade offers a solid 2.1 risk/reward setup (entry at $134.14, stop at $108.80, target at $188.34), the current entry is not ideal—price is extended from support, and the breakout has already moved significantly. However, the structure still points to bullish continuation. If RDDT can hold above the $130–$135 zone, there’s room to run into the $180s and potentially beyond. A pullback toward the breakout zone would offer a stronger entry, but the upside here remains attractive for a swing trade. This setup is best approached with smaller size or added confirmation if chasing.

Reddit - Long & StrongOn the 10th of March I posted about Reddit, as it lost the $120 level I advised the bulls to get ready to buy in at $80, which was the gap fill area met with the confluence of the 0.786 Fib level. We remained patient at went long at $82, with a stop loss under the 0.786 at $78. That move is now paying off, as we are up 50% from these levels. Congratulations to those paying attention, we are reaping the rewards of this trade. We had the initial strong bounce to $130, I also said at this point we will likely have another chance to accumulate under $100 - check the minds section - indeed that happened and here we are again 18% from $100.

So what's next? I am seeing continued sign of strength on the charts. This was aided by the recent development that Reddit is suing Anthropic for using their data, despite repeated warnings from Reddit. This stock has a strong technical and fundamental reason to remain bullish.

I'm taking this one step at a time. There's no doubt it is a volatile stock, I think we have put in the lows for now and we continue the path towards $150. But this market can flip at any time, all it takes is post on X to send the entire market into chaos. So be mindful of the risks.

But we remain long and strong here. We didn't fomo into the stock, and we don't plan to panic sell out of it. That is my philosophy.

Not financial advice.

Reddit breaks out for bullish run I have been watching Reddit for a couple of weeks and identified that we had put in the .786 low from the correction since February and then formed a range that was well respected for the past 4 months .

In this video I highlight zones where i expect price to gravitate too and where a nice entry will be if you are looking to long reddit.

Tools used Fib suite , trend based fib , tr pocket , 0.786 + 0.382 and fixed range .

Bullish on RDDT - Can it clear 130 and hold this time?Key levels to watch

Support: 108–110. This zone held on the most recent pullback and aligns with prior structure.

Short-term target: 125–126. If price breaks and holds above this level, it suggests momentum is building.

Overhead Resistance: 130. Clearing and holding above this level is what would turn this from a bounce into something with more swing potential.

Upside potential: 155–166, if price can build a base above 130

While the structure is building constructively, and a decline from here isn't my first pick, it is possible that we just continue to chop. But, for now I am bullish on RDDT for the next few weeks, and I will continue to update you here as it plays out.

RDDT Weekly Trade Plan – 2025-06-06🚀 RDDT Weekly Trade Plan – 2025-06-06

Bias: Moderately Bullish

Timeframe: 1-day (0DTE)

Catalyst: Momentum continuation, supportive VIX, strong short-term technicals

Trade Type: Naked call option

🧠 Model Summary Table

Model Direction Strike Entry Price Target Gain Stop-Loss Confidence

Grok Moderately Bullish $118 CALL ~$0.68 +25% –30% 75%

Claude Moderately Bearish $115 PUT ~$0.74 +50–100% –50% 72%

Llama Moderately Bullish $119 CALL ~$0.66 +10–15% support break 70%

Gemini Moderately Bullish $120 CALL ~$0.58 +50–100% –50% 65%

DeepSeek Moderately Bullish $118 CALL ~$0.68 +50% –50% 65%

✅ Consensus: Momentum-driven upside with support from trend, RSI, MACD

⚠️ Disagreement: Claude bearish due to max pain gravity and fading M5 momentum

📉 Technical & Sentiment Summary

Trend: Price above EMAs, RSI positive, MACD confirms momentum

Resistance: $117.30–$117.73 zone to clear before $119 strike in play

Sentiment: VIX falling, news cycle supportive

Max Pain: $113 – downside gravity risk if momentum stalls

Liquidity: Decent OI on $118–$120 strikes; spreads could widen at open

✅ Final Trade Setup

Parameter Value

Instrument RDDT

Direction CALL (LONG)

Strike $119

Expiry 2025-06-06 (0DTE)

Entry Price $0.66

Profit Target $0.99 (≈+50%)

Stop Loss $0.33 (≈–50%)

Size 1 contract

Entry Timing At market open

Confidence 70%

💡 Rationale: Balanced strike with reasonable premium and realistic target before EOD, while staying inside momentum breakout range.

⚠️ Key Risks & Considerations

Theta decay: Time erosion steep on 0DTEs—move must be fast and early

Max pain: $113 could anchor the stock if resistance isn’t cleared

Resistance: Cluster around $117.30–$117.73 needs break for $119 test

Open volatility: Bid-ask spreads could widen—consider limit entry

📊 TRADE DETAILS SNAPSHOT

🎯 Instrument: RDDT

🔀 Direction: CALL (LONG)

🎯 Strike: 119.00

💵 Entry: $0.66

🎯 Target: $0.99

🛑 Stop: $0.33

📅 Expiry: 2025-06-06

📏 Size: 1

📈 Confidence: 70%

⏰ Entry: Open

🕒 Signal Time: 2025-06-06 11:29:24 EDT

RDDT Swing Options Outlook —June 1, 2025📈 RDDT Swing Options Outlook — May 31, 2025

🚨 AI Consensus: Bullish Momentum with Legal Risk Overhang

🧠 Model Breakdown

🔹 Grok (xAI)

Bias: Bullish

Technicals: Above all key EMAs; RSI overbought; MACD strong.

Sentiment: Positive earnings, legal uncertainty.

Trade: Buy $113C @ $5.90 → PT +20%, SL −30%

Confidence: 75%

🔹 Claude (Anthropic)

Bias: Bearish

Technicals: Overbought short-term; resistance at $113.90.

Sentiment: Fraud probe risk; Max Pain = $105.

Trade: Buy $110P @ $4.90 → PT $7.50/$10.00, SL $3.50

Confidence: 75%

🔹 Llama (Meta)

Bias: Bullish

Technicals: Bullish across 15m & daily; weekly catching up.

Sentiment: Strong earnings reaction; risk underpriced.

Trade: Buy $115C @ $5.05 → PT $7.50, SL $3.50

Confidence: 85%

🔹 Gemini (Google)

Bias: Bullish

Technicals: Strong daily trend, near resistance.

Trade: Buy $120C @ $3.35 → PT $5.00/$5.85, SL $2.00

Confidence: 70%

🔹 DeepSeek

Bias: Bullish

Technicals: MACD bullish, overbought signs visible.

Sentiment: Call OI > Put OI; Max Pain drag noted.

Trade: Buy $113C @ $5.45 → PT $6.81/$8.18, SL $3.80

Confidence: 75%

✅ Consensus Summary

✅ 4 of 5 models lean bullish, citing strong earnings and upside momentum

📈 Price is above all major EMAs; MACD and volume support upside

🧲 Max Pain @ $105 may create drag into expiry

⚠️ Short-term RSI is hot → watch for early week pullback

🎯 Recommended Trade

💡 Strategy: Swing Long Naked Call (2-week expiry)

🔘 Ticker: RDDT

🔀 Direction: CALL (LONG)

🎯 Strike: $115.00 (slightly OTM, liquid with OI 657)

💵 Entry: $5.05

🎯 Profit Target: $7.50 (+48%)

🛑 Stop Loss: $3.50 (−30%)

📏 Size: 1 Contract

📅 Expiry: 2025-06-13

⏰ Entry Timing: Market Open

📈 Confidence: 75%

⚠️ Risks and Considerations

📉 RSI is overbought—expect possible fade early week

🧲 Max Pain at $105 could slow gains by expiration

📰 Any legal investigation update could inject volatility

⌛ 2-week expiry gives room, but theta ramps after day 5

📊 TRADE DETAILS (JSON)

json

Copy

Edit

{

"instrument": "RDDT",

"direction": "call",

"strike": 115.0,

"expiry": "2025-06-13",

"confidence": 0.75,

"profit_target": 7.50,

"stop_loss": 3.50,

"size": 1,

"entry_price": 5.05,

"entry_timing": "open",

"signal_publish_time": "2025-06-01 09:30:00 UTC-04:00"

}

$RDDT – Big Move Incoming? 38% Upside🚀 NYSE:RDDT – Big Move Incoming?

🔥 Daily: Inverse H&S nearing breakout—above $131.50, target $182.30 (+38%) 🚀

📈 Weekly: Bearish WCB breakout → Uptrend in motion. If Inverse H&S confirms, bullish combo sets up a big move!

This train is moving—watch for the breakout! 🚊💰

RDDT on sale again today: buying feels hardest when it’s downWatching NYSE:RDDT today, it’s clear the market is still undecided. Is this dip another chance to add, or just a pause before the next run?

It’s a classic market paradox: When prices fall, fear grips the crowd, and conviction weakens. Yet, when stocks soar, like NYSE:RDDT did with a +12% jump yesterday, confidence floods back, and everyone wants in.

This behavior isn’t unique to $RDDT. It’s a psychological trap that can keep investors chasing gains instead of buying value.

Technically, NYSE:RDDT has strong support between 107 and 114.

The real edge? Learning to act opposite to that instinct, buying when others hesitate, selling when everyone’s euphoric. Easier said than done, but that’s how alpha is made.

The market often rewards those who can sit with discomfort and make moves when the crowd won’t.

Reddit making a come back after correction NYSE:RDDT is looking at a potential comeback after the stock managed to stay intact within the uptrend line of more than a year (started since April 2024). Inverted head and shoulder was spotted at the support and is looking at a potential breakout to the upside!

Both 23-period ROC and mid-term stochastic oscillators are showing signs of oversold, which increase the chance of breaking above.