Overweight $XYZ ; Raising Price Target to $140+- BOATS:XYZ has been included to S&P 500 . It's a big news for BOATS:XYZ , this was one of the undervalued stock, treated like a dog but this company is always innovating and has strong talented employees.

- On top of that now BOATS:XYZ will get passive funds which is massive and bullish for the company.

1SQ trade ideas

Block Inc (SQ) – Macro Reaccumulation Play into S&P Breakout🧠 Block Inc (SQ) – Macro Reaccumulation Play into S&P Breakout 📈

WaverVanir VolanX Protocol | Long-Term Thesis | Smart Money Structure

🗓️ Chart as of July 19, 2025 | 1D Timeframe | DSS Score: High Conviction Long

📍 Technical Analysis – VolanX SMC Layer

Block Inc (SQ) is forming a macro reversal base after years of distribution and downside compression:

✅ Break of Structure (BOS) off deep discount zone

✅ CHoCH and BOS cluster near $48–$55 suggests institutional accumulation

✅ Price reclaimed Equilibrium (~$72.80) with clean volume breakout

🟥 Red zone = supply / inefficiency from 2022

🟨 Target zone = $147.62, the 2021 fair value gap top

🌐 Macro + Fundamental Catalysts

🧾 S&P 500 Inclusion Confirmed

Block (SQ) has officially been added to the S&P 500 index (as of June 2025), unlocking large inflows from passive index funds and boosting institutional exposure.

💰 Fundamental Growth Narrative:

Gross profit set to exceed $8.65B in 2025

Cash App expanding with lending, rewards, and direct deposit capture

Bitkey wallet + Proto mining chip reinforce dual revenue from crypto hardware and Bitcoin transactions

Analyst median target: $75–90; VolanX scenario-adjusted upper target: $120–147

🧭 Trade Setup – WaverVanir Playbook

📌 Accumulation confirmed. Sentiment reset. Now preparing for revaluation.

Metric Value

Entry Zone $71–75

Stop Loss Below $66

TP1 $98

TP2 $122

TP3 (macro fill) $147.62

🔐 Narrative Bias:

“S&P inclusion acts as a flow catalyst. The macro regime now favors quality fintechs with crypto rails. Block is no longer speculative—it’s foundational.”

🔺 #WaverVanir #VolanXProtocol #SmartMoneyConcepts #SQ #SMP500 #MacroBreakout #OptionsFlow #BitcoinEquity #CashApp #CryptoRails #SMC #DSS #ChartAnalysis #InstitutionalFlow

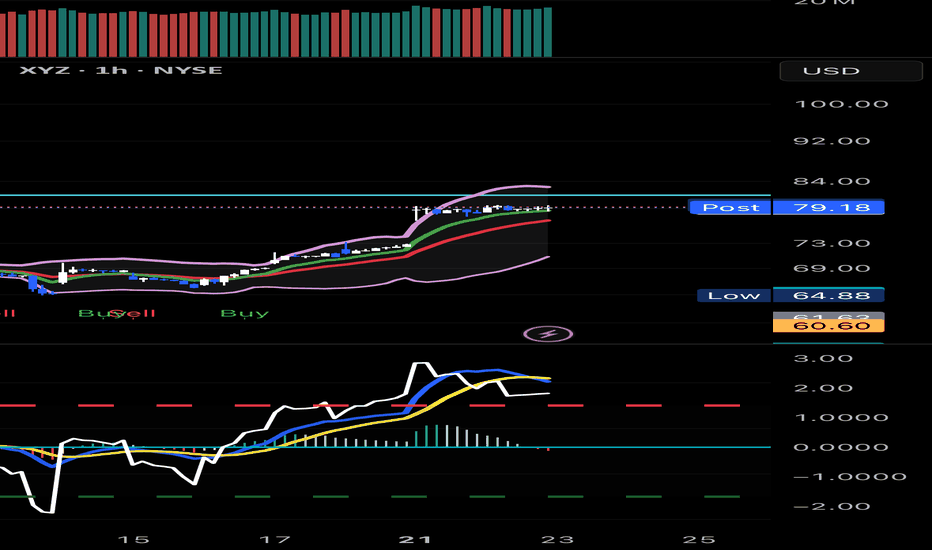

Block | XYZ | Long at $64.84Block's NYSE:XYZ revenue is anticipated to grow from $24 billion in FY2024 to $32 billion in FY2027. With a current price-to-earnings ratio of 13.8x, debt-to-equity ratio of 0.36x, and rising cash flow in the billions, it's a decent value stock at its current price. Understandably, there is some hesitation among investors due to competitive fintech market and economic headwinds. But, like PayPal NASDAQ:PYPL , growth is building.

From a technical analysis perspective, the price dropped to within my historical simple moving average bands. Often, but not always, this signals a momentum change and the historical simple moving average lines indicate an upward change may be ahead. While the open price gaps on the daily chart in the $40s and GETTEX:50S may be closed before a true move up occurs, NYSE:XYZ is in a personal buy zone at $64.84.

Targets:

$80.00

$90.00

$100.00

[*) $134.00 (very long-term)

A BNPL Bubble Is Actually Why I'm Bullish, For NowBNPL is growing and inflating at an increasing rate. From concert tickets to burritos, everyone is using buy now pay later. The global market is projected to hit 560 billion dollars in 2025, up from around 492 billion in 2024, and climb to 912 billion by 2030 at a compounding growth rate of 10.2%. Just in the U.S. alone, demand is expected to reach 122 billion next year and scale to 184 billion by the end of the decade. The trajectory is steep, with the structural weaknesses already showing.

Block is positioned at the center of BNPL. In Q1 2025 they reported:

2.29 billion in gross profit, up 9 percent YoY

466 million in adjusted operating income, up 28%

10.3 billion in GMV through Afterpay, with 298 million in BNPL gross profit, up 23% YoY

The stock took a hit. It dropped 9 percent in February and another 21 percent after missing Q1 earnings, but this is seen as typical early bubble behavior. There is short term fear but continuing growth and acceleration. Klarna’s credit losses, IPO delays, and regulatory friction are not problems, they are actually signals that the sector is growing faster than the market, or quite frankly, anyone can control.

BNPL is becoming the default credit system for younger consumers. It is overused and expanding too fast. That is the formula for both upside and implosion. However with that, timing will be everything here, and knowing when to close will be crucial if BNPL can't stabilize.

Baseline expectation: SQ trades in the 80 to 90 range in the short term

Midterm upside: 120 by 2027

Long-term target: 180 to 220 if BNPL stabilizes and Block captures its runway

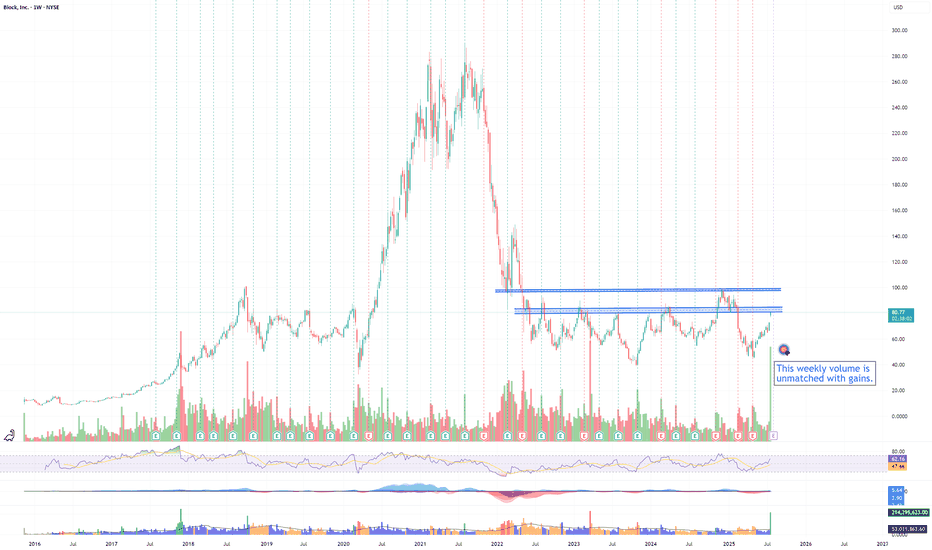

XYZ momentum is buildingXYZ positive weekly volume this week is a first in its history! Even though it has never had this much 'green' volume in its weekly history, there is plenty of resistance to be overcome for this stock

$81-85 will be challenging as sellers all the way from 2022 will begin dumping shares, especially when uncertain market conditions will be pushing them to sell. If it consolidates at 85, plan for a move to 98, where there will be another wave of sellers from Dec 2024 and 2022.

XYZ moves will parallel the BTC market with a lag. When BTC breathes, XYZ will breathe. With a BTC bull, expect XYZ to run.

Rating is neutral as this needs to break through resistance prior to accumulation, not the other way around.

"Breakout Eagle: Soaring Past Resistance XYZ!"Breakout Eagle: Soaring Past Resistance!"

📝 Trade Breakdown:

🚀 Setup:

XYZ just blasted past a key resistance zone with strong bullish momentum. The breakout is confirmed with a clean retest on both the trendline and horizontal support — a textbook long setup!

📍 Entry: $65.84 (on breakout retest)

🎯 Target: $68.20

🛡 Stop Loss: Below $65.00 support zone

📊 Risk-Reward: 2:1 — clean, calculated, and high conviction

🔍 Why It Stands Out:

Trendline breakout 📈

Resistance flip to support 🔄

Volume + price action confirm breakout ✅

XYZ breakout imminent? Block NYSE:XYZ looks like it's getting ready to breakout.

It was impressive to see this stock holding relative strength today as the markets were under pressure and selling off.

The OANDA:SPX500USD & NASDAQ:QQQ sold off and this stock closed green.

2 bullish patterns can be observed on the daily chart. A bull flag and and inverse head and shoulders.

The major indices broke key ranges to the downside and this stock has traded in a tight range.

XYZ Block Options Ahead of EarningsIf you haven`t sold XYZ before the previous earnings:

Now analyzing the options chain and the chart patterns of XYZ Block prior to the earnings report this week,

I would consider purchasing the 58usd strike price Calls with

an expiration date of 2025-5-2,

for a premium of approximately $3.40.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

$XYZ pullback would be a gift for longsNYSE:XYZ back in bull trend here since tapping the 50 psych level. The 100WMA showing some confluence here with bull flag + trendline break from last month's disaster.

Fibs also coincide with some of the idea here with us currently in the golden zone

Short term, I'd take a stop here below 52.50 as it can get ugly back to 50, and would consider taking another long there at 50.

For now, 53-54 range looks good for long pullback. 54.60 is the 333SMA on the 1HR chart here. Looks like a great spot for starter entries. If the pullback does not come, a break above 57 (pm highs TODAY, 4/23) should see a nice push towards 60 psych level which could see some strong resistance. Targeting 62 if we break 60.

Leaps look great here with all this confluence. Easy stop below that 50 psych.

Targets on chart are assuming we do not get a pullback tomorrow. If we do, the r/r becomes much better to the long side. This chart does not look good for bears. Options flow

Thoughts on XYZ?

The ABC's about XYZ (formerly SQ)Update Daily Chart 1/29 - would like to see it hold support at 83.95. If not, support at 80 (0.5 Fib)seems tenuous. Lower support at 72.5 remains solid. sell cash secured puts $72 - $80 for income and a potential favorable entry price. RSI above 50 is neutral-positive with room for upside.

Ascending triangle forming, bias undetermined. MACD is neutral-positive with slight lean to the upside

Conclusion: Mixed. Right now it's "Stuck in the middle with you" amid general market and geopolitical uncertainties.

Upside: $103 - $140+ but has to break above resistance with volume. Support $80 - $60 and is strong at those levels.

Bearish chart pattern on XYZWeekend analysis complete. After monitoring NYSE:XYZ for weeks, my alert triggered on a daily H pattern coinciding with a death cross.

Planning put positions next week with targets at 50.87, 45.80, and 42.77. Expect a brief recovery early week before a significant drop ahead of April 2nd reciprocal tariffs.

XYZ eyes on $59.xx: Double Golden Fibs that bulls need to HoldXYZ got a nice bounce with the market but is pulling back.

Now at a key support zone of two Golden Fibs (Genesis+Covid)

$58.95 - 59.25 is the exact zone of interest that muss must hold.

========================================================

.