SentinelOne Looks Like Palantir Before The BreakoutIn every market cycle, some high-growth companies are misunderstood—until they aren’t. Palantir (PLTR) was one such stock, dismissed early for its lack of profitability and complex model, only to soar when its AI tools gained traction. Now, SentinelOne (NYSE: S) may be next in line.

🧠 What SentinelOne Does

SentinelOne is a top-tier cybersecurity firm offering an AI-powered endpoint protection platform called Singularity. Like Palantir, SentinelOne has faced criticism for:

Persistent losses

High stock-based compensation (SBC)

A misunderstood business model

Despite this, its technology is sticky, deeply embedded in client IT systems, and well-positioned to ride macro trends in AI and cybersecurity.

📈 Financials: Turning a Corner

While the stock hasn’t moved much in two years, trading around $18, SentinelOne’s fundamentals are improving:

Revenue Growth: Double-digit YoY revenue growth (23%+ in each of the last 10 quarters)

Free Cash Flow: $214 million in the past 12 months (~25% FCF margin)

Gross Margins: High and improving

Operating Expenses: Slowing, creating operating leverage

Adjusted Earnings: Near breakeven, signaling profitability is in reach

These trends mirror Palantir’s path before its breakout, particularly the shift from high OpEx to better margins and rising free cash flow.

💰 Valuation: Still Underrated

SentinelOne is trading at only 6x sales and 27x free cash flow, despite:

Strong 20%+ expected revenue growth

Analyst EPS estimates of ~$0.50 by 2028

A market cap under $6 billion

It’s significantly cheaper than peers like CrowdStrike and Palo Alto Networks—despite having similar growth and margin profiles.

⚠️ Risks to Consider

Fierce Competition: Cybersecurity is a crowded field. SentinelOne will have to keep innovating to stay relevant.

Market Sentiment: As a high-growth name, it may be hit hard in downturns.

Limited TAM vs. PLTR: The cybersecurity market isn’t as vast as AI data platforms.

🚀 Final Take

With strong recurring revenue, improving profitability, and an attractive valuation, SentinelOne looks poised for a re-rating. While it may not match Palantir’s scale or splash, the setup is strikingly similar.

Rating: Strong Buy

1SUS trade ideas

S SentinelOne Options Ahead of EarningsIf you haven`t bought S before the recent rally:

Now analyzing the options chain and the chart patterns of S SentinelOne prior to the earnings report this week,

I would consider purchasing the 20usd strike price Calls with

an expiration date of 2025-9-19,

for a premium of approximately $2.50.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Shorting sentinelonecompany Info ; :

SentinelOne ensures the security of IoT devices through a combination of its Endpoint Protection Platform (EPP) and its Singularity platform. The EPP is designed to detect, prevent, and respond to advanced cyber threats.

Price action : shorting at the zone target is 1:7

1/3/25 - $s - Back in sub $23, but small1/3/25 :: VROCKSTAR :: NYSE:S

Back in sub $23, but small

- previous entry was so good at $17 that I sold too quickly (tends to be something I do - working on it in '25 - but i also cut losers too so that's good)

- i like the inflecting margins here, profitable inflecting and mid 20s growth for a unique 7 bn EV (smallish/ M&A -able), for only 6x this year's sales (almost the same growth and GM as everyone's favorite meme - PLTR - but for 90% cheaper on multiple lol). yeah i get they're not the same.

- semis r playing well here in the tape, but in '25 cyber i believe will be an important sector to keep a close eye on and not penny pinch. i think there are more winners than other sectors bc each have interesting attributes. NASDAQ:PANW is the NASDAQ:NVDA and continues to win but is expensive so i'm waiting for mkt to one-more-risk-off to re-enter. NASDAQ:ZS is ownable at 10x sales also compounding sales >20%. and you have stuff like NYSE:S that's more of a high risk play b/c of the inflecting profitability ? marks. also like NASDAQ:OKTA as i've written about which is the top dog in access mgmt (though my sights are on OMXSTO:YUBICO too - but the foreign txn fee probably keeps me wanting a better entry here too).

right now i have a pile of shares and have fwd sold covered calls at $25 for dec at $3.8 which gives a nice high teens capture (return) and i'm playing some shorter-dated C's into jan 17 2025 expiry so i don't need to neck out b/c they're trading slightly more than spot and give me 10-1 leverage.

what do u think?

V

S SentinelOne Options Ahead of EarningsIf you haven`t bought S before the previous breakout:

Now analyzing the options chain and the chart patterns of S SentinelOne prior to the earnings report this week,

I would consider purchasing the 30usd strike price Calls with

an expiration date of 2024-12-6,

for a premium of approximately $0.87.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

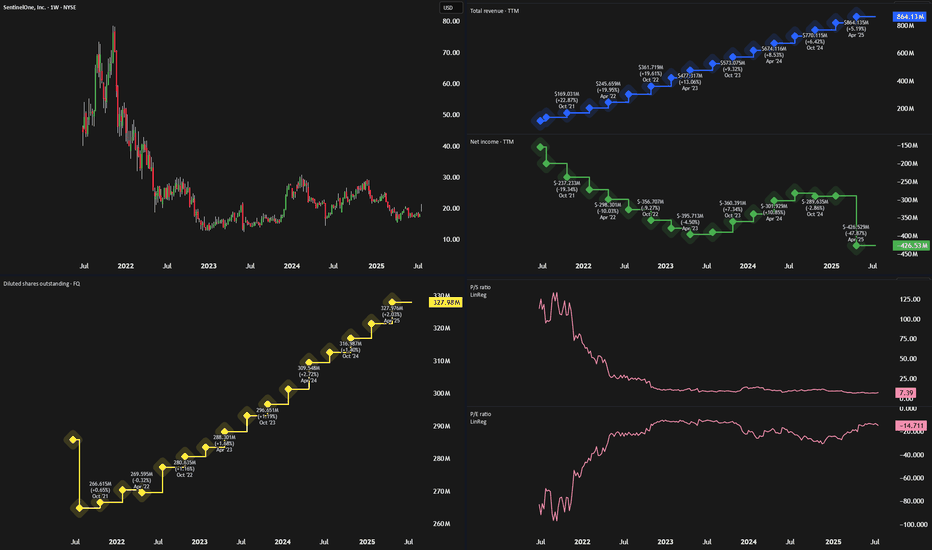

Happy ThanksgivingsAccording to the information provided in the image:

After 30 months, S made 200% more revenue, but its stock was trading 83% below the all-time high.

Based on this revenue trend, two future scenarios are presented:

1. S could go up 186% in the next 18 months.

2. S could go busted and down 50% in 18 months.

The key insight is that despite the large increase in revenue, the stock price has not reflected this. The analysis suggests two possible outcomes - a significant upside or a 50% downside - depending on how the market reacts to the revenue growth.

This is for the next 18 months, not the next 18 weeks or the next 18 days!

Happy Thanksgiving! I hope you and your loved ones enjoy the holiday.

I appreciate your support.

S - SentinelOne, Inc.MT Newswires

SentinelOne Cybersecurity Applications Receive FedRAMP Approval

Sep 12, 202417:42 GMT+3

SentinelOne said Thursday its Singularity Platform and Data Lake cybersecurity applications have received the federal government's highest ranking for protecting sensitive, unclassified data.

High Impact Level authorization by the Federal Risk and Authorization Management Program (FedRAMP) indicates the SentinelOne's software-as-a-service platforms meet compliance and safety standards for use on federal, public sector, defense industrial base and critical infrastructure facilities throughout the US.

SentinelOne shares were climbing 2% in recent mid-morning trading.

Undervalued cybersecurity stockShare price has recently formed a clear rising channel of late, currently trading at the bottom of the channel.

Revenue is growing at an exponential rate and they are projected to start making profits soon.

Motley Fool has some great recent articles on this company, take a look for yourself.

SentinelOne (S) AnalysisCompany Overview: SentinelOne is preparing to release its second-quarter fiscal 2025 results on August 27. The company, known for its cybersecurity solutions, is poised to deliver solid financial performance, driven by consistent growth and strong earnings surprises.

Key Highlights:

Revenue Expectations: SentinelOne NYSE:S anticipates total revenues of $197 million for Q2, aligning with the Zacks Consensus Estimate. This figure represents a significant 31.84% growth compared to the same quarter last year.

Earnings Performance: The consensus estimate for the company’s loss per share has remained steady at 1 cent, an improvement from the 8 cents per share loss reported in the year-ago period. This steady estimate reflects the company's efforts to improve profitability.

Historical Earnings Surprises: SentinelOne has a strong track record of exceeding earnings expectations, with an average earnings surprise of 64.79% over the past four quarters. This track record highlights the company's ability to outperform market forecasts consistently.

Technical Outlook: Given the company's strong performance history and the current technical setup, the stock is positioned well for potential growth.

Investment Outlook: Bullish Outlook: We are bullish on S if it holds above the $22.00-$22.75 range. Upside Potential: The upside target for SentinelOne is set at $27.00-$28.00, supported by the company’s robust growth prospects and positive earnings track record.

🏅 SentinelOne—poised for growth with strong earnings performance and bullish technicals! #S #Cybersecurity 🚀📈

S SentinelOne Options Ahead of EarningsIf you haven`t bought S before the previous earnings:

Now analyzing the options chain and the chart patterns of S SentinelOne prior to the earnings report this week,

I would consider purchasing the 27usd strike price Calls with

an expiration date of 2024-11-15,

for a premium of approximately $2.07.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

SentinelOne Gains as CrowdStrike Faces Software Update IssuesSentinelOne, Inc. experienced a boost in stock value following a problematic software update by its competitor, CrowdStrike Holdings Inc., which disrupted Microsoft Windows operating systems. The failed patch affected approximately 1% of Windows devices, translating to around 8.5 million units globally. Many of these devices belong to large, mission-critical service providers that rely on CrowdStrike's cybersecurity solutions.

This incident has led some investors to anticipate a potential increase in SentinelOne's market share, as organisations affected by the glitch might consider switching to alternative cybersecurity providers. The positive shift in SentinelOne's stock reflects investor confidence in the company's ability to capitalise on CrowdStrike's misstep.

Technical analysis of SentinelOne, Inc. (NYSE: S)

Reviewing the stock performance of SentinelOne for potential trading opportunities:

Timeframe : Daily (D1)

Current trend : the stock is currently in a global uptrend

Resistance level : previously at 22.25 USD, now serving as new support after being surpassed

Support level : established at 20.05 USD.

Potential downtrend target : should the stock revert to a downtrend, a potential target could be set at 17.25 USD

Short-term target : if the uptrend persists and further resistance is breached, a short-term target could be 29.10 USD

Medium-term target : with continued upward momentum, the price might aim for 36.00 USD

Investors should closely monitor the developments surrounding SentinelOne's competitive positioning in the cybersecurity market. The current scenario offers a strategic advantage that could significantly influence SentinelOne's operational performance and stock valuation.

—

Ideas and other content presented on this page should not be considered as guidance for trading or an investment advice. RoboMarkets bears no responsibility for trading results based on trading opinions described in these analytical reviews.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law L. 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65.68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Make it or break it moment for $SWith the spectacular fall of NASDAQ:CRWD last week I expect to be a decisive week for SentinelOne.

Scenario nr 1

Break out of the correction or for Bill O'Neill followers break out of the base.

Supporting evidence:

1. Fundamental. Better than expected earnings

The biggest competitor is having a terrible day

2. Rising MACD histogram on the weekly

3. MACD lines almost crossing

4. Force Index getting positive

5. Getting The Positive Direction Line above the Negative Directional Line will mean that the bullish traders dominate the market.

Scenario nr 2

Break out is not ready yet and we go back in the correction range evidenced on my graph by the parallel channel

Why?

Waiting for earnings confirmation?

Force Index above 0 is minor at this point a follow-up week will break the trend.

The stock needs to deal with the overhang supply. First hurdle, people who bought around the $22 price.

S LongSentinelOne (S) shows a bullish setup on the 4-hour chart. The stock has recently broken above a downtrend line and is now testing previous resistance around $22. The price action displays higher lows and higher highs, indicating a potential trend reversal. A green uptrend line supports the recent price action, and the stock has crossed above both the 50 and 200-period moving averages. The breakout is accompanied by increased volume, suggesting genuine buying interest. Key resistance levels are visible at $21.95 and $22.21, with support at $19.70 and $19.33. The entry is placed at the current price level, with a stop below the recent swing low and uptrend line. The profit target is set near the next significant resistance level. The risk-reward ratio is favorable, and the overall technical picture supports a bullish bias.

{

"direction": "Long",

"symbol": "S",

"interval": "4h",

"entry": 21.8,

"stop": 20.5,

"profit": 23.8,

"risk": 130,

"reward": 200,

"quantity": 100,

"score": 7

}

5/30/24 - $s - bot $17 AH. like the entry here. great biz.5/30/24 - vrockstar - NYSE:S - starting my position here at $17 after hours. hard to say what's buying mgn of safety here, but i'll make a few points:

1) growing 35-40%, same as industry leaders but spending way less

2) better tech, Tomer confident and humble communicating this; have heard it from those in industry as well. buy tech in enterprise, not necessarily in consumer, but it matters in B2B

3) net cash, 5.5x next year EV. half as cheap as avg. of NASDAQ:ZS , NASDAQ:CYBR , NASDAQ:PANW etc. if they were a yester-year product i'd say that was expensive. but these guys are the marginal winners that wall street doesn't see yet

4) 2H pipeline strong, but mgmt communicating conservatively. compare this to $zs. NYSE:S has done a great job beating #s, so it's not like they're promising low #s on missing. what mgmt is comm'ing has to do w/ rebuilding product team esp emerging product ramp. they're incentivized (this is ~40% of their team)

5) what's downside? 4-5x sales? w/ net cash, that's basically 20% most here. that's $3 off the $17 it will open at so $14? at $15 i'd probably already be pretty large. the position i started here wasn't small - 2% to go and would take it to 3-4% at $16, 4-5% at $15 and we'll see thereafter (if/how/why/when etc.)

gl to all. lmk if you see it otherwise.