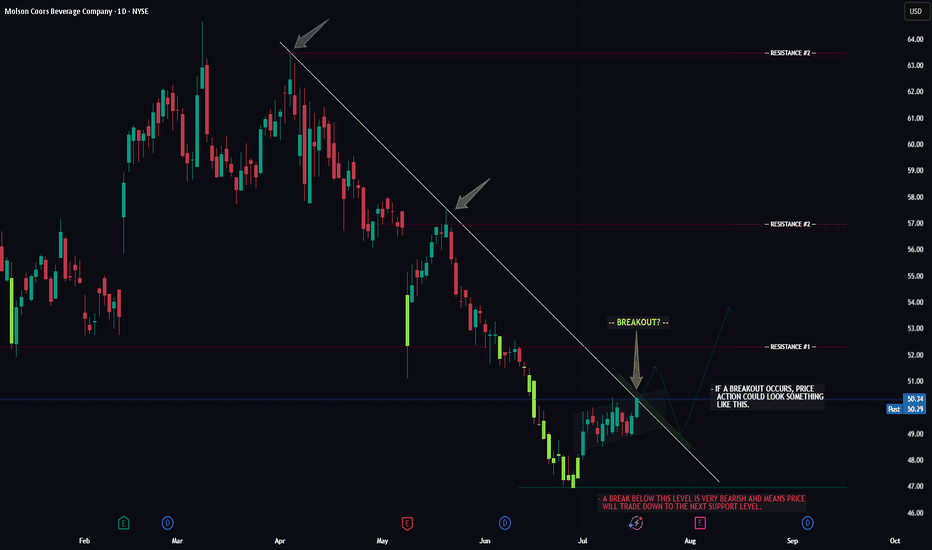

TAP -- Breakout Attempt -- Target LevelsHello Traders!

The chart of TAP (Molson Beer co.) is currently flirting with a major resistance trendline. Now whether or not price can successfully seal the deal and make it too third base remains to be seen.

If price does breakout, watch for a potential retrace to the breakout trendline first, t

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

4.62 EUR

1.08 B EUR

11.23 B EUR

166.60 M

About Molson Coors Beverage Company

Sector

Industry

CEO

Gavin D. K. Hattersley

Website

Headquarters

Golden

Founded

1786

FIGI

BBG01TNWZC77

Molson Coors Beverage Co. is a holding company, which engages in the production and sale of beer. It operates through the Americas and EMEA and APAC geographical segments. The Americas segment imports, markets, distributes, and sells owned brands and partner brands and licensed brands in the U.S., Canada and various countries in Latin America. The EMEA and APAC segment consists of the production, marketing, and sales of primary brands as well as other owned and licensed brands in Bulgaria, Croatia, Czech Republic, Hungary, Montenegro, the Republic of Ireland, Romania, Serbia, the U.K., various other European countries and certain countries within the Middle East, Africa and Asia Pacific regions. The company was founded in 1786 and is headquartered in Golden, CO.

Related stocks

TAP short tradeIn this case, the price has pulled back into a key resistance area but failed to break out. It's also aligned with both the 200 and 20 moving averages, and today we’ve seen a strong bearish reaction from that zone.

Considering this confluence and the current direction of the overall market, I belie

MOLSON COORS Stock Chart Fibonacci Analysis 022625Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 56/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E

TAP - The Molson Coors Beverage Company ready for short?

The Molson Coors Beverage Company NYSE:TAP on New York Stock Exchange looks like ready for short. We see here a brake out from the long time resistance with a confirmation from this move. This is maybe the end of the long time correction since october 2020. Next Target 40,00 $?

TAP Molson Coors Beverage Company, LONG (MID-term)Financials

- Earnings are rising, good outlook, bright expectations

- Stock is at a low point, trading under its book values.

Techincal

- Stock is picking up momentum.

- Stock is at a great R/R point.

Strategic

- Stock should be priced way higher in an investment of lowering interest rates

TAP flushed on a good earnings beat into support LONGTAP appears to to have fallen into support on a good earnigns beat Perhaps traders were

expecting a better beat. It is now 15% below the resistance zone where shorts will take

positions and longs will sell- off. TAP has sales and consumer loyalty in its brands. It is

free of the controversi

Tap Double Top or buying opportunity?NYSE:TAP has had a rough time as of late as noted on the weekly chart.

I am torn between the was it a double top or are we entering a buying opportunity here?

If it loses the 53 level it can continue to slide especially if earnings disappoint, on the other hand it could rise if earnings surprise a

TAP ( Coors Molson Miller ) Ready for Bullish Continuation?On the daily chart, TAP was on a good trend up heading into earnings which were favorable.

It is consolidated since just after earnings in a " high tight bull flag pattern" Volume has been

healthy with many buyers and seller trading shares in a tight range channel. The stochastic

RSI is now at a

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

US60871RAH3

MOLSON COORS BEV. 16/46Yield to maturity

6.66%

Maturity date

Jul 15, 2046

US60871RAD2

MOLSON COORS BEV. 12/42Yield to maturity

6.18%

Maturity date

May 1, 2042

US60871RAG5

MOLSON COORS BEV. 16/26Yield to maturity

4.78%

Maturity date

Jul 15, 2026

A3LZEX

MOLSON COORS BEVERAGE CO 2024-15.06.32Yield to maturity

3.49%

Maturity date

Jun 15, 2032

See all 1TAP bonds

Curated watchlists where 1TAP is featured.

Frequently Asked Questions

The current price of 1TAP is 43.40 EUR — it has decreased by −1.41% in the past 24 hours. Watch MOLSON COORS BEV stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange MOLSON COORS BEV stocks are traded under the ticker 1TAP.

1TAP stock has risen by 0.37% compared to the previous week, the month change is a 6.32% rise, over the last year MOLSON COORS BEV has showed a −15.30% decrease.

We've gathered analysts' opinions on MOLSON COORS BEV future price: according to them, 1TAP price has a max estimate of 73.85 EUR and a min estimate of 41.64 EUR. Watch 1TAP chart and read a more detailed MOLSON COORS BEV stock forecast: see what analysts think of MOLSON COORS BEV and suggest that you do with its stocks.

1TAP reached its all-time high on Apr 28, 2025 with the price of 51.24 EUR, and its all-time low was 40.34 EUR and was reached on Jun 27, 2025. View more price dynamics on 1TAP chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1TAP stock is 1.43% volatile and has beta coefficient of 0.24. Track MOLSON COORS BEV stock price on the chart and check out the list of the most volatile stocks — is MOLSON COORS BEV there?

Today MOLSON COORS BEV has the market capitalization of 8.38 B, it has increased by 0.34% over the last week.

Yes, you can track MOLSON COORS BEV financials in yearly and quarterly reports right on TradingView.

MOLSON COORS BEV is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

1TAP earnings for the last quarter are 0.46 EUR per share, whereas the estimation was 0.72 EUR resulting in a −36.11% surprise. The estimated earnings for the next quarter are 1.56 EUR per share. See more details about MOLSON COORS BEV earnings.

MOLSON COORS BEV revenue for the last quarter amounts to 2.13 B EUR, despite the estimated figure of 2.21 B EUR. In the next quarter, revenue is expected to reach 2.63 B EUR.

1TAP net income for the last quarter is 111.85 M EUR, while the quarter before that showed 278.01 M EUR of net income which accounts for −59.77% change. Track more MOLSON COORS BEV financial stats to get the full picture.

Yes, 1TAP dividends are paid quarterly. The last dividend per share was 0.41 EUR. As of today, Dividend Yield (TTM)% is 3.56%. Tracking MOLSON COORS BEV dividends might help you take more informed decisions.

MOLSON COORS BEV dividend yield was 3.07% in 2024, and payout ratio reached 32.91%. The year before the numbers were 2.68% and 37.56% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 27, 2025, the company has 16.8 K employees. See our rating of the largest employees — is MOLSON COORS BEV on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MOLSON COORS BEV EBITDA is 2.26 B EUR, and current EBITDA margin is 22.18%. See more stats in MOLSON COORS BEV financial statements.

Like other stocks, 1TAP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MOLSON COORS BEV stock right from TradingView charts — choose your broker and connect to your account.