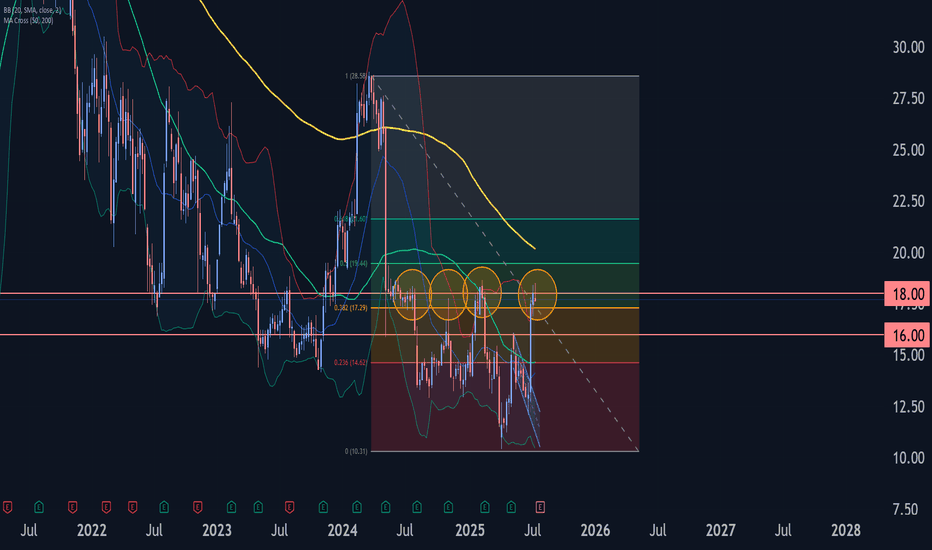

Trip Wave Analysis – 16 July 2025- Trip reversed from resistance area

- Likely to fall to support level 16.00

Trip recently reversed down from the resistance area located at the intersection of the strong resistance level 18.00, upper weekly Bollinger Band and the 38.2% Fibonacci correction of the weekly downtrend from 2024.

The

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.355 EUR

4.83 M EUR

1.77 B EUR

109.58 M

About TripAdvisor, Inc.

Sector

Industry

CEO

Matthew A. Goldberg

Website

Headquarters

Needham

Founded

2000

FIGI

BBG00J7BJ103

TripAdvisor, Inc. is an online travel company, which owns and operates a portfolio of online travel brands. It operates through the following segments: Brand Tripadvisor, Viator, and TheFork. The Brand Tripadvisor segment offers travelers and experience seekers an online global platform for travelers to discover, generate, and share authentic user-generated content. The Viator segment enables travelers to discover and book iconic, unique, and memorable experiences from experience operators around the globe. The TheFork segment provides an online marketplace that enables diners to discover and book online reservations. The company was founded by Nicholas Shanny and Stephen Kaufer in February 2000 and is headquartered in Needham, MA.

Related stocks

Trip Wave Analysis – 1 July 2025- Trip broke daily down channel

- Likely to rise to resistance level 14.50

Trip recently broke the resistance trendline of the daily down channel from the start of May (inside which the price has been falling in the last few weeks).

The breakout of this down channel accelerated the active short-te

Trip Wave Analysis – 11 March 2025

- Trip reversed from multi-month support level 13.00

- Likely to rise to resistance level 14.20

Trip recently reversed up from the support area between the multi-month support level 13.00 (which has been reversing the price from September) and the lower daily Bollinger Band.

The upward reversal f

TRIP at a Make-or-Break Moment: Reversal Incoming?TRIP is currently testing a major descending trendline resistance around $18.85-$19.00, a critical level that could determine its next move. If price breaks and holds above this resistance, it may trigger a shift in trend, with the next key target at $27.15. However, failure to break out could resul

Bullish Breakout $TRIPTripAdvisor, Inc. is an online travel company, which owns and operates a portfolio of online travel brands. It operates through the following segments: Brand Tripadvisor, Viator, and TheFork. The Brand Tripadvisor segment offers travelers and experience seekers an online global platform for traveler

TripAdvisor | TRIP | Long at $14.83Travel Boom: Commence. TripAdvisor, Viator, and TheFork NASDAQ:TRIP

Pros:

Profitable company

Earnings are forecast to grow by an average of 30.9% per year for the next 3 years

Debt to equity is 0.94x (low)

My historical simply moving average is approaching the price (which may lead to

TRIP Tripadvisor Buy TF H1 TP = 16.83On the hour chart the trend started on August 28 (linear regression channel).

There is a high probability of profit taking. Possible take profit level is 16.83

But we should not forget about SL = 15.18

Using a trailing stop is also a good idea!

Please leave your feedback, your opinion. I am v

Stock to buy. Trip Advisor Could Make Your Portfolio ExplodeIf you're looking for a growth stock to add to your portfolio, you may want to consider TripAdvisor (NASDAQ: TRIP). The online travel company has seen its stock price nearly lose 50% of its value in the past year and is currently trading at all-time lows with a strong weekly demand level in control.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where 1TRIP is featured.

Frequently Asked Questions

The current price of 1TRIP is 14.395 EUR — it has decreased by −6.59% in the past 24 hours. Watch TRIPADVISOR stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MIL exchange TRIPADVISOR stocks are traded under the ticker 1TRIP.

1TRIP stock has fallen by −4.07% compared to the previous week, the month change is a 18.09% rise, over the last year TRIPADVISOR has showed a −11.74% decrease.

We've gathered analysts' opinions on TRIPADVISOR future price: according to them, 1TRIP price has a max estimate of 20.44 EUR and a min estimate of 11.07 EUR. Watch 1TRIP chart and read a more detailed TRIPADVISOR stock forecast: see what analysts think of TRIPADVISOR and suggest that you do with its stocks.

1TRIP reached its all-time high on Dec 6, 2018 with the price of 57.000 EUR, and its all-time low was 9.550 EUR and was reached on Apr 9, 2025. View more price dynamics on 1TRIP chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

1TRIP stock is 7.88% volatile and has beta coefficient of 1.41. Track TRIPADVISOR stock price on the chart and check out the list of the most volatile stocks — is TRIPADVISOR there?

Today TRIPADVISOR has the market capitalization of 1.86 B, it has decreased by −2.29% over the last week.

Yes, you can track TRIPADVISOR financials in yearly and quarterly reports right on TradingView.

TRIPADVISOR is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

1TRIP earnings for the last quarter are 0.13 EUR per share, whereas the estimation was 0.03 EUR resulting in a 316.70% surprise. The estimated earnings for the next quarter are 0.35 EUR per share. See more details about TRIPADVISOR earnings.

TRIPADVISOR revenue for the last quarter amounts to 367.89 M EUR, despite the estimated figure of 357.01 M EUR. In the next quarter, revenue is expected to reach 449.91 M EUR.

1TRIP net income for the last quarter is −10.17 M EUR, while the quarter before that showed 965.98 K EUR of net income which accounts for −1.15 K% change. Track more TRIPADVISOR financial stats to get the full picture.

TRIPADVISOR dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Aug 2, 2025, the company has 2.86 K employees. See our rating of the largest employees — is TRIPADVISOR on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. TRIPADVISOR EBITDA is 207.98 M EUR, and current EBITDA margin is 11.93%. See more stats in TRIPADVISOR financial statements.

Like other stocks, 1TRIP shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade TRIPADVISOR stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So TRIPADVISOR technincal analysis shows the neutral today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating TRIPADVISOR stock shows the sell signal. See more of TRIPADVISOR technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.