TSLA TA – Call Side Dominance Nearing Resistance-July 14TSLA GEX Analysis – “Call Side Dominance Nearing Critical Resistance 💥”

GEX Snapshot:

* Highest Positive GEX / Resistance: $320 – This is where call positioning is heaviest and likely where dealer hedging could resist further upside.

* Call Walls:

* $317.5 (44.18%)

* $320 (High NetGEX)

* $335–$340 (Intermediate resistance, weaker positioning beyond)

* Put Walls:

* $300 (48.79% support)

* $295 / $290 (3rd/2nd tier walls)

Options Oscillator:

* IV Rank (IVR): 16 (Low)

* IVx avg: 64.5

* Call Positioning: 69.8% (very bullish skew)

* GEX: 🔰 Bullish

🎯 Options Trade Setup:

Direction: Cautiously Bullish – but close to key resistance!

⚡ Aggressive Bullish Setup:

* Entry: Near $312.75 (current price)

* Strike: Buy $317.5C or $320C expiring this week

* Target: $320+

* Stop: Close below $308

* Note: Watch dealer hedging around $320. If TSLA breaks $320 with strength, gamma squeeze toward $335 is possible.

🛡️ Bearish Reversal Setup (if rejected at $320):

* Strike: Buy $310P or $305P (next week expiry)

* Trigger: Rejection at $320 + breakdown below $311

* Target: $304–$300

* Stop: Above $321

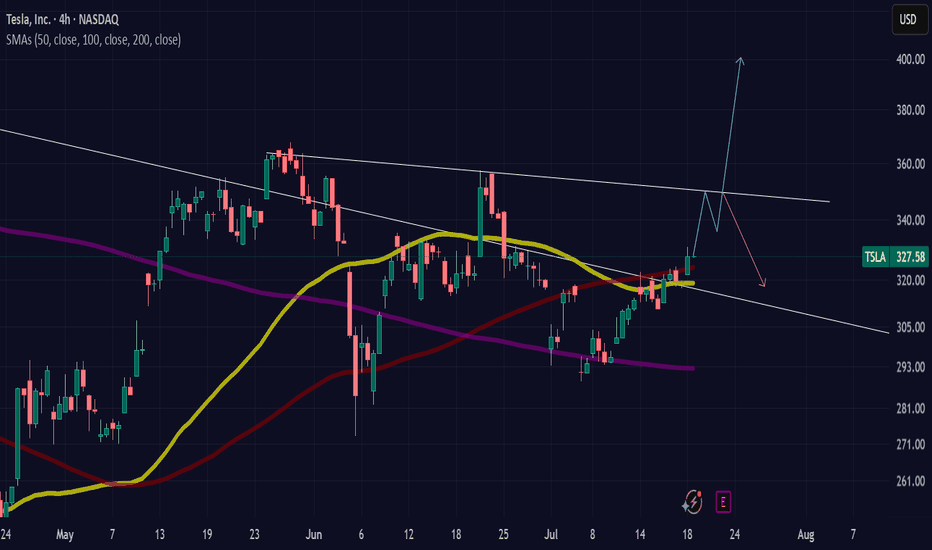

📉 TSLA 1-Hour Chart Analysis – “Breakout Zone or Fakeout Trap? Watch These Levels 🎯”

Structure:

* TSLA broke above the CHoCH and BOS zones between $308–$310. Price is consolidating under the $317.5–$320 resistance (also seen on GEX).

* There’s a clean ascending wedge/channel forming – upper boundary is near $320, and the lower trendline is near $304.

Key Zones:

* Supply Zone (Purple): $317.5–$320 (watch for rejection or breakout)

* Support: $309.8 (BOS zone), then $304 (trendline + demand overlap)

* Demand Zone: $293.5–$296 (origin of last rally)

🛠️ Trade Scenarios:

🔼 Bullish Continuation:

* Entry: Break and hold above $320

* TP1: $325

* TP2: $335

* SL: Below $311

🔽 Bearish Pullback:

* Entry: Rejection at $317.5–$320 zone and break below $309

* TP1: $304

* TP2: $296

* SL: Above $320

✅ Summary:

* GEX favors calls but $320 is a critical gamma wall – if broken, it opens room toward $335+.

* On the chart, watch the rising channel and upper resistance at $320.

* Bullish momentum is still intact unless $309 fails.

* Stay nimble: scalp calls on breakout, or prepare for a reversal put if there's rejection and structure break.

Disclaimer: This analysis is for educational purposes only and not financial advice. Trade at your own risk with proper risk management.

1TSLA trade ideas

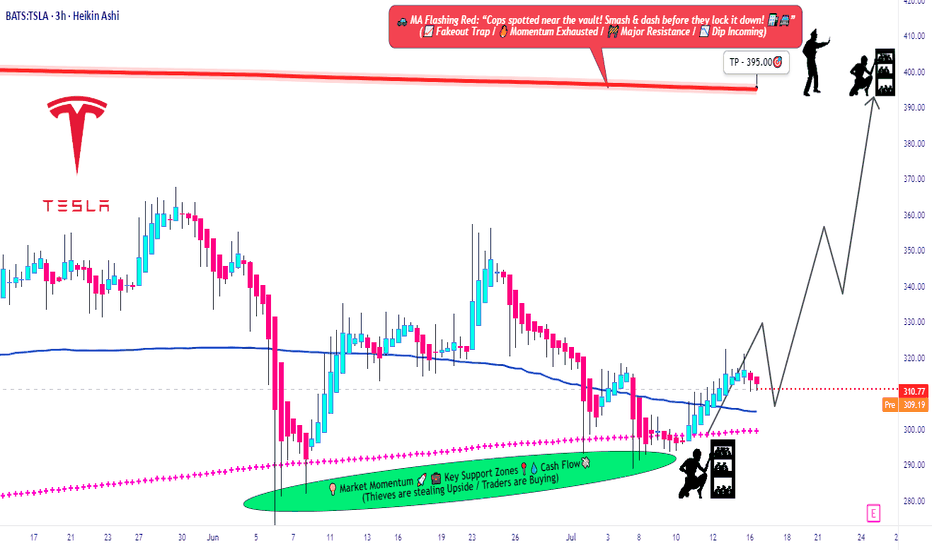

Tesla Bulls Assemble: It’s Time for a Clean Robbery🚨🔥TESLA STOCK ROBBERY BLUEPRINT: Thief Trading Heist Plan v2.0🔥🚨

(Swing & Day Traders, Scalpers — Welcome to the Ultimate Market Raid)

🌍 Greetings, Money Makers & Market Bandits!

Hola! Ola! Bonjour! Hallo! Marhaba! Salute from the global Thief Squad! 💰💸🕶️

Today, we’re unleashing a bold market raid on NASDAQ:TSLA (Tesla Inc.), using our signature Thief Trading Strategy™ — a fusion of technical precision, smart risk, and fundamental power. This is not your average trade idea — this is a robbery plan, tailor-made for those ready to outsmart the market with elite tactics.

🎯 The Mission: Steal the Bullish Breakout Before the Bears Wake Up!

Market Status:

Tesla is showing early signs of bullish strength — short-term consolidation with a potential breakout toward the upper red zone. However, that red zone is where the “Police” (resistance + short sellers) wait to ambush — so we enter with strategy, not emotion.

🟢 Entry Zone – "Vault is Open, Thieves Assemble!"

We’re looking for a long entry anywhere inside the most recent pullback zones (use 15m / 30m candles). Place layered buy-limit orders like a DCA thief stacking charges, targeting the swing low or support wick.

🔑 Pro Tip: Be patient. Let the pullback bless your orders. We rob smarter, not harder.

🛑 Stop Loss – "Escape Route Planned"

Stop Loss = Placed under swing low (3H TF). Current suggested SL: $280.00 (adjust for risk profile).

💬 Thief Note: Your SL depends on position size, number of entries, and account leverage. Never risk your life savings on one job. 😉

🎯 Target Zone – "The Big Loot"

Main Target 🎯: $395.00

Optional Exit: Trail your SL and escape early with bags full of gains. Exit before the trap if heat rises. 🔥

👀 Scalpers – "Fast Hands Get First Cash"

Stick to the long side only. Shorting this train is standing in front of a robbery truck. Use trailing SLs and grab those quick gains.

If you're a small account thief — no worries — ride with the swing crew. We share the loot.

📊 Why the Heist Now?

TSLA's move is supported by:

🔍 Fundamental strength & positive sentiment

🌐 Macro tailwinds & sector rotation favoring EV/Tech

🧠 Intermarket & index alignment

📰 Bullish outlook from recent positioning and COT data

🧨 Consolidation base forming an explosive setup

⚠️ Caution Tape – News Alert Zone

🚨Stay Clear of Major News Releases!

Avoid opening fresh entries during high-impact news. Use trailing SLs to protect your gains. Market heat can go nuclear — be alert, not emotional.

💖 Support the Heist – Smash That BOOST Button!

If you love this Thief Strategy, hit the BOOST 💥

Help us reach more robbers, dreamers, and money makers across TradingView. Let’s build the biggest, smartest, most strategic trading crew ever.

📌 Disclaimer (We're Thieves, Not Financial Advisors)

This is not financial advice — it’s a strategic idea shared for educational purposes. Adjust based on your own risk profile. Never enter a robbery without a plan. 🧠💼

🔥 Stay locked in. Another market heist blueprint is coming soon.

Until then — keep your charts clean, your entries smart, and your exits legendary.

💸Rob the Market — The Thief Way™

🐱👤🎯📈🚀

Why TSLA will Crash based On Copper TarrifsHere’s why that bearish outlook is gaining traction:

Copper costs are surging: Tesla uses over 180 pounds of copper per vehicle. With prices spiking 13% in a single day and a 50% tariff looming, production costs are rising fast.

Analysts are cutting price targets: UBS, JPMorgan, and Bank of America have all lowered their forecasts for Tesla, citing margin pressure and weakening demand3.

Brand sentiment is shaky: Tesla’s recent delivery miss and political controversies around Elon Musk have added to investor unease.

Tariff ripple effects: The broader trade war is expected to disrupt supply chains and inflate costs across the EV sector5.

That said, some analysts still see long-term upside if Tesla can pivot quickly—especially with its AI and autonomous driving ambitions. But for now, the market is reacting to the immediate risks.

Overall Enter Short for Gains of 3-5 percent.

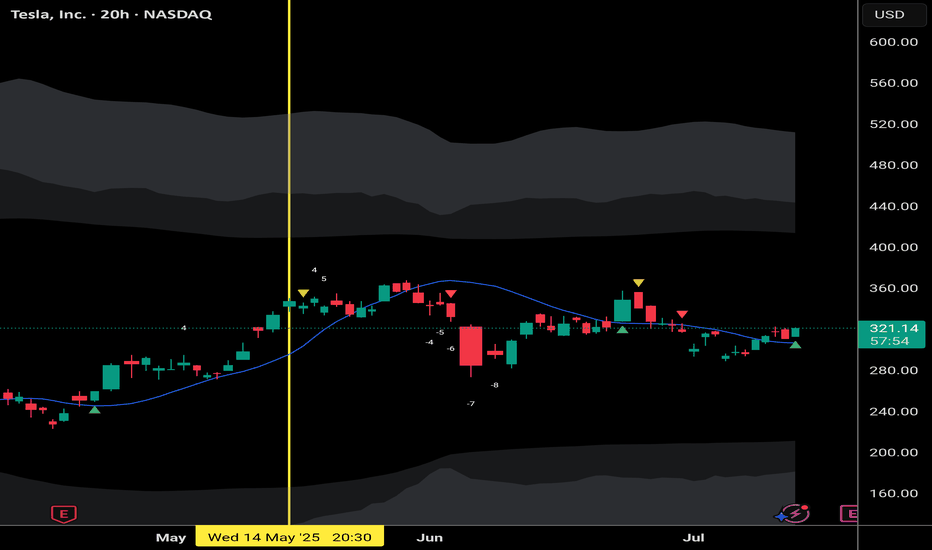

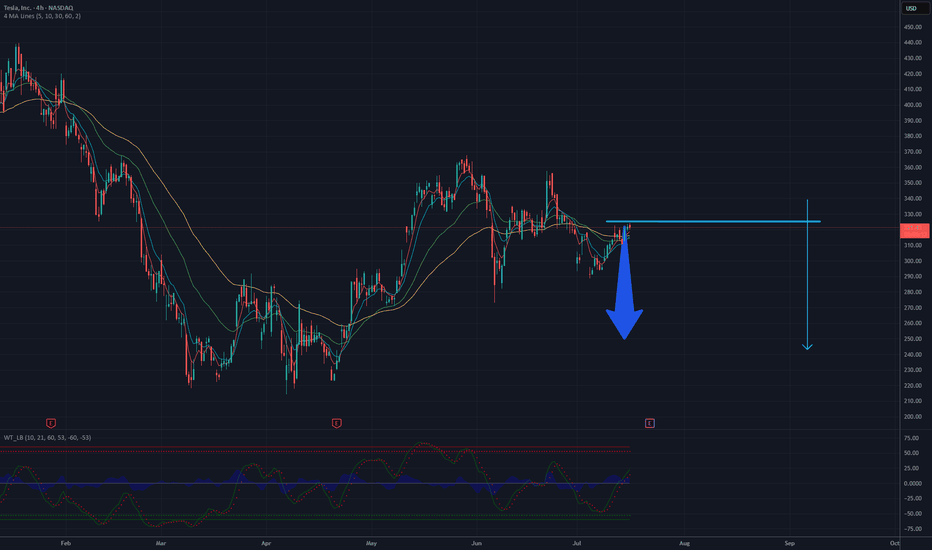

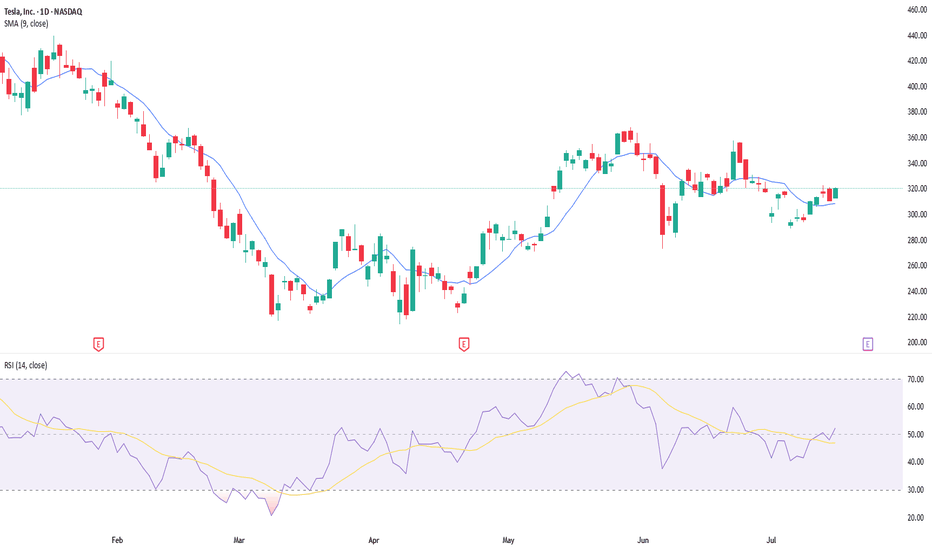

UPTADE TESLA -- 250 USD still potentialTesla is consolidating in a tight range, showing bearish pressure near the lower boundary of the formation. Moving averages (MA 5/10/30/60) are flattening, indicating a loss of bullish momentum, while the Wavetrend oscillator has issued a sell signal (bearish crossover below the zero line). A downside breakout from this range projects a potential move toward the $250 level, as illustrated by the measured move. This bearish scenario gains validity if price breaks below the $315 support level.

Potential TP still 250 USD

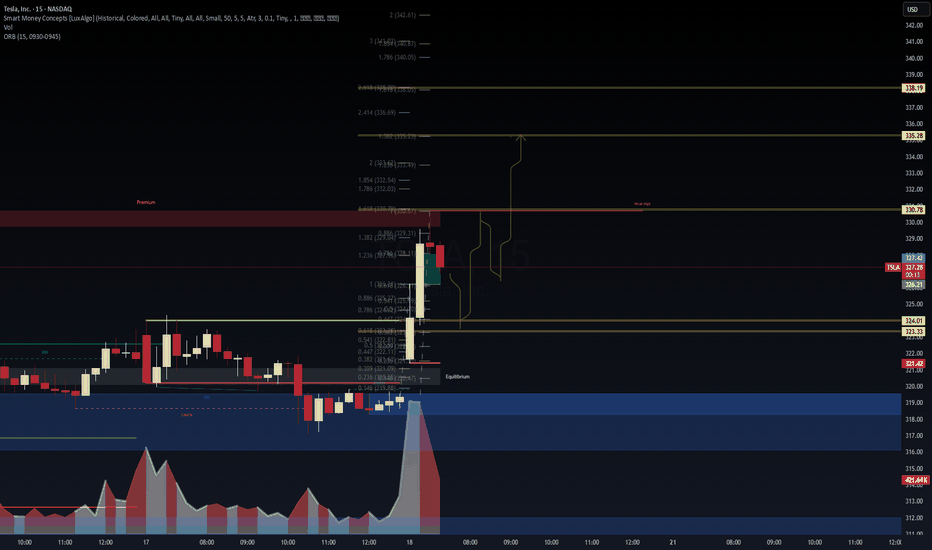

TSLA | Breakout Fuel Loaded – Will the Trend Accelerate Toward 🚗 TSLA | Breakout Fuel Loaded – Will the Trend Accelerate Toward $350?

🔍 Chart Type: 15m

🧠 System: Smart Money Concepts (LuxAlgo) + WaverVanir DSS

📊 Volume: 2.08M

🧭 Narrative: Liquidity Engine + Bullish Flow Momentum

📈 Current Price: $314.78

Clean breakout above BoS and ChgofCHoCH

Currently testing Strong High within a defined Premium Zone

EMA Stack (20/50/100/200) is bullishly aligned

📌 Key Levels to Watch:

📍 Premium Resistance: ~$315–$318

⚖️ Equilibrium Support: ~$309

💧 Discount Liquidity Zones: $292.43, $290.26

🚀 Upside Targets:

Minor: $322.49

Mid: $331.10

Major: $349.74 → $351.63 (projected wave peak)

📈 Bullish Case (Preferred by DSS Flow Model):

Retest of strong high → rally toward $322 then $331

Momentum and volume support trend acceleration

Break of $331 opens path toward $349.74–$351.63 (final wave)

📉 Bearish Invalidator:

Break below equilibrium ($309) → Discount zone retest

Watch $292–$286 for final liquidity sweep if rejection occurs

📅 Catalyst:

Earnings (📦 E icon marked) + macro tech sentiment could ignite explosive continuation

Market structure favors liquidity vacuum toward premium targets

🧠 VolanX DSS Sentiment: STRONG BULLISH

✅ Structure: Uptrend

✅ Volume: Expanding

✅ Momentum: Aligned

🟡 Risk: Premium rejection short-term possible

🔁 Executed via VolanX AI Scanner + WaverVanir DSS Engine

📊 “The Edge Is a System. The System Is Intelligence.”™

#WaverVanir #TSLA #SmartMoneyConcepts #PriceAction #LiquidityZones #Tesla #TechnicalAnalysis #VolanX #InstitutionalEdge #AITrading #QuantFinance

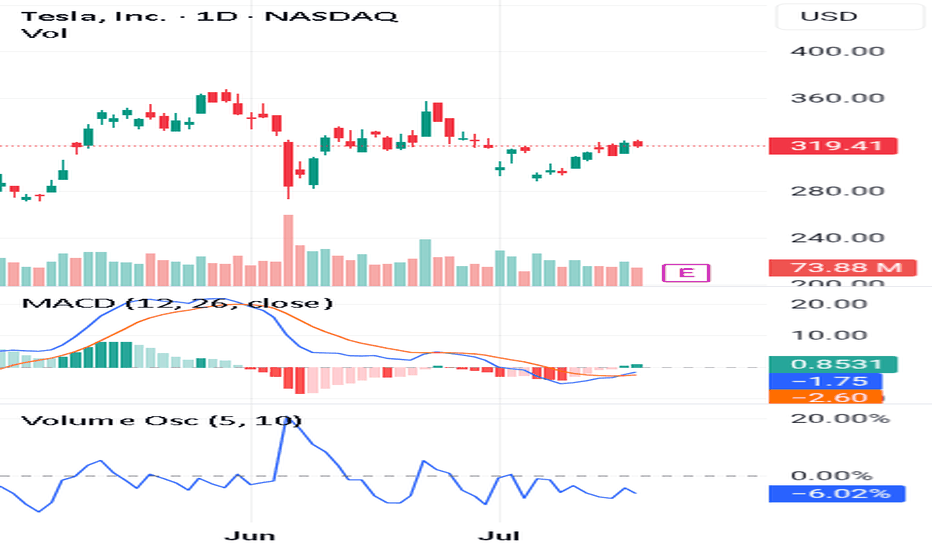

(Learn More)Use These 3 Steps To Spot Long-Lasting Trends👉Trade before the earnings report

👉Make sure the volume oscillator is below zero

👉Make sure the MACD lines give you a Bullish signal

If you look at this chart you can see all the steps alignment.

This is very important because you want to catch a long term trend.

Also it has to follow the 3step rocket booster strategy.

In order for you to learn more about this strategy 🚀 Rocket Boost This Content.

Disclaimer ⚠️ Trading is risky please learn how to use Risk Management And Profit Taking Strategies. Also feel free to use a simulation trading account before you use real money.

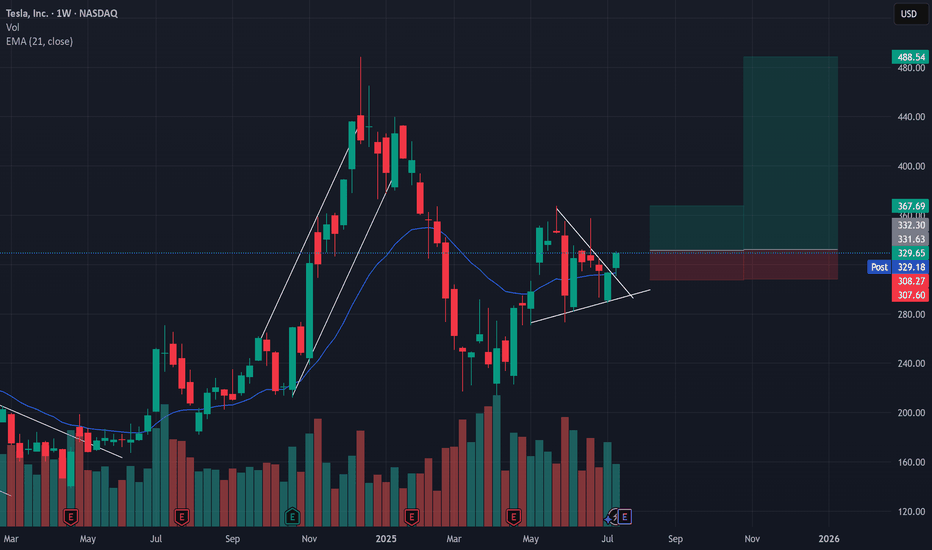

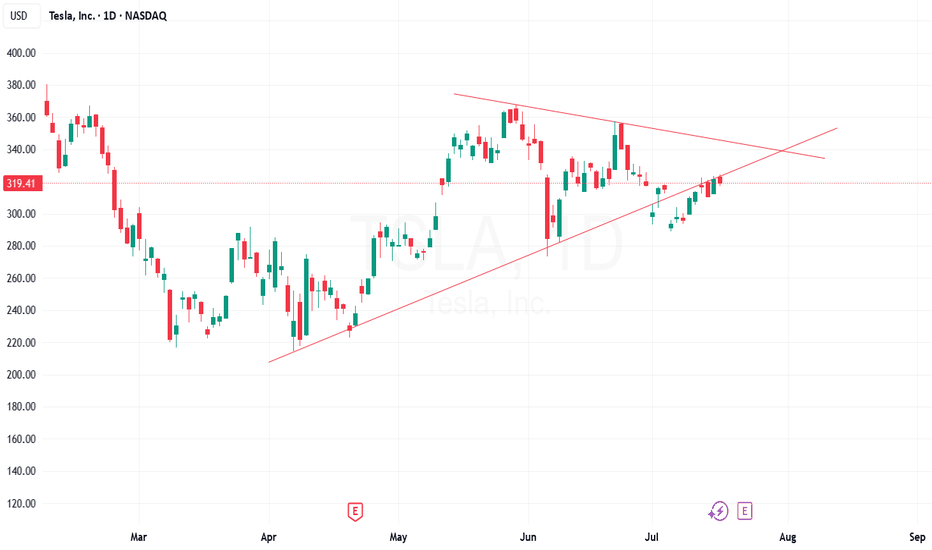

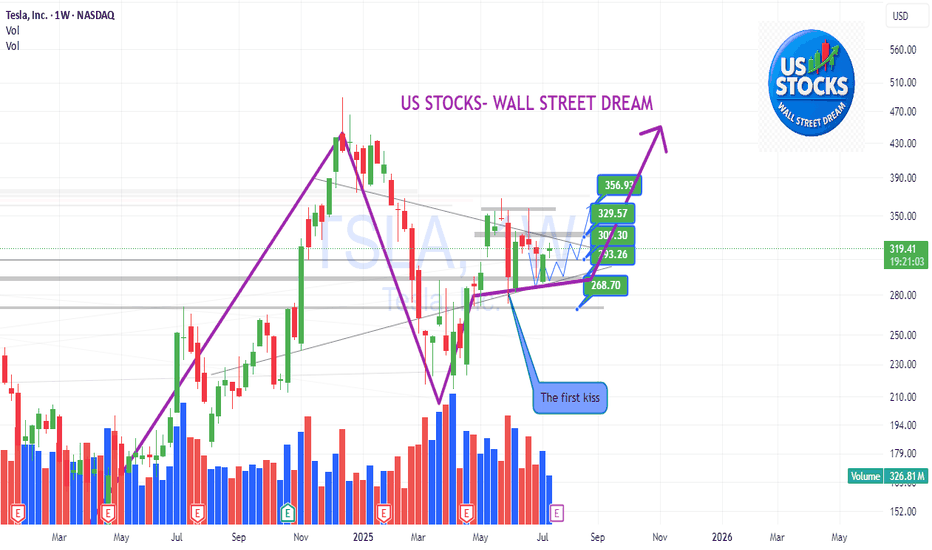

Retested Wedge Bullish Breakout = New Highs?

NASDAQ:TSLA

NASDAQ:TSLL

Tesla has currently showcased two very bullish setups with one already taking place.

Over the past 2 month we've seen TSLA swing dramatically from a high of $368 to a low of $278 while producing lower highs and higher lows AKA a wedge formation.

Wedge formations are a low probability set up and typically produce a 50/50 breakout, however there are a couple of bullish signals on the weekly chart that have kept me in my TSLL position expecting a retest of either the $368 high and/or $490.

Bullish insights -

1 - After a strong push above the 21d EMA, TSLA had a 2 legged pull back with last week being a short failure and closing above the 21d EMA

2 - this week's candle retested the breakout trendline and closed in a very bullish candle.

3 - Tesla's $488 high was an overshoot which produced a strong breakout to the low end, however there was no new high formed meaning there is a high probability chance that we will revisit ~$500.

Trade set up Idea:

If next week's candle forms higher than this weeks bullish candle, target is $368, Stop loss is set at $306 for a 1:1.5 Risk vs reward.

Or

If next week's candle forms higher than this weeks bullish candle, target is $348, Stop loss is set at $306 for a 1:6.5 Risk vs reward.

I'm holding for the second one ;)

Current position - 7400 shares of TSLL

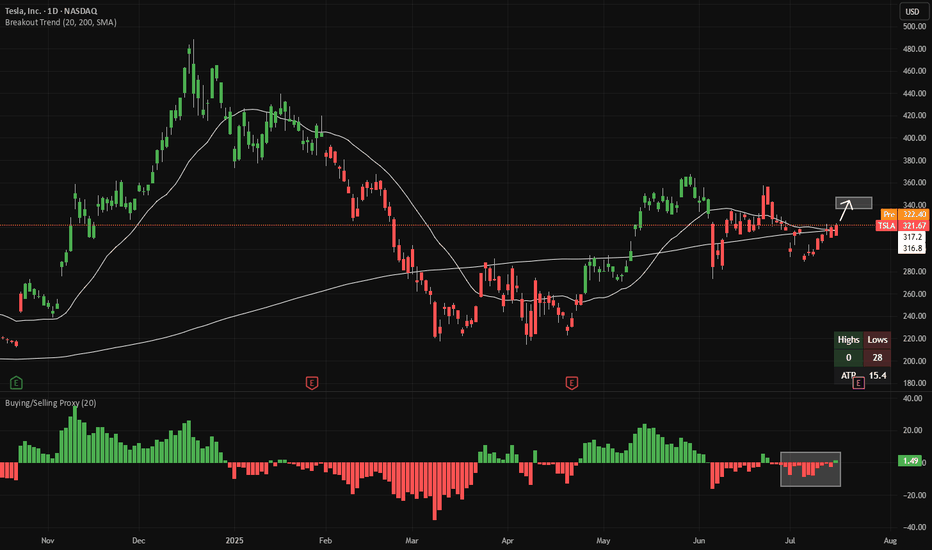

Long TSLA - buyers almost have controlThe buying/selling proxy (bottom panel) is showing signs of net-buying in TSLA. This makes 20-day highs (area indicated in the main chart) more likely to come next. That's around $349.

There is good risk/reward to buy TSLA here, with a stop-loss if the buying/selling proxy flips back to net-selling (red bars). If a 20-day high is made, the candles will change color from red to green.

Both indicators (Breakout Trend and Buying/Selling Proxy) are available for free on TradingView.

TSLA: Anyone knows this pattern?TSLA:

Anyone knows this pattern?

Think contrarily to the market — seek opportunities in things that few people notice or pay attention to, and when you do, opportunities will come to you earlier than they do to the crowd.

.

US STOCKS- WALL STREET DREAM- LET'S THE MARKET SPEAK!

How We’ll Trade Earnings This Season Earnings season is almost here — and if you're with QS, you’re already holding the most powerful edge in the market.

Let me walk you through how QS trades earnings, why we built 💸earning-signal, and how you can use it most effectively this quarter.

---

📜 A Little History: The Birth of 💸earning-signal

When QS launched in early April, we started with just two short-term signals:

⏰0dte

📅weekly-options

Both focused on short-term options trades.

Then came TSLA earnings in late April. That’s when we launched our very first 💸earning-signal — and nailed the prediction.

Since then?

We’ve had one of the best earnings win streaks on the internet. Period.

📌 Don’t take my word for it — check:

#✅signal-recap for the track record

#🤑profits and #🤩member-testimonials for real wins from members

---

🤖 Why We Built a Separate Earnings Signal

Earnings are not regular trading days. The dynamics are completely different.

On normal days, a stock might move <1%

On earnings? 10–20% swings are common

This is what we call a “pivot event” — and it requires a different engine to predict.

That’s why we separated:

📅 #weekly-options → normal day-to-day setups

💸 #earning-signal → high-volatility earnings plays

---

🧠 How a Human Would Trade Earnings...

If you wanted to manually trade an earnings report, you’d need to analyze:

Past earnings reactions

Analyst expectations

Earnings call language

Financial statement surprises

Options IV & skew

Post-earnings stock behavior

This would take hours (or days) — and most retail traders don’t have time.

---

⚙️ How QS AI Does It Instead

We built 💸earning-signal to do all that work for you — and more.

✅ It pulls in all the data above

✅ Runs it through 5 top LLM models (each acts as an independent analyst)

✅ Aggregates their insights + calculates probability-weighted direction & strategy

✅ Uses fine-tuning to learn from its past prediction success/failures

This means: faster decisions, deeper insights, and better accuracy — every week.

We don’t just run predictions. We let the AI learn from past mistakes and self-improve each quarter.

---

💥 Results Speak for Themselves

Last season, we nailed:

TSLA

MSFT (10x–20x winners!)

NVDA

AAPL

And many more...

All based on this unique AI-driven earnings analysis stack.

This season?

We’re going harder, faster, and even smarter. 📈

🎯 The goal is clear:

Make 💸earning-signal the #1 earnings prediction system in the world.

---

🧩 Final Notes

Earnings are 10x harder to trade than regular days

But with QS, you’re equipped with 500x the speed and insight of an average trader

Upgrade if you haven’t yet: #💰upgrade-instructions

Earnings season kicks off next week

Let’s get it.

Let’s win big.

Let’s make season 2 of 💸earning-signal our most legendary yet. 🚀💸

Tesla earnings setup favours upsideTesla is scheduled to report its second-quarter results on Wednesday 23 July, after the New York close of trading. The company is forecast to report revenue of $22.8bn, representing a 10.5% year-on-year decline, with earnings expected to decrease 19% to $0.34 per share. Gross profit margins are also anticipated to contract by 2.3 percentage points to 16.4%, down from 18.7% last year.

Tesla does not provide traditional guidance but instead offers a business outlook. In its first-quarter release, the company noted difficulties in assessing the impact of shifting global trade policies and stated it would revisit its 2025 guidance during the second-quarter update. Consequently, investors will undoubtedly be focused on any insights regarding 2025 delivery forecasts, especially given the weak performance in the first half of 2025.

Given the current uncertainty, the market is pricing in a 7.5% rise or fall in the shares following the earnings release. Options positioning is relatively neutral, with only a slight bullish bias. However, there is significant support for the stock between $280 and $300, marked by substantial put gamma levels. Conversely, resistance from call gamma exists between $325 and $330. This setup suggests that it could be easier for the stock to rise rather than fall following the results.

The technical chart clearly illustrates this scenario, highlighting strong support around $290 that dates back to March. More recently, the shares have encountered resistance around the $330 mark. If Tesla can successfully break above this resistance, the stock could move towards approximately $360, while downside seems limited to around $290 to $300.

Written by Michael J. Kramer, founder of Mott Capital Management.

Disclaimer: CMC Markets is an execution-only service provider. The material (whether or not it states any opinions) is for general information purposes only and does not take into account your personal circumstances or objectives. Nothing in this material is (or should be considered to be) financial, investment or other advice on which reliance should be placed.

No opinion given in the material constitutes a recommendation by CMC Markets or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person. The material has not been prepared in accordance with legal requirements designed to promote the independence of investment research. Although we are not specifically prevented from dealing before providing this material, we do not seek to take advantage of the material prior to its dissemination.

TSLA Short Setup – Fading the July 7 Gap FillTSLA Short Setup – Fading the July 7 Gap Fill 📉

This short idea on TSLA builds off a key gap fill from Monday, July 7 , combined with a strong local volume profile and risk-reward alignment on the 15-minute chart.

Entry: $312.76

Stop Loss: $314.81 (above gap resistance and local high)

Target: $299.89 (gap base and volume shelf)

RR: ~6.3R

Why I'm shorting here:

TSLA has just filled the July 7 gap , which often acts as a technical resistance zone on retest.

Price stalled right as it completed the fill — with visible hesitation and selling pressure stepping in.

VRVP shows low liquidity above, suggesting diminished reward for upside continuation.

Below, there's a clean volume shelf around $294–$300 that could attract price if weakness confirms.

Trade Logic:

This is a classic fade-the-gap-fill setup, targeting the lower edge of the volume cluster for a potential bounce or reversal zone.

As always: size accordingly, stick to the stop, and don’t chase if the entry’s already gone.

Thoughts? Anyone else watching this gap level?

Tesla (TSLA) Market UpdateTesla NASDAQ:TSLA shares dropped nearly 7% after Elon Musk dismissed analyst Dan Ives' suggestion to scale back his political activities. Musk also proposed a new pay package, raising concerns among investors about potential distractions from Tesla’s core business.

📊 Upcoming Catalyst:

Tesla is set to report its Q2 earnings on July 23, with investors eagerly awaiting updates on the company’s financial performance and the newly launched robo-taxi service in Austin, Texas.

⚠️ Sentiment:

Recent bearish headlines include:

Concerns over potential Robotaxi issues

The ongoing Trump/Elon Musk political drama

📈 Trading Opportunity (Long Setup):

Despite the negative sentiment, this dip could offer a solid long entry opportunity:

Entry Zone: $275–$270

Take Profit Targets:

TP1: $315

TP2: $335

Stop Loss: Close below $265

TSLA Caught in Tug-of-War-TA for July 10TSLA Caught in Tug-of-War: Key Gamma & Price Action Setups Unfolding ⚠️

🔍 GEX (Gamma Exposure) Analysis:

Tesla’s options market is highly polarized heading into the week.

* Gamma Walls: Strong Call Wall near $304–$310, showing potential upside magnet if bulls regain control. Above this, the $317.5–$320 zone could trigger a gamma squeeze.

* Put Walls: The $288–$285 zone represents a heavily defended downside, marked by high negative NET GEX and multiple put walls.

* Current GEX Bias: Negative gamma regime persists, increasing potential for volatile moves and sharp directionality.

* IVX is elevated at 61.1, with IVR 17.4, suggesting the options market is pricing in moderate near-term volatility.

📈 Options Trade Ideas:

* Bullish Setup: Consider July 12/July 19 300c–310c debit spread if price confirms reclaim of $300, targeting a gamma squeeze toward $317.5–$320.

* Bearish Setup: If price breaks below $288, buy 285p–275p vertical or 295p straight puts, expecting continuation toward $280 and below.

🕒 1H Price Action Outlook:

Tesla remains stuck in a tight consolidation wedge, showing a battle between supply at $300–304 and demand near $288–290.

* Structure: Market formed a bullish BOS earlier this week but failed to extend higher. The latest CHoCH + rejection from $300 zone suggests sellers are still active.

* Range: Coiling inside a triangle formation with tightening price action. A breakout or breakdown is imminent.

* Demand Zone: The green liquidity block around $284–$288 has held firm so far.

* Trendlines: Price is being compressed between a descending trendline (supply) and ascending trendline (demand), signaling a make-or-break moment.

🎯 Intraday Trade Plan:

* Bullish Case:

* Entry: Above $300 with volume

* Target: $304 → $310 → $317

* Stop: Below $294

* Bearish Case:

* Entry: Breakdown below $288

* Target: $284 → $280

* Stop: Above $295

💭 Final Thoughts:

TSLA is in a pressure cooker. A breakout above $300 opens the door to gamma-driven upside, but continued compression or a loss of $288 support could trigger a fast liquidation. Monitor volume closely — this wedge is near resolution.

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage risk responsibly.

TSLA consolidation before expansionTesla despite being effected once again by fud is ready to pop. Average volume is up, a bear flag has played out, and oscillators reset. This 55 EMA on the weekly is a nice DCA zone. A bounce here or around 270 is likely. I think we see another try at 350 in coming weeks.

My plan:

Averaging down on TSLL, in CSP, already captured a few rounds of covered calls