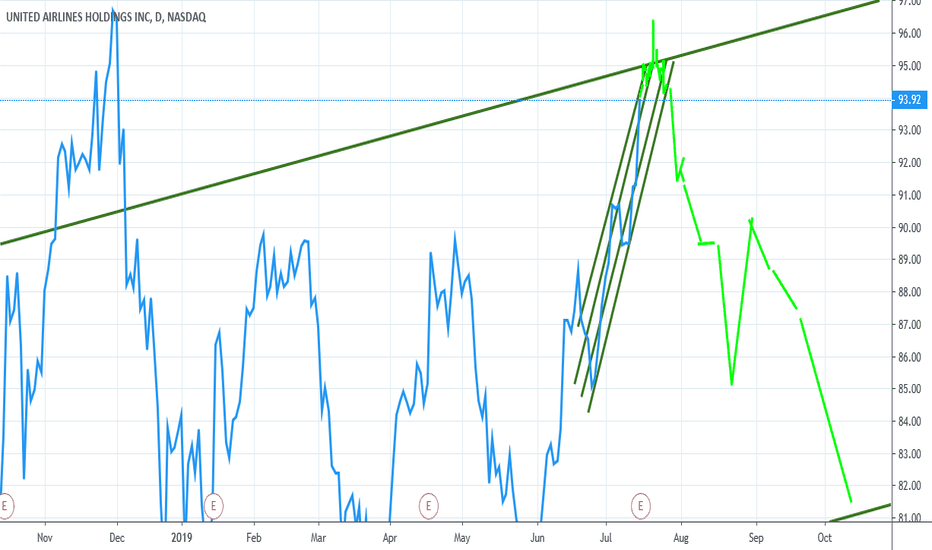

UAL (United Airlines Holdings), Time cycled trading!If you look at this time cycles you can see how we can predict the future using the past!

And we don't need to be an oracle to chose the Buy Zone place.

Push like if you think this is a useful idea!

Before to trade my ideas make your own analysis.

Write your comments and questions here!

Thanks for your support!

1UAL trade ideas

UALEarnings to be released later today. Expecting some volatility in price today moving into towards the last hour of the day. After Hours market will aid in determining what the outlook for united will be. With weakening indicators there is potential for continuing of the consolidation in the sideways trend,.

$UAL Trading a breakout in United Airlines. Entry level $88.50 = Target price $97.00 = Stop loss $87

Trading for the breakout on earnings tomorrow.

Stock is in a very tight range and the move should be quite frantic.

Indicators are bullish.

Fundamentals are strong, Fuel costs remain low and passenger demand increase.

Downside is limited.

BUY $UAL under $95 SELL $UAL over $95.25The chart speaks for itself. It's an inversion of United States broader market index movements (defensive sector rotation). As broader markets trend lower over the next week, UAL will continue a slow path upward and most likely over 95.50 for a moment. But just as the going seems to be good for $UAL, and as everything seems to be nosediving in broader SPY index, suddenly UAL will descend upon the lower ranks of well, lower. Probably 5 points lower, at least.

Clear pattern for UAL (United Continental) - Short or buy putsWe have one of the most prominent channeling patterns here in UAL. We also have global tensions in the Persian gulf leading to concerns about oil prices going higher. Taken altogether, now is a great time to buy some near the money put options for UAL. Perhaps the July 26 or August 2 87 strike puts.

United Continental Rallying on EarningsI've been watching the airlines to try to figure out where the big money players are stashing their aerospace investment dollars, and it looks like they're flocking to UAL after a 12.50% earnings surprise this morning. The stock rallied with a upward opening gap and the bulls held out over the day. The move is large enough to push up against and widen the top Bollinger band, and while the price is above the 52-wk average and the 20-day average is below the the 200-day which is below the 50-day, indicating that this is a minor inflection downward presenting a buying opportunity before the trend traces further to the upside.

MACD broke positive and held in the last two weeks, and this earnings rally is showing signs of establishing a longer running trend. RSI is just starting to peak near 70 since the mid-March low when the entire airline and aerospace industries took a beating following the Ethiopian 737 MAX crash. Volume is spiking but almost no short interest rise shows that the crowd isn't willing to bet against UAL's rally.

$UAL Not confident going into earnings tonight, nice short.Technically it is hard to be positive prior to UAL earnings report after the close. The chart has negative signal throughput, gaps needs filled, possible H&S formation, well defined downtrend resistance and a very defined drop on the Chaikin Money Flow. As a sector the transports have lagged the market and UAL looks like a definite short for us, with a stop lose above trend-line.