Stock's Uptrend of UniCredit is in the triangle HI,

UniCredit with its background which means take over or merge of Commerzbank has got a very good fire, fuel to move the its stock higher.

Stock passed all previous levels of resistance even we can think about the first stop on the level of price in field of 53 EUR. It would be incredible achievement.

Please look on the latest news that show that big players - investors are also on the field and are interested that shares have to become more expensive. Please add fact that it all the time is in the program of buyback of its shares.

UniCredit stocks are very interesting and has lot of potential to go higher and higher.

UCG trade ideas

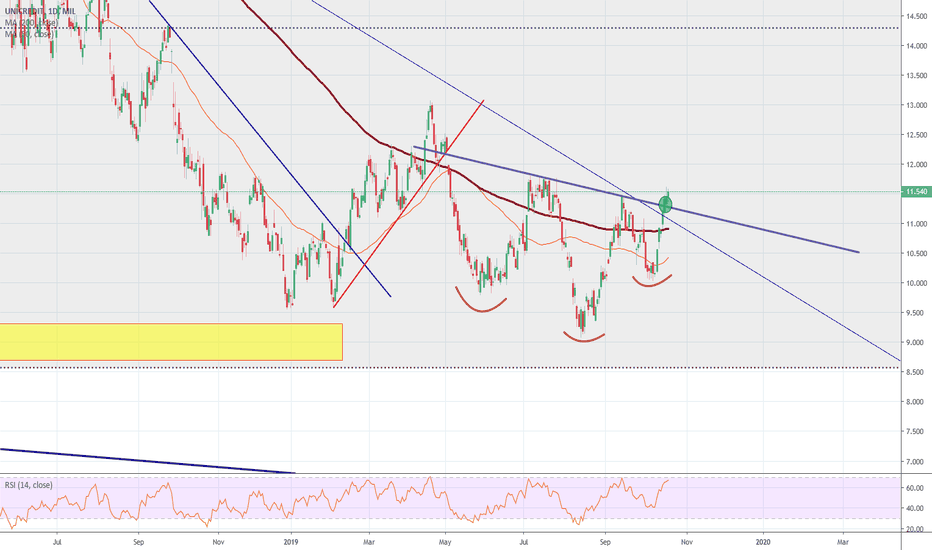

UCG Daily TimeframeSNIPER STRATEGY

This magical strategy works like a clock on almost any charts

Although I have to say it can’t predict pullbacks, so I do not suggest this strategy for leverage trading.

It will not give you the whole wave like any other strategy out there but it will give you huge part of the wave.

The best timeframe for this strategy is Daily, Weekly and Monthly however it can work any timeframe above three minutes.

Start believing in this strategy because it will reward believers with huge profit.

There is a lot more about this strategy.

It can predict and also it can give you almost exact buy or sell time on the spot.

I am developing it even more so stay tuned and start to follow me for more signals and forecasts.

6000 employees cut from UnicreditAnother bank, the same story "The Italian bank may lose as many as 10,000 staff in a new strategic plan." It just proves that the banking sector continues to suffer... only a few will survive. For that, they need to restructure and optimize the service.

UniCredit joins other large European banks slashing costs and reducing job numbers as they seek to adapt to low-interest rates that make it harder for lenders to increase revenue. Deutsche Bank AG plans to cut 18,000 positions in a sweeping overhaul, while Societe Generale SA in April announced plans to cut 1,600 jobs globally and exit capital-intensive businesses.

Sell: it's retesting the 12.800 resistanceThe 12.800 has being retested and with very little volumes going to that direction.

There's the potential for a sell-off. The ratio reward/risk it's pretty high since we are close to 12.800 and a good stop loss would be 12.900 - 13.000, while it could go down for much more.

Italian Bank problems?ECB President Mario Draghi and other EU authorities are telling Italian banks to sell their bad debts,

since it’s choking their balance sheets to give new loans to new business, and support economic growth.

The central bank insists it can solve the problem on its own.

But let’s put a bit of meat on the issue: A problem of 379 Billion Dollar is not going to disappear without a bit of stimulus spending.

UCG: possibile inversione rialziata a VDal grafico odierno a seguito delle ultime candele dei giorni precedenti si deduce una possibile inversione di tendenza multiday a V. Inversione anticipata dal MACD qualche giorno fa. Il trend puo' essere confermato con chiusura odierna al rialzo in area 16.75/ 16.90

A smooth short ahead for Unicredit A smooth sell opportunity with Unicredit Spa. Bollinger Bands are widening out, giving a clear signal for a short. Geopolitical tension is now favoring bears. As a general warning, it would a very bad idea to open long trades on major stocks with an investing eye. Longs should be done only for speculation and possibly intraday. I expect a huge crack worlwide. It seems we are getting closer day by day. Personally, I prefer shorting stocks in this moment.

New long entry suggested on raised volumesUnicredit seems to be a good opportunity to entry long in favor of trend.

A spike in volumes has pushed quotation higher. Such a volumes are a signal that it might be realistic to see a break-out above the horizontal resistance at 14.40, giving further fuel to the movement upwards.