GBPUSD1! trade ideas

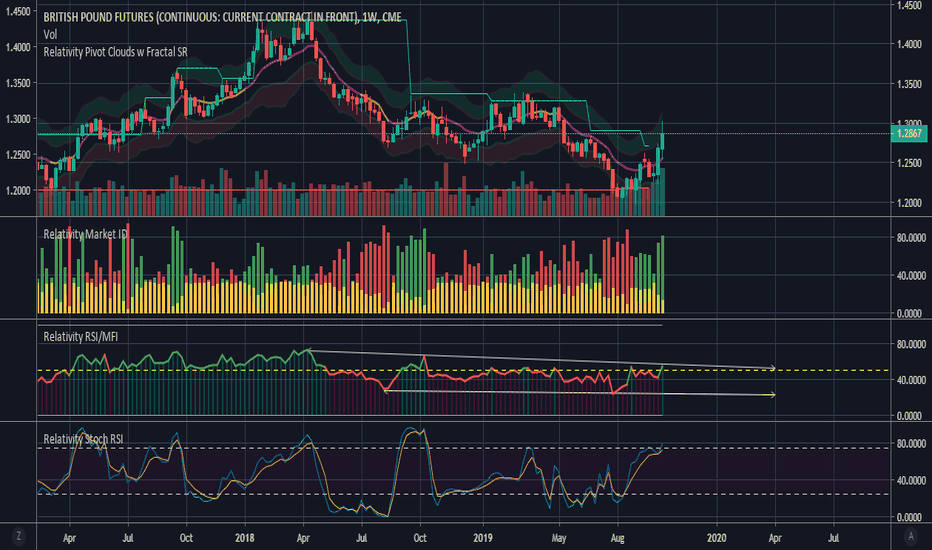

6B1! 0.382 fib retracement on the weekly - looking for a longAs the chart shows, pound futures have retraced 0.382 on the weeky chart. I am looking to see what price action will do here n the 4 hourly but would like to go long if the price can start to show some bullish momentum. Initial target would be the 1.3860 area

The Fed & BOEUS berencana mengurangi tariff produk dari china menjadi $100B (berita positif) sehingga berdampak pada keputusan the Fed yang berpotensi kuat untuk menahan suku bunga saat ini (market sudah price in).

BOE menghadapai ketidakpastian brexit dan sudah mendekati ke keputusan untuk dovish(normal).

Dari kedua kondisi tersebut, short GBPUSD lebih potensial.

BRITISH POUND : "Can't take my eyes off you."There are so many improvements to this instrument that I paused even when I saw the long signal.

Everyone's waiting for what British Pound gonna do.

I drafted the analysis three times and erased it.

I'm looking at the channel I drew on the RSI.

And on the one hand, I follow developments.

My opinion is neutral , despite positive signals in line with mixed developments.

Regards.