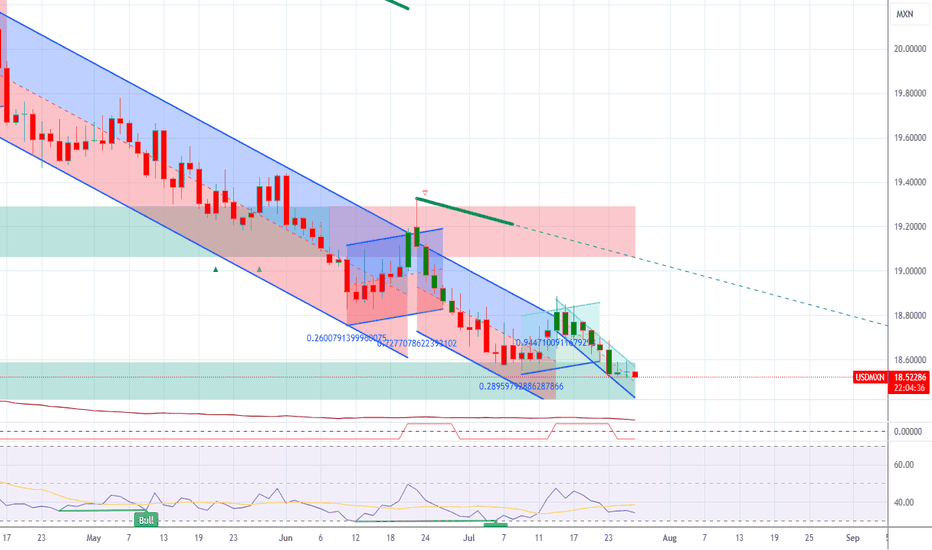

USD PESO- Support, Fib and other reasons LONGHello fellow traders!

Good news! good NEWS GOOOOOOD News for USA! here is the idea- support holding hence going for the 19.10-19.11 level of resistance Aldo the drop of the price seen well on a weekly/monthly chart hit the 0.5 fibs normally being reaction level and with a new trades and America is

Related currencies

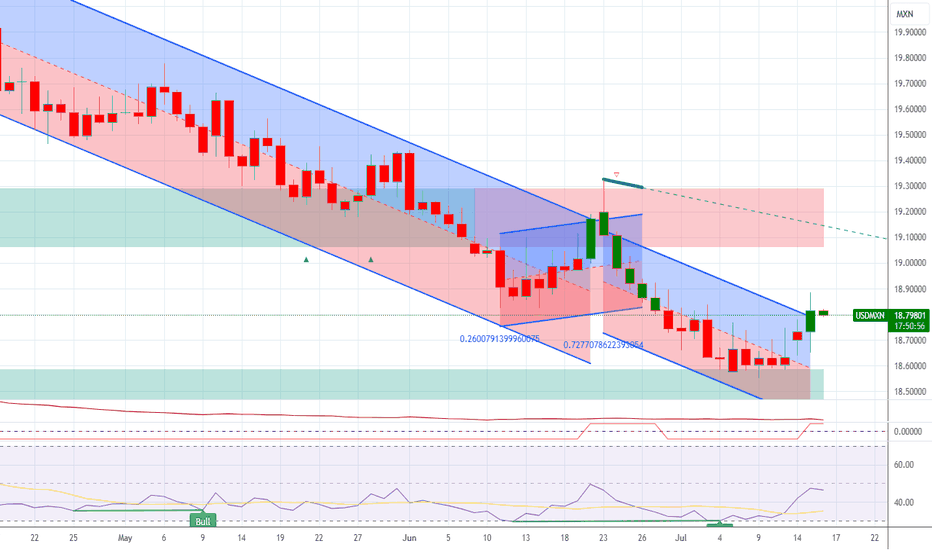

USD/MXN Bounces Back Ahead of August 2024 LowUSD/MXN appears to be bouncing back ahead of the August 2024 low (18.4291) as it extends the advance from the July low (18.5116), with the exchange rate trading above the 50-Day SMA (18.8993) for the first time since April.

USD/MXN trades to a fresh weekly high (18.9810) following the failed attemp

USD/MXN Defends Rebound from July LowUSD/MXN seems to be defending the rebound from the July low (18.5116) as it attempts to retrace the decline from earlier this week.

A breach above 18.7780 (50% Fibonacci retracement) may push USD/MXN toward the monthly high (18.9810), with a move/close above 19.3720 (38.2% Fibonacci retracement) op

USD/MXN: The Mexican Peso Starts a New Bullish Bias During the latest trading session, the Mexican peso has started to appreciate by nearly 1%, supported by short-term weakness in the U.S. dollar. For now, bearish pressure has begun to dominate the pair, mainly because the dollar is under pressure following signs that the Federal Reserve may consider

Mexico in a weaker bargaining power over USAI could be wrong but I think Mexico has a weaker bargaining power over US in the tariffs matter. As such, I would expect its currency to weaken against the USD sooner/faster than the Canadian dollars.

Day chart shows 20.83 resistance level - if this cannot be break up, then I expect it to falter a

See all ideas

Summarizing what the indicators are suggesting.

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Oscillators

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Summary

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Moving Averages

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current rate of MXNUSD is 0.053821 USD — it has increased by 0.19% in the past 24 hours. See more of MXNUSD rate dynamics on the detailed chart.

The value of the MXNUSD pair is quoted as 1 MXN per x USD. For example, if the pair is trading at 1.50, it means it takes 1.5 USD to buy 1 MXN.

The term volatility describes the risk related to the changes in an asset's value. MXNUSD has the volatility rating of 0.61%. Track all currencies' changes with our live Forex Heatmap and prepare for markets volatility.

The MXNUSD showed a 1.59% rise over the past week, the month change is a 0.29% rise, and over the last year it has increased by 1.56%. Track live rate changes on the MXNUSD chart.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Learn how you can make money on rate changes in numerous trading ideas created by our community.

Currencies are usually traded through forex brokers — choose the one that suits your needs and go ahead. You can trade MXNUSD right from TradingView charts — just log in to you broker account. Check out the list of our integrated brokers and find the best one for your needs and strategy.

When deciding to buy or sell currency one should keep in mind many factors including current geopolitical situation, interest rates, and other. But before plunging into a deep research, you can start with MXNUSD technical analysis. The technical rating for the pair is strong buy today, but don't forget that markets can be very unstable, so don't stop here. According to our 1 week rating the MXNUSD shows the buy signal, and 1 month rating is buy. See more of MXNUSD technicals for a more comprehensive analysis.