FKLI1! trade ideas

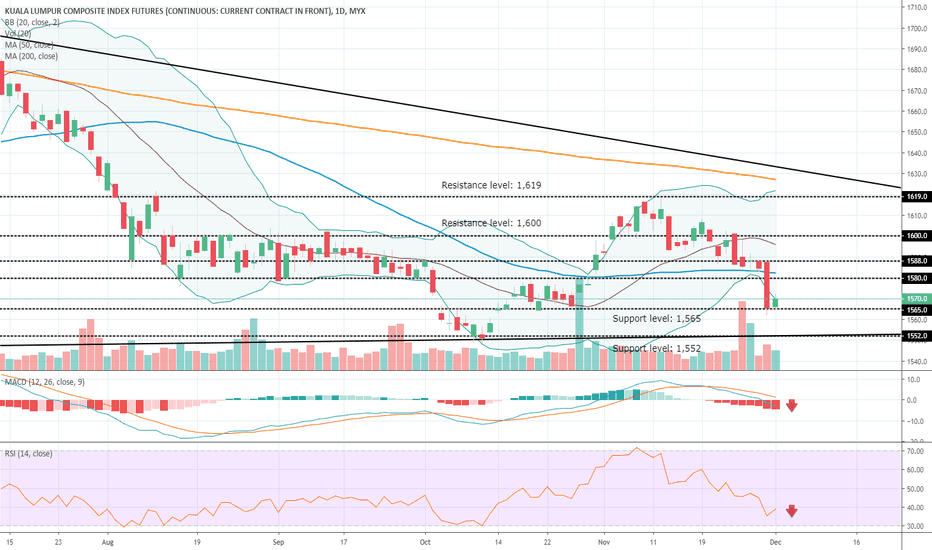

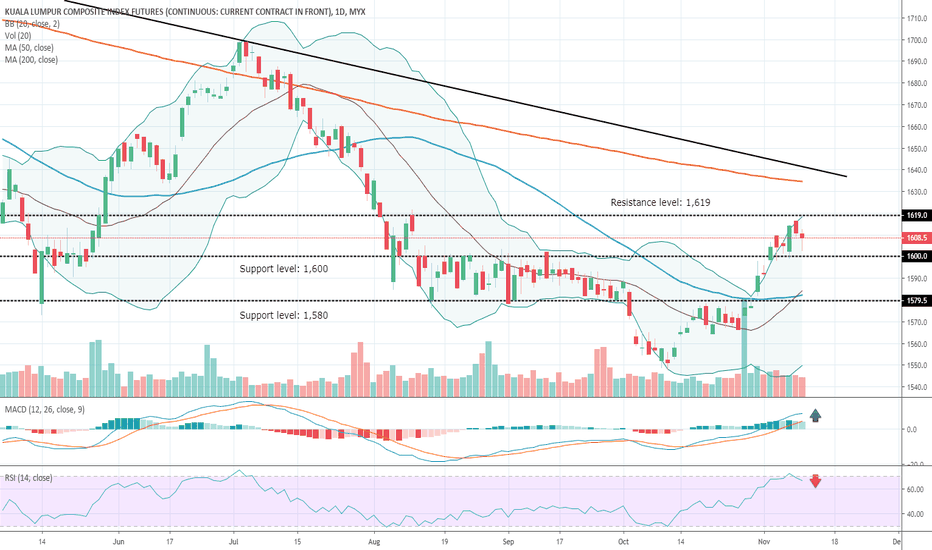

FKLI - Bearishness To Continue Amid of Weaker Global SentimentFKLI - Our index futures shall continue its downward trajectory after slipping down from symmetrical triangle formation, widening Bollinger Band and bearish crossover of Stochastic will lead the index way lower. Support level at 1,530; resistance level at 1,580

FKLI - Still Testing Crucial Support LevelFKLI - Our index future is still testing important support level at 1,580. Bollinger Band is narrowing which signals the index is seeking new direction. If it breaks below this important support, it will form bearish breakout from symmetrical triangle which is shall unleash stronger downside. RSI remains weak, no sign of recovery. Support again, is at 1,530

Direction for FKLI FKLI - Daily chart indicates the index still plagued by weak tone, resistance is strong at 1,600 as we can see attempts to break above this level is proven hard. Downward sloping RSI & softer MACD shall drag the index lower. And there's another risk hovering, the index may risk falling below the pennant formation which will continue to lead further bearishness to unfold. We maintain our bearish view, coming support should be observable at 1,530