FSOY1! trade ideas

SOYBEAN OIL FUTURES (MAR 2019), 1D, CBOTTrading Signal

Short Position (EP) : 30.62

Stop Loss (SL) : 30.91

Take Profit (TP) : 30.04

Description

ZSH2019 formed Double Repo Sell at 1d time frame. Trade setup with Sell Limit at 0.382 Level (30.62) and place stop after 0.618 level (30.91). Once the position was hit, place take profit before an agreement (30.04)

Money Management

Money in portfolio : $1,000,000

Risk Management (1%) : $10,000

Position Sizing

$0.01 = +-$ 6.00/std-contract

Commission fee = -$5.64/contract (Standard)

EP to SL = $0.29 = -$174

Contract size to open = 57 standard contracts

EP to TP = $0.58 = +$348

Expected Result

Commission Fee = -$321.48

Loss = -$9,918

Gain = +$19,836

Risk/Reward Ratio = 1.91

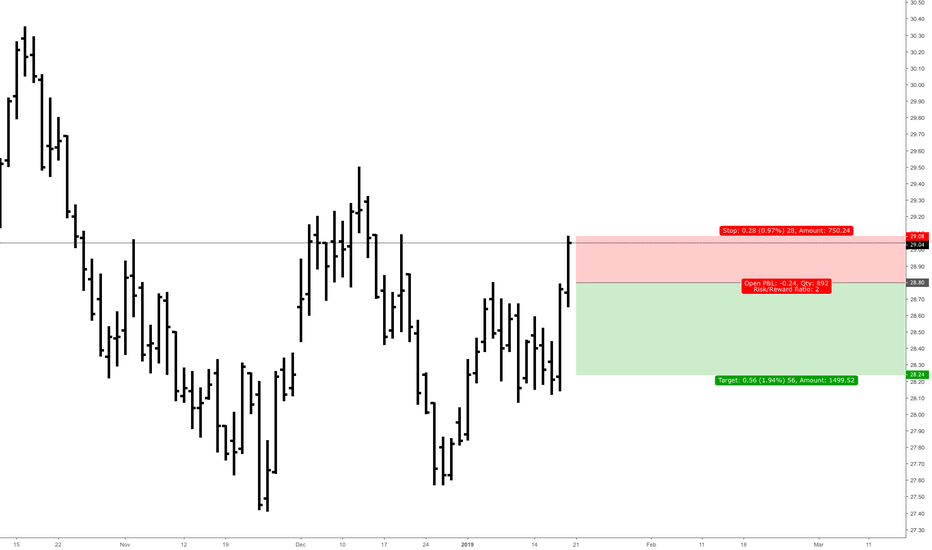

SOYBEAN OIL FUTURES (MAR 2019), 1D, CBOTTrading Signal

Short Position (EP) : 28.8

Stop Loss (SL) : 29.08

Take Profit (TP) : 28.24

Description

ZLH2019 formed Turtle Soup Sell at 1d time frame. Trade setup with Sell Limit at 0.382 Level (28.8) and place stop after 0.618 level (29.08). Once the position was hit, place take profit before an agreement (28.24)

Money Management

Money in portfolio : $280,000

Risk Management (1%) : $2,800

Position Sizing

$0.01 = +-$ 6.00/std-contract

Commission fee = -$5.64/contract (Standard)

EP to SL = $0.28 = -$168

Contract size to open = 16 standard contracts

EP to TP = $0.56 = +$336

Expected Result

Commission Fee = -$90.24

Loss = -$2,688

Gain = +$5,376

Risk/Reward Ratio = 1.9

Kathy Lien Double Bollinger Band Strategy.As per Kathy Lien's Double Bollinger Band Strategy, here we can see a short opportunity as the price action has broken and closed below the 20 day, 1 standard deviation band. We take the open, or as i do the low of the previous close plus 1 tick for a short sell stop order.

Initial stop loss once in the trade is 1 tick about the 15 day simple MA and I aim for a profit target of 1.6 times entry and stop loss difference.

Targest hit. Wait for confirmation on breakout points.Both TP = 30.14 and 29.44 hit as the previous bearish Channel aggressively broke earlier and met the targets much earlier than I expected. Soybean Oil has now entered a new Channel Down on 1D, which is coming off a Lower High (hence Highs/Lows = 0, RSI = 51.334). We now need to wait for confirmation from the two break-out points (illustrated by the circles). If the upper point breaks then we will go long (TP = 28.99 and 29.44). If the lower point breaks then we will go short (TP = 26.51).

SOYBEAN OIL FUTURES, 1D, CBOTTrading Signal

Short Position (EP) : 28.72

Stop Loss (SL) : 28.98

Take Profit (TP) : 27.92, 27.43

Description

ZL formed Double Repo Sell at 1d time frame. Trade setup with Sell Limit at 0.382 Level (28.72) and place stop after 0.618 level (28.98). Once the position was hit, place take profit before an agreement (27.92) and 27.43

Money Management

Money in portfolio : $150000

Risk Management (1%) : $1500

Position Sizing

$0.01 = +-$ 6.00 (Standard)

Commission fee = -$2.82/contract (Standard)

EP to SL = $0.26 = -$156/contract (STD)

Contract size to open = 9 standard contracts

EP to TP#1 = $0.8 = +$480 (STD)

EP to TP#2 = $1.29 = +$774 (STD)

Expected Result

Commission Fee = -$50.76

Loss = -$1404

Gain#1 = +$2400

Gain#2 = +$3096

Total Gain = +$5496

Risk/Reward Ratio = 3.78

Soybean Oil (ZL): Monthly EW CountIt is already 10 years since commodities super cycle took commodity markets to the all time high and soybean oil (ZL) market has been in the corrective period ever since. In a monthly chart, we could see that the correction of larger degree takes in the form of flat correction (3-3-5). As far as supply and demand (SnD) is concerned, there are 2 demand zones of interests

1. demand zone #1 (23.46 - 25.34)

2. demand zone #2 (18.83 - 20.84)

Technically, wave (3) of V of C is currently developing and could extend its tail to 24.00 level or below. With the trade war between the USA and China is on the brink of being fully developed, the market dipping to the 19.00 level is not really a far fetched projection.