Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.015 MYR

63.67 M MYR

1.65 B MYR

2.10 B

About MALAYSIAN RESOURCES CORPORATION BERHAD

Sector

Industry

CEO

Mohamad Imran bin Mohamad Salim

Website

Headquarters

Kuala Lumpur

Founded

1968

ISIN

MYL1651OO008

FIGI

BBG000BF6DX2

Malaysian Resources Corp. Bhd. is an investment holding company, which engages in property development, property investment, engineering and construction related activities, environmental engineering and provision of management services to its subsidiaries. It operates through the following segments: Property Development and Investment; Engineering, Construction, and Environment; Facilities Management and Parking; and Others. The Property development & investment segment involves MRCB Land's property developments which provides high rise office towers, transportation hub, retail assets, hotels, luxury residential, and commercial properties. The Engineering, Construction & Environment segment engages in the engineering, procurement and construction services for green office buildings, retail mall, residential buildings, infrastructure improvement and beautification of its surrounding areas, and also develops high voltage transmission projects. The Facilities Management and Parking segment provides security services at transportation hubs, high profile commercial and residential complexes. The company was founded on August 21, 1968 and is headquartered in Kuala Lumpur, Malaysia.

Related stocks

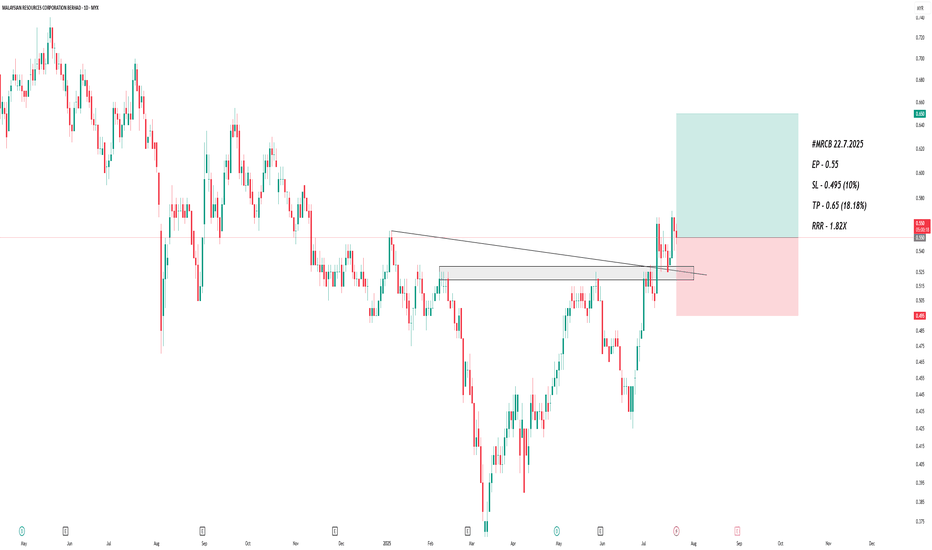

MRCB - Require an aggressive bullish momentum.N wave with E, V, N & NT projection. Currently price and Chikou Span still below Tenkan Sen, Kijun Sen & down Kumo, considering the market still in bearish position. Require an aggressive bullish momentum to push the price upward with Tenkan Sen as an immediate resistance. if the price breaks above

[MRCB]: Riding the construction wavePrice has tested resistance formed since September 2023 with some low volume selling on 9.1.2024.

Long & short term moving averages have aligned.

MACD shows bullish momentum.

Between Oct to Nov 2023, prices have tested support with low volume as well as two shakeouts.

Wyckoff accumulation patter

MRCB, AlgoSignal reveals potential uptrendFeb 19

Several indicators within my algorithmic system are signaling a potential uptrend. These include:

- Increased volume: Activity is picking up, suggesting growing interest and potential momentum.

- Mid- to long-term uptrend: Both the 50-day and 150-day exponential moving averages are pointing u

MRCB. AlgoSignal reveals potential uptrendSeveral indicators within my algorithmic system are signaling a potential uptrend. These include:

- Increased volume: Activity is picking up, suggesting growing interest and potential momentum.

- Mid- to long-term uptrend: Both the 50-day and 150-day exponential moving averages are pointing upward,

MRCB Breakout From DT Line - Good Price to EntryThis undervalued construction and property player in Malaysia, MRCB has shown good performance recently. Pullback from the 52Wk high at 0.705, the price now stabilize around 0.56 to 0.59.

The intrinsic value for Malaysian Resources Corporation Berhad is RM9.91 based on Discounted Cash Flow Valuatio

MRCB... protect downside?I didn't hold any position in this counter.

If I do, wil choose to take profit / protect the downside.

Base on day chart, it seems like will pullback.

We cannot control how much we win. But we can control how much we lose. Focus on what you can control!

Disclaimer: Mentioned stocks are solely ba

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of MRCB is 0.550 MYR — it has increased by 2.80% in the past 24 hours. Watch MALAYSIAN RESOURCES CORPORATION BERHAD stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on MYX exchange MALAYSIAN RESOURCES CORPORATION BERHAD stocks are traded under the ticker MRCB.

MRCB stock has risen by 0.92% compared to the previous week, the month change is a 5.77% rise, over the last year MALAYSIAN RESOURCES CORPORATION BERHAD has showed a −12.00% decrease.

We've gathered analysts' opinions on MALAYSIAN RESOURCES CORPORATION BERHAD future price: according to them, MRCB price has a max estimate of 0.67 MYR and a min estimate of 0.45 MYR. Watch MRCB chart and read a more detailed MALAYSIAN RESOURCES CORPORATION BERHAD stock forecast: see what analysts think of MALAYSIAN RESOURCES CORPORATION BERHAD and suggest that you do with its stocks.

MRCB reached its all-time high on Jul 26, 2007 with the price of 2.635 MYR, and its all-time low was 0.280 MYR and was reached on Mar 19, 2020. View more price dynamics on MRCB chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MRCB stock is 4.67% volatile and has beta coefficient of 1.57. Track MALAYSIAN RESOURCES CORPORATION BERHAD stock price on the chart and check out the list of the most volatile stocks — is MALAYSIAN RESOURCES CORPORATION BERHAD there?

Today MALAYSIAN RESOURCES CORPORATION BERHAD has the market capitalization of 2.39 B, it has decreased by −2.78% over the last week.

Yes, you can track MALAYSIAN RESOURCES CORPORATION BERHAD financials in yearly and quarterly reports right on TradingView.

MALAYSIAN RESOURCES CORPORATION BERHAD is going to release the next earnings report on Aug 29, 2025. Keep track of upcoming events with our Earnings Calendar.

MRCB net income for the last quarter is 8.59 M MYR, while the quarter before that showed 629.00 K MYR of net income which accounts for 1.27 K% change. Track more MALAYSIAN RESOURCES CORPORATION BERHAD financial stats to get the full picture.

Yes, MRCB dividends are paid annually. The last dividend per share was 0.01 MYR. As of today, Dividend Yield (TTM)% is 1.87%. Tracking MALAYSIAN RESOURCES CORPORATION BERHAD dividends might help you take more informed decisions.

MALAYSIAN RESOURCES CORPORATION BERHAD dividend yield was 1.90% in 2024, and payout ratio reached 70.42%. The year before the numbers were 2.25% and 44.25% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MALAYSIAN RESOURCES CORPORATION BERHAD EBITDA is 205.85 M MYR, and current EBITDA margin is 16.69%. See more stats in MALAYSIAN RESOURCES CORPORATION BERHAD financial statements.

Like other stocks, MRCB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MALAYSIAN RESOURCES CORPORATION BERHAD stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MALAYSIAN RESOURCES CORPORATION BERHAD technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MALAYSIAN RESOURCES CORPORATION BERHAD stock shows the buy signal. See more of MALAYSIAN RESOURCES CORPORATION BERHAD technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.