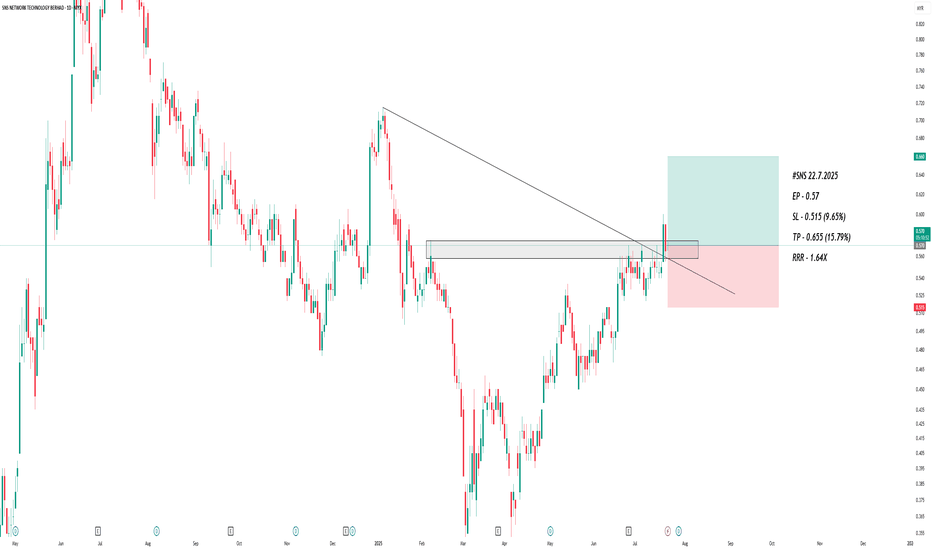

SNS trade ideas

SNS GOOD VOLUME AND MOMENTUM. 2 ENTRY PHASE WE WAITINGToday FORECAST on SNS

Opportunity for SNS. This setup is my trading idea/plan, if you want to follow: trade at your own risk (TAYOR).

Risk Factors:

1. Market conditions, unexpected news, or external events could impact the trade.

2. Always use risk management strategies to protect your capital.

SNSOur algorithm has identified potential upward signals in the current market. Increased trading volume and prices above the EMA20 and EMA50 suggest a possible upward trend.

💡Trading idea dan plan:

✅Entry: 0.545

🛑Stop Loss @SL: 0.445

🎯Target Price @TP1: 0.675

🎯Target Price @TP2: 0.775

🎉Target Price @TP3: 0.875

(This trading plan is for reference only and may vary based on your entry point and risk tolerance.)

Remember, trading strategies are just 10-20% of your overall success. The real key lies in effective risk management. Having a solid trading plan and proper position sizing are crucial for maintaining the right trading psychology. Master your risk management and stick to your plan.

Happy trading!

SNSThe current point exhibits upward signals according to my algorithmic system, meeting various criteria. These include rising trading volume, an upward trend indicated by prices above EMA20 and EMA50, and the closing price surpassing VWAP. As a result, the present conditions suggest a potential upward trend.

SNS; Uptrend based on AlgoSignal StrategyThe current point exhibits promising upward signals according to my algorithmic system, meeting various criteria. These include rising trading volume, an upward trend indicated by prices above EMA20 and EMA50, and the closing price surpassing VWAP. As a result, the present conditions suggest a potential upward trend.

SNS still downtrend ATM >> 0225 as current strong support.

>> An OS counters, regards base on weekly or daily time frame.

>> Price below Hull MA, not a good sign to entry.

∆ OS may continue OS.

When the market moves where, and how, and if - these are all unknown. The only thing which we can control is our risk. Focus on risk management!

Keep the long term vision.

Disclaimer: Mentioned stocks are solely based on own opinions for education and/or discussion purpose only. There's no buy and/or sell recommendation. Trading involve financial risk on your own. The author shall not be responsible for any losses or lost profits resulting from investment decisions based on the use of the information contained herein.