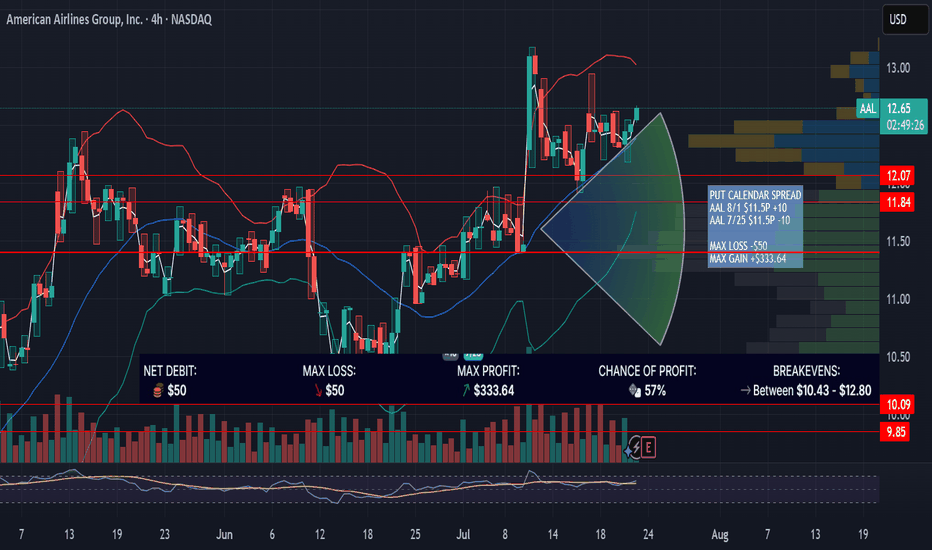

AAL PUT CALENDAR SPREAD / EARNINGSAAL is up 11% since 7/9/25 with a gap up riding on earnings of its competitor DAL. AAL earnings are in the morning on 7/24/25. Looking for a "sell the news" event with a good risk/reward options trade. This trade is designed for price to settle near the high volume node at $11.50 near expiration on

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.86 USD

846.00 M USD

54.21 B USD

649.72 M

About American Airlines Group, Inc.

Sector

Industry

CEO

Robert D. Isom

Website

Headquarters

Fort Worth

Founded

2013

FIGI

BBG005P7Q881

American Airlines Group, Inc. is a holding company, which engages in the operation of a network carrier through its principal wholly owned mainline operating subsidiary, American. The firm offers air transportation for passengers and cargo. It operates through the following geographical segments: Domestic, Latin America, Atlantic, and Pacific. The company was founded on December 9, 2013, and is headquartered in Fort Worth, TX.

Related stocks

$AAL – Turbulence Over? Prepping for Altitude Reclaim (13.76+ Ta✈️ 📅 Date: July 3, 2025 | 🧠 Source: VolanX Hybrid Predictor + SMC Confluence

📍 WaverVanir International LLC

🧭 Macro Backdrop

Fed on Pause, Dollar Cooling → Creates tailwinds for airlines by lowering hedging costs and boosting consumer demand.

Jet Fuel Prices Stable → Crude hovering under $85 keeps

American Airlines Stock Chart Fibonacci Analysis 061625Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 10.6/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E

American Airlines Group Inc.Key arguments in support of the idea.

International routes continue to show strong demand. While the U.S. domestic market is facing challenges—especially in the low-cost carrier (LCC) segment—the company is capitalizing on inbound foreign tourism. However, it's worth noting that the U.S. Travel

AAL in a massive Weekly Demand! OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can c

AAL American Airlines Group Options Ahead of EarningsIf you haven`t bought the dip on AAL:

Now analyzing the options chain and the chart patterns of AAL American Airlinesprior to the earnings report this week,

I would consider purchasing the 9usd strike price Puts with

an expiration date of 2025-5-2,

for a premium of approximately $0.44.

If these op

Looking

I. Company Overview

American Airlines (NASDAQ: AAL) is one of the largest legacy carriers in the U.S. and globally, operating thousands of daily flights across a vast domestic and international network. It’s a key player in the post-pandemic recovery of the airline industry, though burdened by hig

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

USU02413AJ8

AMERN AIRL. 23/29 REGSYield to maturity

7.11%

Maturity date

May 15, 2029

US23771T32

AMERN AIRL. 23/28 144AYield to maturity

6.59%

Maturity date

Feb 15, 2028

USU02413AH2

AMERN AIRL. 23/28 REGSYield to maturity

6.36%

Maturity date

Feb 15, 2028

AAL4327177

American Airlines, Inc. 4.1% 15-JAN-2028Yield to maturity

6.21%

Maturity date

Jan 15, 2028

AAL4867591

American Airlines, Inc. 3.85% 15-FEB-2028Yield to maturity

6.09%

Maturity date

Feb 15, 2028

USG0R209AB6

AADVANTAG/AA 21/29 REGSYield to maturity

5.87%

Maturity date

Apr 20, 2029

USG0R209AA8

AADVANTAG/AA 21/26 REGSYield to maturity

5.64%

Maturity date

Apr 20, 2026

AAL4867590

American Airlines, Inc. 3.5% 15-FEB-2032Yield to maturity

5.47%

Maturity date

Feb 15, 2032

AAL4526208

American Airlines, Inc. 3.6% 15-OCT-2029Yield to maturity

5.19%

Maturity date

Oct 15, 2029

AAL5291551

American Airlines, Inc. 3.95% 11-JUL-2030Yield to maturity

5.06%

Maturity date

Jul 11, 2030

AAL4526209

American Airlines, Inc. 3.35% 15-OCT-2029Yield to maturity

4.83%

Maturity date

Oct 15, 2029

See all AAL bonds

Curated watchlists where AAL is featured.

Frequently Asked Questions

The current price of AAL is 11.50 USD — it has increased by 0.35% in the past 24 hours. Watch American Airlines Group, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange American Airlines Group, Inc. stocks are traded under the ticker AAL.

AAL stock has fallen by −8.15% compared to the previous week, the month change is a 0.61% rise, over the last year American Airlines Group, Inc. has showed a 15.93% increase.

We've gathered analysts' opinions on American Airlines Group, Inc. future price: according to them, AAL price has a max estimate of 20.00 USD and a min estimate of 8.00 USD. Watch AAL chart and read a more detailed American Airlines Group, Inc. stock forecast: see what analysts think of American Airlines Group, Inc. and suggest that you do with its stocks.

AAL stock is 2.09% volatile and has beta coefficient of 1.04. Track American Airlines Group, Inc. stock price on the chart and check out the list of the most volatile stocks — is American Airlines Group, Inc. there?

Today American Airlines Group, Inc. has the market capitalization of 7.59 B, it has decreased by −5.18% over the last week.

Yes, you can track American Airlines Group, Inc. financials in yearly and quarterly reports right on TradingView.

American Airlines Group, Inc. is going to release the next earnings report on Oct 16, 2025. Keep track of upcoming events with our Earnings Calendar.

AAL earnings for the last quarter are 0.95 USD per share, whereas the estimation was 0.78 USD resulting in a 21.78% surprise. The estimated earnings for the next quarter are −0.11 USD per share. See more details about American Airlines Group, Inc. earnings.

American Airlines Group, Inc. revenue for the last quarter amounts to 14.39 B USD, despite the estimated figure of 14.29 B USD. In the next quarter, revenue is expected to reach 13.71 B USD.

AAL net income for the last quarter is 599.00 M USD, while the quarter before that showed −473.00 M USD of net income which accounts for 226.64% change. Track more American Airlines Group, Inc. financial stats to get the full picture.

American Airlines Group, Inc. dividend yield was 0.00% in 2024, and payout ratio reached 0.00%. The year before the numbers were 0.00% and 0.00% correspondingly. See high-dividend stocks and find more opportunities for your portfolio.

As of Jul 26, 2025, the company has 133.3 K employees. See our rating of the largest employees — is American Airlines Group, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. American Airlines Group, Inc. EBITDA is 4.75 B USD, and current EBITDA margin is 9.56%. See more stats in American Airlines Group, Inc. financial statements.

Like other stocks, AAL shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade American Airlines Group, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So American Airlines Group, Inc. technincal analysis shows the sell today, and its 1 week rating is sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating American Airlines Group, Inc. stock shows the sell signal. See more of American Airlines Group, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.