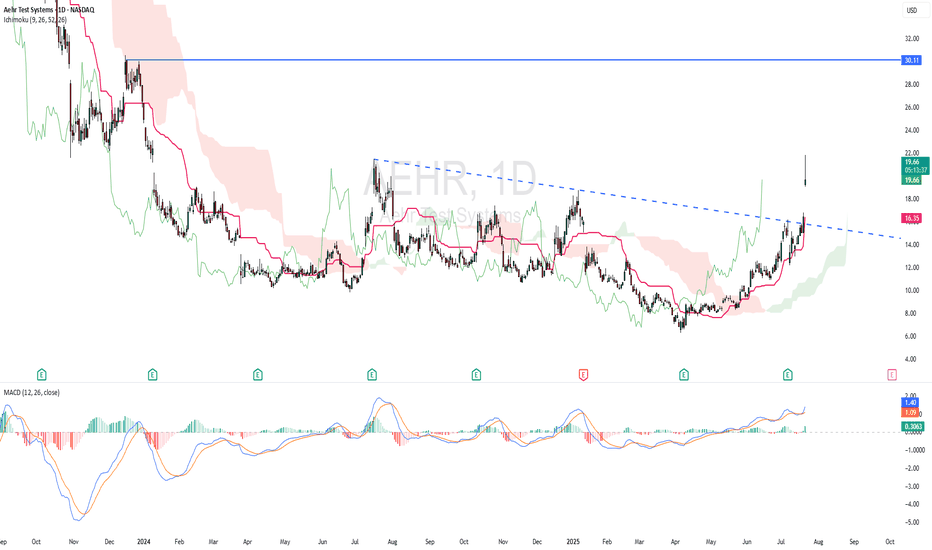

AEHR watch $15.99-16.27: Major Resistance may give a Dip BuyAEHR has been flying high with the general market.

Approaching a significant resistance into $16 round.

$15.99-16.27 is the exact zone of concern up here.

.

Previous analysis that caught the BreakOut:

===============================================

.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.13 USD

−3.91 M USD

58.97 M USD

27.73 M

About Aehr Test Systems

Sector

Industry

CEO

Gayn Erickson

Website

Headquarters

Fremont

Founded

1977

FIGI

BBG000BWM083

Aehr Test Systems engages in the design, manufacture, market, and sale of test and burn-in equipment used in the semiconductor industry. Its products include FOX-XP, FOX-NP, and FOX-CP wafer contact parallel test and burn-in systems, the WaferPak full wafer contactor, the DiePak Carrier, the WaferPak Aligner, the DiePak Autoloader, and test fixtures. The company was founded by Rhea J. Posedel on May 25, 1977 and is headquartered in Fremont, CA.

Related stocks

AEHR - RISING WINDOWTechnically AEHR is bullish as the stock made a strong rising window. Based on ICHIMOKU CLOUD, price is above cloud and chikou span is above candlestick - indicating bullish scenario. Kijun Sen is rising. MACD indicator showing bullish momentum.

ENTRY PRICE : 19.30 - 19.70

TARGET : 30.00 (potential

100% run up into earningsChance to get hot with semis if SPX can claim above 5950

High $8 for buying until we lose the 50MA.

Break above 12 with strength/volume will be key for continuation to 20.

Price-To-Earnings ratio (12.6x) is below the US market (17.8x) *

Revenue is forecast to grow 17.78% per year *

Earnings grew

Divergent structure, could lead to early trend reversal.This one just hit my radar, and here’s how I plan to approach it:

$9 Break = Key Alert Level

This is the trigger zone. I’ve got a volume alert set at 35K to confirm there’s real interest backing the breakout. No volume? No dice.

Downside Risk:

If this fails to hold the Low Volume Node at $7.73, it

$AEHR Set to Report Q125 Financial Results Post-Market April 8thAehr Test Systems ( IG:NASDAQ : NASDAQ:AEHR ) will report its first-quarter fiscal 2025 financial results on April 8, 2025. The announcement will follow the market close and the earnings call will begin at 5:00 p.m. Eastern Time.

The upcoming report covers the fiscal quarter ending February 28th, 2

$NASDAQ:AEHR Breaking out of a triangle patternNASDAQ:AEHR is breaking out of a triangle pattern with positive news and earning coming.

Things to consider:

Earnings - Monday 1/13, they've been posting wins quarter after quarter, and I suspect this quarter will be no different. I'd expect a positive boost for the stock price.

News - They've

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of AEHR is 16.84 USD — it has decreased by −0.36% in the past 24 hours. Watch Aehr Test Systems stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Aehr Test Systems stocks are traded under the ticker AEHR.

AEHR stock has fallen by −20.57% compared to the previous week, the month change is a 15.74% rise, over the last year Aehr Test Systems has showed a −9.99% decrease.

We've gathered analysts' opinions on Aehr Test Systems future price: according to them, AEHR price has a max estimate of 17.00 USD and a min estimate of 16.00 USD. Watch AEHR chart and read a more detailed Aehr Test Systems stock forecast: see what analysts think of Aehr Test Systems and suggest that you do with its stocks.

AEHR reached its all-time high on Aug 1, 2023 with the price of 54.10 USD, and its all-time low was 0.40 USD and was reached on Nov 22, 2011. View more price dynamics on AEHR chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

AEHR stock is 8.22% volatile and has beta coefficient of 1.81. Track Aehr Test Systems stock price on the chart and check out the list of the most volatile stocks — is Aehr Test Systems there?

Today Aehr Test Systems has the market capitalization of 503.77 M, it has increased by 1.34% over the last week.

Yes, you can track Aehr Test Systems financials in yearly and quarterly reports right on TradingView.

Aehr Test Systems is going to release the next earnings report on Oct 2, 2025. Keep track of upcoming events with our Earnings Calendar.

AEHR earnings for the last quarter are −0.01 USD per share, whereas the estimation was −0.02 USD resulting in a 36.51% surprise. The estimated earnings for the next quarter are 0.00 USD per share. See more details about Aehr Test Systems earnings.

Aehr Test Systems revenue for the last quarter amounts to 14.10 M USD, despite the estimated figure of 14.80 M USD. In the next quarter, revenue is expected to reach 11.48 M USD.

AEHR net income for the last quarter is −2.90 M USD, while the quarter before that showed −643.00 K USD of net income which accounts for −350.86% change. Track more Aehr Test Systems financial stats to get the full picture.

No, AEHR doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 136 employees. See our rating of the largest employees — is Aehr Test Systems on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Aehr Test Systems EBITDA is −1.43 M USD, and current EBITDA margin is −1.57%. See more stats in Aehr Test Systems financial statements.

Like other stocks, AEHR shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Aehr Test Systems stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Aehr Test Systems technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Aehr Test Systems stock shows the buy signal. See more of Aehr Test Systems technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.