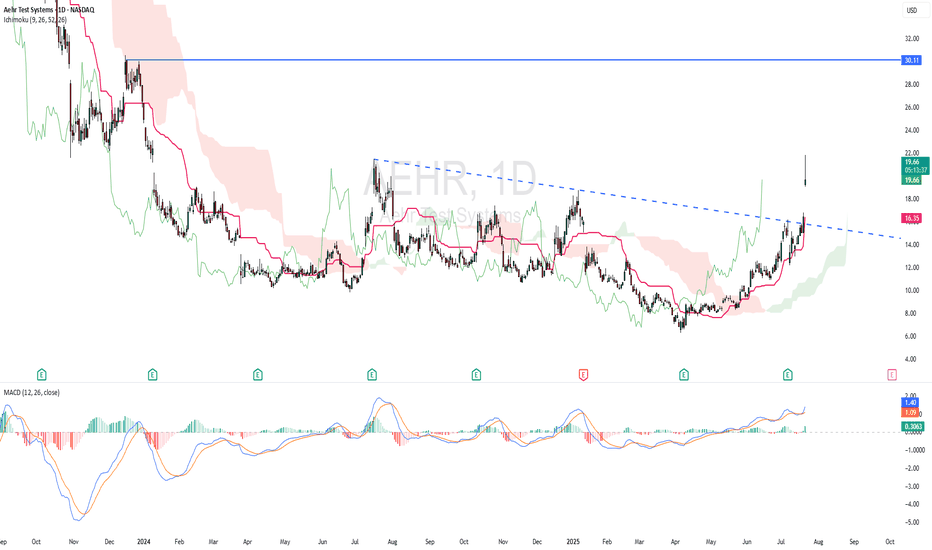

AEHR watch $15.99-16.27: Major Resistance may give a Dip BuyAEHR has been flying high with the general market.

Approaching a significant resistance into $16 round.

$15.99-16.27 is the exact zone of concern up here.

.

Previous analysis that caught the BreakOut:

===============================================

.

AEHR trade ideas

AEHR - RISING WINDOWTechnically AEHR is bullish as the stock made a strong rising window. Based on ICHIMOKU CLOUD, price is above cloud and chikou span is above candlestick - indicating bullish scenario. Kijun Sen is rising. MACD indicator showing bullish momentum.

ENTRY PRICE : 19.30 - 19.70

TARGET : 30.00 (potential almost 50% roi)

SUPPORT : 14.72

100% run up into earningsChance to get hot with semis if SPX can claim above 5950

High $8 for buying until we lose the 50MA.

Break above 12 with strength/volume will be key for continuation to 20.

Price-To-Earnings ratio (12.6x) is below the US market (17.8x) *

Revenue is forecast to grow 17.78% per year *

Earnings grew by 47.8% over the past year *

Short Interest 6.94M

Short Previous Month 7.16M

Short % of Shares Out 23.30%

Short % of Float 26.13%

Short Ratio (days to cover) 17.67

they will have tariff issues, so guidance is likely to bring uncertainties

Divergent structure, could lead to early trend reversal.This one just hit my radar, and here’s how I plan to approach it:

$9 Break = Key Alert Level

This is the trigger zone. I’ve got a volume alert set at 35K to confirm there’s real interest backing the breakout. No volume? No dice.

Downside Risk:

If this fails to hold the Low Volume Node at $7.73, it could flush to $7.15 support. That’s the next major demand zone, so know your risk before you size.

Fundamentals:

It’s not a crown jewel fundamentally but not trash either. The last quarter’s earnings +142% sales growth definitely caught my attention. That kind of spike can be a precursor to institutional interest — especially in low float names.

Relative Strength:

It’s got low RS, and the industry rank is 114, which means this name is swimming against the tide unless we get a sector-wide rotation into chips. I usually look for names in the top 40–50 industry ranks when hunting breakout setups or early leaders, but every cycle has its sleepers.

Float & Volatility:

Only 25M float, which is ripe for explosive moves if we catch early accumulation. But don’t forget: Beta = 2.11, so it's a whipsaw. Small position sizing is key.

Institutional Sponsorship is low, but not a terrible thing if you are looking to catch the wave early.

My Plan:

Start small near $8.88 and only add on strength through $9 with volume confirmation. If it can hold above and consolidate, I’ll consider scaling in — otherwise, I’m out.

Final Takeaway:

Not a "buy and forget" play — this is a technical setup first, fundamentals second. But if semis heat up, this could be a low-float sleeper that wakes up fast. Just respect the volatility and let the volume lead the way. Besides the ascending triangle, a will be looking for bullish patterns on smaller timeframes leading up to $8.88

Thank you for your time. Stay sharp & trade with intent,

OnePath

$AEHR Set to Report Q125 Financial Results Post-Market April 8thAehr Test Systems ( IG:NASDAQ : NASDAQ:AEHR ) will report its first-quarter fiscal 2025 financial results on April 8, 2025. The announcement will follow the market close and the earnings call will begin at 5:00 p.m. Eastern Time.

The upcoming report covers the fiscal quarter ending February 28th, 2025. Zacks Investment Research expects the company to post an EPS of $-0.02. This compares to an EPS of $-0.05 from the same quarter last year.

As of 3:35 p.m. EDT on April 7th, AEHR stock traded at $7.31, up $0.05(0.69%), with the price hovering above a key support level at $7.

Recent Financial Performance and Guidance

In July 2024, Aehr reported financial results for the fourth quarter and full fiscal year 2024.

For Q4 2024, revenue was $16.6 million, down from $22.3 million in Q4 2023. GAAP net income was $23.9 million or $0.81 per share. This included a tax benefit of $20.8 million. Non-GAAP net income was $24.7 million or $0.84 per share.

Bookings during the quarter totaled $4.0 million. The backlog stood at $7.3 million as of May 31, 2024. Effective backlog, including post-quarter orders, reached $20.8 million. For the full year 2024, Aehr recorded record revenue of $66.2 million. This was slightly higher than $65.0 million in 2023. GAAP net income for the year was $33.2 million or $1.12 per share. Non-GAAP net income reached $35.8 million or $1.21 per share.

Cash and cash equivalents were $49.2 million at the end of May 2024. This was an increase from $47.6 million at the end of February 2024. The company expects at least $70 million in revenue for fiscal 2025. It also projects a pre-tax profit of at least 10% of revenue.

Technical Analysis: Support at $7 Holds

AEHR stock is testing a crucial support zone at $7, a level that has shown buyer interest in the past. The stock is currently trading slightly above support as traders watch to see if it remains above this level after earnings.

A positive earnings report may offer more bull strength at the support and trigger a rebound. If the price rebounds, the next immediate target is a descending trendline resistance. The trendline has rejected prices to trade above it in recent months. This therefore acts as a strong point that will need positive market developments to break above.

However, if earnings disappoint and bearish pressure grows, the stock could fall below $7. A breakdown would however expose NASDAQ:AEHR to lower support zones and potential new lows.

$NASDAQ:AEHR Breaking out of a triangle patternNASDAQ:AEHR is breaking out of a triangle pattern with positive news and earning coming.

Things to consider:

Earnings - Monday 1/13, they've been posting wins quarter after quarter, and I suspect this quarter will be no different. I'd expect a positive boost for the stock price.

News - They've made recent announcement about new product offerings which will help increase their revenue stream. See:

www.tradingview.com

www.tradingview.com

Entry Point:

Current Price ~$17/$18

Stop Loss Target:

Since the stock appears to be in an upward trajectory, setting a close stop loss should be ok something like $15/16. That would mean the price starting dropping back below the breakout point.

Price Target:

$35.99

Back Story:

I have a love/hate relationship with AEHR, it was one of my first big wins in trading stocks - It was my first pennant pattern that I bought ~$6. I then continued taking profits and looking for new entry points. I bought low, sold high (rinse and repeat) and finally got burned by not selling when it hit ~$50's! Lesson learned... Stocks do come crashing down, take profits and accept losses.

AEHR - ready to blow?AEHR test systems is a highly volatile stock to trade. It can provide some excellent returns in the event we continue to this upwards move in the stock market. I believe AEHR is in a bottoming structure, we ended the 5th wave and now in a period of sideways consolidation. Preparing for a volatile move to the upside.

Within this period of sideways consolidation, we are seeing bullish signs. According to my Elliot Wave analysis, we are in a Power Flat - which is essentially a higher low (Wave B) and if we can maintain the point of control (red horizontal line at $11.50) we should rally up higher than Wave C.

This stock suits a risk on environment for several reasons. It is a small cap involved in the semiconductor industry, particularly known for its EV industry solutions. I expect this industry to receive a huge boost for a looser interest rate cycle.

I have enjoyed trading this stock before, if you look at my previous idea tagged. That was a very successful trade and I believe now may be a good time to think about going long again.

Do your own research, not financial advice.

AEHR systems has a good long trade set upAEHR systems has a strong weekly long set up. It has just started to break out. I will be accumulating at 14 and below as long as the stock maintains above the support level of $12.84.

My first profit target is at 28 dollars. This is a weekly chart so it will take some time to play out.

Upside Targets:

- Nearest upside target: $22.68 (56.5% above current price)

- Next step higher: $57.84 (155.2% above nearest target)

- Downside Targets:

- Nearest downside target: $13.47 (7.1% below current price)

- Next step lower: $10.80 (19.8% below nearest target)

- Watch for a breakout above the resistance level of $21.44 for a more bullish confirmation.

- Be cautious of a drop below $13.47, which could indicate a bearish reversal.

$AEHR - Trend reversal?Key Highlights:

Strong Support: Held firm at $11.50, showing resilience.

Volume Surge: Significant volume spike ahead of earnings.

Technical Indicators: Bounced off the 20-day moving average and reclaimed the 50EMA – bullish signals!

Key Highlights:

What’s Next?

Gap Up to $15: This will be the real test of strength.

Potential Run: Could see a rally to $20-$23 before any pullback.

My Take: This stock is showing promising signs. Keep an eye on it! 👀📈

Disclosure: I am long from 12.5

$AEHR - The ER playNASDAQ:AEHR has the potential for a descending wedge breakout. The company will be reporting earnings on October 10th. 👀

It is a small-cap stock with a 27.67 million share float, of which institutions hold 67%, and it has a 17% short interest. This means that if the company reports a strong quarter, a short squeeze could be a possibility.

The stock has formed a solid base and has been holding up above the Point of Control (POC), which could serve as a launch pad.

Targets:

$14.70

$16.58

$19.11

$23.97

As always, I share my opinions and trades. I am not suggesting that anyone follow my trades. You do you.

AEHR, has potential but could just be hot airA leverage play to the EV market.

Fundamentally the stars may align for this semiconductor business, as the EV market might be bottoming. The price looks weak, however, we are coming off lows and the selling volume has declined. Price needs to break above the 0.786 and move towards the golden pocket. I suspect it's the end of the corrective wave 5 and the start of an abc pattern back towards the upside. I'm waiting for a breakout above the Fib level first, as a sign of strength

AEHR Test Systems Options Ahead of EarningsIf you haven`t bought AEHR before the rally:

nor sold the Double Top:

Then analyzing the options chain and the chart patterns of AEHR Test Systems prior to the earnings report this week,

I would consider purchasing the 15usd strike price Calls with

an expiration date of 2024-7-19,

for a premium of approximately $0.98.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

AEHR has potential but could also just be hot airA leverage play to the EV market. Fundamentally the stars may align for this semiconductor business, as the EV market might be bottoming. The price looks weak, however, we are coming off lows and needs to break above the 0.786 and move towards the golden pocket. I suspect it’s the end of the corrective wave 5 and the start of an abc pattern back towards the upside. I’m waiting for a breakout above the Fib level first.

AEHR - LONGI've been tracking Aehr Test Systems, with the EV boom cooling off a bit in 2024, Aehr's facing a couple of headwinds, especially their heavy betting on ON Semiconductor for a massive chunk of their sales. Still, they're not just sitting around; they're actively broadening their customer list and staying vital in the EV manufacturing world. They're bracing for a bit of a slowdown in growth, but it's clear they see this as just a bump in the road, not the end of it. And with the stock price coming down to more earthy levels, it looks like a pretty good opportunity for us looking to get a piece of the EV action. I'm eyeing this stock, ready to jump on a .618 micro retracement, and then hoping to ride it up to around the $20 mark, Possibly even filling that January gap. Good Luck Friends!