ATAI trade ideas

ATAI weekly higher low set into continuationAnother big week for ATAI, Weekly higher low is set at 3.06 and 2.85 monthly breakout resistance was backtested as support in after hours. Friday saw the highest close in years. and we're watching an hourly equilibrium shape up for Monday morning, the break of which will let us know if we're going to see continuation of this push higher or if we will be looking for a healthy daily HL above 3.06.

S: 3.82, 3.66

R: 4.29, 4.52

ATAI bulls buy the dip on increasing bull volumeClose above daily EMA12, bulls aggressively bought the top above $3, the same price the sellers were stepping in over the last two weeks, speaking to demand outweighing supply at the present time. Bounce continuation is key into tomorrow as bulls want to create enough space to form a higher low above today's low 3.08 which is our most important short term support.

Support: 3.25, 3.20, 3.10, 3.08, 3.06

Resistance: 3.37, 3.48, 3.72, 4.00

ATAI bulls bounce hard from hourly oversoldATAI bulls bounced hard from the daily EMA12 at hourly oversold conditions, V-shape bounce into hew high of day with a close at the high. This is the highest close in well over 3 years! We haven't yet changed the hourly trend back to bullish, but we did end the downtrend. I got a lot of information from today's price action and tomorrow's price action will be equally important as well, as we will need to form an hourly higher low above today's low and change the hourly trend back to bullish.

I publish regular technical analysis of the shrooms sector, be sure to like and follow so you don't miss future updates!

ATAI sideways healthy consolidation. Will we see a pull back?Very healthy consolidation sideways holding the daily EMA5. Zooming into the hourly timeframe we see an hourly eq with supports at 4.04 and 4.01, and resistance up at 4.30 and 4.40

I publish regular technical analysis of the shrooms sector, be sure to like and follow so you don't miss future updates!

ATAI bulls confirm daily bullflagATAI bulls bought the dip for the third day in a row off of 3.31 support and V-shaped to a new high of day. As mentioned in previous videos we are now in a medium volume node so price can move through this area a bit more easily. Beware of short term extension, I wouldn't be a buyer up here but I see no reason to be a seller.

Support: 3.77, 3.75, 3.68, 3.31

Resistance: 3.90, 4.00, 4.08, 4.17, 4.52

ATAI bulls look primed for another leg upATAI gave us the highest close we've seen in nearly 3 years today as bulls closed at high of the day approaching resistances from the gap up on July 1st. Today saw 2x the volume traded yesterday which is a great sign when looking for daily continuation.

Anticipate resistance at 2.81. 3.00, 3.01, and weekly 200 SMA

Red flag from here would be to fail at 3.00 and reverse to break below 2.53.

ATAI bulls finally show upATAI closed the day with a bullish looking candle for the first time since daily consolidation started July 2. Big bounce on the hourly chart today but stopped just shy of two key short term hourly resistances 2.76 and 2.82. Tomorrow bulls want to see these levels taken out and an hourly uptrend regained in order to call 2.53 our new daly higher low.

A big bounce is nice but we MUST see 1) hourly resistance breaks and 2) hourly uptrends. So far, neither of these things have happened.

ATAI consolidating in a 4hr channelATAI has been consolidating sideways on the daily chart for the last 5 days, in a confined channel on the 4hr chart. The channel levels are denoted by yellow dotted lines. This consolidation remains constructive above the last weekly resistance at 2.64, denoted by the solid white line. There is a LOT of volume being traded here (check it out yourself using Volume Profile) which can potentially be a bearish P-shaped volume profile, so bulls want to see a strong push upwards towards $3.00 sooner rather than later. Still, the consolidation remains constructive at this point in time while the market digests the giant gap up and breakout on the back of readout July 1st.

Safe Entry Place ATAINote: Watch with 1h TF for better details.

Stock Current Movement Up.

Due to recent good news.

P.High Lines (Previous High) Consider as Strong Support.

Also My Beloved CAthie Wood BEST INVESTOR All Time (based on statics better than Warren Buffet Entire Histroy) Is BUYING!

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock:

On 15M TF when Marubozu Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu Candle, because price will always and always re-test the

Note: ATAI represents a compelling high-risk, high-reward opportunity.

ATAI breaks out of three year channel on massive volumeATAI had a big breakout last week on positive market reaction to news, and is trading at the highest levels in 3 years. This is the first monthly trend change in the history of this stock (and maybe even the psych sector!) and I'm anticipating this to continue playing out as hype slowly returns to the sector. this is a small cap and a little volume on this can go a long way. Entry: 2.15, stop loss 1.95

ATAI | High Risk/RewardATAI Life Sciences operates in the emerging psychedelic medicine sector, developing novel treatments for mental health disorders including depression, anxiety, and addiction. The company focuses on therapeutic applications of compounds like psilocybin and MDMA.

Technical Analysis:

The weekly chart reveals a compelling setup after an extended consolidation period around the $2.60 support zone.

Key observations:

• Long Base Formation: Price has held above critical support for over 18 months, building a solid foundation

• Breakout Potential: Recent price action shows signs of life above the consolidation range

• High Risk/Reward Setup: The path (pink arrow) shows massive upside potential targeting $10+ levels

Trade Setup:

• Entry Zone: Current levels around $2.60-$2.80

• Stop Loss: Below $2.00 (invalidation of base)

• Target: Initial target $6.00, extended target $10.00+

• Risk/Reward: Exceptional 4:1+ ratio

ATAI Life Sciences | ATAI | Long at $1.30ATAI Life Sciences NASDAQ:ATAI , a clinical-stage biopharmaceutical company aiming to transform the treatment of mental health disorders, is fast approaching my selected historical simple moving average (SMA). Often, but not always, the closer the price gets to this line, the higher chance there is for a fast upward move. In anticipation of this move, NASDAQ:ATAI is in a personal buy zone at $1.30.

A word of caution: this is a pure technical analysis play and this company is not expected to be profitable for many, many years...

Target #1 = $1.75

Target #2 = $2.50

Target #3 = $2.95

ATAI – Mental Health Biotech Flag | Momentum SetupWe’re watching NASDAQ:ATAI for a momentum breakout after reclaiming key levels with strong volume and clean structure. ATAI is a biotech player focused on psychedelic-assisted therapies, backed by institutional investors and a growing news cycle.

Setup Summary:

Sector: Biotech / Mental Health / Psychedelics

Market Cap: ~$440M

News Catalyst: Positive R&D outlook + analyst re-ratings

Analyst Target: $5.00 (→ +100 % from current levels)

Technical Picture (1D + 15min)

RSI breakout > 65, steady climb with no divergence

MACD crossover + histogram expansion

Flag/base forming between $2.15–$2.30

Holding above EMA9 & EMA20, with rising volume

Last high: $2.35 → breakout watch

Trade Levels:

Trigger Type Price

Entry Trigger $2.35+ with volume confirmation

TP1 $2.70

TP2 $3.00–$3.15

SL $2.10

Re-Entry $2.20–$2.23 (if pullback into flag zone)

Notes:

Float is manageable → breakout can scale

Not a news popper – pure technical + smart money structure

This one favors swing traders: hold 2–4 days if breakout holds

“Not every moonshot needs hype – some need structure and silence.”

Penny Stocks vs Forex: Advantages and ChallengesPenny Stocks vs Forex: Advantages and Challenges

Penny stocks and forex trading offer potential opportunities and challenges, appealing to traders with different goals and risk tolerances. This article explores how the speculative nature of penny stocks compares to the dynamic forex market, examining their key characteristics, risks, and potential rewards.

Understanding Forex Trading

Forex trading involves the exchange of currencies in a global, decentralised market.

What Is Forex Trading?

You already know what the forex market is. However, to make our article comprehensive, we should mention its unique characteristics.

Forex, or foreign exchange trading, is the process of buying and selling currency pairs to take advantage of changes in their relative values. It is the largest financial market in the world, with an average daily trading volume exceeding $7 trillion (as of April 2022). Unlike traditional stock markets, forex operates without a central exchange and functions 24 hours a day, five days a week, allowing traders from different time zones to participate.

Currencies are traded in pairs, such as EUR/USD or GBP/USD, where the value of one currency is quoted relative to another. Traders aim to take advantage of the market by speculating whether a currency pair's value will rise or fall based on market movements.

Where Are Currencies Traded?

Forex trading occurs in the over-the-counter (OTC) market, facilitated by a global network of banks, financial institutions, and individual traders. Trading takes place in three primary sessions: the Asian, European, and North American, ensuring a nearly continuous market.

The primary platforms for forex trading are electronic trading networks and broker-provided software. Retail traders often access the market through brokers offering leverage, enabling them to control larger positions with smaller capital. While leverage amplifies potential gains, it also increases the risk of significant losses.

Major Driving Factors and Risks

Forex prices are influenced by several key factors, including economic indicators, geopolitical events, and central bank policies. Economic reports like GDP growth, unemployment rates, and inflation can cause significant price swings. For instance, a strong employment report might boost the value of a country's currency, while political instability could weaken it.

Geopolitical events such as elections or conflicts can also lead to sudden volatility, making it difficult to analyse price movements. Central banks play a critical role, as interest rate changes or monetary policy shifts can strengthen or weaken a currency's appeal to investors.

The forex market is known for its liquidity, especially in major currency pairs like EUR/USD and GBP/USD. However, high liquidity does not eliminate risks. Forex trading involves exposure to leverage, meaning even small market movements can result in significant losses. Additionally, global economic uncertainty can create tricky market conditions, requiring traders to exercise caution and implement sound risk management strategies.

Understanding Penny Stocks

While looking for their best penny stocks to purchase, traders approach this segment with a balanced perspective and conduct thorough research.

What Is a Penny Stock?

The penny stock definition refers to shares of small-cap companies trading at a low price, typically below $5 per share. They distinguish themselves from larger stocks by their market capitalisation, which is usually below $250 or $300 million. Penny stocks today could be found in industries characterised by small, emerging enterprises, such as technology, biotechnology, renewable energy, mining, and pharmaceuticals, where companies seek capital investment to fund early-stage development and growth initiatives. Penny stocks are often associated with the term "Pink Sheets'', which originated from the practice of displaying price quotes for stocks traded over the counter on pink-coloured sheets of paper.

Where Are Penny Stocks Traded?

Like currency pairs, penny stocks can be found in the over-the-counter (OTC) market, which serves as a decentralised space where securities are traded directly by a network of market participants. It’s unlikely you will find them on large stock exchanges; however, there are exceptions. As companies traded in the OTC market are subject to less strict reporting requirements, it’s vital to be careful when choosing a platform for penny stock trading and investing.

The requirements for filing financial information to regulatory authorities play a crucial role in choosing a trading platform. Marketplaces such as OTCQX, within the OTC Market Group, attract companies committed to transparency and stringent disclosure standards. In contrast, the Pink market, which also operates within the OTC Market Group, is a less regulated tier, allowing securities to trade while complying with few financial standards.

Major Driving Factors and Risks

Penny stocks are highly sensitive to perceived opportunities for quick and substantial returns. Associated with small, less-established companies, for which financial data is often scarce, penny stock prices may surge unexpectedly on news about the company's progress, such as product launches, partnerships, and financial results.

Another significant consideration in penny stock trading is dilution. The number of outstanding shares may escalate due to mechanisms like employee stock options, share issuance for capital raising, and stock splits. When a company issues shares to secure capital, a common necessity for small enterprises, it often leads to a dilution of ownership percentages held by existing investors, which exerts downward pressure on the share price.

How Do Penny Stocks Compare to Forex?

Below, we discuss various aspects in which penny stocks and forex trading can be compared.

Risk Level

Penny stocks carry risks, primarily due to their potentially higher volatility, lower liquidity, and less availability of financial information. Prices can experience sharp fluctuations, particularly in the most volatile penny stocks often influenced by speculative trading or news events related to the issuing company. Penny stocks are usually less regulated than large-caps, which makes thorough research essential for investors and traders aiming to capitalise on price swings in these markets.

As with any financial market, the forex market presents risks. Currency fluctuations, driven by factors such as interest rates, inflation, and economic data releases, can lead to rapid market movements. Geopolitical events, including elections or conflicts, can further amplify volatility. Additionally, forex trading often involves leverage, which allows traders to control larger positions with relatively small capital. While this magnifies potential returns, it also increases the risk of substantial losses, making risk management critical in forex trading.

Potential Opportunities

Due to their low share prices, penny stocks could offer potentially high returns if the market moves favourably. Emerging companies in this segment often attract attention after announcing major developments, such as product launches or partnerships, creating conditions for sharp price increases.

However, this also makes them high-risk assets. Even the best low-price stocks don’t guarantee future growth, and the lack of historical performance data for many small-cap companies can make analysis challenging. Thorough research and careful asset selection are essential to navigate these penny stocks.

Forex trading also presents potential opportunities, primarily through significant fluctuations in currency values. Major currency pairs usually experience high liquidity, which could enable traders to enter and exit positions efficiently. Leverage enhances the potential for returns by allowing traders to control larger positions with smaller capital, but also equally magnifies the risk of losses.

Liquidity

Penny stocks often face challenges related to liquidity, as their lower market capitalisation can result in fewer buyers and sellers. Major currency pairs, on the other hand, are known for their high liquidity, given the vast number of participants involved, including major financial institutions and central banks. Contrasting liquidity in penny stocks with forex emphasises the different trading environments and potential impact on trade execution when defining your best way to trade penny stocks and currency pairs.

Accessibility and Learning Curve

Penny stocks are often seen as an accessible option for investors due to their low cost, allowing individuals to start trading with a minimal investment. However, for traders seeking the best penny stocks to invest in 2024 or any other year, a combination of research and careful market analysis is critical to mitigate risks potentially. Limited availability of information can make the learning curve steep, requiring diligence in research to avoid potential pitfalls.

Forex trading offers unparalleled accessibility, as the market operates 24/5 and allows traders to enter with relatively low capital through leverage (please remember about increased risks caused by leverage). However, while forex provides abundant educational resources and tools, understanding the complexities of global economic indicators, currency correlations, and leverage management presents a challenging learning curve that demands continuous effort and skill development.

Key Considerations for Traders

Navigating penny stocks or forex trading requires a clear understanding of various factors that impact decision-making and performance. Below are some key considerations for traders in these markets.

Risk Tolerance and Goals

Every trader should evaluate their risk tolerance and align it with their goals. Penny stocks are highly speculative and popular among those with a higher risk appetite and a willingness to accept volatility. Forex trading, with its leveraged positions and fast-paced environment, demands similar self-assessment. Traders should clearly define their objectives and choose their strategies accordingly.

Time Commitment and Market Knowledge

Trading in either market requires a significant investment of time and effort to build knowledge and expertise. Penny stock traders should sift through limited financial data and monitor company developments closely. Forex traders need to stay informed about global economic trends, geopolitical events, and currency movements. Both markets demand continuous learning to refine strategies and adapt to changing conditions.

Costs and Fees

Understanding trading costs is essential. Penny stock transactions often come with higher broker fees, particularly in over-the-counter (OTC) markets, which can eat into potential returns. Similarly, forex traders face costs such as spreads, commissions, and overnight swap fees for holding positions. Comparing platforms and selecting one with competitive rates is vital. At FXOpen, you can trade currency pairs with spreads from 0.0 pips and low commissions from $1.50.

Importance of Diversification and Education

Diversification may help potentially mitigate risk by spreading investments across multiple assets or markets. In penny stocks, this may involve selecting shares from various industries, while forex traders could trade a mix of major, minor, and exotic currency pairs. Additionally, both types of traders take advantage of ongoing education. Accessing resources like webinars, articles, and demo accounts can deepen understanding and potentially improve performance.

Emotional Discipline

Emotions can cloud judgment, leading to impulsive decisions. Traders should develop emotional discipline to stay consistent with their strategies, especially during periods of potential loss or high volatility. Establishing rules for entry, exit, and position sizing—and sticking to them—helps maintain objectivity and control.

Conclusion

Forex and penny stock markets share similarities, but they differ significantly in their market structures, liquidity, and goals. Traders should weigh all the relevant factors to navigate these distinct markets. Penny stocks and forex aren’t the only options for trading. You can open an FXOpen account and apply your trading strategies to over 700 markets. Enjoy tight spreads from 0.0 pips and low commissions from $1.50.

FAQ

What Are Penny Stocks?

The penny stock meaning refers to shares of small-cap companies that typically trade at less than $5 per share. These stocks are often associated with emerging or niche industries and are traded in over-the-counter (OTC) markets or less frequently on major exchanges.

How Do Penny Stocks Work?

Penny stocks are bought and sold like any other stock, but they often trade in lower volumes and with less transparency. Investors may aim to take advantage of price fluctuations driven by company news or market speculation.

What Is Penny Stock Trading?

Penny stock trading involves buying and selling low-priced stocks in an effort to capitalise on their volatility. This type of trading requires thorough research due to limited financial data and high risks.

What Is the Penny Stock Rule?

The penny stock rules, established by the SEC, require brokers to disclose the risks of trading penny stocks and verify that trades are suitable for investors. This rule may help protect traders from potential fraud.

Trade on TradingView with FXOpen. Consider opening an account and access over 700 markets with tight spreads from 0.0 pips and low commissions from $1.50 per lot.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Psychedelic Stocks About to Trip! 100%+ UpsidesPsychedelic Stocks About to Trip! 🍄

RFK Jr. has been named the top health official in Trump's administration, and he's known for his stance against big pharma and preference for natural products like psychedelics. This could be a game-changer for psychedelic stocks!

In this video analysis, I dive deep into the potential impact RFK Jr. could have on key psychedelic stocks: AMEX:CYBN , NASDAQ:CMPS , NASDAQ:ATAI , and $MNMD.

These stocks are poised for significant movement, and you won't want to miss out on the insights and strategies I share. Not financial advice. 👇

High potential over the coming yearsPositioned to disrupt the medicinal industry with its wide range of products and significant stakes in other biotech companies like Compass. ATAI possess ample funds to quickly become a leader in a market that has not yet fully emerged. High Volatility I wouldn't be surprised to see the stock reach $20 next year, analysts predict $11.

Weekly RSI looks great and primed to run showing strength above 50 with key MA overhead

The daily is getting a little hot pullbacks will offer great opportunities.

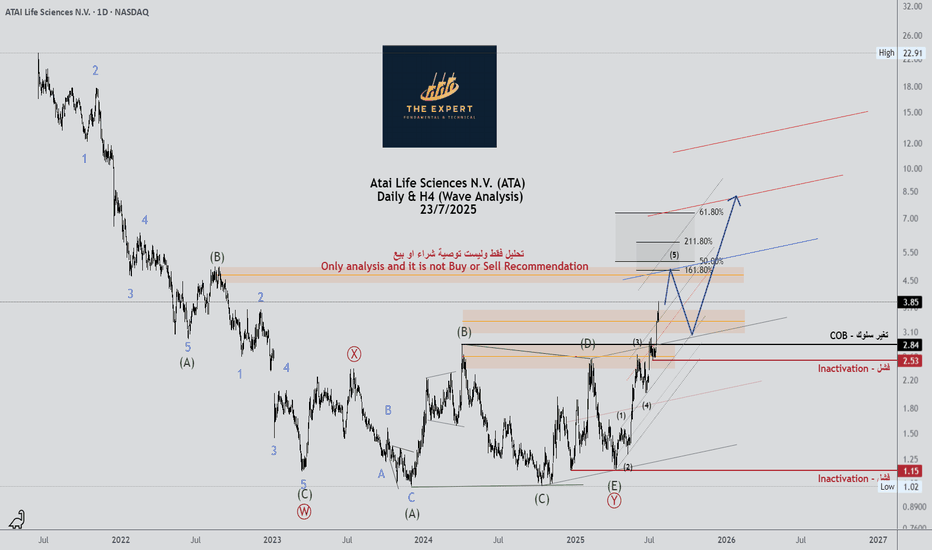

ATAI - 2 potential paths to $5After successfully surpassing the previous swing high with considerable volume, attaining a fresh 52-week peak of $2.85, and witnessing the 50-day moving averages intersecting the 150 and 200 SMAs, ATAI appears poised for a reversal from its downtrend.

**Potential Scenarios:**

**Scenario 1: Triangular Consolidation (Orange)**

ATAI may undergo consolidation within a triangular pattern marked by points A to E. This consolidation phase could indicate a period of indecision in the market as buyers and sellers balance their positions. Typically, triangular patterns suggest that volatility is decreasing, leading to an impending breakout. If this pattern unfolds as expected, a breakout is anticipated around mid-August, potentially triggering a significant move in the stock price.

**Scenario 2: Corrective Pattern (Yellow)**

Alternatively, the stock might experience a corrective phase represented by an A-B-C pattern. This corrective pattern could indicate a temporary pullback or retracement within the broader uptrend. Such corrections often serve to alleviate overbought conditions and provide an opportunity for new buyers to enter the market. In this scenario, ATAI is expected to establish a higher low by mid-August, reinforcing the bullish momentum and setting the stage for further upside potential.

**Price Targets:**

Anticipated Fibonacci targets include 1.414 ($4.45) or 1.616 ($5.54) to be achieved by year-end. These Fibonacci extensions are commonly used by traders to identify potential levels of resistance or support based on previous price movements. Additionally, a more ambitious target exceeding $15 within the next few years is also envisaged. This long-term target reflects the potential for ATAI to capitalize on emerging trends and developments within its industry, driving sustained growth and shareholder value over time.

ATAI looking to bottom out

After closely monitoring psychedelic stocks for approximately six months, my attention has been drawn to ATAI. Despite enduring a challenging period over the past couple of years, the stock appears to be signaling a potential turnaround.

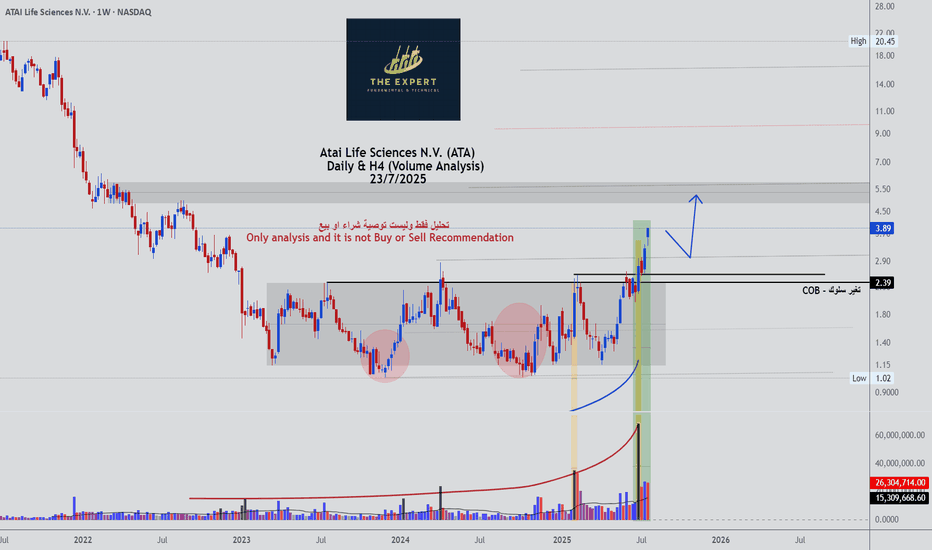

Volume Analysis

A notable observation is the diminishing volume during each downturn, coupled with a substantial surge in volume in November of the previous year. This pattern indicates a decisive breakout from the prevailing trend.

RSI Insights

Simultaneously, the Relative Strength Index (RSI) reached its peak at 69. This represents the highest momentum level in the stock's history, signaling increasing strength. This noteworthy event marks the first instance of the weekly RSI surpassing the halfway mark, hinting at the initiation of a potential uptrend. Further supporting this indication is the presence of a bullish RSI divergence.

Anticipated Developments

My focus is straightforward, with two key criteria:

Demand Zone Confirmation ($1.05 - $1.29)

Previous High Breakout ($2.23)

The occurrence of these events could pave the way for significant upside potential in ATAI, as well as the entire psychedelic industry, with target projections reaching into the double figures.