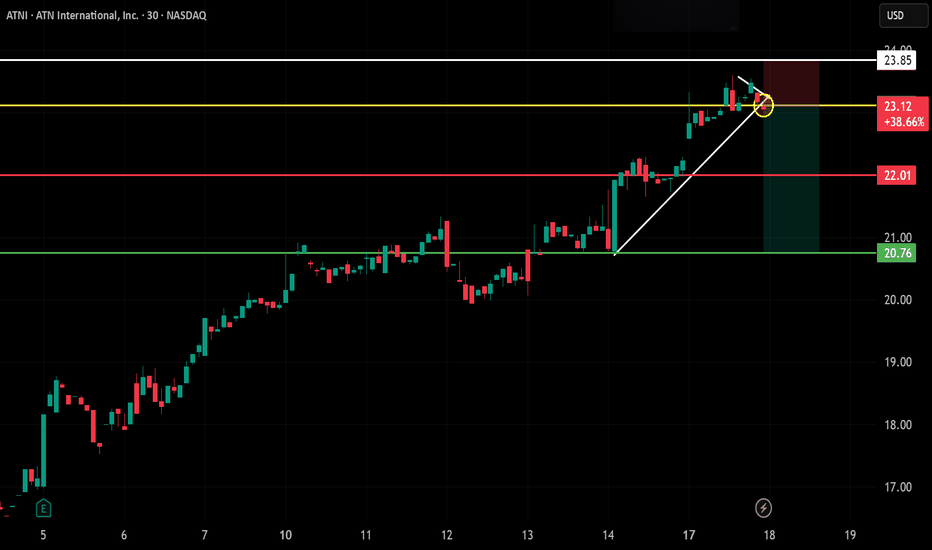

ATN International, Inc. (ATNI) – 30-Min Short Trade Setup!📌 🚀

🔹 Asset: ATN International, Inc. (ATNI – NASDAQ)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Rising Wedge Breakdown

📊 Trade Plan (Short Position)

✅ Entry Zone: Below $23.12 (Breakdown Confirmation)

✅ Stop-Loss (SL): Above $23.85 (Key Resistance Level)

🎯 Take Profit Targets:

📌 TP1: $22.01 (First Support Level)

📌 TP2: $20.76 (Extended Bearish Move)

📊 Risk-Reward Ratio Calculation

📉 Risk (SL Distance):

$23.12 - $23.85 = $0.73 risk per share

📈 Reward to TP1:

$23.12 - $22.01 = $1.11 (1:1.52 R/R)

📈 Reward to TP2:

$23.12 - $20.76 = $2.36 (1:3.23 R/R)

✅ Good Risk-Reward Ratio – A solid short trade setup!

🔍 Technical Analysis & Strategy

📌 Rising Wedge Breakdown: Price is breaking below the wedge pattern, indicating bearish momentum.

📌 Key Support at $22.01: A breakdown through this level opens the way to TP2.

📌 Volume Confirmation Needed: Ensure above-average selling volume below $23.12 to validate the breakdown.

📌 Resistance at $23.85: A move above this invalidates the trade setup.

📉 Trade Execution & Risk Management

📊 Volume Confirmation: Look for strong bearish volume below $23.12 before entering.

📉 Trailing Stop Strategy: Move SL to break-even ($23.12) after TP1 ($22.01) is hit.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at TP1 ($22.01), let the rest run toward $20.76 (TP2).

✔ Adjust Stop-Loss to Break-even ($23.12) after TP1 is reached.

⚠️ Fake Breakdown Risk

❌ If price fails to stay below $23.12, exit early.

❌ Wait for a 30-min candle close below the breakdown level before entering.

🚀 Final Thoughts

✔ Bearish Setup – Strong downside potential.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:3.23 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀📈

🔗 #ATNI #NASDAQ #ShortTrade #TradingView #ProfittoPath 💰📊

ATNI trade ideas

ABC BullishPossible stop below 51.1

Possible Targets 2: 105 115

Not a recommendation

NV high

ATN International, Inc., through its subsidiaries, provides telecommunications services in North America, the Caribbean, Bermuda, and India. It operates in three segments: International Telecom, US Telecom, and Renewable Energy. The International Telecom segment provides wireless services, including voice and data services to retail customers in Bermuda, Guyana, and the US Virgin Islands; and wireline services, such as voice and data services in Bermuda, the Cayman Islands, Guyana, and the US Virgin Islands, as well as video services in Bermuda, the Cayman Islands, and the US Virgin Islands. This segment also offers managed information technology services to commercial customers; and wholesale long-distance voice services to other telecommunications carriers. The US Telecom segment offers wireless and wireline services; wholesale wireless voice and data roaming services to wireless carriers principally in the Southwest United States; consumer and enterprise mobile and fixed telecommunications services; and wholesale long-distance voice services to telecommunications carriers. The Renewable Energy segment provides distributed generation solar power to commercial and industrial customers in India, as well as in Massachusetts, California, and New Jersey. As of December 31, 2019, it operated twelve retail stores in US Telecom segment and nineteen retail stores in International Telecom segment. The company was formerly known as Atlantic Tele-Network, Inc. and changed its name to ATN International, Inc. in June 2016. ATN International, Inc. was founded in 1987 and is headquartered in Beverly, Massachusetts.

Indirect play on renewable energy