BAND trade ideas

One of My Favorite AI Plays Hasn't Gone Anywhere in 3 YearsSometimes, trading is boring. The same can be said for investing as well. I first got interested in Bandwidth when AI was starting to emerge about 2+ years ago. I found their approach and AI product interesting because they quickly started building voice at scale for AI products by providing the "piping" to quickly connect AI interfaces to voice applications across web, desktop, mobile, and cell operators. Seems like a no brainer right?

Not so fast.

While some stocks trade on lofty expectations and big stories, others also simply trade at a "fair" value. For one reason or another Bandwidth has continued to trade at a fair value even despite most recently hitting record revenue, record free cash flow, record customers, and record earnings.

The markets are designed to confuse people most of the time. In their most recent earnings report the founder and CEO said:

"Let me share two recent wins that showcase this for AI. First, one of the world's largest cruise lines chose Bandwidth for their first ever cloud contact center migration and they did it right before their peak holiday season. That is the ultimate vote of confidence.

They chose us for three reasons, our proven CCaaS integration capabilities, our comprehensive communications offering and our track record of mission-critical reliability. But what really sealed the deal was our ready to deploy voice AI capabilities, positioning them for future innovation.

Second, a Fortune 25 healthcare provider needed to switch between cloud contact center platforms, traditionally a massive undertaking. Because Maestro is pre-integrated with leading CCaaS platforms, we made this transition seamless. Their legacy provider quoted months for the same project. Even more compelling, our platform enables them to integrate AI capabilities that were simply impossible with their previous solution."

Currently, the company is valued around to 8x-11x EV/EBITDA. Some of might say it's fairly valued there. Others might say it should have more bullish backing from the market.

Anyways, that's it. And a reminder... sometimes things just go sideways for a long time.

Tracking some of my holdings in real-time. More coming soon.

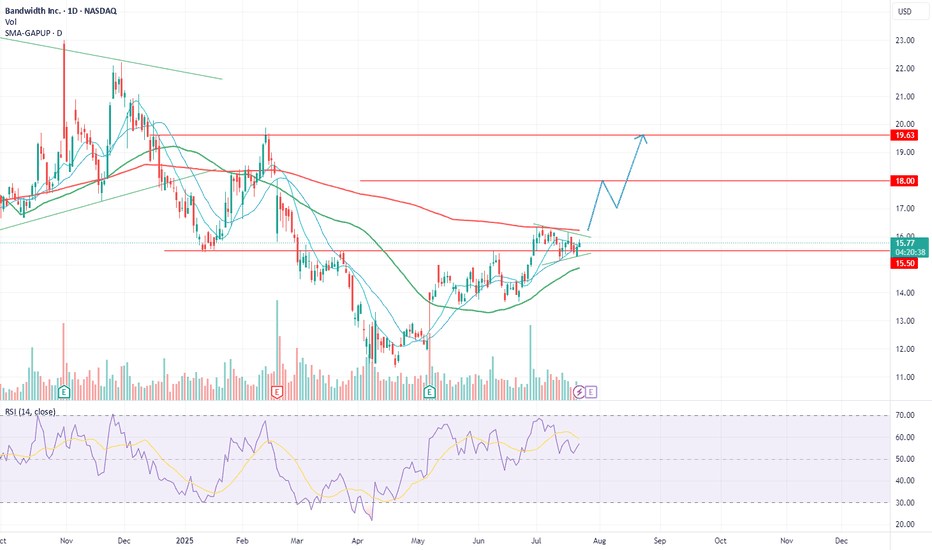

Bandwidth (BAND) - Watching the gapsThere's a saying that "gaps act as magnets" and that saying has always stuck with me. It's one reason why I always look for gaps on the chart to watch.

Bandwidth, ticker symbol BAND, is a company that provides cloud-based communications services for enterprises. I have written about them a few times and you have probably seen my charts, some GREAT and some bad. Tis is the trader life.

Nevertheless, as a trader who relies heavily on chart analysis, I've been closely monitoring BAND's stock movement, paying particular attention to two significant gaps that have emerged on the chart.

The first notable gap occurred following a mega earnings beat by Bandwidth, catapulting the stock price to recent heights. This earnings surprise not only exceeded market expectations but also signaled the company's strong performance and potential for future growth. For me, this gap serves as a landmark, a testament to Bandwidth's ability to deliver results that resonate positively with investors.

On the flip side, there's another crucial gap that formed during the most recent bear market. This downturn-induced gap reflects a period of heightened uncertainty and fear in the market, leading to a sharp drop in BAND's stock price. However, as a gap aficionado, I view this as an opportunity rather than a setback. These gaps often act as magnets, drawing the price back towards them as sentiment shifts and narratives evolve. For me, this bear market gap represents a potential entry point, a chance to capitalize on the market's overreaction and position myself for future gains as the narrative around Bandwidth shifts once again.

My Favorite AI Play - Bandwidth (BAND)Bandwidth (BAND) is my favorite AI play right now.

The chart looks really bad! I get it. Today, it trades for below even its IPO price.

But the reason why I think it's an AI play ready to double, possibly triple, is a fundamental reason that I'll explain in this post.

First of all, let me state something very interesting about Bandwidth - today it's one of the worst performing stocks in the entire market since 2020 and 2021. I don't entirely know why that's the case, but I do think the market has overreacted.

Let me now get the bad news out of the way: when BAND's stock was flying high, management took out several large loans to expand faster and grow globally. Those gains are starting to be realized, but it's key to mention this as the debt profile is still somewhat high. The question now is: can they keep paying it off? They're on target to have little to no debt within the next few years.

Okay, so why is Bandwidth an AI play? To understand this you need to know that Bandwidth is essentially the connector for data that is transmitted over the web. Bandwidth's platform helps data, messages, voice calls, video calls, email, and more travel from Point A to Point B.

For example, when you make a call on Zoom or even Slack or Google Hangouts, it's highly likely your call is being routed over Bandwith's network. The point is, Bandwidth is the toll keeper, the train conductor, for most modern communications that are triggered at scale.

So how does AI fit into this?

That's where this gets good. All of these AI companies NEED a company to help deliver the information to their end consumer. If OpenAI creates a chatbot that works on text message or sends push notifications or can even speak over calls, Bandwidth will most likely be the resource that delivers that information from business to consumer.

What's even more interesting is call centers and the future of talking to call centers to get help or support. In one scenario, you upload all your most frequently asked questions, pair it with an AI service, and then let users call that AI service over the Bandwidth network and now an AI customer support agent is solving issues at scale.

This is just one example.

I could go on and on.

But that's my play!

I own a little Bandwidth and will be watching closely in the coming years.

Meet the worst performing industry in the bear marketThis chart shows RingCentral, Bandwidth, and Twilio. I have actually wrote about Twilio a few times because its sell-off has been especially pronounced.

In some respects, Twilio is one of the poster childs of the recent bear market mania among high flying tech names.

Nonetheless, not that I am a knife catcher all that much, but more-so the extent of this crash in communication and tech companies that have become essential tools in all digital aspects of life, it's hard to ignore a sector like this. I partly think the sell-off is as intense as it is because no one actually knows what these companies do!

A quick background on what they do...

When Zoom connects video & voice calls, there's a company working behind the scenes to ensure those communications are running as smoothly as possible.

When Apple sends you a two-factor text message to secure your account, there's a company working behind the scenes to connect that information.

When an internal team conducts a conference call on their private network or in the office, there's a product behind the scenes connecting all of them.

When someone calls a customer support line, and gets routed based on the information they need, there's a company working behind the scenes to connect that information.

These companies are largely responsible for the majority of that infrastructure. Without them, the connectivity among apps, calls, texts, emails, and notifications would be a fraction of what it is today. Our capabilities would be greatly reduced.

Nevertheless, it's hard for me to ignore these companies and these industries from RNG to TWLO and BAND.

I bought a small chunk of BAND recently and that's my full disclosure. I'll sell the trade at a loss if it goes back below $13.50 and I'll take gains if it goes back to $28.00 per share (the recent highs - possible double top formation).

So with that being said, those are my thoughts currently...

BAND: BULL of the WeekBAND has produced better than expected earnings since its inception and it currently sitting on support from Dec. 2018. It has a gap to fill at $47, so you're looking at a 50%+ move over the next few weeks to fill said gap. RSI is extremely low as well, so expect this to be a big winner if you go long. The lowest I see it going is mid $27, but calls are for mid March, so it gives us plenty of time to reach our target.

Not financial advice

BandwidthBandwidth is a Communications Platform as a Service company. They sell software application programming interfaces for voice and messaging, using their own IP voice network

link to VCHART indicator based on my previous indicator (The Rush) will be published in 12 days God willing due to tradingview restrictions

BAND, and it's not a good concert either.What to say about this stock. A competitor to TWLO it was touted. Well, the chart to put it mildly is totally destroyed.

I would write a thorough thesis and DD on the value this stock offers relative to the competition but sadly it seems the markets have other ideas.

Crashing through multiple supports not to mention the bear flag formation which I ignored to my PERIL.

I have taken a short position of 200 shares and look to close around 100 dollars seeing as the support below is practically non existent.

A shame for a great stock in the sector which gets no love.

SHORT: 200 shares @126.52

Symmetrical TriangleBAND appears to be looking for the bottom trendline of the triangle. When it reaches the bottom trendline, it could break down, or turn around and go back up.

Long entry would be around 183.16ish..short entry would be at break of bottom trendline. Throwbacks happen and it may not break the full width of the triangle's back end. BAND has broken up then a throwback occurred.

Triangles are a contraction as well as a consolidation pattern and are neurtral until a break of the upper or lower trendline occurs and a trend one way or the other is confirmed. Breakouts on increased volume perform the best. Throwbacks hurt performance.

5 touches noted, the 6th would be the bottom trendline. Triangles are opposite of broadening wedges like a megaphone.

No recommendation.