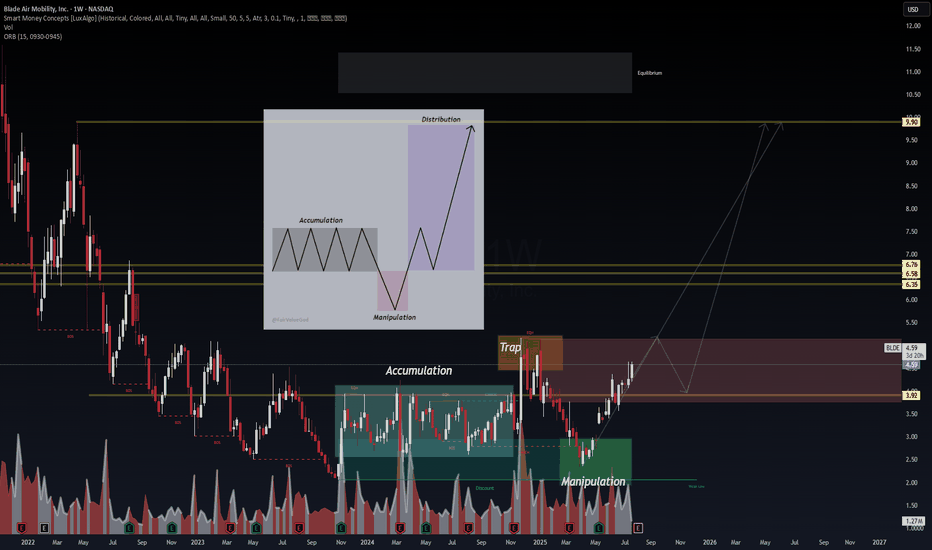

BLDE – VolanX Smart Cycle Activation📈 BLDE – VolanX Smart Cycle Activation

Timeframe: Weekly

Posted by: WaverVanir International LLC | VolanX Protocol

Model: Accumulation → Manipulation → Expansion

After multiple Breaks of Structure (BOS) and prolonged markdown, BLDE has now confirmed a Smart Money Accumulation Cycle. A clear manipul

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.34 USD

−27.31 M USD

248.69 M USD

57.06 M

About Blade Air Mobility, Inc.

Sector

Industry

CEO

Robert S. Wiesenthal

Website

Headquarters

New York

Founded

2014

FIGI

BBG00Q3Q29N4

Blade Air Mobility, Inc. is engaged in providing air transportation and logistics for hospitals across the United States. The firm operates as transporter of human organs for transplant, and flights for consumers, with helicopter, and fixed wing services primarily in the Northeast United States and Southern Europe. It operates through the Passenger and Medical segments. The Passenger segment includes short distance helicopter and amphibious seaplane flights and non-medical jet charter. The Medical segment is involved in the transportation of human organs for transplant. The company was founded by Robert S. Wiesenthal and Steven Martocci on December 22, 2014 and is headquartered in New York, NY.

Related stocks

WaverVanir_International_LLC | $BLDE Trade Plan ActivationJune 29, 2025 | Chart:

“We don’t predict price. We model narrative probabilities.” – VolanX

🧠 Setup Thesis

Blade Air Mobility ( NASDAQ:BLDE ) is entering a potential Phase 2 expansion cycle after a structural reversal from deep discount levels. Smart Money Concepts (SMC) confirm a Change of Char

3/28/25 - $blde - sizing up 5%3/28/25 :: VROCKSTAR :: NASDAQ:BLDE

sizing up 5%

- i've covered 2/3 of the position for aug exp $2.5 strike b/c the implied 13% yield in this chop for an asset which already trades below fair value for 5 mo looks way better than cash

- but 1/3 of the book which i just added on this ((ridiculous

Still bullishRespected the Fibonacci reversal target, we just need it to respect the retracement target and have a nice bounce which is also in a high volume area, so it's very likely. Currently still inside the arch which is nice.

It's all lining up very nicely so we shall see if it reaches the target. (Red l

2/27/25 - $blde - playing tmdx here...2/26/25 :: VROCKSTAR :: NASDAQ:BLDE

playing tmdx here...

- sometimes fishing in the non-passive pools can generate some interesting buys as these things get whipped around as if they're being sanctioned, tariff'd or otherwise _____

- NASDAQ:BLDE 's product remains solid. valuation cheap. i'll l

2/12/25 - $blde - Adding more2/12/25 :: VROCKSTAR :: NASDAQ:BLDE

Adding more

- last note in 11/18/24 spells out logic on valuation

- not much has changed, but the px went up substantially

- i get the sense ppl trade NASDAQ:BLDE like their other profitless low bid low liquidity trash

- so on a day like today where it gets h

11/18/24 - $blde - LT buy under $3.2, going slow11/18/24 :: VROCKSTAR :: NASDAQ:BLDE

LT buy under $3.2, going slow

- have written extensively about this one in the past, so won't dive into details but here's the incremental

- mgmt continues to deliver solid results, turned FCF +ve already and are on track to meet MT targets

- it's in my portfo

Blade Air Mobility Inc. | Chart & Forecast SummaryKey Indicators on Trade Set Up in General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Active Sessions on Relevant Range & Elemented Probabilities;

London(Upwards) - NYC(Downwards)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of BLDE is 3.78 USD — it has decreased by −5.26% in the past 24 hours. Watch Blade Air Mobility, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Blade Air Mobility, Inc. stocks are traded under the ticker BLDE.

BLDE stock has fallen by −11.89% compared to the previous week, the month change is a −6.67% fall, over the last year Blade Air Mobility, Inc. has showed a 14.89% increase.

We've gathered analysts' opinions on Blade Air Mobility, Inc. future price: according to them, BLDE price has a max estimate of 13.50 USD and a min estimate of 5.00 USD. Watch BLDE chart and read a more detailed Blade Air Mobility, Inc. stock forecast: see what analysts think of Blade Air Mobility, Inc. and suggest that you do with its stocks.

BLDE reached its all-time high on Feb 16, 2021 with the price of 19.88 USD, and its all-time low was 2.06 USD and was reached on Oct 30, 2023. View more price dynamics on BLDE chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

BLDE stock is 5.98% volatile and has beta coefficient of 2.14. Track Blade Air Mobility, Inc. stock price on the chart and check out the list of the most volatile stocks — is Blade Air Mobility, Inc. there?

Today Blade Air Mobility, Inc. has the market capitalization of 306.25 M, it has increased by 6.35% over the last week.

Yes, you can track Blade Air Mobility, Inc. financials in yearly and quarterly reports right on TradingView.

Blade Air Mobility, Inc. is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

BLDE earnings for the last quarter are −0.04 USD per share, whereas the estimation was −0.12 USD resulting in a 65.49% surprise. The estimated earnings for the next quarter are −0.04 USD per share. See more details about Blade Air Mobility, Inc. earnings.

Blade Air Mobility, Inc. revenue for the last quarter amounts to 54.31 M USD, despite the estimated figure of 49.44 M USD. In the next quarter, revenue is expected to reach 64.08 M USD.

BLDE net income for the last quarter is −3.49 M USD, while the quarter before that showed −9.79 M USD of net income which accounts for 64.33% change. Track more Blade Air Mobility, Inc. financial stats to get the full picture.

No, BLDE doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 322 employees. See our rating of the largest employees — is Blade Air Mobility, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Blade Air Mobility, Inc. EBITDA is −25.58 M USD, and current EBITDA margin is −8.93%. See more stats in Blade Air Mobility, Inc. financial statements.

Like other stocks, BLDE shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Blade Air Mobility, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Blade Air Mobility, Inc. technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Blade Air Mobility, Inc. stock shows the neutral signal. See more of Blade Air Mobility, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.