This Casey does NOT strike out - Long at 448.47Step 1: Zoom out on the chart for CASY. Please. Feel free to scroll back all the way to 1984. I'll wait...

That view alone tells you all you need to know. This is one of the prettiest charts you'll find anywhere on Wall Street. Not flashy, just relentlessly and consistently profitable. If I make money on this trade, the credit goes to the stock, not me.

And that's really not an "if", fundamentally. 1183-0 all time (real and backtested trades). Average gain of 1.7% in 15 trading days. That's almost 3x the average daily return of the market's long term return. The last 8 times it has thrown off this signal, it has paid off in 1 day each time. That's obviously not a promise, especially in this market environment, but there are few potential trades that would let me sleep easier while I wait for it to pay off as this one will.

As a plus, there is support at the April low and that particular blue trendline on the chart goes back 2 years.

I don't know if I'll sell this one as soon as it becomes profitable, but I may, depending on how the market is acting. I'll update when I do. I'm not really a buy and holder, but if I was, it would be a core holding for me.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

CASY trade ideas

Breaking: Casey's Announces Third Quarter ResultsCasey's General Stores, Inc., together with its subsidiaries, operates convenience stores under the Casey's and Casey’s General Store names announces Third Quarter Results leading to shares rising 2.35% in premarket trading on Wednesday early morning session.

Earning's Highlight:

Diluted EPS of $2.33, flat with the same period a year ago. Net income was $87.1 million, also flat with the prior year, and EBITDA1 was $242.4 million, up 11.4%, from the same period a year ago.

Inside same-store sales increased 3.7% compared to prior year, and 8.0% on a two-year stack basis, with an inside margin of 40.9%. Total inside gross profit increased 14.3% to $573.1 million compared to the prior year.

Same-store fuel gallons were up 1.8% compared to prior year with a fuel margin of 36.4 cents per gallon. Total fuel gross profit increased 17.4% to $302.1 million compared to the prior year.

Same-store operating expenses excluding credit card fees were up 3.2%, favorably impacted by a 2% reduction in same-store labor hours.

Technical Outlook

As of the time of writing, Casey shares ( NASDAQ:CASY ) are up 2.35% in Wednesday's premarket trading with eyes set on the 38.2% Fibonnaci retracement point, should NASDAQ:CASY break above that pivot a move to the 1-month high resistance point is certain. Similarly, in the case of a trend reversal, the 1-month low is holding the levels as support point but with the RSI at 31, a little dip below the 1-month low point would place the shares in an oversold region leading to further sell-out.

CASY Casey's General Stores Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CASY Casey's General Stores prior to the earnings report this week,

I would consider purchasing the 260usd strike price Calls with

an expiration date of 2023-10-20,

for a premium of approximately $2.02.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

CASY gonna grab it before earningslooks like this one could make a little in gains earnings comming out on the 8th the past 11 days have green bars on volume and we are sitting several clicks above the 50MA.the tecnical indicators are showing strong buy through the next week.

the past four earnings reports are all beats lets keep our fingers crossed for another! hopefully we see a new support level as well!

have a happy day and good trading!

CASYSystem T Performances: Annual Compound Profit 40%, Win Rate 55%, Risk/Reward Ratio 1:2, 20 Years of Backtesting Data, Over 100 Markets.

* Click Like and Follow to Support My Work!

---

Hi Traders,

I'd like to introduce the System T, a computerized trading system that analyzed and backtested the 20 years history data of over 100 markets.

This post is my sharing of how I think about systematic trading and the signals generated by the System T.

(This is my opinion only, NOT the financial advice.)

I think that for the system to open a trade and manage risk, it only needs a buy signal & a stop-loss signal clearly on the chart.

Once the system finds a good trend, it will ride it as long as possible. The stop-loss will be adjusted accordingly to the new price movement.

(Remember to follow this trade idea and follow my profile to get updates about the stop-loss adjustment and sell signal based on the latest price and market conditions daily.)

System T performances above will give you an idea of how it performs in the last 20 years.

Notice that this result was achieved only if I strictly followed the rule: "Only and Always Buy & Sell based on the System Signals".

Don't sell when there is no sell signal as we all want to follow the good trends til the end like everything in life does. \(^-^)/

Also, my system is extremely diversified through over 100 markets so that it only risks less than -1% of the total capital per trade.

Thank you and good luck!

---

DISCLAIMER:

I am NOT a financial advisor, and nothing I say is meant to be a recommendation to buy or sell any financial instrument.

My views are general in nature and I am not giving financial advice. You should not take my opinion as financial advice. This is my opinion only.

Do your own due diligence, and take 100% responsibility for your financial decisions.

Trading and investing are risky! Don't invest money you can't afford to lose, because many traders and investors lose money. There are no guarantees or certainties in trading.

- Content is for education purposes only, not investment advice.

- Trading involves a high degree of risk.

- We’re not investment or trading advisers.

- Nothing we say is a recommendation to buy or sell anything.

- There are no guarantees or certainties in trading.

- Many traders lose money. Don’t trade with money you can’t afford to lose.

CASY- Pizza join/convenience storeOverbought on RSI. Stoch looking to potentially give us the heads up on a downturn in the next day or 2. There's NO accumulation going on. Fat tail looking to give it all back. MACD Strong as can be, but the rest of the indicators lead me to believe this will be a decent short. It's only up on a golden cross and a strong earnings.

www.investopedia.com

Expected EPS was $0.52 actual was $0.68

Reminds me of QCOM a while back

BTW- it's a pizza place that's out of Iowa. No way in hell Iowa pizza is good as NY or even that soup called Chicago. TF is wrong with this world.

This is not financial advice. I will probably be going short in the next 48 hours. Unfortunately the June's expire Friday and the next is July. Just a matter of which to buy for this gap fill of $10 or so.

CASY. Double top.Double top pattern. Sell @ $125-135, TP $100-105, SL above $140. avg. volume is less than 1M, so there might be some problems if u are going to short 1000+ shares. this idea is not so perfect, cuz uptrend is still going. so I hope that the price reached it's top and will continue to stay in range $100-135 for some time.

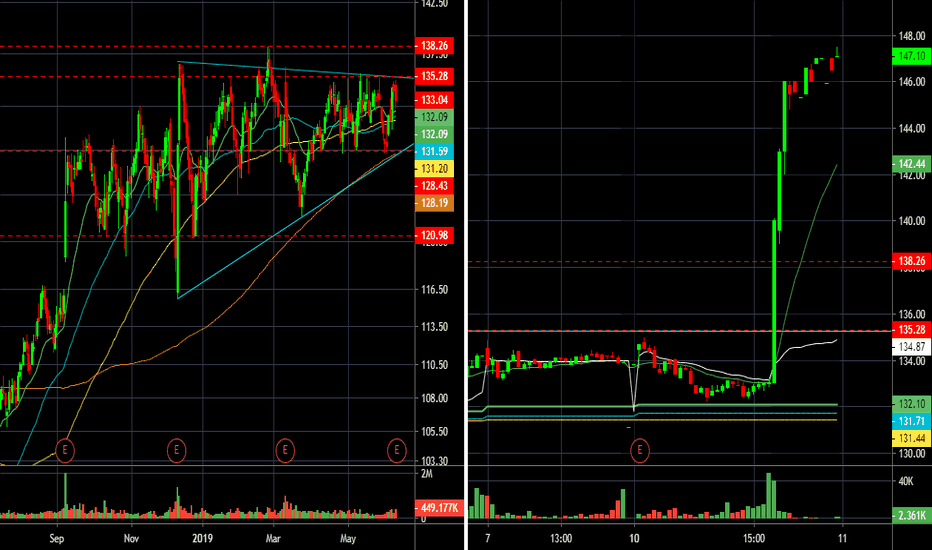

$CASY Day Trade Parabolic Potential on Good News $CASY has gone parabolic premarket on good earnings. Its at $147 premarket, the all time highs on the daily is $138. This is going be very volatile, but if it gets good volume (at least 500,000 shares in first 5 minutes on market open) then I would go Long on it after, and only after a Pullback. I would use that Pullback as my stop and take only small share size since its going be spready. Good potential on the long side. I need to be quick and fast to react.

$CASY MAJOR CHANGES AT CASEY'S STORES, BREAKOUT POTENTIAL There has been a lot of very positive changes at NASDAQ:CASY in the past few weeks, the updated digital store and online ordering system now offers easier ordering, more customisation and faster carryout which is hoped to improve efficiency and boost sales. More recently Casey's have appointed former IHOP CEO Darren Rebelez to the CEO role, he brings 25 years of business leadership experience.

H.LYNN Horak commented

“Darren brings a remarkable combination of leadership experience in the convenience store, fuel and restaurant industries, and he has an impressive track record of driving performance and innovation. We have enjoyed getting to know Darren through our succession planning process and are confident that he will build on Casey’s strong heritage of customer service, employee development, giving back to our communities, and our focus on creating sustainable growth and profitability.”

From a technical perspective the stock is looking like a breakout candidate, currently forming a ascending triangle and holding support above all MA'S, all the indicators are also in tension and signal a substantial move ahead, hopefully that is a break up not down. $upside alert for $137 and breakdown short alert on $128

AVERAGE ANALYSTS PRICE TARGET $139

AVERAGE ANALYSTS RECOMMENDATION OVERWEIGHT

P/E RATIO 25

COMPANY PROFILE

Casey's General Stores, Inc. engages in the management and operation of convenience stores and gasoline stations. It offers food, beverages, tobacco products, health and beauty aids, automotive products, and other nonfood items. The company was founded by Donald F. Lamberti in 1959 and is headquartered in Ankeny, IA.