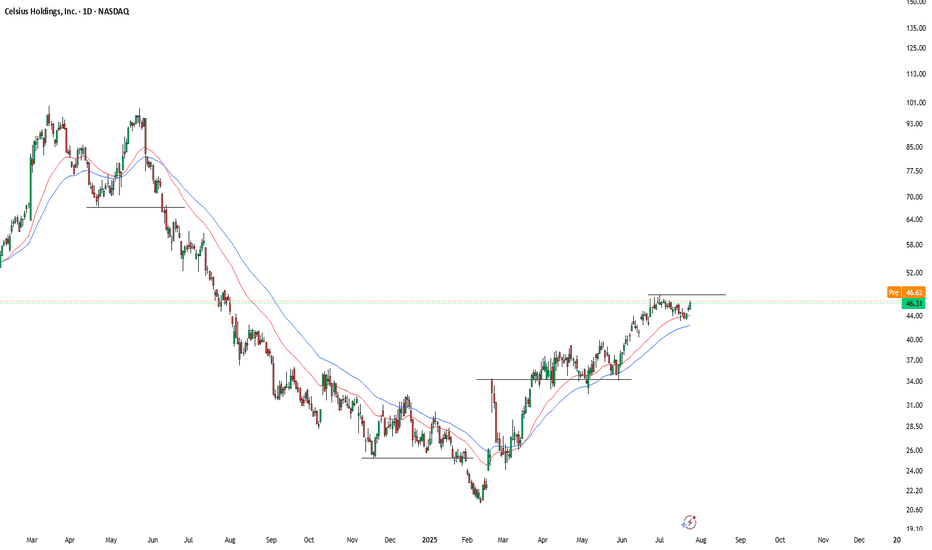

CELH Eyes Upside Momentum as Consolidation TightensCelsius Holdings, Inc. ( NASDAQ:CELH ) has shown a notable recovery from its early 2025 lows, steadily climbing and recently consolidating around the $46 level. The stock is currently trading above both the short-term (red) and mid-term (blue) moving averages, which are sloping upward—indicating bul

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

0.32 USD

145.07 M USD

1.36 B USD

177.49 M

About Celsius Holdings, Inc.

Sector

Industry

CEO

John Fieldly

Website

Headquarters

Boca Raton

Founded

2004

FIGI

BBG000NY37X4

Celsius Holdings, Inc. engages in the development, marketing, sale, and distribution of functional drinks and liquid supplements. It also offers post-workout functional energy drinks and protein bars. The company was founded in April 2004 and is headquartered in Boca Raton, FL.

Related stocks

push pass 40 is coming, i can smell it.boost and follow for more 🔥 CELH has clearly been in a uptrend for months, I also noticed when spy tanks CELH does not pullback much. But when the market rallies CELH follows.

This shows clear strength and sign investors aren't scared, and expect much higher and soon! this continues to be one of my

CELH | Triple Digit Gains IncomingCelsius Holdings, Inc. engages in the development, marketing, sale, and distribution of functional drinks and liquid supplements. It also offers post-workout functional energy drinks and protein bars. The company was founded in April 2004 and is headquartered in Boca Raton, FL.

Celsius Stock Chart Fibonacci Analysis 051525Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 35/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E

Celsius Holdings Outperforms Market with Strong YTD GainsCelsius Holdings Inc. (CELH) continues to attract significant investor attention, closing at $37.24 on April 17, up $0.58 (1.58%). The functional energy drink maker has delivered impressive year-to-date returns of 41.38%, substantially outpacing the S&P 500's 10.18% gain during the same period.

For

Celsius Holdings (CELH) – Fueling the Wellness Energy RevolutionCompany Snapshot:

Celsius NASDAQ:CELH is a top-tier functional beverage brand, capitalizing on the explosive growth of health-conscious energy drinks. Known for its clean-label, metabolism-boosting formulas, CELH is a favorite among fitness enthusiasts and wellness-driven consumers.

Key Catalysts

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where CELH is featured.

Frequently Asked Questions

The current price of CELH is 46.64 USD — it has increased by 0.71% in the past 24 hours. Watch Celsius Holdings, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Celsius Holdings, Inc. stocks are traded under the ticker CELH.

CELH stock has risen by 4.93% compared to the previous week, the month change is a 2.48% rise, over the last year Celsius Holdings, Inc. has showed a 2.19% increase.

We've gathered analysts' opinions on Celsius Holdings, Inc. future price: according to them, CELH price has a max estimate of 57.00 USD and a min estimate of 33.00 USD. Watch CELH chart and read a more detailed Celsius Holdings, Inc. stock forecast: see what analysts think of Celsius Holdings, Inc. and suggest that you do with its stocks.

CELH reached its all-time high on Mar 14, 2024 with the price of 99.62 USD, and its all-time low was 0.05 USD and was reached on Aug 9, 2011. View more price dynamics on CELH chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

CELH stock is 1.82% volatile and has beta coefficient of 0.50. Track Celsius Holdings, Inc. stock price on the chart and check out the list of the most volatile stocks — is Celsius Holdings, Inc. there?

Today Celsius Holdings, Inc. has the market capitalization of 12.03 B, it has decreased by −1.62% over the last week.

Yes, you can track Celsius Holdings, Inc. financials in yearly and quarterly reports right on TradingView.

Celsius Holdings, Inc. is going to release the next earnings report on Aug 12, 2025. Keep track of upcoming events with our Earnings Calendar.

CELH earnings for the last quarter are 0.18 USD per share, whereas the estimation was 0.20 USD resulting in a −8.11% surprise. The estimated earnings for the next quarter are 0.21 USD per share. See more details about Celsius Holdings, Inc. earnings.

Celsius Holdings, Inc. revenue for the last quarter amounts to 329.28 M USD, despite the estimated figure of 342.49 M USD. In the next quarter, revenue is expected to reach 647.30 M USD.

CELH net income for the last quarter is 44.42 M USD, while the quarter before that showed −18.88 M USD of net income which accounts for 335.32% change. Track more Celsius Holdings, Inc. financial stats to get the full picture.

No, CELH doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 28, 2025, the company has 1.07 K employees. See our rating of the largest employees — is Celsius Holdings, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Celsius Holdings, Inc. EBITDA is 142.32 M USD, and current EBITDA margin is 12.02%. See more stats in Celsius Holdings, Inc. financial statements.

Like other stocks, CELH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Celsius Holdings, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Celsius Holdings, Inc. technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Celsius Holdings, Inc. stock shows the buy signal. See more of Celsius Holdings, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.