WEED> ShortCanopy short as ACB steals participants from CANOPY GROWTH, the stock is starting to slow down.

If the SPY becomes bearish over the next 2 weeks and retraces or even without this motivation it may start to become more bearish as more investors move to ACB because it's rallying. On the flip side Canopy may also rally as ACB drives the market higher but the move will be weaker. Analysts are pushing this to stay up as people are buying up the stock over $60.

Target $50

Max Loss $300 total, if it moves above $65.

CGC trade ideas

Watch Triangle Breakout in WEED.TOCurrently long on a "front-running" trade for this triangle pattern. (vantagepointtrading.com)

After a strong run higher prior to the pattern, looking for a continuation. Will be watching for confirmation with a break higher out of the pattern, and may add to the position at that juncture.

There are two targets posted. One is very conservative just in case the sector doesn't move up or the breakout is weak. If the breakout is strong (strong price move with strong volume, and the sector is moving up with it) then will be looking for the higher target.

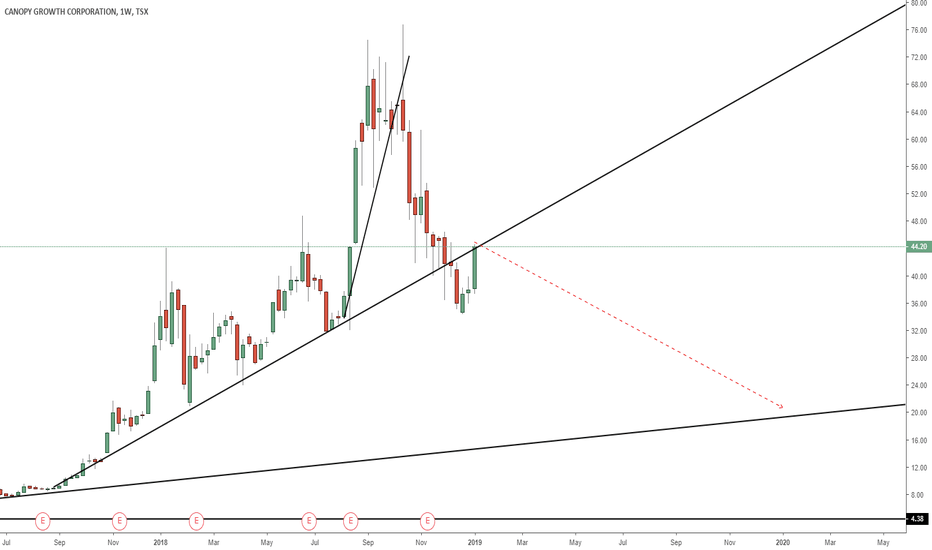

SHORT CGC RUN!!!Run for your life... JK

In all seriousness this stock is and has been overvalued for a very long time. Charts starting to reflect this.

With the failure to break ATH weekly close its starting to form a double top formation.

Especially with this weeks candle opening below last weeks red candle it is adding to my confidence on the short.

Ultimately the target is as highlighted in the chart but it is reasonable to take profits along the way.

I will update the chart throughout the weeks.

Cannabis Industry 2 Year GrowthThe cannabis industry has seen massive 2-year growth. Three key factors that have contributed to this growth are; the legalization of cannabis for recreational use in Colorado and Washington 5 year ago, the legalization of medical cannabis in many US states, and the legalization of cannabis in Canada having the biggest and most recent impact on industry growth.

Mexico is soon to join Canada and Uruguay with legalization.

WEED Symmetrical Triangle BreakoutAfter a few weeks of watching canopy and trying to short it. I've become convinced its going to produce a similar breakout from the previous rally.

Jan 9th > The first breakout started. Support began then the crowd started to rally and it produced substantial gains for longs leading into the next congestion phase.

Jan 14 - Jan 24 > The Bull flag congestion print which held selling volume and built up buying pressure to move it to a higher point.

Jan 28 - March 7th > Symmetrical Triangle Breakout - Jan 28 hit a top then 67.99 Feb 4th. Earnings were on Feb 13 which showed poor EPS however revenue was stronger than last year which is what captivated the crowd. The continued support is due to the sentiment of the overall market. Participants believe its going to the moon. April 1st stores open. There is a good reason to be optimistic about WEED/CGC and the market in general. (Fluff) Feb 15 was light due to ER mixed feelings of poor EPS and high revenue from prior earnings.

Hit a support level of $56.49 on Feb 25th. My target is within a few weeks for this to breakout like it did in October. Similar formation has formed. There seems to be strength behind canopy still. I plan to make this a mechanical trade and stick to what I've listed below.

This is my analysis I think there will be a breakout happening shortly which will push it into the 70 levels in the next few weeks. This isn't trading advice just my idea.

Call Contract expiring March 22nd Cost $3.45 Per contract. Target is $74 3 contracts

Stop price is $2.2 Delta is 0.53

Full sell of all contracts at $56.50 as this is support if it breaks then my trade is wrong.

I think Canopy Growth will retest its support in the coming week

I think Canopy Growth will retest its support in the coming weeks. Much based around the accounting error and no short term catalyst to move the SP higher from a already high SP, price near ATH. I think Canopy Growth will find support around $48-55 Cad or as low as $40 Cad, depending on more factors then only Canopy.

And with positive news around the Cannabis market not having a significant impact on the share price, i believe it impact the sentiment to become more positive towards Cannabis market, see it with a little bit less risk.

And with risk in mind, i think most well known companies have there share price reflecting the risk in the market rather then the potential of the market.

When the shift comes from investing for the potential rather then the risk. I think the good companies will have lower volatility and a steady SP and healthy technical moves. Rather then this risk investing climate, with high volatility, fast up and down moves and SP destroyed in a couple of days/weeks.

Based on the belief stated above, i think the SP will move down from 60 range to 40-50 range depending on sentiment/ things unknown to me.

And from there trade in an range until a leg up or down, or a shift in the sentiment.

Canopy Short 2nd Top Lower HighPossible Swing trade leading to support at $56. Small position.

Journal entry. Stop at 62 $80 loss.

I will wait to see how it responds to $56 if it bounces I'll change direction and go long if it fails add to my position

40 shares only if it passes support adding 100.

Testing smaller positions based on right sizing my trade against the average range from similar volume ranges. $2 price move into $80 is a good position for my stop

Bitcoin temporary bull run coming!Hello traders,

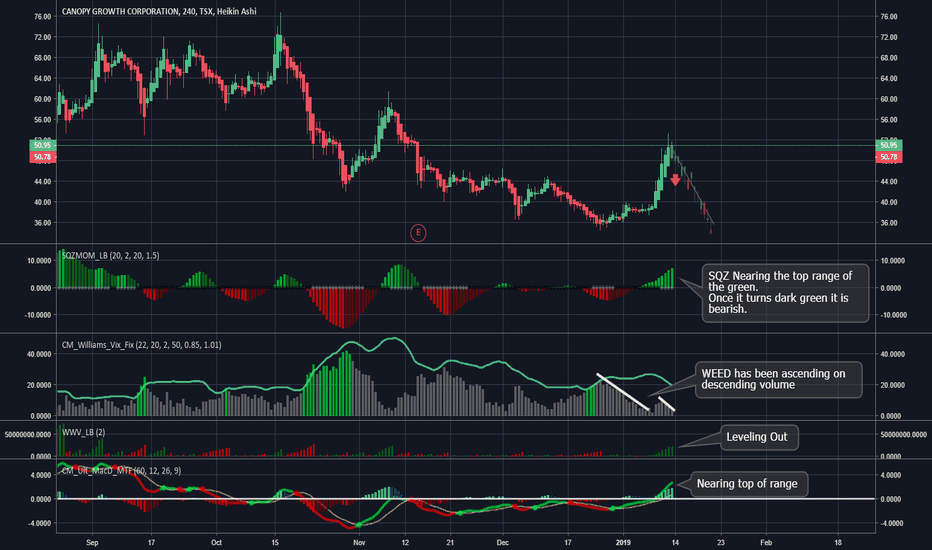

Looking at the daily chart for marijuana stock, WEED, we see that bulls are started to do profit taking. As a matter of fact, we see majority of marijuana stocks (CRON, N, ACB, APHA) just reached temporary top and looking to consolidate in next few days/weeks.

What I want you to notice is that marijuana stock and bitcoin has inverse relation, aka when weed stock goes up, bitcoin goes down, and vise versa (see highlight region). If people start to taking profit from marijiana stock, most likely we will start to see money inflow into the crypto market. My chart looks a little bit messy, but my temporary target is $3600.

Happy trading!

Canopy GrowthI believe the majority of cannabis investors are retail investors with low knowledge about the market and there company(s) of choice, with a hope of becoming rich fast and without pain. I see reports about cannabis investors that says investors are young people, and talks on yahoo about young investors in the cannabis space. I have followed the charts closely since mars 2018, when most retail hype started to come around, and people in my surrounding start to talk about cannabis. And for most part it, it looks the same, Big gains under some time and then selloff for some time after, and the sellers i believe are the buyers wanting to get rich fast, which is probably 90% of young investors mindset. The selling is under much lower volume then the buy up.

And with no new news on sale or progress in the US that indicates a higher valuation for the companies already high valuation compared to revenue and earnings, i can easy see "smart money" just waiting for price to slowly come down and then start to buy. I believe if the industry were to get a higher valuation the price will continue to climb higher and stabilize with smaller movements. Not continue to sway 10-15 % or more per week, for me that indicates a market without serious players, and more a environment where the big players sees a opportunity to make big money without risking not getting a good price for the stock, there is room and time to play the markets. But the time is counting down as the companies gets better sales figures, and really show its a viable business model. Given the fact the companies is losing millions on there operational side of business. And only time will tell what company will survive until breakeven. And the really big money will start pouring in..

If the volatility in the stocks get lower and trade in a tighter range, in a slow and steady climb, that indicates for me that the markets players is starting to buy up the stocks and is anticipating a higher valuation of the cannabis industry/company. And with growth slowing down on many sectors like tech and more, cannabis industry will become a good place for growth investors, looking for growth during a slower economy.

With all the negative news coming out on the cannabis sector, specially on the big player on over valuation or right out scams, when the real trouble in this young industry is to pick a company that will survive and flourish, its not that the cannabis industry not will create big winners. So, the impotence of getting in early is not that important and there is no early getting in now, the valuations is high for all companies until they produce much better numbers, most companies in the industry have valuations when they are running at 2019 full year capacity, and some with a premium, etc Canopy and Cronos, as people view them having a competitive edge with the investment of Constellations brands and Altair, where the cash injection they revived and partnership it gain it enables them for bigger and better business opportunities where they can make massive profits and it protects investors from the risk of the company running out of money, a premium investors are willing to pay in this new and high risk market. Where companies without partnerships have a higher risk to them of needing to issue new shares for capital or face bankruptcy. As so price is lower and the reward is higher.

When companies start to show strong signs of breakeven with strong revenue growth the price of the stock will skyrocket, as it shows investors with lower risk profile, where the most money is, will start to pour into the market and specific companies. Until then the market will continue to move money from the impatience investor to the patience investor.

So with that said:

Canopy growth are now trading in there ATH range, after a strong January, and nothing really new information beside a 60 Cad $ rek and the stock become cheap at a point, with heavy buy volume to follow, and the price increased almost 100 % from lows of late 2018. So if the price on Canopy is going to be higher i want to see a slow and steady climb from here to 70 ish. With a possible pullback to 60 range before continuation of the uptrend.

With many days of good gains and the market is still being played price will drop below 60, and buying will comeback at lower 50 range, where it can do two things, continue to trade in a range of start to trade higher.

Only for educational purposes.

Weed - RSI Overbought, hitting previous resistance at $65Weed - RSI Overbought, hitting previous resistance at $65. I was wrong with my short at $58 level. Short interest went up 4x from jan 1-16th, shortdata.ca. Earnings is Feb 14th, so I am on sidelines and will wait post ER. If spy breaks over 270 next week, weed can go higher! FOMC is Jan 30th. Holding $TGOD shares from 2.99. Safe trading!

WEED.TO Bullflag triple top on daily +60 = breakoutWEED.TO has been running on positive sentiments and news of hemp production in New York. They are currently holding strong in a consolidation pattern.

A bull flag will be completed if it runs passed 60 with any amount of decent volume. Buyers are not letting up and they're not letting go of any shares.

If 60 doesn't break it will retrace and retest 54-55 levels.

Let's see what happens

200 shares if it runs passed 60 with any good volume.

*Any idea listed here is just my opinion of what I plan to do and not trading advice.*

Weed - Hit .618 Fib level, pull back on 4 hour chart to $55Weed - Hit .618 Fib level, pull back for higher low. Look for back test $54.62 on 4 hour chart as support. RSI overbought, good news about hemp facility in NY. I will wait for support level to buy more shares. Picked up some TGOD for long hold last week at $2.99. Good luck!

$weed looking for pull back on daily chart , RSI OB, Fib level$weed looking for pull back on daily chart , RSI OB, Fib level closed right around .382 level or $50.80. Looking for consolidation and higher low, volume is not bullish and $spy is hitting resistance at $259. Tech Earnings next will set market direction. *own canopy shares, $nbev calls and bought $pyx feb calls friday. Shortdata.ca for short interest information. Good luck, happy trading!