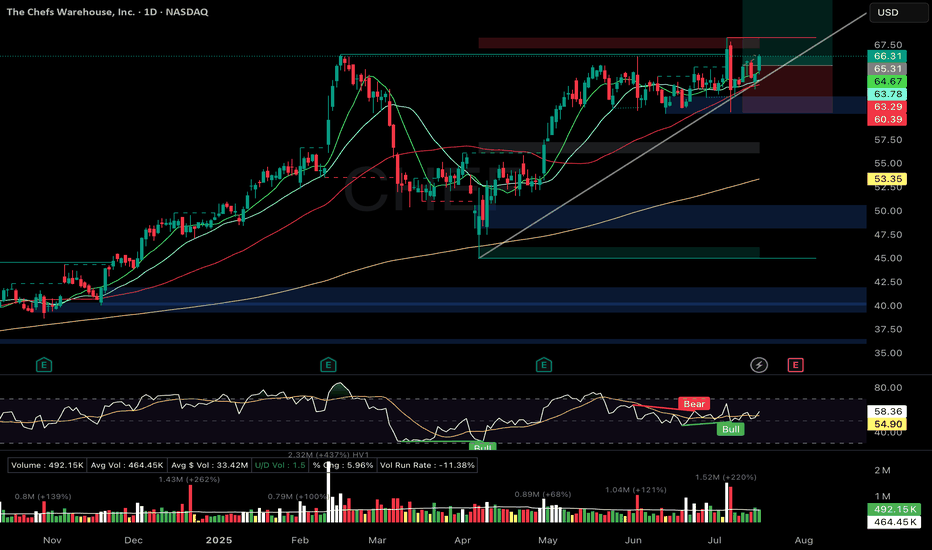

CHEF - Hammer off 21DMA + volume surge. Tight coil forming.CHEF – Chef’s Warehouse

Setup Grade: B+

• Entry: $66.35 (7/17)

• Status: Active

• Trailing Stop: $62.30 (2x ATR)

• Setup: Hammer off 21DMA + volume surge. Tight coil forming. RSI ~58.35.

• Plan: Watch for squeeze breakout confirmation. Manage with trailing stop.

• Earnings: July 3

CHEF trade ideas

CHEF a consumer discretionary stock to relish LONGCHEF on a 4H chart has been trending up since earnings in November. The report last week was

improved over November's. I got this one January and uploaded an idea then. CHEF has ran

25% since then. The bot alert is signaling SELL. RSI is at 64 and not yet overbought on a

period of 14. The mass index is signaling a reversal down at it went over the threshold

and then triggered.

I see CHEF ans a good stock that did 25% on the shares and 150% on the options since my buy.

I will sell the full position here. I will wait for a period of consolidation and Bollinger Band

tightening and a flat Supertrend line to make a sizeable new entry.

CHEF rises in price and volume for earnings LONGChef's Warehouse reports in two days. This is a slow grind it out type of stock. In the past week

volume spiking is seen on the indicator with the blue bars pointing out aberrancies in volume

otherwise called spikes. On the volume profile, CHEF fell down and out of the high volume

area of the profile for much of February but on Thursday the 8th re-entered it and pass through

it and breaking above it all in the same day. This is a rather explosive reversal pattern.

Price has maintain itself above the area in the past two trading session. The past week saw

more than a 6% rise for CHEF. This trade is best suited for investors, patient swing traders

or those trading options. This is not an intraday stock trade.

CHEF Setup to Benefit from Vaccine and Stimulus News

Chefs Warehouse (CHEF), I believe, is uniquely set up to benefit from any vaccine news and government stimulus, provided that they can survive the remainder of this 2020 and Q1 2021-which I believe they will due to a good balance sheet.

CHEF is a specialty food distributor mostly specializing in restaurant sales and distribution. Unlike US Foods or Sysco they mainly service independent restaurants, fine dining, and country clubs-although they do service cruise lines, hotels, etc. Which hurt them in the short run, long term however they are primed for a comeback and are beginning to look like they are making a move. As can be seen on my chart CHEF has broken out above the 200, 100, 50, and 20 Day SMA as well as its major trend channels and created a lovely little pennant pattern.

On the balance sheet CHEF has $71.81M in levered FCF and total cash of $208.54 due to a revolving line of credit they can draw on. This gives them a current ratio of 3.25 where US Foods ($USFD) is 1.6, Sysco ($SYY) 1.74, and United Natural Foods ($UNFI) of 1.56. This puts, I believe, CHEF in a position to enter the post-Covid economy in a period of growth.

With the potential shift in business and the way the US does business from a distance staying permeant post-Pandemic Chef's Warehouse could largely benefit from the take-out/dine-out windfall from all those stay at home employees. While their competitors have a larger market share of institutional and retail food CHEF is more focused on center of the plate items that will transition well into a work from home culture of the future.

ABC BullishNo rising wedges

Stock has been kinda hanging on support. If it ges below C..time to get out. An ABC pattern can turn in to a head and shoulders pattern if the C leg does not proceed..or hit break out and pulls back under C

Stop under C to keep you safe from this

PLNT is a bit iffy and was in an ABC pattern. Patterns change and are not set in stone. The only thing that never changes is change itself

This one would be cyclical I would imagine but has seen much higher prices in the past. I do not think the risk is extraordinary at this point but we all have our own idea of risk, although the low was 3.55

The Chefs' Warehouse, Inc., together with its subsidiaries, distributes specialty food products in the United States and Canada. Its product portfolio includes approximately 55,000 stock-keeping units comprising specialty food products, such as artisan charcuterie, specialty cheeses, unique oils and vinegars, truffles, caviar, chocolate, and pastry products. The company also offers a line of center-of-the-plate products, including custom cut beef, seafood, and hormone-free poultry, as well as food products, such as cooking oils, butter, eggs, milk, and flour. It serves menu-driven independent restaurants, fine dining establishments, country clubs, hotels, caterers, culinary schools, bakeries, patisseries, chocolatiers, cruise lines, casinos, and specialty food stores. The company markets its center-of-the-plate products directly to consumers through a mail and e-commerce platform. The Chefs' Warehouse, Inc. was founded in 1985 and is headquartered in Ridgefield, Connecticut.

Not a recommendation

NV picking up Large effective volume and a pocket pivot on Tuesday.

Pocket Pivots

Pocket Pivot: This is a price/volume pattern. Price forms a pocket pivot, when:

The price goes up compared to yesterdays close.

The volume today is higher than the maximum down volume of the past 10 days.

More details on pocket pivots and how they are implemented in chartmill can be found here. Note that both screens use the setting 'pocket pivot today', so this screen will look at the current candle. When you run this screen right after the opening of a new trading day, almost certainly zero results will be returned as we need at least more volume than the maximum down volume of the last 10 days. But, during the trading day nice candidates may appear, and after the current trading day you will get a list of all pocket pivots of the day.

Effective Volume

Effective Volume analyses the intraday volume on the minute level to determine what small and large players are doing in terms of accumulation and distribution. For a complete understanding you should read the book from Pascal Willain. (great book)

$CHEF can rise in the next daysContextual immersion trading strategy idea.

The Chefs' Warehouse distributes specialty food products in the United States and Canada.

On 29 May Moody's announces completion of a periodic review of ratings of The Chefs' Warehouse. It causes a rise in the share price.

At the and of the day the demand for shares of the company looked higher than the supply.

These and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $15,23;

stop-loss — $14,23.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

CHEF AnalysisAs of right now, I am keeping an eye on CHEF (Chefs Warehouse). Yes, it did break through the 23.6% fibonacci resistance line, however, we need to see a whole green candle above the resistance in order to jump in (using 1 hr candles). If CHEF breaks through the $11.84 resistance, expect to see $17 in the upcoming days. This is a very good opportunity for a long term investment #CHEF

CHEF is a buy on pullbackFull disclosure I am holding long from the 27-28 level, bought on earnings winner pullback. I thought about throwing it up here may a time but life has gotten in the way. Lets get to it!

The bottom (volume) has broken out over the 2x std line twice in the last week (The orange triangles point out he deviation breaks) while powering to a new high and confirming the breakout. I would like to get my last 1/4 of a position in, so I am waiting for a pullback towards the support line round 29- 29.50 before I pull the trigger.

Target is 33.00

Stop loss under 28.00

What does chef do? I don't know! This is purely a chart + earnings winner play.

I am planning on selling into the runup BEFORE the next earnings to keep earnings surprise risk down.

Disclaimer: This is for educational purposes only.