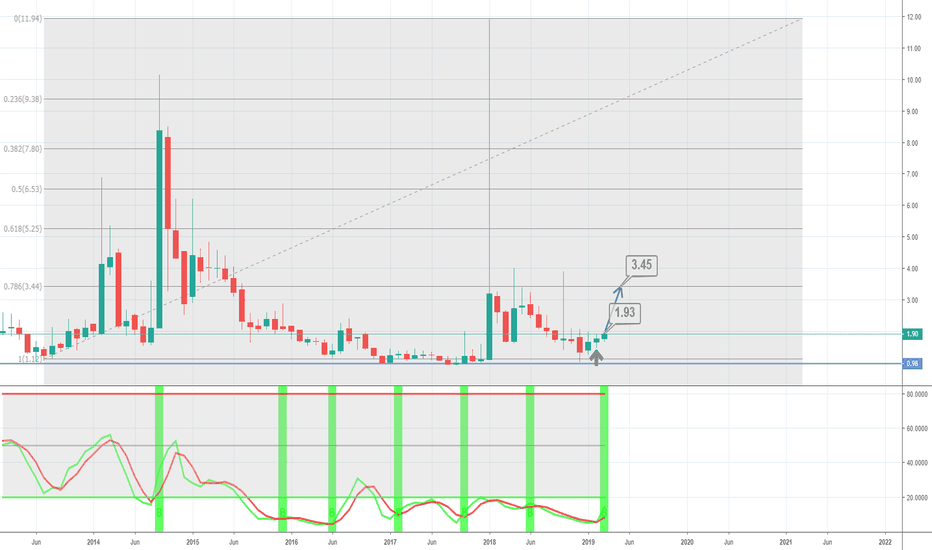

$CNET entry PT 1.70-1.80 PT 9-10 and higherBULLISH CYPHER PATTERN, REPEATING...REPEATING...

ZW Data Action Technologies Inc., through its subsidiaries, provides omni-channel advertising, precision marketing, and data analysis management systems in the People's Republic of China. It offers Internet advertising, precision marketing, and related data services through its Internet portals, including 28.com and liansuo.com that provide advertisers with tools to build sales channels in the form of franchisees, sales agents, distributors, and/or resellers. The company also develops and operates blockchain technology-based products and services. In addition, it provides; digital business promotion; and other e-commerce online to offline advertising and marketing and related value-added technical services, as well as research and development, and other technical support services for the block chain business. The company was formerly known as ChinaNet Online Holdings, Inc. and changed its name to ZW Data Action Technologies Inc. in October 2020. ZW Data Action Technologies Inc. was founded in 2003 and is headquartered in Beijing, the People's Republic of China.

CNET trade ideas

Potential breakout ( volume is picking up)ZW Data Action Technologies, Inc. engages in providing advertising, precision marketing, online to offline sales channel expansion and the related data services to small and medium enterprises. Its services include precision marketing, data analysis, member point’s management and other value added services. The firm operates through the following segments: Internet Advertising and Data Services; Ecommerce O2O Advertising and Marketing Services; Blockchain technology; and Corporate. The company was founded by Han Dong Cheng and Zhi Ge Zhang in 2003 and is headquartered in Beijing, China.

Please note:

- I'm just sharing my view. it's not a recommendation for buying or selling.

$CNET can rise in the next daysContextual immersion trading strategy idea.

ZW Data Action Technologies Inc., through its subsidiaries, provides omni-channel advertising, precision marketing, and data analysis services in the People's Republic of China.

The demand for shares of the company looks higher than the supply.

This and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $6,19;

stop-loss — $4,14.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

Pricing of $18.7 Million Registered Direct Offering Priced ATMZW Data Action Technologies Inc. Announces Pricing of $18.7 Million Registered Direct Offering Priced at the Market under Nasdaq Rules

today announced that it has entered into a securities purchase agreement with several institutional investors for a registered direct placement of approximately $18.7 million of shares of common stock of the Company at a price of $3.59 per share. The price was set at market price in accordance with the rules of Nasdaq. The Company will issue a total of 5,212,000 shares of common stock to the institutional investors.

The Company also completed a concurrent private placement of warrants to purchase shares of common stock to the same institutional investors. The warrants are to purchase up to 2,606,000 shares at an exercise price of $3.59 and have a term of three and one-half years.

finance.yahoo.com

ZW Data Action Technologies signed a strategic cooperation agreement with BitSpace for Joint Blockchain Mining Platform

The two parties will use their respective capital, platforms and resources to build a joint blockchain mining platform.

The ZW data’s blockchain infrastructure framework (BIF) platform will offer a new model of smart contract for automatic aggregate mining and achieve the automatic distribution of income.

finance.yahoo.com

$CNET is gonna fall todayPupm&Dump trading strategy idea.

$CNET is rising too much despite the news today.

The demand for shares of the company looks lower than the supply.

This and other conditions can cause a fall in the share price today.

So I opened a short position from $2,97;

stop-loss — $3,30;

take-profit — $2,31;

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

CNET$CNET NEW ARTICLE : ZW Data Action Technologies Entering into Partnership to Redefine and Increase the Traffic Value of the Enterprise WeChat for Better ROI

Surprised this isn’t up higher, WeChat is one of China’s biggest and most popular messaging platforms, I have friends from China that use it a lot..feel like this should be up higher.

STAY TUNED

CNET Announces Strategic Partnership with Yujun CapitalZW Data Action Technologies Announces Strategic Partnership with Yujun Capital

CNET announced that it has reached strategic partnership with Yujun Capital and its subsidiary Yujun Digital Technology Co., Ltd. (together, “Yujun Digital”) pursuant to which Yujun Digital will provide online branding and management service to the Company’s merchant clients.

Yujun Digital team consists of experts in the fields of new consumer products and digital transformation in the Guangdong-Hong Kong-Macao Greater Bay Area.

The Company is confident that together they will build a strong management and consumer service platform for its merchant clients.

“ZW Data and Yujun Capital will build a five-dimensional platform with digital product selection, brand content marketing, digital growth, private domain traffic operation, and brand digital intelligence.

finance.yahoo.com

Price Action & Psychology - Pullback, TrendHello !

Halfway retracement

Key support zone

Direction of the trend + wide-range candles

Indecision + spike in volume

Charts are like books. They tell us a story. We're trading in the direction of the trend, marked by these spikes in volume combined with wide-range candles.

What do the shadows/wicks tell us ? Well there's much conviction here. Whenever buyers are in control, they get very aggressive. Anyway, sellers still manage to bring the price back down (buyers are still in control!).

Obviously, everytime the price gets over-extended it retraces, usually on low volume. This shows that sellers are : 1) not being aggressive, 2) not being numerous. In other words, whenever prices get down, it's not a shift in investors/traders minds, but rather the natural course of profit-takers.

The trade is pretty clear here. After getting rejected from the resistance (and breaking out from the range), the stock comes down, on low volume, showing low interest in selling the stock. The hint here, is the indecision candlestick coupled with a spike in volume. This means, the stock has arrived at an important historical zone and buyers are stepping in.

Thanks for reading and if you have suggestions or want to discuss the idea, just leave a comment, I'll be happy to answer.

***Disclaimer : This is not an advice to buy the stock. Please, be aware that trading is a matter of probabilities and that it only takes ONE trader to deny your trade.***

ChinaNet-Online Holdings strategic partnership case studyThis strategic partnership between ChinaNet and Jingtum is focused on blockchain technology to build a credible, fair and transparent platform for business opportunities and transactions. Both companies will aim to develop credible, traceable, and highly secured blockchain applications for business entities.

globenewswire.com

CNET undervalue stock keep watching it !!!!Financially this stock should targeting higher with

PEG = 0.65 and P/E =6.54 P/S = 0.55 P/B = 0.41 that mean the stock is undervalue , Technically the stock break 50 SMA on Weekly and 200 SMA on Daily also break the downtrend seen with unusual volume increased buying from 0.85 could be a great chance targeting 1.20 as first target then we would forward 2 $ next 4 months