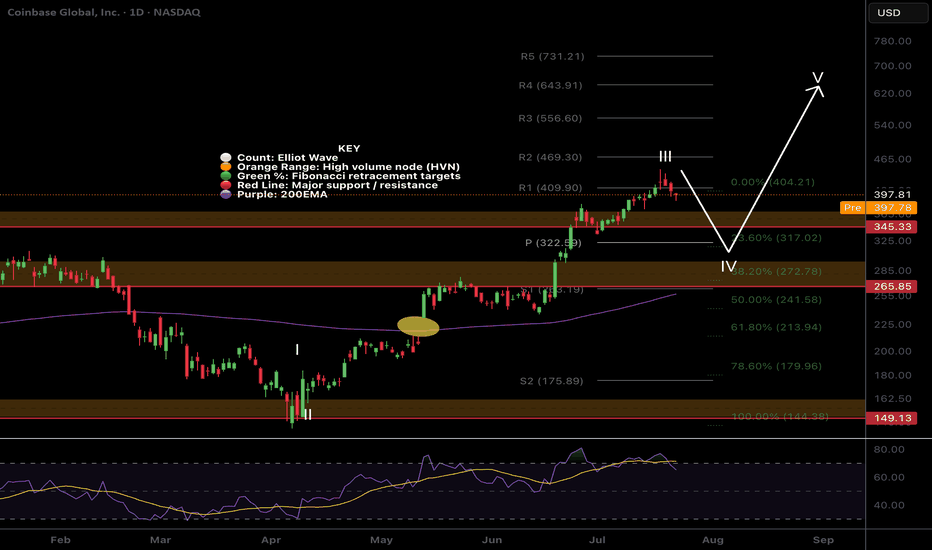

COINBASE Bearish RSI Divergence Signals Impending ABC CorrectionCoinbase Global has completed a full wave cycle and is now positioned for a corrective leg toward the base of Wave 4, following a classic Elliott Wave structure. The unfolding scenario aligns with a potential ABC corrective move, with Wave A currently in development.

A strong bearish RSI divergence has also emerged price continues to make higher highs while RSI prints lower highs indicating underlying weakness and increasing the probability of a deeper retracement.

The strategic plan is to monitor for short opportunities or pullback zones as the market unfolds this corrective leg, with the base of Wave 4 serving as the target zone. All eyes on the momentum breakdown and support reaction.

💬 Share your views on this setup in the comments.

COIN trade ideas

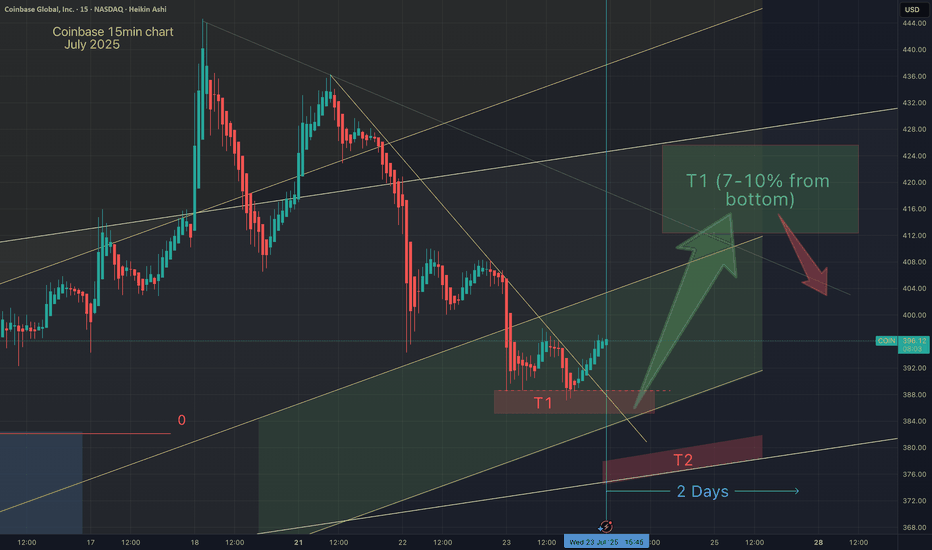

Coinbase dumped to my T3 range. Here is my Bullish targetCoinbase is in my range for a big bounce soon.

Could go a little lower, but I expect around a 25% bounce as soon as the retracement is done.

I anticipate Coinbase to go straight up to my bullish T1 target (around $400 +/- $10).

May the trends be with you.

COIN Gamma Storm Incoming!!!## 🚨 COIN Weekly Options Setup (Aug 7, 2025) 🚨

**Massive Call Flow vs. Bearish Momentum — Who Wins?**

> 🔍 Multiple AI models conflicted. Gamma risk rising. One day to expiry. Here's the trade...

---

### 🧠 Key Model Consensus (Across Grok, Claude, Llama, DeepSeek, Gemini):

✅ **Bullish Options Flow** from institutional players

📉 **Bearish Price Momentum** and RSI

⚠️ **High Gamma Risk** into expiration

🤔 **Signal Divergence** = Uncertainty + Volatility

---

### 🟩 **Bulls’ Case (Grok, Claude, Llama):**

* Oversold conditions + call buying = Rebound Setup

* Volume spike confirms institutional interest

* Moderate bullish lean with upside potential

### 🟥 **Bears’ Case (DeepSeek, Gemini):**

* Price action still weak

* Distribution pressure detected

* Recommending no trade or puts

---

### 📊 Trade Setup Summary

| Parameter | Value |

| -------------------- | ----------------- |

| 🎯 **Strike** | \$322.50 |

| 📅 **Expiry** | 2025-08-08 (1DTE) |

| 📈 **Direction** | CALL (LONG) |

| 💵 **Entry Price** | \$0.96 |

| 🎯 **Profit Target** | \$1.44 |

| 🛑 **Stop Loss** | \$0.57 |

| 📏 **Size** | 2 Contracts |

| 🔁 **Entry Timing** | Market Open |

| 🧪 **Confidence** | 65% (Moderate) |

---

### ⚠️ Risks to Watch:

* 1DTE = High volatility swings ⚡

* Momentum still leaning bearish 📉

* Gamma moves could trigger sharp reversals

---

📌 **Final Take**:

**Trade if you’re aggressive. Sit out if you’re cautious.**

This is a classic high-risk/high-reward setup driven by **options flow vs. price action divergence**.

COIN: Retesting Broken Resistance - Decision Point IncomingCOIN (Coinbase) has pulled back sharply after its breakout run to ~420 and is now retesting the prior resistance zone near 310–315, which previously acted as a lid during Q1.

This area now becomes a classic support-turned-resistance flip and serves as a major decision point for price:

Technical Levels & Setup:

310 horizontal zone = former resistance from February/March → now being retested

Buyers stepping in here would confirm a bullish retest, keeping the breakout structure intact

Failure to hold opens the door for a deeper flush toward 220-250

Price currently sitting on the zone with indecision - watch for confirmation candle (hammer / bullish engulfing)

Measured breakout continuation still targets 450+ if support holds

Is COIN simply back-testing the breakout before another leg higher - or is this the start of a larger reversal?

COIN Don't Miss Out

## 🚨 COIN WEEKLY TRADE IDEA (Aug 4–8)

**Bullish Setup Despite Mixed Signals — \$330 CALL ON WATCH**

---

### 🧠 Model Consensus:

* **📈 Weekly RSI** = bullish recovery potential

* **📉 Daily RSI** = bearish pressure, short-term caution

* **📊 Volume** = Institutional activity spotted

* **🧠 AI Models**:

* **Grok & Claude** = Bullish bias ✅

* **Gemini** = Bearish, sees distribution ❌

* **Meta & DeepSeek** = Neutral, sit-tight ⚖️

🧭 **Net Bias: MODERATE BULLISH** (But choppy daily tape)

---

### 🔍 Trade Setup:

| 🎯 Strike | 🎯 Entry | 🎯 Target | 🛑 Stop | ⏳ Expiry | 🎯 Confidence |

| ---------- | -------- | --------- | ------- | -------- | ------------- |

| \$330 CALL | \$4.00 | \$5.00 | \$2.50 | Aug 8 | 65% ✅ |

📍 **ENTRY TIMING:** At open

📍 **VIX Conditions:** Supportive (low-vol = favor gamma grind)

📍 **Risk Trigger:** Exit on close under \$315 or stop hit

---

### ⚠️ Key Risks:

* Daily RSI → 🟥 still bearish = choppy path

* Sector-wide pressure (crypto news, SEC)

* Negative macro or earnings = fast invalidation

---

### 🔥 Tags:

`#COIN #Coinbase #OptionsTrading #CallOption #BullishBias #GammaSqueeze #AITrade #TradingView #WeeklySetup #MomentumPlay`

Coinbase Stock Chart Fibonacci Analysis 080125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 310/61.80%

Chart time frame:C

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

Coinbase - T2 hit (but stopped out)We can't win them all, but I can limit my losses by knowing where are the best entry points, and quickly understanding how/when my strategy gets invalidated. So I know where to set my stop losses and minimize risk. Proper risk management is key.

I'm more focused on Btc and alts, but if anyone is interested in more of my Coinbase trading ideas let me know.

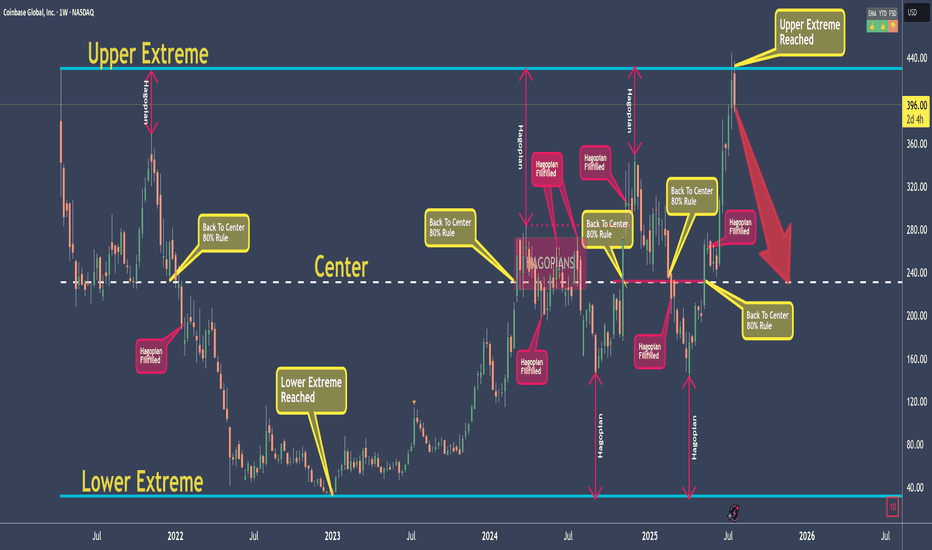

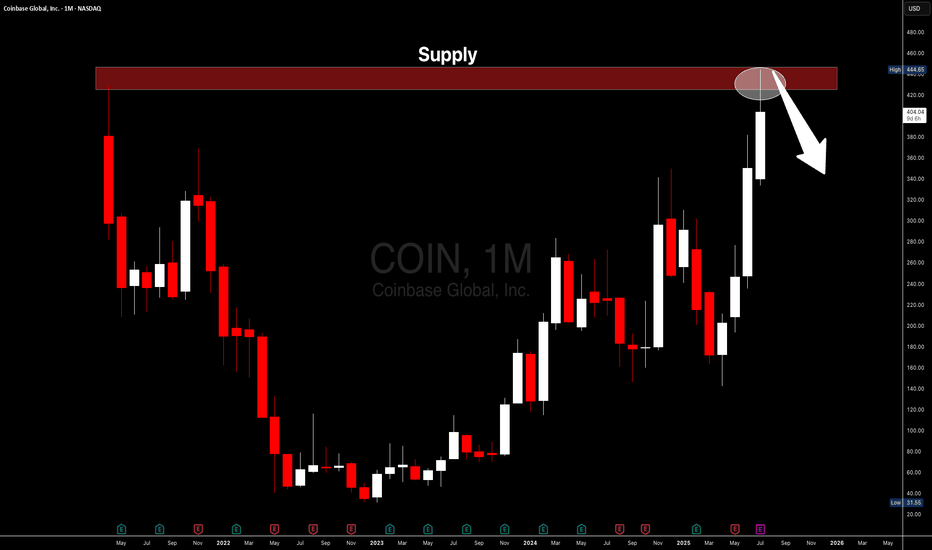

COIN - Topped at Supply TopPlease refer to our previous post:

In this post we were looking for sellers to come in at our red box between $350-$370. This did originally happen but as soon as we breached the red box price started pumping towards the top of our white box.

The top of our white box was around $430 (First day trading price) and once price reached that level we could not close a candle above. We reached a high slightly higher around $444 but as soon as we close a weekly below the top of the white box we have seen downwards momentum ever since.

We are getting close to our first level of support around $270-$280 and want to see that hold if we want to see a retest of high.

Right now COIN is not in a good spot on the weekly as we have a macro double top (around $430) as well as a bearish divergence forming on the weekly.

So although in the short term we are nearing some key support levels be aware that on the weekly we might be seeing the start of a bear trend. Coinbase's stock did skyrocket 1,300% in the last 2 and half years so a strong pullback to normal valuations would not be out of the picture.

COINGetting interesting!! miss on earnings and maybe a little lower in short term lets see if 300 holds as support if not looks as if we might see 250-260 again... lower while probably a good buy long term but probably says something has gone wrong in the economy and a weekly close under could spell doom for awhile

COIN 0DTE Trade Breakdown – July 25, 2025

📉 COIN 0DTE Trade Breakdown – July 25, 2025

Put Play or Pass? Let’s break it down 👇

📍 Price: $392.34

🧠 Sentiment: Neutral → Bearish

📊 Call/Put Ratio: 1.08 (Balanced flow)

⚠️ Gamma Risk: HIGH

⌛ Time Decay: Accelerating (0DTE!)

⸻

🎯 TRADE IDEA: 0DTE PUT

✅ Strike: $380.00

💵 Entry Price: $0.69

🎯 Profit Target: $1.00

🛑 Stop Loss: $0.37

📆 Expiration: Today (Jul 25)

📈 Confidence: 65%

📍 Entry Timing: At Open

⸻

⚠️ Why This Trade?

🔻 RSI trending down

🚫 Weak institutional volume

⚠️ High volatility expected from gamma squeeze

🕒 Tick. Tock. Time decay’s your biggest enemy here.

📌 Strategy:

➡️ Naked PUT (speculative short-term play)

⛳ Goal? Quick move → quick exit

⸻

🚨 Risk Warning:

❗ 0DTE = Massive swings

❗ One wrong move = rapid premium decay

❗ Stay nimble. Know your exit.

⸻

💬 Drop a 🔥 if you’re watching COIN today

#OptionsTrading #0DTE #COIN #DayTrading #PutOption #TradingView #StockTok #GammaRisk #TradeSetup

$COIN Wave 4 pullback?NASDAQ:COIN had a tremendous run, a text book Elliot wave 3 but has confirmed bearish divergence on the daily RSI.

The trend is strong so wave 4 could be shallow, only reaching the previous all time high, High Volume Node and 0.236 Fibonacci retracement and daily pivot point between $322-345

Further decline brings up the High Volume Node support at 0.382 Fib retracement and ascending daily 200EMA! Also a highly probable scenario!

Long term outlook remains around $600 target

Safe trading.

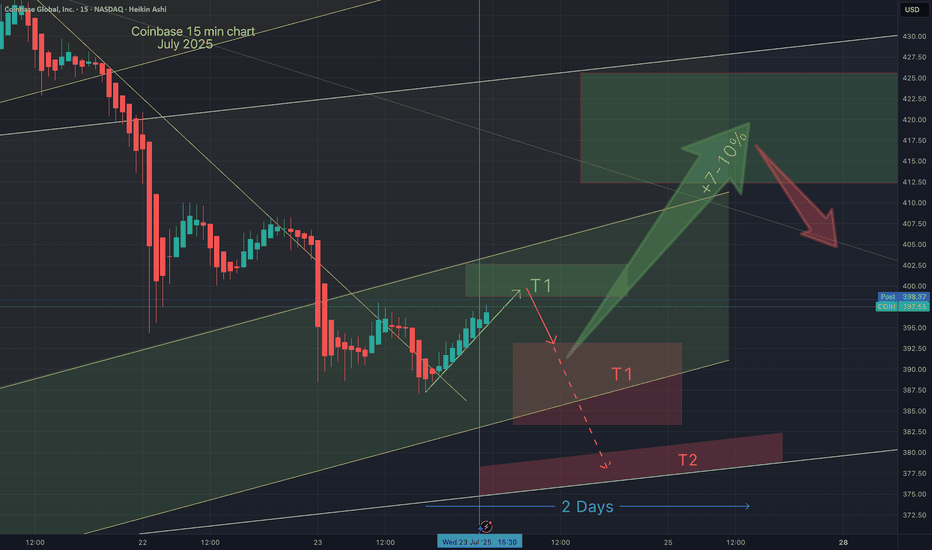

Coinbase targetsI'm confident that coinbase has more upside after this recent retracement. I have zoomed in (on 15 min timeframe), on what I believe may be the bottom of this dip. As Coinbase dips, we note that Alt coins are also retracing. I believe Alts and Coinbase will soon see a reversal to the upside. This chart shows my entry points and how I anticipate price action to unfold.

COINBASE - My rules say: Down with high probabilityI don't elaborate too much here, because I want to give you a chance to learn something!

As for the Trade, my rules say that it is a good Short.

The Short is not valid anymore, if price open and close above the Upper Extreme!

So, what are the rules?

Well, that's exactly what you will learn today ;-)

Go to my previous post which I will link, and you find everything you need to jump on the Steam-Train if you like.

As my old Mentors always said: "Larn To Earn"

Happy Profits Guys & Gals §8-)

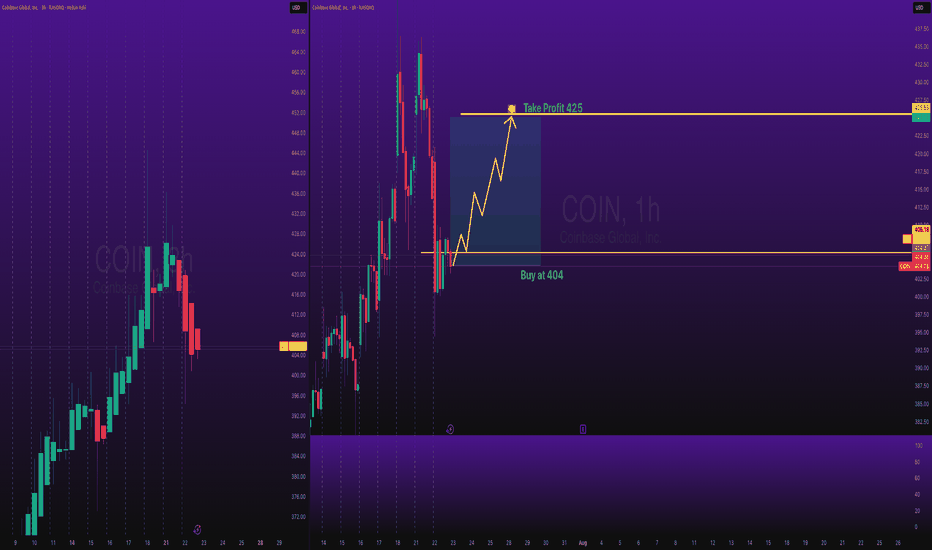

COIN Shares Buy at 404 Take Profit at 425NASDAQ:COIN Shares Buy at 404 Take Profit at 425

Stocks SPOT ACCOUNT:

NASDAQ:COIN shares: my buy trade with take profit.

This is my SPOT Accounts for Stocks Portfolio.

Trade shows my Buying and Take Profit Level.

Spot account doesn't need SL because its stocks buying account.

Looks good Trade.

Disclaimer: only idea, not advice

COINBASE I Strong Bearish Outlook (Take Action Now)Welcome back! Let me know your thoughts in the comments!

** COINBASE Analysis - Listen to video!

We recommend that you keep this stock on your watchlist and enter when the entry criteria of your strategy is met.

Please support this idea with a LIKE and COMMENT if you find it useful and Click "Follow" on our profile if you'd like these trade ideas delivered straight to your email in the future.

Thanks for your continued support!

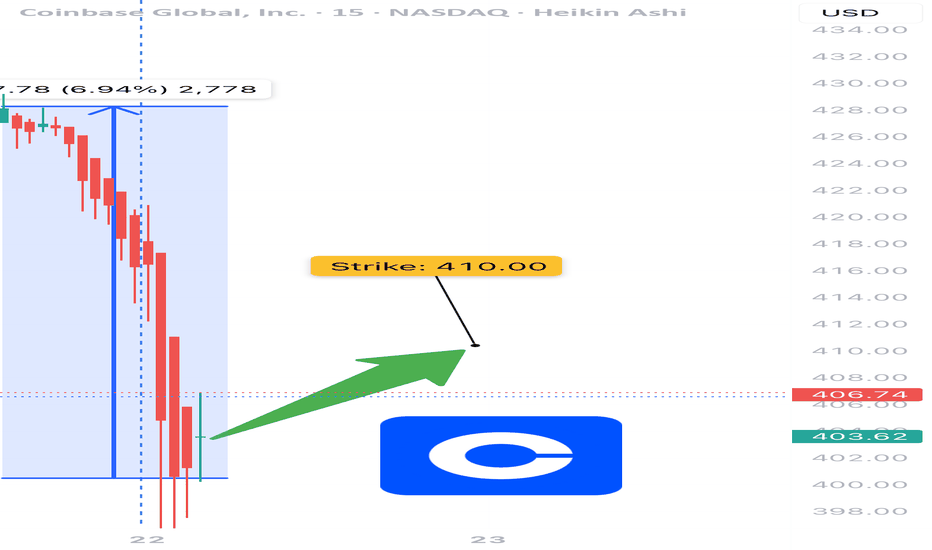

COIN Weekly Bullish Options Setup (Jul 22, 2025)

🚀 NASDAQ:COIN Weekly Bullish Options Setup (Jul 22, 2025)

Institutional call flow is heavy. Momentum is fading — but not dead. Volume confirms bulls. This is a calculated strike before earnings zone noise.

⸻

📊 Trade Setup

• 🎯 Direction: CALL

• 📍 Strike: 410

• 💰 Entry: $14.70

• 🎯 Target: $17.00+

• 🛑 Stop: $11.60

• ⏰ Expiry: 07/25/2025 (3DTE)

• 📈 Confidence: 65%

• 📍 Entry Timing: Market open

⸻

🔍 Model Consensus (Multi-AI Synthesis)

• 🟢 3/5 models bullish: Grok, Llama, DeepSeek

• 🟡 1 neutral: Gemini (momentum divergence noted)

• 🔴 1 bearish: Claude (overbought RSI divergence risk)

• 📈 VIX < 22 = Green Light

• 🧠 Key Catalyst: PNC x Coinbase partnership + institutional volume surge

• 📉 Watch for RSI reversal > Weekly 83.5

⸻

📎 Trade Logic

• Options flow + volume = 🔥 institutional accumulation

• RSI high but manageable — expect momentum pockets, not full reversals

• Range target: $428–$444.65

• Stop loss = discipline, not fear

⸻

🧠 Risk Note:

• Momentum divergence is real.

• Avoid chasing if VIX > 22 or if open shows reversal.

• Size small. Let the volume do the work.

⸻

📢 Tagline (for virality)

“Snakes see a breakout, but bulls smell blood. NASDAQ:COIN loading calls on institutional flow. 3DTE scalp or breakout runner. Your move.” 🐂📈

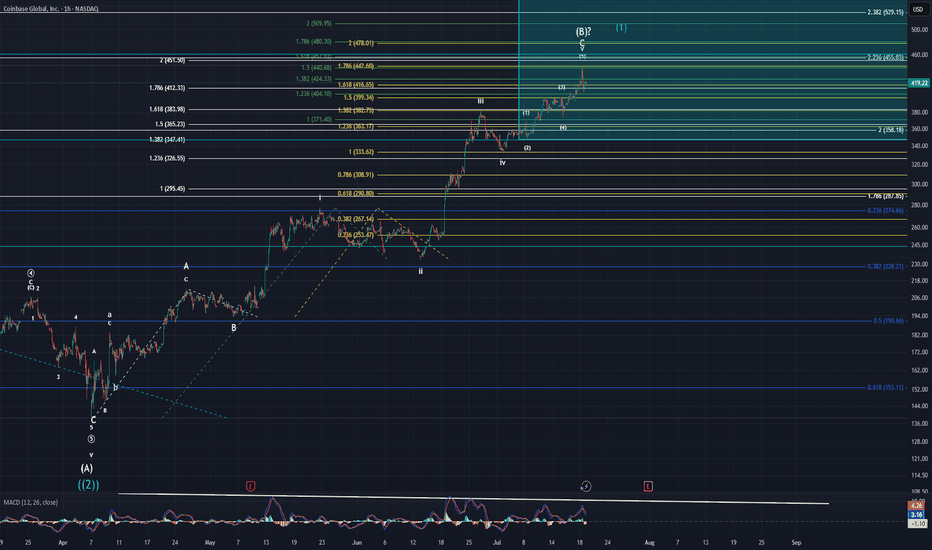

Coinbase UpdateI stated that if price broke through the yellow 1.618 @ $416 with strength that I would start to very seriously doubt the corrective count that I have. Well, it broke well through that fib only to immediately fall right back down and close only $3 away from it. Now, that being said, I am still in very seriously skeptical of the corrective pattern I am tracking. Lets start at the beginning of how I re-evaluated this pattern.

First thing I did was revisit the very beginning of the larger move higher that started way back in January 2023. I zoomed out to the monthly and then worked my way through the weekly, daily, 4hr, so on and so forth. I looked at MACD in relation to price action and notice a few things.

MACD Observations:

#1 - Monthly is still pointing higher in a strong manner.

#2 - Weekly is also pointing higher with strength and is on the verge of making a new high.

#3 - Daily just made a new ATH. This is significant given we're supposed to be in a (B) wave according to my white count.

#4 - Daily high in MACD combined with a high in price suggests eventual continued upside movement as momentum is still to the upside.

#5 - 4Hr and below is showing weakness

Now, to interpret all of this, one must know the typical correlation between price and MACD. Before, my ALT was that this was a continuation of intermediate (5) of primary ((1)). Now, after I have reflected on the recent longer-term developments, I am of a mind that this could be the intermediate wave (1) of primary wave ((3)). That would help to explain why the move down that began in Dec 2024 breached the wave 4 of a lesser degree. When you turn off log scale on the longer-term retracement fibs, it shows price slightly breached the 0.618 @ $153.11 to hit a low of $138.45. Is this the more accurate way to look at this? I cannot say for certain, but it sure is starting to seem like it.

Chris and I have been forecasting an imminent high in the overall markets for some time now. I still believe the markets are on the precipice of a super cycle wave (III) high. So how does this new possible outlook on Coinbase fit in with the overall markets dropping for the next few decades. How can it continue to move higher towards such highs while most everything else is getting hammered? Short answer, I have no idea. I have largely given up trying to link causation with events. Sure, it is fun to think about it and try to link certain things towards price action. In the end though, what does it really matter? All I care about is WHAT price does. Not WHY it does it.

For now, I am still stuck in not being able to make a decision on which count I prefer more. After this last week or two of price action I am beginning to strongly lean towards Coinbase entering into a new bull phase in the form of primary wave ((3)). The main problem I have with wave ((3)) though is that would suggest that primary wave ((2)) only lasted for four months whereas primary wave ((1)) lasted for two years. There are no rules that says this cannot be the case. It is odd for sure though.

Rather this is wave (1) of ((3)) or wave (B) of ((2)), price is overextended and does need a consolidation of the gains made in the last four months. As of now, if we have a top or only make a minimal new high, I forecast that retracement will fall to sub $300 easily and likely $250 to as low as $170. Once we have a larger abc pattern down from a top, that will be a GREAT time to go long. Worst case scenario, I will ride the minor B wave higher if it is a larger corrective pattern. Best case scenario, I ride the wave (3) of ((3)) to all time new highs. Obviously, it goes without saying one needs to keep their assets protected no matter what happens.

P.S: I am sorry the chart looks a little messy. I thought it pertinent to leave the three different fib extensions to give you as much information possible as to what prices possible intentions are. There is a lot of information in this post. PLEASE let me know if you have questions or I left anything unanswered.

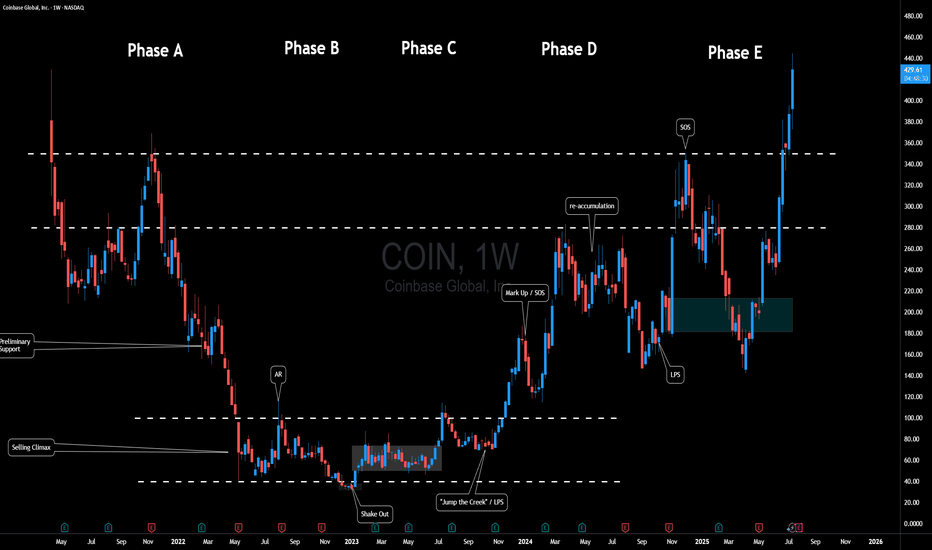

$COIN Fun Wyckoff InterpretationHere's a fun Wyckoff-inspired take on Coinbase Global ( NASDAQ:COIN ) over the past few years, mapping its weekly chart to the classic Accumulation Schematic. Wyckoff's method, envisioning the "Composite Man" quietly scooping up shares during weakness before blasting off... fits COIN perfectly, especially in crypto's wild swings.

We can see a textbook multi-year accumulation from mid 2022, a breakout into markup in 2024, and even a cheeky re-accumulation mid-2024 to fuel the latest highs.

Phase A: Stopping the Downtrend

After the initial IPO Coinbase experienced quite a bit of downside pressure.

Eventually price began to range between $40 and $100.

Phase B: Building Cause

Months of boring sideways chop.

Sellers exhausted because let's think for a moment... If crypto was truly going to stick around - how much lower could this thing go?

Smart money absorbs.

Phase C: The Trap

That shakeout low at ~$32 in early 2023. If you study Wyckoff, this is Schematic #1 vibes.

Phase D: Demand Dominates

Explosive rally (SOS) to ~$280 in early 2024, breaking the range on surging volume.

Mid-2024 pullback to ~$150 acts as a mini Re-Accumulation with its own LPS at the low. Higher lows / mitigation confirm no real distribution yet. Another SOS post-re-accumulation, pushing toward $400+.

Phase E: Markup Phase

Where will the composite man be eyeing for the next target?

Overall, Crypto adoption's heating up (BTC ETF flows, regulatory, etc), and the chart's still in a strong uptrend. But remember, Wyckoff's not crystal ball... it can however be used as a roadmap to navigate the chart.

Fun fact: COIN often mirrors BTC, so keep an eye out for correlation.

What's your opinion - accumulation complete or more shakeouts ahead? 🚀📈

Disclaimer: Not financial advice; DYOR! Chart based on weekly data up to July 2025.

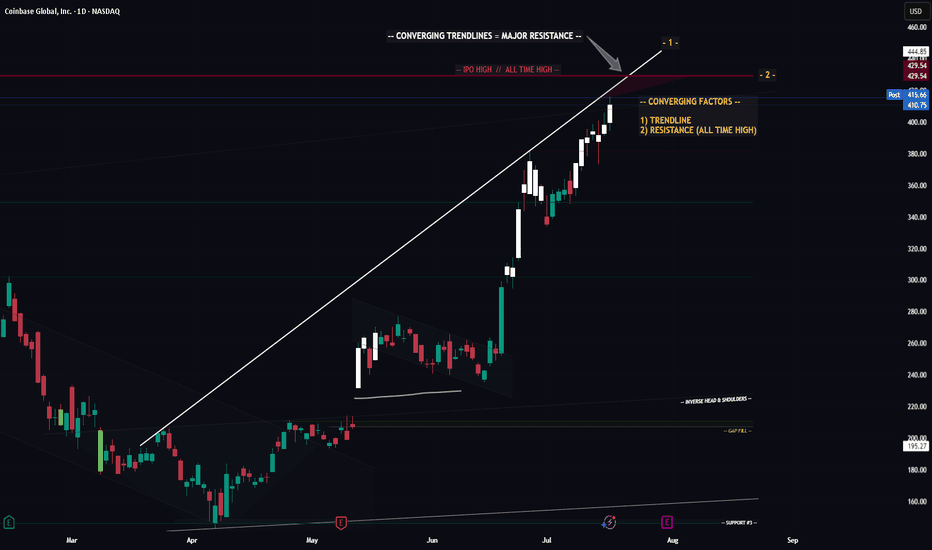

COIN (Update) -- Potential Max Price TargetHello Traders!

Coin seems to potentially have a little bit more steam left. If it does make one more push... where will price go?

At $429.54 we have the All Time High for COIN.. interesting enough that price was hit on the first day of trading for COIN which adds to the significance of this price level. There is also a trendline connected from pivot to pivot. These two factors converge and create a significant level of resistance.

Most likely I will be entering a short position at this level.

Thanks everyone and best of luck on your trading journey!