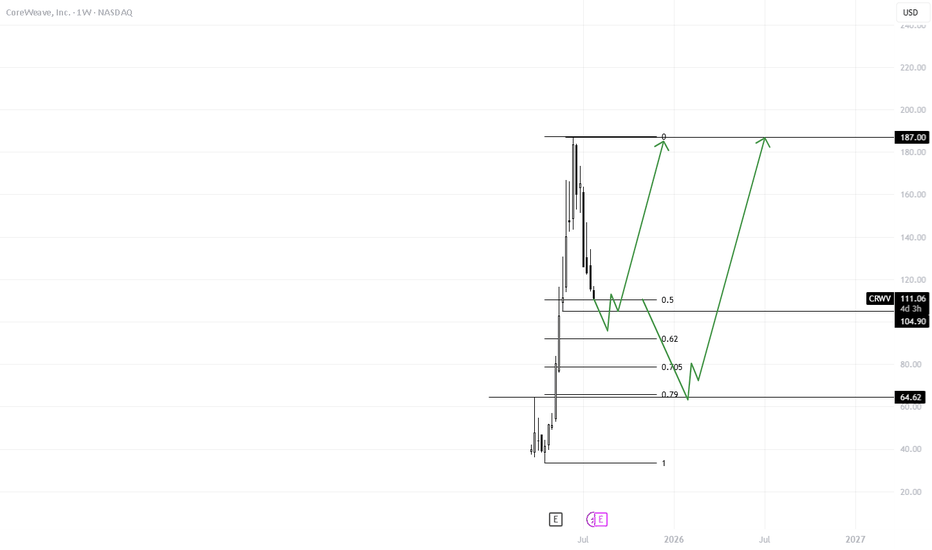

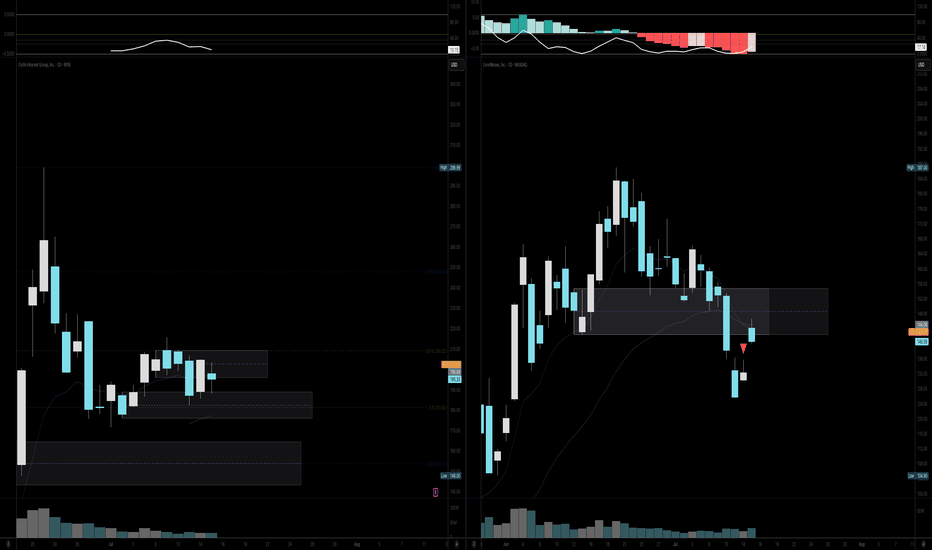

$CRWV: Reversal Brewing or More Pain Ahead?🧠 NASDAQ:CRWV – Technical Analysis (Daily Timeframe)

CoreWeave is currently trading at $104.14, sitting at the lower end of a well-defined descending channel after a steep selloff (-8.75% today). Volume is spiking, suggesting growing interest — whether that's accumulation or distribution is the key to watch next.

📉 Descending Channel Breakdown

Upper trendline = breakout trigger

Lower trendline = breakdown trapdoor

🟡 Midline of the channel = key decision zone (dynamic resistance/support)

Acts like a battlefield: bulls want to flip it, bears want to reject it.

CRWD has been respecting the midline as resistance — until price reclaims and holds above it, trend remains bearish.

If we break above the midline with volume, that’s early confirmation of strength before even touching the top of the channel.

🟢 Long Setup (Breakout Play)

Trigger: Break & close above channel top (~$110+)

Confirmation: Reclaim midline, convert it to support

Targets:

$120 local supply

$140 minor inefficiency

$186 gap-fill + key supply zone

🔴 Short Setup (Breakdown Play)

Trigger: Break & close below lower trendline (~$100 or under)

Confirmation: Fail to reclaim midline on bounce

Targets:

$85 psychological zone

$64.82 demand level

📊 Indicators

MACD: Bearish, but curling. A bullish cross on a midline reclaim = fuel.

RSI: Near oversold, showing early divergence = potential bounce

Volume: Big pop today — first real signal buyers/sellers are clashing hard.

🎯 Key Takeaway:

✅ Break & close above midline → early strength

✅ Break & close above channel → CONFIRMED BUY

❌ Close below lower channel → HIGH-PROBABILITY SHORT

❓ Rejections at midline → continue fading pops until proven wrong

CRWV trade ideas

CRWV - THE MOMENT OF TRUTH📰 CoreWeave (CRWV) — Technical & Macro Update

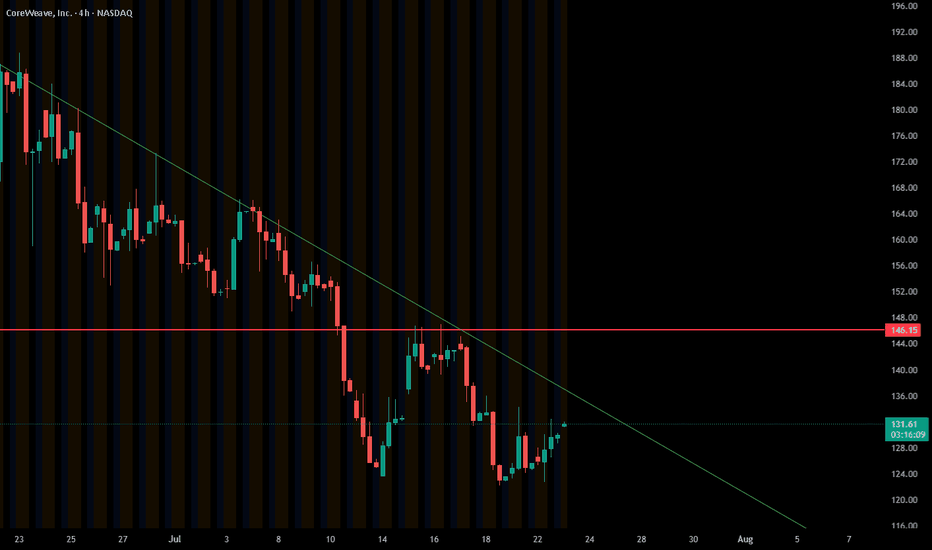

Ticker: CRWV | Chart Timeframe: 30-min | Current Price: $115.62

Sector: AI Infrastructure / Data Centers

Date: July 26, 2025

⚡ Market Recap

CoreWeave was in the spotlight this week following two key developments:

🏗️ $7 Billion Lease Deal: Entered two 15-year AI data center agreements with Applied Digital (APLD), expected to generate $7B in top-line revenue. This solidifies long-term client infrastructure demand and recurring income.

💸 Debt Load Grows: Issued $1.75B in 9% bonds, raising concerns over capital intensity and financing strategy. Total projected capex through 2025 is $20–23B, requiring significant additional funding.

📉 HSBC Slashes Price Target: HSBC initiated coverage with a sell rating and an aggressive price target of $32 — a 72% downside from current levels. The firm cited:

Unsustainable customer concentration (Microsoft makes up ~60% of revenue)

High financial leverage

Risk of multiple compression as AI hype cools

Despite bullish sentiment from lease news, the downgrade weighed on investor confidence, pushing shares into a tight range.

🔍 Chart Technical Outlook

Structure Summary:

Price has compressed under a descending trendline

Trading between $114.00 (support) and $118.50 (resistance)

Price action is setting up for a breakout or breakdown

✅ Bullish Setup

Breakout Level: $118.50+

Short-Term Targets: $122 → $126 → $130

Tailwinds:

Long-term lease revenue visibility

Strong Q1 growth (+420% YoY)

Core partners: OpenAI, Mistral, Microsoft

❌ Bearish Breakdown

Breakdown Level: $114.00

Targets: $110 → $106.50

Headwinds:

$12B+ in debt, rising interest costs

Analyst downgrade to $32 price target

Customer concentration and margin risk

🧠 Strategic Takeaway

CoreWeave is perched at a critical level. While bulls are encouraged by long-term deals and market share in AI compute, bears are becoming louder following HSBC’s stark warning.

Play the breakout—but know the macro backdrop. A move above $118.50 opens upside, but failure below $114 could confirm bears' thesis.

CRWV earnings pop perhapsIt's a buy for many. Consolidating nicely. Doesn't look like we will make it to the Christmas fib level .786

Earnings is next week and I think it can do well.

APLD announced a major partnership during their earnings call. They have contract(s) with NVDA. What else is going on pop worthy?

Close Targets: 125, 135

Great earnings... 145+?

SL 99; or tight at 103

Weekly Equities Trade Idea: CRCL Puts (Update)Hello Traders!

I'm providing an update to the CRCL trade idea from Monday July 14th. Here's what I'm watching:

- Price to open within the range from Tuesday July 15th

- Potential imbalance resolve from Monday July 14th at $204.70

- If price breaks Friday July 11th's high at $206.80 the trade is invalidated

Cheers,

DTD

Short-term Bear Case for CRCLHello Traders!

As part of my weekly equity trade analysis, I will be uploading my recordings of what I am seeing and intending to trade for the week. A quick summary of what's in the video is as follows:

- CRCL is a high beta stock that seems to not be moving in tandem with its peers as of late

- I am expecting volatility due to market data and monthly options expiration

- CRCL has formed a new bearish order block below another bearish order block and is wedged with a weekly bearish setup. We are anticipating expansion out of this range to the downside

- I am waiting for a re-test of $199-$205 for a full move to $155-$145

Cheers,

DTD

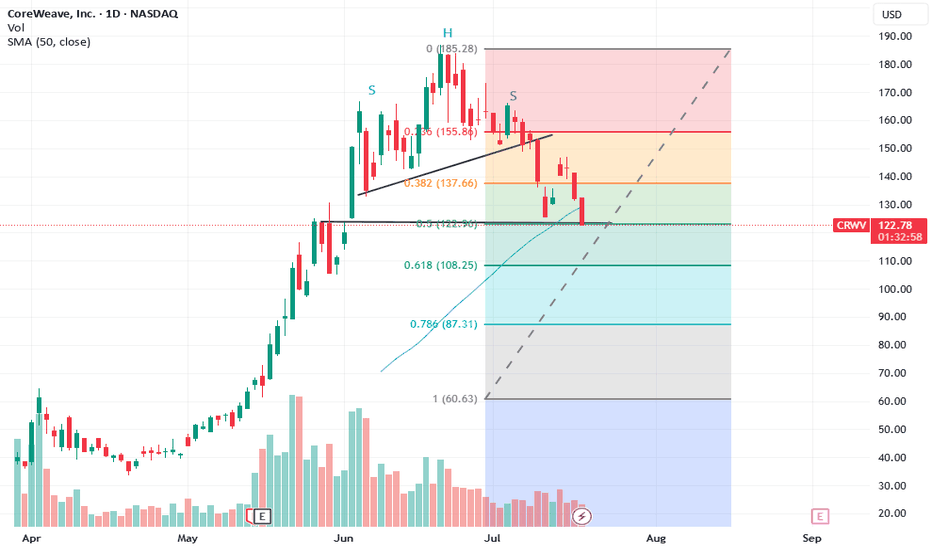

WHAT GOES UP MUST COME DOWN wants to close daily gap at $123.66CRWV forms ‘Head and Shoulders’ on the daily over the past month. The breakout to $180s is all I saw a month ago…but now a reversal has started to $123.66 and maybe to $111.95 as the worse case scenario. My daughter made me hold on to this one like she did on Nvidia. She was right on that one….but she is 45 and I am 82. She has more time to wait it out than me. CRWV has taken the path of many IPOs….it pulls up right after coming out of the gate. Regains its footing and starts to move (using horse racing terminology) Great speed rating, so she gains ground in the first turn. Still improving her time down the backstretch as she breaks the $100 mark by middle of May and gaining momentum. She continues to pass horses and moves into the lead as they reach the 1/4 pole. By now it’s apparent that CRWV is a closer as she demonstrates moving down the last eighth of a mile. As she roars up the home stretch 8 lengths ahead of the field closing above $180.

Unfortunately her next race is dismal as she forms a ‘head and shoulder’ pattern. From here it’s all downhill until she reaches $123.66 …..or worse $111.95

Who Silently Powers the AI Revolution?While the spotlight often shines on AI giants like Nvidia and OpenAI, a less-publicized but equally critical player, CoreWeave, is rapidly emerging as a foundational force in the artificial intelligence landscape. This specialized AI cloud computing provider is not just participating in the AI boom; it is building the essential infrastructure that underpins it. CoreWeave's unique model allows companies to "rent" high-performance Graphics Processing Units (GPUs) from its dedicated cloud, democratizing access to the immense computational power required for advanced AI development. This strategic approach has positioned CoreWeave for substantial growth, evidenced by its impressive 420% year-over-year revenue growth in Q1 2025 and a burgeoning backlog of over $25 billion in remaining performance obligations.

CoreWeave's pivotal role became even clearer with the recent partnership between Google Cloud and OpenAI. Though seemingly a win for the tech titans, CoreWeave is supplying the critical compute power that Google then resells to OpenAI. This crucial, indirect involvement places CoreWeave at the nexus of the AI revolution's most significant collaborations, validating its business model and its capacity to meet the demanding computational needs of leading AI innovators. Beyond merely providing raw compute, CoreWeave is also innovating in the software space. Following its acquisition of AI developer platform Weights & Biases in May 2025, CoreWeave has launched new AI cloud software products designed to streamline AI development, deployment, and iteration, further cementing its position as a comprehensive AI ecosystem provider.

Despite its rapid stock appreciation and some analyst concerns about valuation, CoreWeave's core fundamentals remain robust. Its deep partnership with Nvidia, including Nvidia's equity stake and CoreWeave's early adoption of Nvidia's cutting-edge Blackwell architecture, ensures access to the most sought-after GPUs. While currently in a heavy investment phase, these expenditures directly fuel its capacity expansion to meet an insatiable demand. As AI continues its relentless advancement, the need for specialized, high-performance computing infrastructure will only intensify. CoreWeave, by strategically positioning itself as the "AI Hyperscaler," is not just witnessing this revolution; it is actively enabling it.

6/17/25 - $crwv - Short again6/17/25 :: NASDAQ:CRWV :: VROCKSTAR

Short again

- much easier to find shorts in this tape

- these guys don't make money when you take out capex

- it's like bitcoin mining, without the bitcoin

- go figure. eat your heart out normies.

i'm short, again. send it higher about 2%. prefer 5% size.

enjoy the bearish divergence on the daily.

V

Where is $CRWV headed to?CoreWeave (NASDAQ: CRWV):

Pros

Explosive revenue growth

-Q1 2025 revenue surged 420% year-over-year to $981.6 million, up from $188.7 million.

-Consensus expects revenue could double in 2025 and reach $16 billion by 2027.

High adjusted EBITDA margins

-Adjusted EBITDA margin around 62% in Q1 and ~64% for 2024.

Strategic customer contracts

-$11.9 b OpenAI deal and partnership with Google Cloud to support OpenAI workloads.

-$7 b lease agreement with Applied Digital over 15 years.

Backed by top-tier capital providers

-Investors include Nvidia, Microsoft, Blackstone, Magnetar, Fidelity.

-IPO raised $1.5 b even after scaling down, plus interest in refinancing $1.5 b debt.

Market leadership in GPU cloud

-Positioned as a “neocloud” AI infrastructure powerhouse, offering specialized high-performance GPU services to hyperscalers.

Cons

-Massive capital intensity & debt

-Carried ~$8 b in debt as of end-2024; raising more to refinance high-yield credit.

-Depreciation and interest charges weigh on GAAP profits

GAAP losses remain significant

-Q1 net loss of $314 million due to high depreciation/interest; GAAP net loss margin ~32%.

-Non-cash adjusted figures hide underlying capital burn.

Customer concentration risk

-Microsoft accounted for ~62% of 2024 revenue; OpenAI and Google help diversify, but client dependency remains.

IPO headwinds & pricing struggles

-IPO priced at\$40 (reduced from $47–55).

-Seen as largest tech IPO since 2021, but faced investor concerns over sustainability.

Valuation and competition concerns

-Stock is up ~250–300% since IPO—possible bubble risk.

-Faces competition from Big Tech hyperscalers and other AI compute providers

-Disclaimer: This analysis is for informational and educational purposes only and does not constitute financial advice, investment recommendation, or an offer to buy or sell any securities. Stock prices, valuations, and performance metrics are subject to change and may be outdated. Always conduct your own due diligence and consult with a licensed financial advisor before making investment decisions. The information presented may contain inaccuracies and should not be solely relied upon for financial decisions. I am not personally liable for your own losses, this is not financial advise.

CRWV eyes on $96.08: Golden Genesis fib Ends 60% trade now DIP? Our last plot (see below) gave a nice 66% gain.

Now looking for a decent dip to re-enter longs.

Each fib below is of interest, especially Goldens.

Previous trade that just closed with 66% gains

=============================================

.

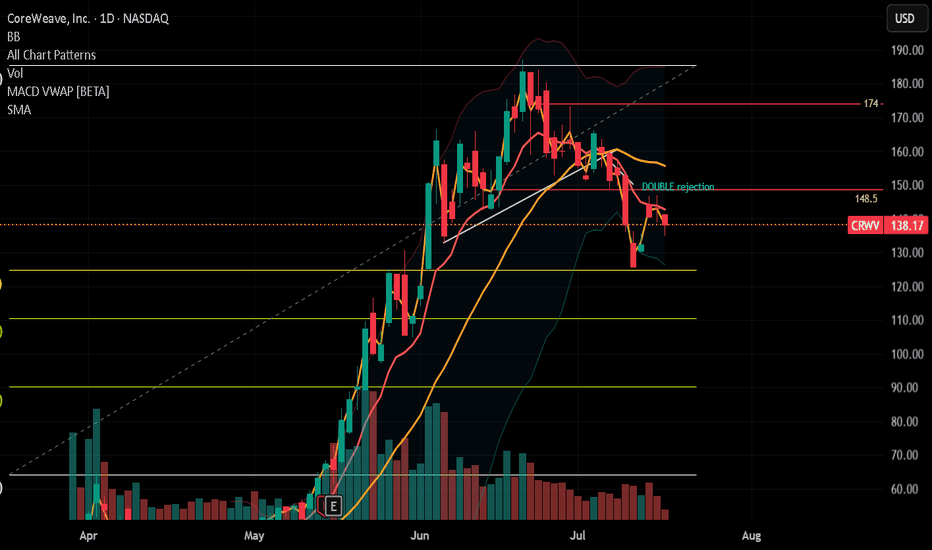

Hype-Fueled Uptrend Likely Exhausted, Gradual Reversion ExpectedCoreWeave, Inc. (Ticker: CRWV) has experienced a sharp and extended bullish run driven largely by market enthusiasm and speculative hype. However, current technical indicators suggest that this uptrend has reached a point of exhaustion and a reversion to mean is highly probable.

Key Observations:

Price Action:

The recent parabolic rise appears unsustainable, with signs of weakening momentum in the latest candles (notably a tall upper wick indicating selling pressure at highs).

Price has moved significantly away from key moving averages, creating a wide gap that historically resolves with a pullback.

Market Sentiment:

The stock's trajectory reflects a hype-driven narrative, likely fueled by AI/data center exposure headlines.

Sentiment-driven rallies often overshoot fundamentals and correct sharply once speculative demand cools.

Trading Idea:

We propose a short-term bearish trading setup, targeting a gradual retracement toward the $65 support zone, which aligns with a key volume shelf and prior consolidation range. This zone represents a more stable "base" from which the stock could rebuild after profit-taking and sentiment normalization.