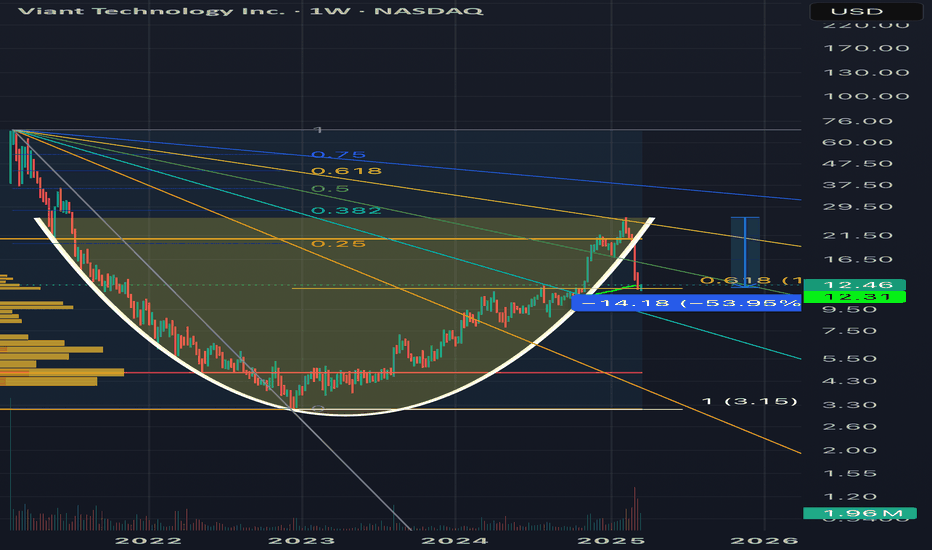

Viant looks ViableI really like the look of this chart. A perfectly rounded bottom and now a pull back to the 200 week moving average and the golden pocket. We’ve closed above this level at $12.46. I’m expecting a bounce next week. Keeping an eye on this and will open a long if the futures look positive on Monday.

This is a small market cap in the digital advertising space, growing extremely well with good cash to debt ratio and solid growth. It’s had a sizeable pullback and has been on my watchlist for a potential buy.

Not financial advice, do what’s best for you.

DSP trade ideas

DSP Viant technology bull flag 24hr potterboxDSP Viant technology inc 24hr potterbox with a bull flag. It went up and rejected the roof of the potterbox as you can see. it is now at the $ 22.11 ish and it is above the 50 percent line or cost basis. It also is above the 100 and 200 moving averages. It looks to be prime ready for a breakout. Happy Trading.

DSP Earnings Call 03/04 After Market CloseThis stock is a small DSP (demand-side platform) set to experience some growth as one of the alternative media spends as google sunsets 3rd party cookies from chrome. Most companies should have been contracting late last year into early this year rather than act reactively in Q3 of 2024 when 100% of cookies are said to be done away with. I started buying in the $4 dollar range but have continued to add to my position.

Full disclosure: I also have a small set of oom calls from now until end of the year.

This is not financial advice but I do enjoy community feedback on my trades occasionally. I also thought to post this because reddit as a whole completely ignore this ticker so maybe someone who wouldn't have otherwise seen this might.

Good luck, this is not financial advice nor should it be considered to be. Might add more to my position Monday depending on how we open.

$DSP is giving a GREAT IPO LONG opportunity todayIPO intraday trading strategy idea

Viant Technology is an advertising software company. Their software enables the programmatic purchase of advertising, which is the electronification of the advertising buying process.

The share price is rising and gonna continue this trend today.

The demand for shares of the company still looks higher than the supply.

These and other conditions can cause a rise in the share price today.

So I opened a long position from $45,00;

stop-loss — $37,00;

take-profit — 69,00/MOC price.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.