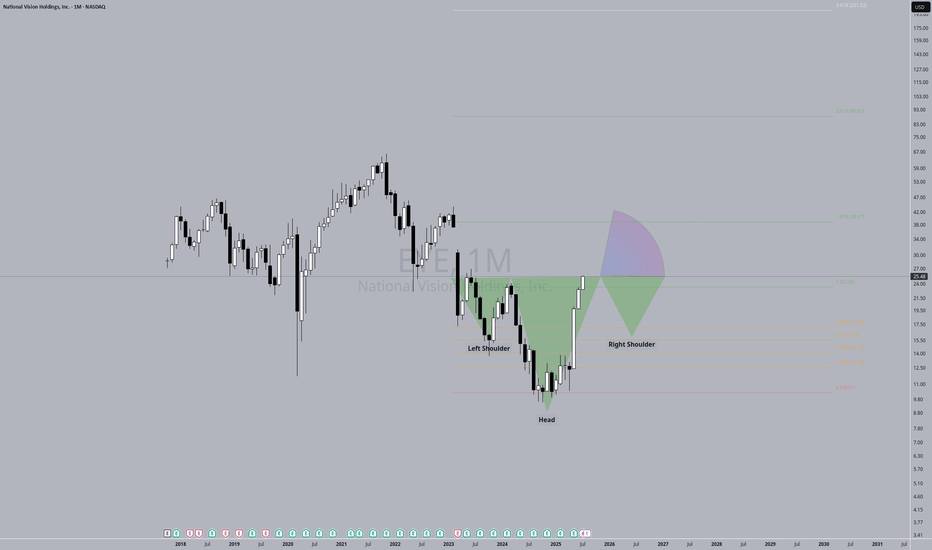

EYE trade ideas

National Vision Stock Quote | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# National Vision Stock Quote

- Double Formation

* Start Of (Diagonal) At 55.00 USD | Completed Survey

* Wave Feature & Short Set Up Entry | Subdivision 1

- Triple Formation

* 0.5 Retracement Area On Downtrend Bias | Subdivision 2

* (TP1) | Subdivision 3

* Daily Time Frame | Trend Settings Condition

- (Hypothesis On Entry Bias)) | Logarithmic Settings

- Position On A 1.5RR

* Stop Loss At 14.00 USD

* Entry At 12.00 USD

* Take Profit At 8.00 USD

* (Downtrend Argument)) & No Pattern Confirmation

* Ongoing Entry & (Neutral Area))

Active Sessions On Relevant Range & Elemented Probabilities;

European-Session(Upwards) - East Coast-Session(Downwards) - Asian-Session(Ranging)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Sell

Eye Long term National Vision Holdings, Inc. (NASDAQ: EYE) is a leading optical retailer in the United States, offering products such as eyeglasses, contact lenses, and accessories.

Technically forming bullish Golden cross.. seems to move up from here

Recent Performance:

Stock Price: As of March 21, 2025, EYE is trading at approximately $12.52 per share.

52-Week Range: The stock has fluctuated between $9.56 and $23.26 over the past year.

Revenue: In 2024, the company reported revenues of $1.82 billion, marking a 3.81% increase from the previous year.

StockAnalysis

Net Loss: The net loss for 2024 was $28.5 million, a 56.75% improvement compared to 2023.

Rating: The consensus among six analysts is a "Hold" recommendation for EYE stock.

Price Target: The 12-month average price target is $14.00, suggesting a potential upside of approximately 10.59% from the current price.

StockAnalysis

Company Overview:

Founded in 1990 and headquartered in Duluth, Georgia, National Vision operates under various brands, including America's Best and Eyeglass World. The company employs nearly 14,000 individuals and focuses on providing affordable eye care services and products across the nation.

Please note that investing in the stock market involves risks. It's essential to conduct thorough research or consult with a financial advisor before making investment decisions.

EYE double bottom on weekly -- significant upside next!EYE just did a double bottom on the weekly chart -- the probability of significant reversal to the upside is very high.

Spotted at 21.00.

Net buying / accumulation has been spotted. Volume has significantly increased the last few days vs. it's average.

EYE has always beat consensus estimate vs recorded EPS.

Here are some fundamental data for reference:

Date Quarter Consensus Estimate Reported EPS Beat/Miss GAAP EPS Revenue Estimate Actual Revenue Call Transcript

5/9/2023

(Estimated)

3/1/2023 Q4 2022 ($0.11) ($0.11) ($0.10) $471.61 million $468.93 million

11/10/2022 Q3 2022 $0.04 $0.12 +$0.08 $0.09 $499.85 million $499.21 million

8/11/2022 Q2 2022 $0.05 $0.16 +$0.11 $0.20 $500.67 million $509.60 million

5/10/2022 Q1 2022 $0.23 $0.29 +$0.06 $0.24 $538.38 million $527.70 million

2/28/2022 Q4 2021 ($0.06) $0.12 +$0.18 $0.17 $457.47 million $477.90 million

EYE: Breakout Confirmed, 22.2% Potential Profit!Description: EYE is trending higher and in an uptrend meaning that highs are getting higher and lows are getting higher. The uptrend line on the chart and the Trending Band Indicator (which measures trend) supports the Long Position.

Stats:

1. Ideal buy range: $48.9 - $51.4

2. Take profit: $61.69

3. Stop Loss: $48.08

4. Risk To Reward: 1 / 4

5. Accuracy Rating: 93%

EYE, Aroon Indicator entered an Uptrend on November 16, 2020.Over the last three days, Tickeron's A.I.dvisor has detected that EYE's AroonUp green line (see chart) is above 70, while the AroonDown red line is below 30. When the green line goes above 70 while the red line stays below 30, this is an indicator that the stock could be poised for a strong Uptrend. For traders, this could mean going long the stock or exploring call options in the next month. Tickeron's A.I.dvisor backtested this indicator and found 149 similar cases, 139 of which were successful. Based on this data, the odds of success are 90%. Current price $42.09 is above $41.07 the highest support line found by Tickeron A.I. Throughout the month of 10/15/20 - 11/16/20, the price experienced a +4% Uptrend, while the week of 11/09/20 - 11/16/20 shows a -11% Downtrend.

Bullish Trend Analysis

The Momentum Indicator moved above the 0 level on November 02, 2020. You may want to consider a long position or call options on EYE as a result. Tickeron A.I. detected that in 39 of 51 past instances where the momentum indicator moved above 0, the stock continued to climb. The odds of a continued upward trend are 76%.

Following a +6.35% 3-day Advance, the price is estimated to grow further. Considering data from situations where EYE advanced for three days, in 158 of 198 cases, the price rose further within the following month. The odds of a continued upward trend are 80%.

The Aroon Indicator entered an Uptrend today. Tickeron A.I. detected that in 139 of 149 cases where EYE Aroon's Indicator entered an Uptrend, the price rose further within the following month. The odds of a continued Uptrend are 90%.