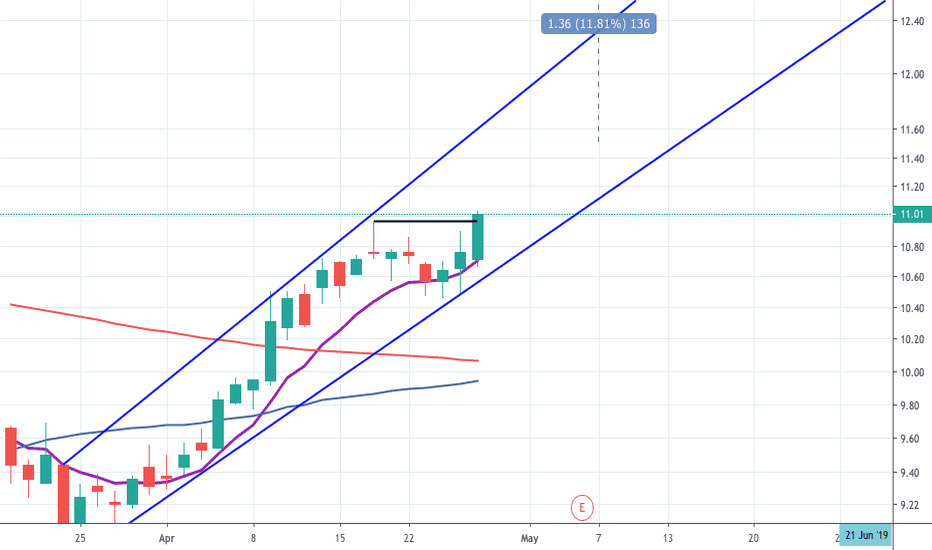

EZPW (EZCORP) - Potential for Quick Upside Momentum!Technical Analysis:

EZPW has recently shown signs of a bullish breakout, and based on the current chart, there could be a strong upside momentum coming in the short term. Here's why:

Breakout Above Key Resistance: EZPW has successfully broken through a key resistance level, indicating a potential trend reversal and the start of an uptrend.

Strong Support Zone: The stock has found solid support at lower levels.

1x to 3x Return Potential: Given the breakout and favorable technical setup, EZPW could see a 1x to 3x return in the coming months if the momentum continues and the stock maintains its upward trajectory.

Stop Loss: Consider placing a stop just below the support zone to manage risk effectively.

🚨 Risk Disclaimer: As always, conduct your own research and use proper risk management strategies before entering any trade. Markets are volatile, and past performance is not indicative of future results.

Let’s see if the bulls take charge here! 📈

#EZPW #EZCORP #StockBreakout #TechnicalAnalysis #MomentumTrading #StockPick

Feel free to adjust the target prices or any specific details based on your analysis.

EZPW trade ideas

EZPW I think the Shorts need to cover. I came across this one on sound fundamentals late last fall and started a small position that I've been trading in and out of. Now positioned long and will start adding Longer dated Calls as the Premium appear cheap for the pay off here. Pawn business is doing well in this rate enviroment and i feel EZPW is well positioned to continue to advance.

Playing with the Charts it appears to be gaining strength and has formed a Cup and Handle

Newer to this so open to feedback.

EZPW ShortEZPW rallied into earnings and spiked after beating EPS. This has been on my watch list as a long idea for a while and fundamentally I like it. Technically, however it appears overbought with an RSI of 76 and ready to retrace.

Notice the most recent candle's extra long upper wick. It tested the 1.61 fibonacci level but it suggests that bulls could not maintain control as it pulled back to close under support/resistance.

I anticipate more profit taking as the most recent close is 28% or so above the YTD POC line, which is the level at which the most shares were traded YTD.

Target: $8.24

EZPW Technical Analysis 🧙EZCORP Inc is a United States-based company engaged in offering pawn loans in the United States and Mexico. It also offers short-term unsecured loans and other consumer financial products, and buy and sell second-hand goods. The operating segments of the company are US Pawn, Latin America Pawn, Lana, and other international. US Pawn segment includes all pawn activities in the United States. Latin America Pawn segment includes all pawn activities in Mexico and other parts of Latin America. The company generates revenue from the merchandise sales, jewelry scrapping sales, and pawn service charges, of which key revenue is derived from the merchandise sales which are primarily collateral forfeited from pawn lending operations and used merchandise purchased from the customers.

If you understand the idea,🎯 press a thumb up! 👍 Have a question? Don't be shy to ask! 🤓 Interested to study how to analyze charts, follow me!

wedge -> inverse head and shouldersEZPW is making a wedge and it seems to be making an attempt to test resistance and possibly breakout.This ticker imo has a lot of potential in this current environment as the stimulus cheque is delayed putting a lot of strain for many Americans who will be forced to sell whatever they can to make ends meet until the cheque arrives meaning this will be bullish for pawnstocks . We can see trendline breakouts on the macd and RSI. On an Relative strength comparison to the sp500 we can see some bullish divergence making it a good indication of some big players accumulating this ticker at these prices, likely hedge funds using bearish stocks to hedge their portfolio.

The ceo has been accumulating some stocks though admittedly it is not much as he only has spent spent 20k into this company since the covid crash. Still a good sign though. www.marketbeat.com

By playing trading based on this wedge we might get the chance to catch the peak of the right shoulder of a inverse head and shoulders making this potentially a great entry for a positional trade.

EZPW: early planEZPW

Key levels: Channel 7.59 - 9.52; then Channel 9.52 - 12.42

A chart I have been watching for potential in early 2019. We will see how this key level tests at 7.59 as possible support and bounce above... however below we are not interested for at least 2-4 months.

Plan:

7.52 support holds ( 2 - 5 days)

mid channel tests around ~8.91 ( 2 - 3 days)

Top of channel tests 9.52 ( 10 - 15 days)

Consolidation around 9.52 taking either 1 - 2 months to gather, pending no catalyst.... with a catalyst we could see the move in half that time to enter channel 9.52 - 12.42. Key note for the second channel the ranged resistance 11.73 - 12.42.

Major resistance line breakoutHere I put this trade idea in your desk: is a clear breakout always from the weekly perspective with the price closing above the resistance line and with a pullback in progress.

The price now is above 13.00 and is consolidating that this is a new level for it

I can say that in the past days when the Dow drops 1,175 points, this stock showed no weakness during those volatile days and this is a good signal.

Remember the Monday 02/05/2018

EZPW Chart breakdownThis week, Stephens & Co (famous for Hillary Clinton's wildly-profitable cattle futures trade back in the 80s) initiated coverage on EZPW with a Sell and an $8 price target. Stock dropped nearly 10% on the day of the report and can't get off the floor.

Upcoming earnings report seems critical to the stock's performance as it needs to start translating strong store-level performance into meaningful earnings and cash flow.

For now, I am long 9and nearing the LT Capital gain date for my position) and getting antsy.

For now, lots of support all through the $9.00-$9.50 range.

EAPW Setting Up fro Breakout Ahead of EarningsEZPW's somewhat delayed (though not technically late) FY-end earnings report for the September quarter will be released after the close on Wednesday and the company will hold an 8:30 a.m. (market time) CC on Thursday morning. The "delay" likely involved restating financials for the sale of its Grupo Finmart division in mexico, which closed on the last day of the FY and needed to be excised from the newly-reported financials.

Already at the C.L. King best Ideas Conference on 9/13, the company's management provided commentary taht the September quarter results appeared to be strong based on store traffic and monitored results across the store base.

Technically, the shares appear to be poised to move to new highs here.

based on fundamental analysis, I have a price target of $20-$25 for December 2018, though it could turn out to be conservative, and would, of courrse, depend upon strong execution.

EZPW at Critical ST LevelOn this 1 hour Candle chart, EZPW can be seen to have pulled back to a ST support level.

I drop/close (your preference) below $10.60 would signal that a fakeout/breakout (your choice)

is underway.

Earnings likely will be out around Election Day and actual results as well as guidance on the call regarding capital allocation and the pace of M&A could be a catalyst for a move higher. For that, switch the view to a 240 minute or daily chart.

My fundamental work (which is under a different "handle" on the Yahoo! Finance "Conversations" page for EZPW, shows the potential for a very substantially higher price for EZPW a couple of years out based on a recovery of the company's Net Income Margins to the 10%+ range (comparable to the LTM level for peer company FCFS) combined with modest 3% "same store" revenue growth, plus 7-12% annual growth from M&A using a combination of internally-generated cash flow and the proceeds from a recent asset sale.

Thus, my money is currently on the "fakeout" outcome, but of course, a market correction (election results, Fed action) would likely turn that into a "breakout" event.